How to Safeguard Your Digital Assets: Cold Wallets and Lost Crypto

Are you worried about the security of your digital assets? With the increasing number of cyberattacks and hacking incidents, it’s crucial to take steps to protect your cryptocurrency. One effective solution is using cold wallets, which offer an added layer of security for your valuable assets.

What are cold wallets?

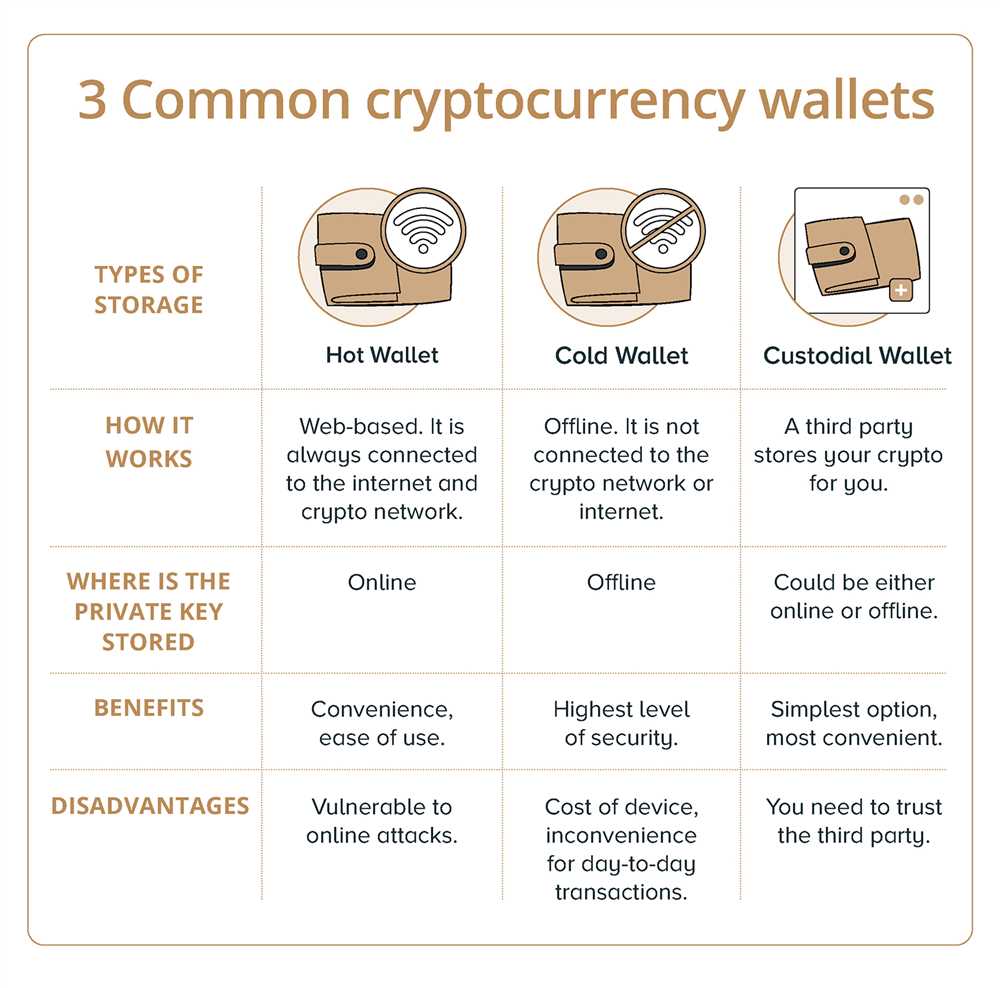

Cold wallets, also known as hardware wallets or offline wallets, are physical devices designed to store cryptocurrencies securely. Unlike hot wallets (online wallets), cold wallets are not connected to the internet, making them immune to hacking attempts and cyber threats.

Why use cold wallets?

Using cold wallets can significantly reduce the risk of losing your hard-earned crypto assets. With no internet connection, your private keys are kept offline, away from potential hackers. Even if your computer or smartphone gets compromised, your funds remain safe and secure in your cold wallet.

Tips for safeguarding your digital assets:

- Choose a reputable cold wallet: Make sure to do thorough research and opt for a trusted cold wallet provider. Look for features like strong encryption, multi-factor authentication, and compatibility with multiple cryptocurrencies.

- Create a strong password: Use a unique and complex password for your cold wallet that is difficult for others to guess or crack.

- Backup your wallet: Regularly backup your wallet by following the manufacturer’s instructions. Keep the backup in a secure location, such as a safe or a safety deposit box.

- Enable additional security features: Some cold wallets offer extra security features, such as biometric authentication or password timeouts. Take advantage of these features to enhance the overall security of your digital assets.

- Keep your wallet software up to date: Stay vigilant and regularly update your cold wallet software to ensure that you have the latest security patches and bug fixes.

By taking these steps and utilizing a cold wallet, you can safeguard your digital assets from potential threats and have peace of mind knowing that your cryptocurrencies are protected.

The Importance of Cold Wallets

When it comes to safeguarding your digital assets, one of the most crucial steps you can take is using a cold wallet. Cold wallets provide an added layer of security for your cryptocurrencies by storing them offline, away from the internet.

Unlike hot wallets, which are connected to the internet and therefore more vulnerable to hacking and theft, cold wallets are not accessible online, making them significantly more secure. By keeping your private keys offline, you eliminate the risk of cyber-attacks and unauthorized access to your digital assets.

Another important aspect of cold wallets is their resilience to technical failures. Hardware failures, software glitches, and system compromises can all result in the loss of your digital assets if stored in a hot wallet. Cold wallets, on the other hand, minimize these risks by keeping your cryptocurrencies safely stored offline.

Furthermore, cold wallets offer peace of mind. With the increasing number of cyber threats and cryptocurrency thefts, knowing that your digital assets are safely stored offline can provide reassurance and protect your investments.

It’s important to note that cold wallets may require extra steps to access your funds, such as connecting to a computer or mobile device when making transactions. While this may seem less convenient compared to hot wallets, the added security provided by cold wallets outweighs any minor inconveniences.

In conclusion, cold wallets play a critical role in safeguarding your digital assets. By storing your cryptocurrencies offline, away from the internet, you minimize the risks of hacking, theft, and technical failures. The added peace of mind and reassurance that cold wallets offer are invaluable in today’s world of increasing cyber threats and cryptocurrency attacks.

Risks of Losing Your Crypto

Investing in cryptocurrencies carries inherent risks, and one of the most significant risks is the potential loss of your digital assets. There are several ways in which you can lose your crypto, and it’s essential to be aware of these risks and take precautions to safeguard your investments.

1. Hacking and Cybersecurity Threats

Hackers are constantly looking for vulnerabilities in cryptocurrency wallets and exchanges to steal users’ funds. If your wallet or exchange account is compromised, you could lose access to your crypto or have it stolen. It is crucial to use secure wallets and employ robust security measures to minimize the risk of hacking.

2. Forgetting or Losing Wallet Recovery Phrases

Most cryptocurrency wallets use a recovery phrase, also known as a seed phrase or mnemonic phrase, to help users regain access to their funds in case they lose their wallet or forget their password. If you lose your recovery phrase, it can be incredibly challenging, if not impossible, to recover your crypto holdings. It is vital to store your recovery phrase securely and have multiple backups in separate, secure locations.

Additionally, if you forget the password to your wallet or lose access to your email account associated with your cryptocurrency exchange, you may face significant hurdles in recovering your crypto assets.

3. Physical Damage or Loss of Hardware Wallets

Hardware wallets, also known as cold wallets, are considered one of the most secure ways to store cryptocurrencies. However, if you lose or damage your hardware wallet without having a proper backup, you risk losing access to your digital assets forever. It is crucial to keep your hardware wallet in a safe place and have a backup recovery option, such as a secure backup phrase or secondary hardware wallet.

Furthermore, hardware wallets are not immune to technical failures or vulnerabilities. It is essential to keep your hardware wallet’s firmware up to date and pay attention to any security notifications or updates from the manufacturer.

By being aware of the risks associated with losing your crypto and taking necessary precautions, you can significantly reduce the likelihood of losing your digital assets. Remember to stay informed, use secure wallets and exchanges, and always have multiple backups of your recovery phrases and wallets.

How to Safeguard Your Digital Assets

When it comes to safeguarding your digital assets, there are several important steps you can take to protect your investments and ensure their safety. Here are some essential strategies to help you secure your digital assets:

1. Use a Cold Wallet: One of the most effective ways to safeguard your digital assets is to store them in a cold wallet. Cold wallets are offline, which means they are not connected to the internet, making them less vulnerable to hacking and online threats. By keeping your digital assets in a cold wallet, you can significantly reduce the risk of losing them.

2. Enable Two-Factor Authentication (2FA): Two-factor authentication adds an extra layer of security to your online accounts. By requiring two forms of verification (such as a password and a temporary code sent to your phone), it becomes much harder for hackers to access your digital assets. Enable 2FA whenever possible to better protect your accounts.

3. Regularly Update Software: Keep all your devices and software up to date to ensure you have the latest security patches and fixes. Software updates often include important security improvements that can help protect your digital assets from new threats and vulnerabilities.

4. Use Strong and Unique Passwords: Avoid using easy-to-guess passwords and always use a unique password for each of your online accounts. Strong passwords should include a combination of uppercase and lowercase letters, numbers, and special characters. This makes it harder for hackers to gain unauthorized access to your digital assets.

5. Employ Email Security Measures: Many cyber attacks originate from phishing emails or malicious attachments. Be cautious when opening emails and avoid clicking on suspicious links or downloading unknown attachments. Use spam filters and antivirus software to help identify and prevent potential email threats.

6. Diversify Your Digital Assets: Instead of putting all your digital assets in one place, consider diversifying your investments. Spread your digital assets across multiple wallets or exchanges to minimize the risk of losing everything if one account gets compromised.

7. Regularly Back Up Your Data: Make regular backups of your digital assets and store them in a secure offline location. In case of accidental loss or theft, having a backup will ensure that you can recover your assets and minimize any potential losses.

By following these strategies, you can greatly enhance the security of your digital assets and protect them from various threats. Remember, digital asset protection is an ongoing process, so stay vigilant and updated on the latest security practices to keep your investments safe.

Question-answer:

What is a cold wallet?

A cold wallet, also known as a hardware wallet, is a device specifically designed to securely store cryptocurrency offline. It keeps the private keys necessary to access and manage the funds separate from the internet, reducing the risk of hacking or theft.

How does a cold wallet safeguard my digital assets?

A cold wallet safeguards your digital assets by keeping the private keys offline. Since the private keys are never exposed to the internet, they are protected from potential hacks or online attacks. Additionally, cold wallets often use advanced encryption methods to further enhance security.

What are the advantages of using a cold wallet?

Using a cold wallet offers several advantages. First, it provides an extra layer of security by keeping your private keys offline. Second, it allows you to have full control over your funds and not rely on a third party. Finally, cold wallets are often compatible with multiple cryptocurrencies, making them versatile for managing different digital assets.

Are cold wallets compatible with all cryptocurrencies?

Most cold wallets are compatible with a wide range of cryptocurrencies. However, it’s always important to check the specifications of the particular cold wallet you are considering to ensure compatibility with the cryptocurrencies you own or plan to use.

Do I need technical knowledge to use a cold wallet?

While some basic understanding of cryptocurrency and technology may be helpful, most cold wallets are designed to be user-friendly and accessible to individuals with varying levels of technical knowledge. Manufacturers often provide detailed instructions and customer support to assist users in setting up and using their cold wallets properly.