Understanding the Worst-Case Scenario: Losing Your Crypto on a Cold Wallet

When it comes to securing your cryptocurrency investments, there’s no doubt that using a cold wallet is one of the best options available. With its offline storage and enhanced security features, it provides a safe haven for your digital assets. However, even with all its advantages, there’s always a worst-case scenario that every crypto investor dreads – losing access to the funds stored in a cold wallet.

The thought of losing your hard-earned crypto can be terrifying, but it’s essential to understand the potential risks and take appropriate measures to mitigate them. In this article, we will delve into the worst-case scenario of losing crypto on a cold wallet and explore the steps you can take to prevent and recover from such a situation.

One of the primary reasons for losing access to funds stored in a cold wallet is forgetting or misplacing the private keys. These keys are crucial for accessing and transferring the cryptocurrency from the wallet. Without them, your funds are essentially locked away forever, inaccessible to anyone, including yourself.

To avoid this scenario, it is vital to create multiple copies of your private keys and store them securely in separate physical locations. Consider using a secure password manager or a hardware device specifically designed for storing private keys. Additionally, memorize the key or write it down and store it in a secure location known only to you. Always make sure to keep the private keys separate from the wallet itself to prevent them from being compromised together.

Importance of Cold Wallets in Secure Crypto Storage

When it comes to storing your cryptocurrencies, security should be at the top of your priorities. With the growing popularity of digital assets, hackers and cybercriminals are constantly seeking ways to exploit vulnerabilities in crypto storage systems. This is where cold wallets come into play as a vital tool for secure crypto storage.

A cold wallet, also known as a hardware wallet, is a physical device that is specifically designed to provide an extra layer of security for storing cryptocurrencies. Unlike hot wallets that are connected to the internet, cold wallets store your private keys securely offline, making it virtually impossible for hackers to gain unauthorized access.

The importance of cold wallets in secure crypto storage cannot be overstated. By keeping your private keys offline, cold wallets significantly reduce the risk of theft and hacking. Even if your computer or mobile device gets compromised by malware, your cryptocurrencies stored in a cold wallet remain safe.

Cold wallets also offer peace of mind by providing backup and recovery options. With most cold wallets, you can generate a recovery seed or backup phrase, which allows you to restore your crypto holdings in case the physical device is lost or stolen. This additional layer of protection ensures that your investments are safeguarded even in the worst-case scenario.

Furthermore, cold wallets are user-friendly and enable easy management of multiple cryptocurrencies. They usually come with user-friendly interfaces that make it simple to send, receive, and manage your digital assets. The convenience and ease of use of cold wallets make them an essential tool for any serious cryptocurrency investor.

In conclusion, with the increasing security risks in the crypto world, the importance of cold wallets in secure crypto storage cannot be ignored. By keeping your private keys offline and providing additional layers of security, cold wallets provide the peace of mind and protection you need to safeguard your valuable digital assets.

Potential Risks and Vulnerabilities of Cold Wallets

While cold wallets are generally considered to be a secure storage solution for cryptocurrencies, they are not without their potential risks and vulnerabilities. It is important for users to be aware of these risks and take necessary precautions to protect their funds.

One of the main risks of cold wallets is physical theft. If an attacker gains access to the physical cold wallet device, they can potentially steal the private keys and gain control over the funds stored in the wallet. To mitigate this risk, it is crucial to store the cold wallet in a secure location, such as a safe or vault, and to use additional security measures such as strong passwords and encryption.

Another vulnerability of cold wallets is the possibility of loss or damage. Cold wallets can be lost or damaged due to various reasons, such as hardware failure, natural disasters, or accidental mishandling. In such cases, it may be extremely difficult or even impossible to recover the funds stored in the wallet. It is therefore important to regularly create backups of the wallet’s private keys and store them in a separate secure location.

Phishing attacks are also a potential risk for cold wallet users. Attackers may use various tactics, such as sending fake emails or creating malicious websites, to trick users into revealing their private keys or other sensitive information. To protect against phishing attacks, users should always verify the authenticity of any communication or website before entering their private keys or other confidential data.

Finally, cold wallets can also be vulnerable to software-related attacks. Malware or keyloggers installed on a computer or smartphone can potentially capture the private keys entered by the user, compromising the security of the cold wallet. To minimize the risk of software-related attacks, users should regularly update their operating systems and antivirus software, and avoid using public or unsecured networks when accessing their cold wallets.

In conclusion, while cold wallets offer a high level of security for storing cryptocurrencies, they are not immune to risks and vulnerabilities. By being aware of these risks and taking necessary precautions, users can effectively protect their funds and minimize the chances of losing their crypto assets.

Mitigating the Risk of Losing Crypto on Cold Wallets

While cold wallets are generally considered to be one of the safest ways to store cryptocurrencies, there is still a risk of losing access to your funds. To mitigate this risk, there are several key steps that you can take:

-

Backup Your Wallet

Before storing any cryptocurrency on a cold wallet, it is crucial to create a backup of your wallet’s private key or recovery phrase. This backup should be stored securely in multiple locations, such as a hardware device or a physically secure location.

-

Use a Cryptocurrency Wallet Manager

To simplify the process of managing your cold wallets and their backups, consider using a cryptocurrency wallet manager. These tools can help you securely store and organize your wallet backups, making it easier to recover your funds if needed.

-

Regularly Test Your Backup

To ensure that your backup is accurate and usable, it is essential to regularly test it. This can involve restoring your wallet using the backup and checking that you can access your funds. Regular testing helps identify any issues with your backup before it is too late.

-

Keep Software and Hardware Up to Date

Regularly updating the software and firmware of your cold wallet is important for security. These updates often include bug fixes and security patches that help protect your funds from potential vulnerabilities.

-

Implement Multi-Signature Wallets

Consider using multi-signature wallets, which require multiple keys to authorize transactions. This adds an extra layer of security to your cold wallet, as multiple parties would need to be involved to access your funds.

-

Store Backups Offline and Securely

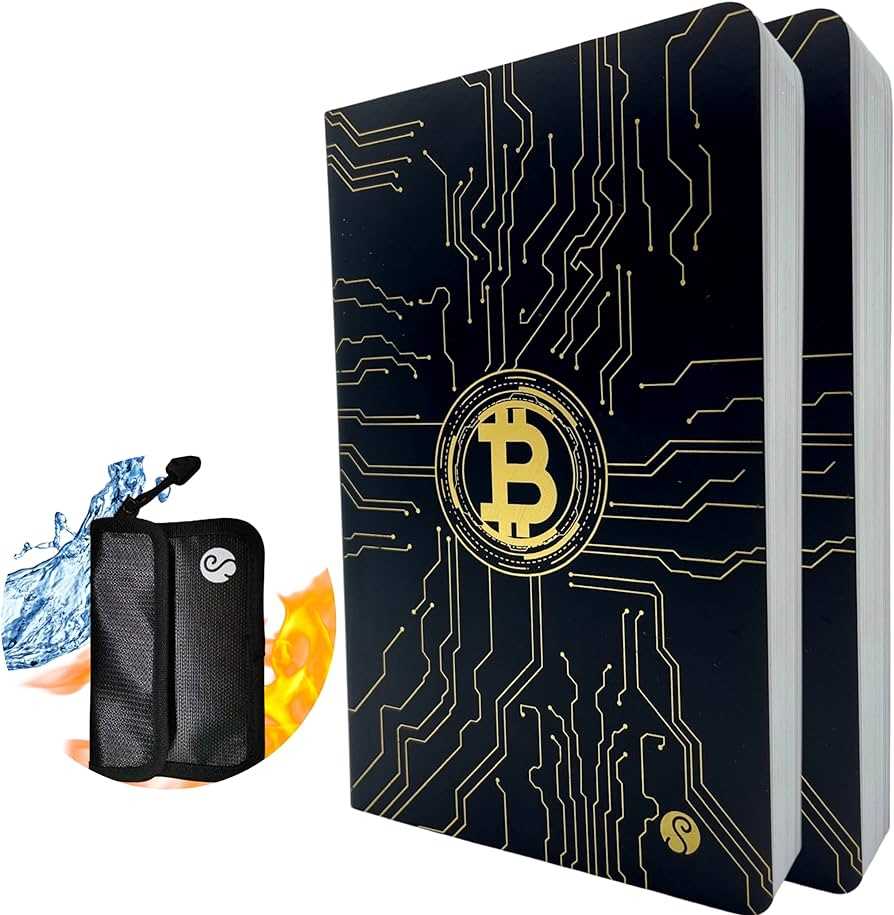

When storing your wallet backups, ensure that they are kept offline and are secure. Physical backups should be stored in a fireproof and waterproof container or a safety deposit box. Digital backups should be encrypted and stored on secure offline storage devices.

-

Practice Safe Security Measures

Practicing good security measures, such as using strong, unique passwords and enabling two-factor authentication, can help further protect your cold wallet and mitigate the risk of losing access to your crypto.

By following these steps, you can significantly reduce the risk of losing your cryptocurrency on a cold wallet. However, it’s important to remember that no security measure is foolproof, and diligence is key when it comes to safeguarding your digital assets.

Q&A:

What is a cold wallet?

A cold wallet refers to a type of cryptocurrency wallet that is not connected to the internet. It provides an extra layer of security by keeping the private keys offline, away from the potential threats of hacking and online attacks.

How can someone lose crypto on a cold wallet?

There are a few ways someone can lose crypto on a cold wallet. One common scenario is losing or misplacing the physical device that stores the wallet. Another way is forgetting or losing the passphrase or private keys associated with the wallet. Additionally, the device itself could be damaged or destroyed, making it impossible to access the funds.

Is it possible to recover lost crypto from a cold wallet?

Recovering lost crypto from a cold wallet can be very challenging, if not impossible. Since cold wallets are designed for maximum security and offline storage, they do not generally have built-in recovery mechanisms. Without the private keys or passphrase, it may be extremely difficult or even impossible to regain access to the funds.

What can I do to prevent losing crypto on a cold wallet?

To prevent losing crypto on a cold wallet, it is important to take precautions. First, make multiple offline backups of your private keys and store them in secure locations. Keep the physical device in a safe place and make sure to remember the passphrase. Consider using a reputable cold wallet with good customer support in case any issues arise.

Are there any alternative storage options that are less risky than cold wallets?

While cold wallets are generally considered one of the most secure storage options for cryptocurrencies, there are alternative methods that some individuals prefer. These include hardware wallets, which are also offline devices but may offer more user-friendly features and recovery options. Additionally, some individuals choose to store their crypto on secure online platforms known as hot wallets, although this introduces a higher level of vulnerability to potential hacking.