The Pros and Cons of Converting USDT to Traditional Currency

In recent years, cryptocurrency, specifically Tether (USDT), has gained significant traction in the financial world. USDT is a type of digital currency that is pegged to the value of traditional currencies like the US dollar. While USDT offers advantages such as low transaction fees and global accessibility, there are also potential drawbacks to consider when converting USDT to traditional currency.

One of the major pros of converting USDT to traditional currency is the stability it offers. Traditional currencies, like the US dollar, have a long history and are backed by the central bank of their respective countries. This provides a level of trust and stability that can be appealing to individuals who are wary of the volatility often associated with cryptocurrencies.

Another advantage of converting USDT to traditional currency is the ease of use. Traditional currencies are widely accepted and can be used for everyday transactions, both online and offline. This makes it convenient for individuals who want to use their funds for various purposes, such as shopping, paying bills, or investing in other assets.

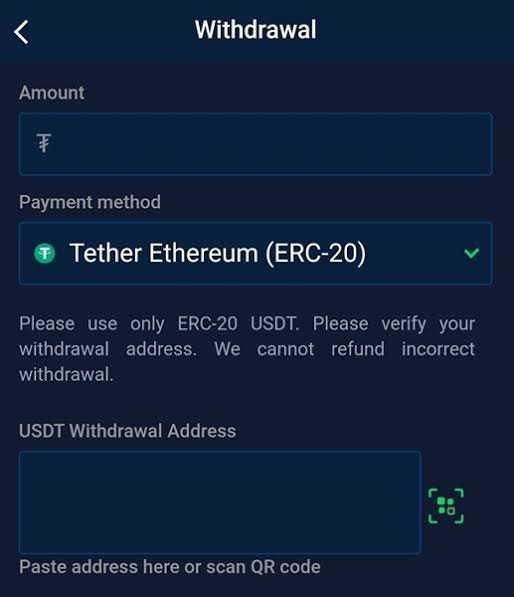

However, there are also some cons to consider when converting USDT to traditional currency. One potential drawback is the time it takes to convert USDT to traditional currency. This process can involve several steps and may require verification procedures, which can be time-consuming. Additionally, there may be limitations on the amount that can be converted at once, which can be an inconvenience for individuals with large sums of USDT.

Another disadvantage is the potential for fees and charges when converting USDT to traditional currency. Some platforms or exchanges may impose conversion fees, which can eat into the value of the funds being converted. It is important to carefully consider these fees and charges before deciding to convert USDT to traditional currency.

In conclusion, converting USDT to traditional currency has its pros and cons. It offers stability and ease of use, but it can also be time-consuming and may involve fees. It is important for individuals to carefully weigh these factors and consider their own needs and priorities before making a decision.

The Advantages and Disadvantages of Exchanging USDT for Fiat Currency

Exchanging USDT for traditional fiat currency can offer various benefits and drawbacks. Understanding these advantages and disadvantages can help individuals make informed decisions about their financial transactions.

Advantages

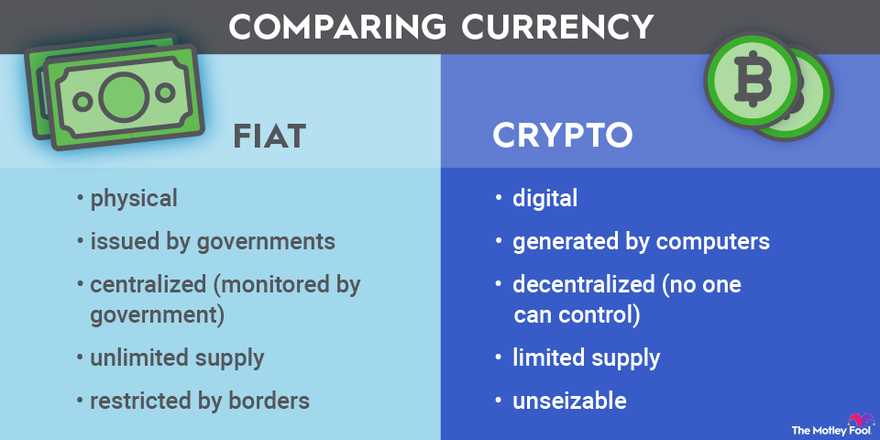

- Stability: Traditional fiat currencies, such as the US dollar or euro, tend to be more stable compared to cryptocurrencies like USDT. Exchanging USDT for fiat currency eliminates the risk of price fluctuations and provides a more predictable value for everyday transactions.

- Accepted Everywhere: Fiat currency is widely accepted across various platforms, businesses, and countries. By converting USDT to fiat currency, individuals can easily use their funds for daily expenses, online shopping, or international travel without the need for additional conversions.

- Regulation and Security: Fiat currency operates within a regulated financial system, offering certain protections and guarantees for consumers. Banks and financial institutions ensure the security of transactions and provide legal recourse in case of fraudulent activities.

- Offline Transactions: Unlike cryptocurrencies that require an internet connection or a digital wallet, fiat currency allows for offline transactions. This convenience makes it easier to conduct transactions in remote or underdeveloped areas without reliable internet access.

Disadvantages

- Transaction Fees: Exchanging USDT for fiat currency typically involves transaction fees, which can vary depending on the chosen platform or service provider. These fees may reduce the total amount individuals receive after the conversion.

- Centralized Control: Fiat currency is controlled by central banks and governments, giving them the power to influence its value and implement monetary policies. This centralized control can lead to inflation or devaluation, affecting the purchasing power of the currency.

- Dependency on Banks: Using fiat currency requires individuals to have access to banks or financial institutions. This dependency on intermediaries can limit financial independence and may subject users to the regulations and policies set by these institutions.

- Identity Verification: Converting USDT to fiat currency often involves complying with Know Your Customer (KYC) and anti-money laundering (AML) regulations. These requirements may involve providing personal information and going through identity verification procedures, which can be time-consuming and intrusive.

Considering these advantages and disadvantages, individuals should weigh their personal preferences, financial goals, and risk tolerance before deciding to convert USDT to fiat currency or vice versa. Each option has its own benefits and drawbacks that can impact the overall user experience and financial outcomes.

Pros of Converting USDT to Traditional Currency

Converting USDT (Tether) to traditional currency offers several advantages:

- Stability: Traditional currencies tend to be more stable compared to cryptocurrencies like USDT, which is pegged to the value of the US dollar. Converting USDT to traditional currency can help mitigate the risks associated with price volatility.

- Wider Acceptance: While USDT is becoming increasingly accepted by a wide range of merchants and service providers, traditional currencies are still more widely accepted globally. Converting USDT to traditional currency allows for seamless transactions in a broader range of establishments.

- Regulation and Security: Traditional currencies are subject to various regulations, offering a level of security and protection for users. Converting USDT to traditional currency can provide reassurance to individuals who prefer to transact within a regulated financial system.

- Access to Banking Services: Many banking services are designed for use with traditional currencies, such as savings accounts, loans, and credit cards. Converting USDT to traditional currency can provide greater access to these financial services and products.

- Ease of Use: Converting USDT to traditional currency allows for more straightforward and familiar use in everyday transactions. Traditional currencies are widely used, making it easier to calculate prices, budget, and track expenses.

While converting USDT to traditional currency offers these benefits, it is important to consider any associated fees and potential delays that may occur during the conversion process. Additionally, individuals should evaluate their financial goals and risk tolerance before making any decisions.

Cons of Converting USDT to Traditional Currency

While there are benefits to converting USDT to traditional currency, there are also a number of drawbacks to consider. Here are some of the cons:

1. Conversion fees

One of the main disadvantages of converting USDT to traditional currency is the conversion fees involved. When exchanging USDT for traditional currency, there are typically fees charged by the exchange platform or service provider. These fees can vary and can eat into the amount of traditional currency you receive.

2. Exchange rate risks

Another drawback is the exchange rate risk. The value of USDT is pegged to the US dollar, but it can still experience fluctuations. When converting USDT to traditional currency, you may be subject to unfavorable exchange rates, resulting in a lower amount of traditional currency than expected.

Furthermore, since the value of USDT is tied to the stability of the US dollar, any significant changes or instability in the US economy could also impact the value of USDT and potentially affect the conversion rate.

3. Limited acceptance

While the acceptance of USDT as a form of payment is growing, it is still not as widely accepted as traditional currencies. This can limit your options for using USDT directly and may require additional steps, such as converting it to traditional currency before making a purchase or payment.

4. Regulatory concerns

USDT and other cryptocurrencies operate in a relatively unregulated space. This lack of regulation can lead to concerns about security, fraud, and money laundering. Converting USDT to traditional currency may subject you to greater regulatory scrutiny and potential public disclosures of your transactions.

It’s important to weigh these cons against the potential benefits when considering whether to convert USDT to traditional currency. Factors such as convenience, transaction costs, and the stability of the US dollar should all be taken into account before making a decision.

Factors to Consider Before Converting USDT to Traditional Currency

Converting USDT (Tether) to traditional currency can be a decision that requires careful consideration. There are several factors to keep in mind before making this conversion.

1. Stability

One important factor to consider is the stability of the traditional currency you plan to convert USDT into. Different countries have different economic and political situations, and their currencies can fluctuate in value. It is essential to research and understand the stability of the currency you wish to convert to before making any decisions.

2. Conversion Fees

Another factor to consider is the conversion fees involved in converting USDT to traditional currency. Some platforms or exchanges may charge a fee for converting USDT or may offer unfavorable exchange rates. It is recommended to compare different platforms and choose one that offers competitive fees and rates.

3. Accessibility

Consider the accessibility of the traditional currency in your location. Some currencies may not be widely available or accepted in certain countries or regions, which can create challenges when converting USDT to traditional currency. Ensure that the currency you plan to convert to is easily accessible and can be used in your desired transactions.

4. Regulatory Compliance

Regulatory compliance is another crucial factor to consider. Different countries have varying regulations and requirements when it comes to cryptocurrency conversions and exchanges. Ensure that the platform or exchange you choose complies with the local regulations and follows proper Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

5. Market Conditions

Lastly, consider the current market conditions before converting USDT to traditional currency. The cryptocurrency market can be highly volatile, and the value of USDT can fluctuate. It is essential to analyze market trends and make informed decisions based on reliable sources of information.

In conclusion, before converting USDT to traditional currency, consider factors such as stability, conversion fees, accessibility, regulatory compliance, and market conditions. By evaluating these factors, you can make a well-informed decision that meets your financial needs and goals.

The Future of Converting USDT to Traditional Currency

As cryptocurrencies continue to gain popularity and acceptance, the future of converting USDT to traditional currency looks promising. With the increasing number of merchants and businesses accepting cryptocurrencies as a form of payment, the demand for converting USDT to traditional currency will only continue to grow.

One of the major advantages of converting USDT to traditional currency is the ease and convenience it offers. Unlike traditional banking systems, which often have long processing times and require extensive documentation, converting USDT to traditional currency can be done quickly and with minimal hassle.

Another significant factor that will shape the future of converting USDT to traditional currency is the development of regulatory frameworks. As governments around the world start to adopt and regulate cryptocurrencies, the conversion process will become more standardized and secure. This will provide users with greater confidence and trust in converting their USDT to traditional currency.

The emergence of stablecoins, like USDT, has also contributed to the increasing demand for converting cryptocurrencies to traditional currency. Stablecoins are designed to minimize price volatility and maintain a stable value, making them a preferred choice for merchants and businesses. This stability makes it easier for them to convert USDT to traditional currency without worrying about significant price fluctuations.

Moreover, technological advancements are likely to play a significant role in shaping the future of converting USDT to traditional currency. As blockchain technology continues to evolve, we can expect the development of more efficient and secure conversion platforms. These platforms will provide users with seamless and transparent conversion experiences, further boosting the adoption of converting USDT to traditional currency.

However, it’s essential to consider some potential challenges that may arise in the future. One such challenge is the impact of government regulations on the conversion process. As governments continue to increase their oversight and introduce stricter regulations, converting USDT to traditional currency may face additional hurdles. It will be crucial for users to stay informed about these regulations and ensure compliance to avoid any complications.

In conclusion, the future of converting USDT to traditional currency looks promising, thanks to the growing acceptance of cryptocurrencies and the development of stablecoins. With the ease and convenience it offers, along with the potential advancements in technology and regulatory frameworks, converting USDT to traditional currency will become more accessible and secure. It will continue to play a crucial role in the broader adoption and integration of cryptocurrencies into our daily lives.

| Pros | Cons |

|---|---|

| Quick and convenient process | Potential impact of government regulations |

| Standardized and secure conversion | Increased oversight and compliance requirements |

| Stability of stablecoins | |

| Technological advancements |

Q&A:

What are the benefits of converting USDT to traditional currency?

Converting USDT to traditional currency has several benefits. First, it allows you to easily transfer funds to your bank account or use them for everyday expenses. Second, traditional currency is widely accepted, making it easier for you to spend your funds. Lastly, converting USDT to traditional currency can help you avoid potential risks associated with cryptocurrency volatility.

Are there any downsides to converting USDT to traditional currency?

Yes, there are some downsides to converting USDT to traditional currency. One downside is that you may incur fees when converting your USDT to traditional currency, depending on the platform or service you use. Additionally, the process of converting USDT to traditional currency may take some time, which could be inconvenient if you need immediate access to your funds.

How can I convert USDT to traditional currency?

There are several ways to convert USDT to traditional currency. One common method is to use a cryptocurrency exchange platform that supports USDT and allows you to withdraw your funds to a bank account. Another option is to use a peer-to-peer trading platform where you can exchange your USDT for traditional currency with other users. It’s important to research and choose a reliable platform or service to ensure the process is secure and reliable.