Trezor Breach What Cryptocurrency Investors Need to Know

The recent security breach at Trezor, one of the leading hardware wallet providers, has sent shockwaves across the crypto community. This incident highlights the importance of understanding the potential risks associated with storing digital assets.

Trezor, known for its robust security features, experienced a breach that compromised the confidentiality of some user data. While the company confirmed that no funds were stolen, the incident serves as a stark reminder that even the most secure systems can be vulnerable to attacks.

As a crypto investor, it is crucial to be aware of the implications of such breaches and take necessary precautions to protect your digital assets. This article will delve into the details of the Trezor breach, what it means for investors, and provide guidance on securing your cryptocurrencies.

First and foremost, it is essential to understand that hardware wallets, like Trezor, provide an additional layer of security compared to online exchanges or software wallets. These devices store private keys offline, making them less susceptible to hacking attempts. However, no system is foolproof, and incidents like the Trezor breach highlight the need for constant vigilance.

Investors should consider diversifying their storage solutions and using a combination of hardware, software, and paper wallets. This approach can help mitigate the risk of a single point of failure and increase the overall security of your crypto holdings.

Protecting Your Crypto Investments: Understanding the Trezor Breach

As a crypto investor, it is crucial to understand the potential risks and vulnerabilities associated with storing your digital assets. The recent Trezor breach serves as a stark reminder of the importance of implementing effective security measures to protect your holdings.

The Trezor breach occurred when hackers gained unauthorized access to the private keys and sensitive information of users. This breach exposed the vulnerability of hardware wallets and the need for enhanced security protocols.

One of the key lessons learned from the Trezor breach is the significance of properly securing your private keys. These keys are essential for accessing and transacting your cryptocurrencies, and their loss or exposure can result in severe financial losses.

To protect your crypto investments, it is essential to use a secure wallet and follow best practices such as creating strong and unique passwords, enabling two-factor authentication, and regularly updating your wallet’s firmware.

Consider investing in a reputable hardware wallet such as Trezor or Ledger. These wallets provide an additional layer of security by keeping your private keys offline and away from potential hackers.

It’s also important to stay vigilant and educate yourself about the latest security threats in the crypto space. Keeping up-to-date with news and developments can help you identify potential risks and take appropriate action to safeguard your investments.

In conclusion, the Trezor breach serves as a wake-up call for crypto investors, highlighting the importance of implementing robust security measures. By taking proactive steps to protect your private keys and staying informed about potential threats, you can mitigate the risks associated with storing and transacting cryptocurrencies.

What Happened:

In July 2021, Trezor, a popular hardware wallet provider, disclosed a security breach that had occurred earlier that year. The breach involved a third-party supplier that provided components for Trezor’s devices. This supplier was infiltrated by malicious actors who gained unauthorized access to sensitive information.

As a result of the breach, the attackers obtained customer order details, including email addresses and shipping addresses. However, Trezor stressed that the breach did not compromise any customer funds or private keys stored within the wallets.

Trezor promptly took action to address the breach, including terminating its relationship with the compromised supplier. The company also notified potentially affected customers and required them to change their passwords for added security. Additionally, Trezor implemented enhanced security measures to prevent similar incidents in the future.

While the breach did not result in the loss of funds, it highlighted the importance of maintaining strong security practices within the crypto industry. It serves as a reminder for crypto investors to be cautious and take necessary precautions to protect their assets.

How This Affects Crypto Investors:

The Trezor breach has significant implications for crypto investors, as it exposes the potential vulnerabilities of hardware wallets, which are believed to be one of the most secure options for storing cryptocurrencies.

1. Increased Risks: The breach highlights the fact that even hardware wallets are not completely immune to attacks. This raises concerns among crypto investors about the security of their funds and the overall trustworthiness of hardware wallet providers.

2. Loss of Funds: If a hacker gains access to a user’s hardware wallet, they can potentially steal the crypto assets stored in it. This could result in significant financial losses for investors, especially those who have large amounts of cryptocurrencies stored in their wallets.

3. Trust Issues: The breach erodes the trust that investors have in hardware wallet providers and may lead to a loss of confidence in the security measures implemented by these companies. This could cause investors to seek alternative storage solutions or even exit the crypto market altogether.

4. Market Volatility: The news of a breach can have a negative impact on the overall cryptocurrency market. It may lead to increased volatility as investors panic and start selling their holdings, fearing for the security of their funds. This can result in sharp price declines across various cryptocurrencies.

5. Regulatory Scrutiny: Incidents like the Trezor breach may draw the attention of regulators, who might impose stricter regulations on the crypto industry. This could have long-term implications for crypto investors, as it may introduce additional compliance requirements and affect the overall liquidity and accessibility of cryptocurrencies.

Given the potential risks and uncertainties associated with the Trezor breach, crypto investors should review their security practices, consider diversifying their storage solutions, and stay updated on the latest developments in the hardware wallet industry.

Security Best Practices:

When it comes to investing in cryptocurrency, security should always be a top priority. Here are some best practices to keep in mind:

1. Use a hardware wallet: Storing your cryptocurrency on a hardware wallet, like Trezor, is one of the safest ways to protect your funds. Hardware wallets keep your private keys offline, reducing the risk of them being hacked.

2. Enable two-factor authentication: Adding an extra layer of security by enabling two-factor authentication (2FA) can help protect your accounts. This usually involves using a mobile app or receiving a text message with a code to enter when logging in.

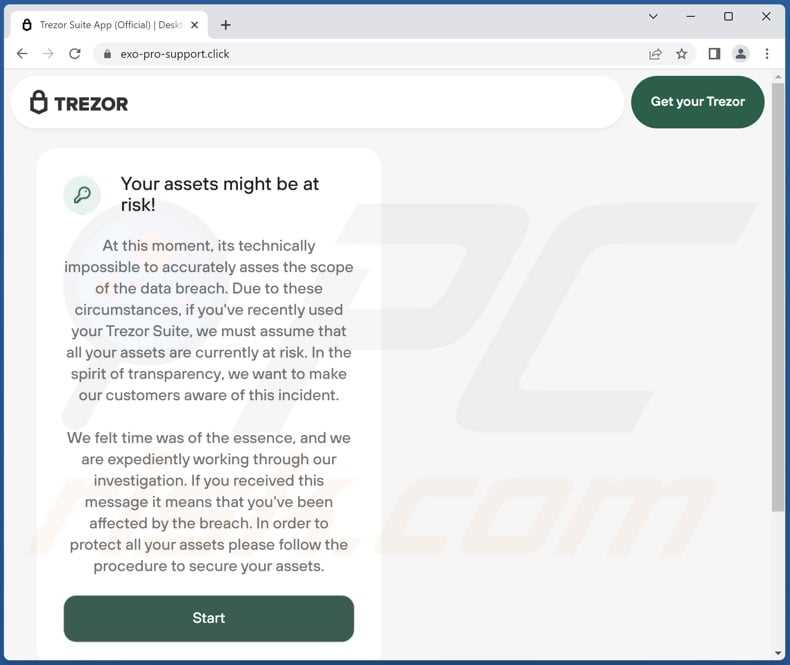

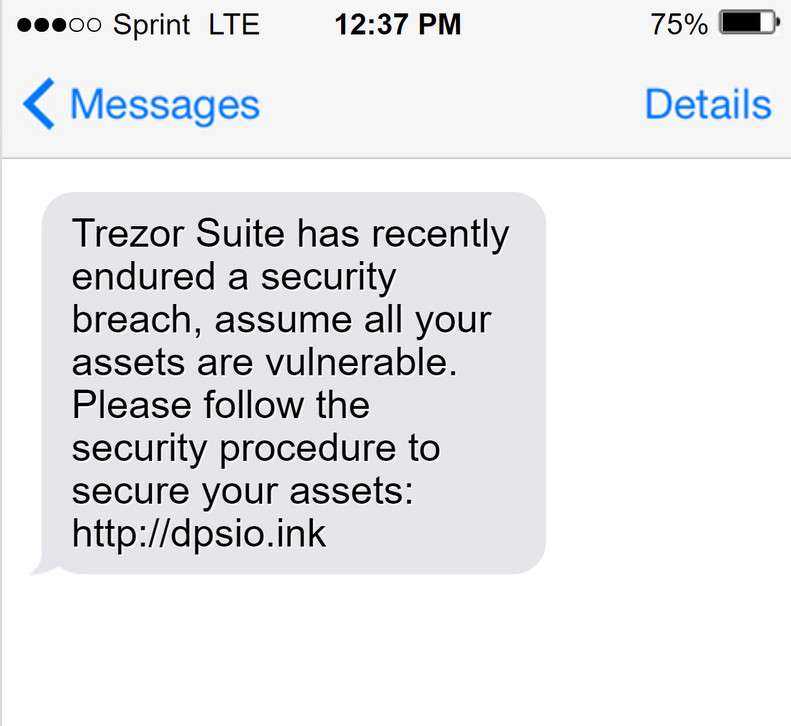

3. Be cautious of phishing attempts: Phishing is a common method used by attackers to trick users into revealing their login credentials. Be wary of suspicious emails, links, and messages, and only provide sensitive information on trusted websites.

4. Keep your software up to date: Ensure that your computer and mobile devices are running the latest software updates. Updates often contain patches for security vulnerabilities, so it’s important to install them promptly.

5. Use strong, unique passwords: Use complex passwords that are difficult to guess and avoid reusing passwords across different platforms. Consider using a password manager to securely store and generate unique passwords.

6. Educate yourself: Stay informed about the latest security threats and best practices for protecting your cryptocurrency. There are many resources available online, such as blogs, forums, and security guides, that can help you stay up to date.

7. Backup your wallet: Regularly backup your wallet and keep the backups in a secure location. This ensures that even if your hardware wallet is lost or damaged, you can still recover your funds using the backup.

8. Be cautious of public Wi-Fi: Avoid accessing your cryptocurrency accounts or making transactions on public Wi-Fi networks. These networks are often unsecured, making it easier for attackers to intercept your data.

9. Use encryption: Encrypt your computer’s hard drive and use secure messaging apps for communication. Encryption adds an extra layer of protection to your data and makes it harder for attackers to access.

10. Diversify your investments: Spreading your investments across different cryptocurrencies and platforms can help mitigate the risk of losses. This way, if one investment or platform is compromised, the others remain unaffected.

By following these security best practices, you can greatly enhance the security of your cryptocurrency investments and minimize the risk of falling victim to an attack.

Q&A:

What is Trezor Breach?

Trezor Breach refers to a security incident where the hardware wallet manufacturer Trezor experienced a breach in their system, potentially compromising the security of their users’ cryptocurrency holdings.

How did the Trezor Breach happen?

The exact details of the Trezor Breach are not disclosed, but it is believed that hackers gained unauthorized access to Trezor’s infrastructure and obtained sensitive information that could be used to compromise the security of the hardware wallets.

What information may have been compromised in the Trezor Breach?

The specific information that may have been compromised in the Trezor Breach is not known, but it could potentially include users’ private keys, wallet recovery phrases, or other sensitive data that could be used to gain unauthorized access to their cryptocurrency holdings.

What should crypto investors do if they have a Trezor wallet?

If you have a Trezor wallet, it is recommended to take immediate action to protect your funds. This can include transferring your cryptocurrency holdings to a different wallet or taking steps to secure your Trezor wallet, such as updating the firmware and using additional security measures like a passphrase.