USDT Stability Guide: All You Need to Know About this Cryptocurrency

For investors looking for stability and a reliable store of value, USDT (Tether) has emerged as a popular choice. Backed by fiat currency reserves, USDT offers a stablecoin experience that is designed to maintain a constant value of 1 USD. However, before diving into the world of USDT, it is essential to understand the factors that contribute to its stability and how investors should approach it.

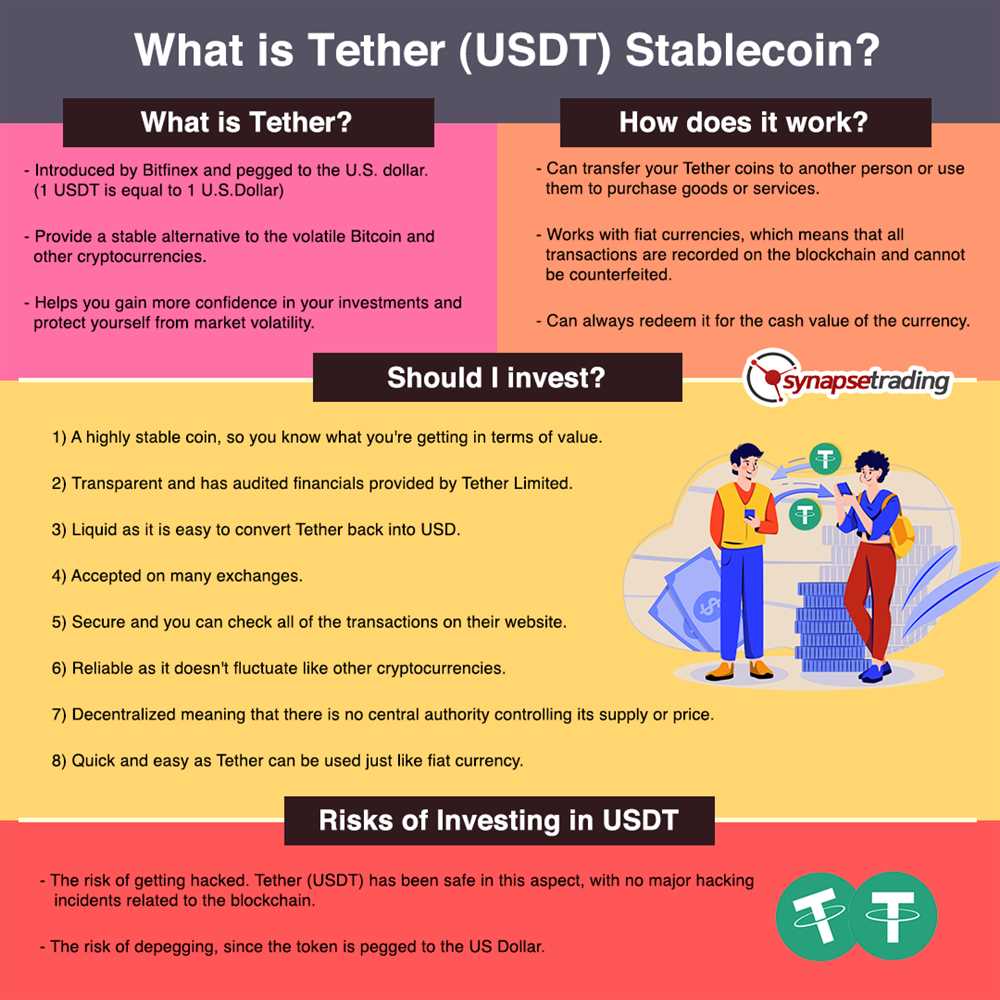

The Mechanism Behind USDT Stability: Unlike cryptocurrencies that experience significant price volatility, USDT maintains its stability through a combination of reserves and market mechanisms. Tether Ltd., the company behind USDT, claims that each USDT token is backed by an equivalent amount of traditional fiat currency, mainly U.S. dollars, held in reserves. This one-to-one backing ensures that USDT maintains a constant value.

Transparency and Auditing: To ensure the stability of USDT, Tether Ltd. regularly undergoes audits to verify the reserves. These audits provide transparency and give investors confidence that the company’s claims are supported by actual fiat currency holdings. However, it is important to note that these audits are not regulated by government authorities, and therefore caution should be exercised.

Investing in USDT: When investing in USDT, it is crucial to consider its purpose and role in your portfolio. USDT is primarily used as a tool for traders and investors to hedge against market volatility or to transfer value quickly between different exchanges. It is not intended as a long-term investment or as a replacement for traditional fiat currencies. Therefore, it is advisable to consult with a financial advisor before allocating a significant portion of your investment portfolio to USDT.

In conclusion, USDT offers stability in the volatile world of cryptocurrencies by being pegged to traditional fiat currencies. However, it is important for investors to understand the mechanisms behind its stability and approach it with caution. By doing so, investors can make informed decisions and integrate USDT into their investment strategies effectively.

USDT Stability Guide: Understanding the Basics

USDT, or Tether, is a cryptocurrency that is designed to maintain a stable value by being pegged to a fiat currency, typically the US dollar. Understanding the basics of USDT stability is essential for investors seeking a reliable and secure investment.

What is USDT?

USDT is a type of cryptocurrency known as a stablecoin. Its value is pegged to a specific fiat currency, in this case, the US dollar. Unlike other cryptocurrencies, such as Bitcoin or Ethereum, USDT aims to maintain a stable value, making it more suitable as a medium of exchange or store of value.

How is USDT Stable?

USDT maintains its stability through a mechanism called “collateralization.” For every USDT token issued, there is a corresponding amount of fiat currency held in reserve by Tether Ltd., the company behind USDT. This ensures that there is always enough backing to support the value of USDT.

Tether Ltd. publishes regular attestations, or audits, to prove that the amount of fiat currency held matches the number of USDT tokens in circulation. This transparency is crucial for investors as it provides confidence in the stability of USDT.

Where Can I Use USDT?

USDT is widely accepted in the cryptocurrency market and can be used for various purposes. Many cryptocurrency exchanges list USDT as a trading pair, allowing investors to easily convert between USDT and other cryptocurrencies.

Furthermore, USDT can be used for decentralized finance (DeFi) applications, lending and borrowing, remittances, and even as a stable store of value during times of increased market volatility.

Benefits and Risks of USDT

The stability of USDT makes it an attractive option for investors seeking a reliable cryptocurrency. Its peg to the US dollar means that its value is not subject to the same extreme volatility as other cryptocurrencies.

However, it is important to note that USDT is not without risks. As with any investment, there is the potential for market fluctuations, regulatory changes, and counterparty risks. Investors should always conduct thorough research and assess their risk tolerance before investing in USDT or any other cryptocurrency.

- USDT is a stablecoin pegged to the US dollar.

- It maintains stability through collateralization.

- USDT is widely accepted in the cryptocurrency market.

- There are benefits and risks associated with investing in USDT.

The Importance of Stablecoins for Investors

Stablecoins have emerged as a crucial tool for investors in the cryptocurrency market. Unlike other cryptocurrencies that are known for their volatility, stablecoins are designed to maintain a stable value, usually pegged to a fiat currency like the US dollar.

One of the main advantages of stablecoins is their ability to offer a reliable store of value. Cryptocurrencies like Bitcoin and Ethereum are notorious for their price fluctuations, which can make them risky investments. However, stablecoins provide stability by minimizing these fluctuations, allowing investors to preserve the value of their assets.

Stablecoins also serve as a bridge between the traditional financial world and the rapidly evolving cryptocurrency ecosystem. By pegging their value to a fiat currency, stablecoins provide a familiar and easily understood unit of measurement for investors. This makes it easier for individuals and institutions to enter the cryptocurrency market and use stablecoins as a means of transferring value.

Moreover, stablecoins offer a practical solution for investors to hedge against market downturns. During times of market instability, investors often seek safe havens to protect their wealth. Stablecoins can provide this stability, offering a reliable alternative when traditional investments like stocks and bonds show signs of volatility.

Additionally, stablecoins facilitate quick and low-cost transactions between different exchanges and wallets, making it convenient for investors to move their assets. This can be particularly advantageous for traders who need to react swiftly to market movements or execute high-frequency trading strategies.

In summary, stablecoins have become an essential tool for investors in the cryptocurrency market due to their ability to offer stability, serve as a bridge between traditional finance and cryptocurrencies, provide a safe haven in times of market downturns, and enable seamless transactions. By incorporating stablecoins into their investment strategy, investors can benefit from the advantages they offer in an otherwise volatile market.

Factors That Contribute to USDT Stability

USDT stability is an important aspect for investors seeking a reliable cryptocurrency. Several factors contribute to the stability of USDT:

Collateralization

One of the key factors that contribute to USDT stability is its collateralization ratio. USDT is reportedly backed by reserves that include cash and equivalent assets, ensuring that every USDT in circulation is backed by an equivalent amount of assets. This collateralization mechanism provides assurance to investors that the value of USDT is maintained and can be redeemed.

Transparency

Transparency is another crucial factor for USDT stability. Tether, the issuer of USDT, has committed to providing regular independent audits to validate the reserves backing USDT. Transparent reporting helps build trust in the ecosystem and ensures that USDT remains stable and reliable for investors.

Market Demand

The market demand for USDT also affects its stability. As USDT is widely used as a trading pair on various cryptocurrency exchanges, its liquidity and demand from traders contribute to its stability. A higher market demand for USDT helps maintain its stability and provides investors with confidence in its value.

Regulatory Compliance

The regulatory compliance of USDT and its issuer is an important factor for stability. Adherence to regulatory requirements helps prevent potential legal and financial risks, ensuring the stability and reliability of USDT. Compliance measures such as AML (Anti-Money Laundering) and KYC (Know Your Customer) policies can further enhance the stability of USDT.

Overall, a combination of collateralization, transparency, market demand, and regulatory compliance contributes to the stability of USDT. These factors work together to maintain its value and reliability as a cryptocurrency, providing investors with a stable token for their investment purposes.

Question-answer:

What is USDT?

USDT is a stablecoin cryptocurrency that is pegged to the value of the US dollar.

How does USDT maintain stability?

USDT maintains stability by being backed by reserves of US dollars, which are held by the company that issues USDT.

What are the benefits of investing in USDT?

Investing in USDT provides stability and protection against the volatility of other cryptocurrencies, as its value is pegged to the US dollar.

How can I purchase USDT?

You can purchase USDT on various cryptocurrency exchanges. You will need to create an account, deposit funds, and then use those funds to buy USDT.

Is USDT a safe investment?

USDT is generally considered to be a safe investment due to its stability and backing by US dollars. However, as with any investment, there are always risks to consider.