Unveiling the Complexities of USDT and USD Relationship

USDT and USD are two terms that you may often come across in the world of finance, particularly in the realm of cryptocurrency. While they may sound similar, they have distinct meanings and play different roles in the financial landscape. Understanding the connection between USDT and USD is essential for anyone looking to navigate the complex world of digital currencies.

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. It is designed to maintain a stable value by being pegged to a fiat currency, most commonly the US dollar (USD). In simpler terms, each USDT token is supposed to represent one US dollar. This stability is achieved through a combination of reserves and algorithms that aim to keep the price of USDT in line with the value of the US dollar.

On the other hand, USD refers to the United States dollar, the official currency of the United States. It is a fiat currency, which means it derives its value from the trust and confidence of its users, rather than being backed by a physical commodity like gold or silver. Unlike USDT, USD is not a digital currency and exists in physical form as banknotes and coins, as well as in digital form within the banking system.

So, how are USDT and USD connected? The connection lies in the fact that USDT is supposed to be pegged to the value of USD. This means that for every USDT token in circulation, there should be an equivalent amount of USD held in reserves. This connection is crucial because it provides stability and confidence for users of USDT, as they can be assured that each token they own is backed by real US dollars. It also allows for easier conversion between USDT and USD, as users can theoretically redeem their USDT for USD at a 1:1 ratio.

Understanding the Relationship Between USDT and USD

When it comes to understanding the relationship between USDT and USD, it’s important to first grasp the basics. USDT, also known as Tether, is a digital cryptocurrency token that is designed to be used as a stablecoin. This means that it is pegged to a real-world asset, in this case, the value of the US dollar (USD).

The value of USDT is intended to remain stable and equal to one US dollar. This stability is achieved through various mechanisms, including frequent audits and the backing of each USDT token with an equivalent amount of USD held in reserves. This ensures that for every USDT in circulation, there is a corresponding amount of USD in a bank account.

So, how does this relationship work? When someone wants to convert their USD into USDT, they can do so by purchasing USDT on a cryptocurrency exchange. The exchange will then hold the equivalent amount of USD in reserve, ensuring that the value of the USDT is maintained.

Conversely, if someone wants to convert their USDT back into USD, they can do so through the same exchange. The exchange will then redeem the USDT for USD, effectively “burning” the USDT tokens as they are taken out of circulation.

It’s worth noting that the relationship between USDT and USD is not a direct one. While USDT is pegged to the value of USD, there can be slight variations in the exchange rate due to market demand and other factors. However, these variations are typically minimal and do not significantly impact the stability of USDT as a stablecoin.

Understanding the relationship between USDT and USD is crucial for anyone looking to use USDT as a form of digital currency. It allows individuals and businesses to seamlessly convert between these two currencies, providing a stable and reliable means of conducting transactions in the cryptocurrency world.

The Role of USDT in the Digital Economy

USDT, or Tether, plays a significant role in the digital economy as a stablecoin and a crucial bridge between traditional fiat currencies and cryptocurrencies. It was created to offer stability to users in the highly volatile crypto market.

One of the primary functions of USDT is to provide a stable value equivalent to the US dollar. This stability is achieved by pegging each USDT to a corresponding reserve of USD held by Tether Ltd., the company behind USDT. In other words, for every USDT in circulation, there should be an equivalent amount of USD held in reserves.

This stability makes USDT an attractive asset for traders and investors who want to minimize their exposure to the volatility of other cryptocurrencies. By using USDT, they can quickly and easily move their funds between exchanges, hedge their positions, or temporarily store their funds in a stable asset.

Furthermore, USDT enables individuals and businesses to transact easily on various cryptocurrency platforms without having to rely solely on traditional banking channels. This is especially beneficial for those in countries with limited access to banking services or unstable national currencies.

USDT also provides an essential link between the worlds of cryptocurrencies and decentralized finance (DeFi). It allows users to participate in DeFi protocols and earn interest on their holdings, without the risk of price fluctuations that are inherent in most cryptocurrencies. This has led to the growth of various DeFi platforms that support USDT as a stable asset.

Overall, USDT plays a vital role in the digital economy as a stablecoin that provides stability, liquidity, and accessibility. It acts as a bridge between traditional financial systems and the world of cryptocurrencies, offering users the benefits of both worlds.

Exploring the Differences Between USDT and USD

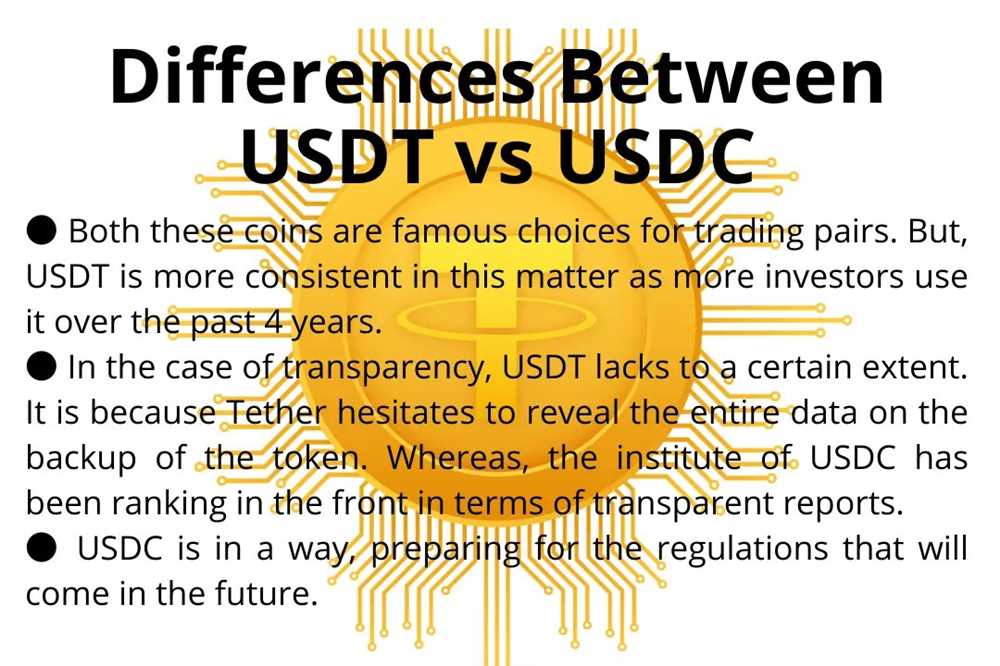

When it comes to cryptocurrencies, there are different types of digital tokens in circulation. Two popular types are USDT and USD. While both refer to the United States Dollar, there are significant differences between the two. Let’s dive deeper into how USDT and USD differ from each other.

What is USDT?

USDT, also known as Tether, is a type of cryptocurrency known as a stablecoin. It is created and maintained by Tether Limited, a company that aims to provide stability in the volatile world of cryptocurrencies. USDT is designed to maintain a value equal to one United States Dollar (USD).

The main difference between USDT and USD is that USDT exists on a blockchain, specifically the Omni Layer protocol. This means that transactions involving USDT are recorded on a public ledger and can be verified by anyone. Additionally, USDT can be traded on various cryptocurrency exchanges, allowing users to buy, sell, and trade it for other cryptocurrencies.

What is USD?

USD, on the other hand, refers to the traditional fiat currency of the United States. It is issued and regulated by the Federal Reserve, the central banking system of the United States. USD exists in physical form as cash and in digital form as bank balances and electronic transactions.

Unlike USDT, USD is not a cryptocurrency and does not operate on a blockchain. It is the most widely accepted form of payment in the United States and serves as the global benchmark for currency rates. USD is backed by the full faith and credit of the United States government and is subject to governmental regulations and policies.

While both USDT and USD represent the United States Dollar, they are used in different contexts and have different features. USDT is commonly used in the world of cryptocurrencies for trading and investment purposes, while USD is used for everyday transactions and as a store of value. It’s important to understand these differences when dealing with each currency.

The Implications of the USDT-USD Connection

The connection between USDT and USD has significant implications for the world of finance. USDT, also known as Tether, is a type of cryptocurrency that is pegged to the value of the US dollar. This means that for every unit of USDT, there is an equivalent dollar held in reserve.

One of the main implications of the USDT-USD connection is the stability it brings to the cryptocurrency market. By pegging USDT to the US dollar, it creates a stable and reliable cryptocurrency that can be used for transactions and as a store of value. This stability is particularly important in a market where prices can be highly volatile.

Enhancing Liquidity

Another implication of the USDT-USD connection is the increased liquidity it provides. Being pegged to the US dollar, USDT can easily be converted into dollars and vice versa. This makes it a convenient and efficient form of payment, and also facilitates trading and investment activities.

The connection between USDT and USD also has implications for international transactions. By using USDT, parties from different countries can transact with each other without the need for a common currency. This can simplify and streamline cross-border transactions, reducing costs and increasing efficiency.

Regulatory Concerns

However, the USDT-USD connection has also raised concerns from regulators. The nature of USDT being pegged to the US dollar means that it is subject to the same regulations and scrutiny as traditional currencies. This has led to investigations into Tether’s reserves and transparency measures to ensure that the USDT-USD connection is maintained.

Overall, the implications of the USDT-USD connection are vast and significant. It brings stability, liquidity, and convenience to the cryptocurrency market, but also raises regulatory concerns. As the world of finance continues to evolve, understanding the intricacies of the USDT-USD connection will be crucial for investors, traders, and regulators alike.

| Implications of the USDT-USD Connection |

|---|

| Stability in the cryptocurrency market |

| Enhanced liquidity |

| Facilitates international transactions |

| Regulatory concerns and scrutiny |

Question-answer:

What is the difference between USDT and USD?

USDT is a stablecoin cryptocurrency that is pegged to the US dollar, while USD is the official currency of the United States.

How does the connection between USDT and USD work?

The connection between USDT and USD works through a process called “backing”. For every USDT in circulation, there should be an equivalent amount of USD held in reserve by the issuer.

What is the purpose of using USDT instead of USD?

The purpose of using USDT instead of USD is primarily for trading and investing in cryptocurrencies. USDT provides the benefits of blockchain technology, such as faster transactions and global accessibility, while maintaining a value pegged to the US dollar.

Is USDT a safer alternative to USD?

USDT and USD have different levels of safety. While USD is backed by the United States government and considered more stable, USDT has the advantage of being more easily transferable and usable in the world of cryptocurrencies. However, there is a greater risk of price volatility with USDT compared to USD.