Demystifying the 1:1 Parity of USDT and USD Is it Real

There has been much speculation and debate surrounding the 1-1 parity of USDT (Tether) and USD (United States Dollar). Many cryptocurrency enthusiasts and skeptics alike have questioned the legitimacy and stability of this relationship. Is USDT truly backed by an equivalent amount of USD? Or is it merely a cleverly designed illusion?

USDT, a type of cryptocurrency known as a stablecoin, was created to provide stability within the volatile world of digital currencies. It is pegged to the value of the USD, with Tether Ltd. claiming that each USDT token is backed by an equal amount of USD held in reserve.

However, doubts have arisen due to the lack of transparency and independent audits of Tether Ltd’s reserves. The company has faced criticism for its opaque practices and failure to provide concrete proof of the 1-1 parity between USDT and USD. This lack of clarity has raised concerns among investors and regulators, leading to investigations and legal challenges.

Despite the controversy, USDT has maintained its status as one of the most widely used stablecoins in the cryptocurrency market. Its popularity can be attributed to its ease of use and widespread acceptance by various exchanges and platforms. Nevertheless, the question remains: Is the 1-1 parity of USDT and USD real, or is it simply a mirage?

Understanding the Parity between USDT and USD

The concept of the parity between USDT (Tether) and USD (United States Dollar) has been a topic of discussion and concern for many individuals and entities involved in the cryptocurrency industry. In order to fully comprehend and analyze this issue, it is crucial to understand the underlying factors and mechanisms that contribute to or challenge the 1-1 parity claim.

What is USDT?

USDT is a cryptocurrency token that operates on the Omni Layer protocol. It is pegged to the value of the US dollar, with each USDT token representing a corresponding US dollar held in reserve by Tether Ltd., the company behind USDT. The aim of USDT is to provide stability and facilitate transactions between different cryptocurrencies, allowing users to move funds across exchanges without relying on traditional banking systems.

The 1-1 Parity Claim

The 1-1 parity claim asserts that each USDT token is fully backed by an equivalent amount of US dollars held in reserves. This claim is central to the credibility and utility of USDT, as it ensures that users can redeem their USDT for USD at a 1-1 ratio. However, the 1-1 parity claim has been met with skepticism and scrutiny due to a lack of transparency and frequent concerns about the company’s reserve holdings.

Issues and Concerns:

- Lack of Auditing and Transparency: One of the primary concerns surrounding USDT’s 1-1 parity claim is the absence of regular audits. Tether Ltd. has faced scrutiny for not providing independent audits or sufficient transparency regarding its reserve holdings.

- Financial Stability and Reserve Holdings: Questions have been raised regarding the actual amount of USD reserves held by Tether Ltd. to back the circulating supply of USDT tokens. Without proper verification, doubts arise about the stability and legitimacy of USDT.

- Regulatory and Legal Challenges: The tether ecosystem has faced regulatory challenges in various jurisdictions. The potential impact of legal and regulatory actions on Tether Ltd.’s operations and reserve holdings can affect the 1-1 parity claim.

It is important to note that the 1-1 parity claim does not guarantee that USDT will always maintain its value equal to the US dollar. Market factors, demand and supply dynamics, and external events can also impact the value and stability of USDT relative to USD.

Overall, understanding the parity between USDT and USD requires a careful examination of the transparency and credibility of Tether Ltd.’s reserve holdings, as well as the potential risks associated with regulatory and legal challenges. Investors and users should exercise due diligence and stay informed about the ongoing developments and discussions surrounding USDT to make informed decisions.

Myths and Misconceptions

As the popularity of stablecoins like USDT continues to grow, so do the myths and misconceptions surrounding their 1-1 parity with the US dollar. It’s important to separate fact from fiction and gain a clear understanding of how these stablecoins operate.

Myth: 1-1 parity means a fixed exchange rate

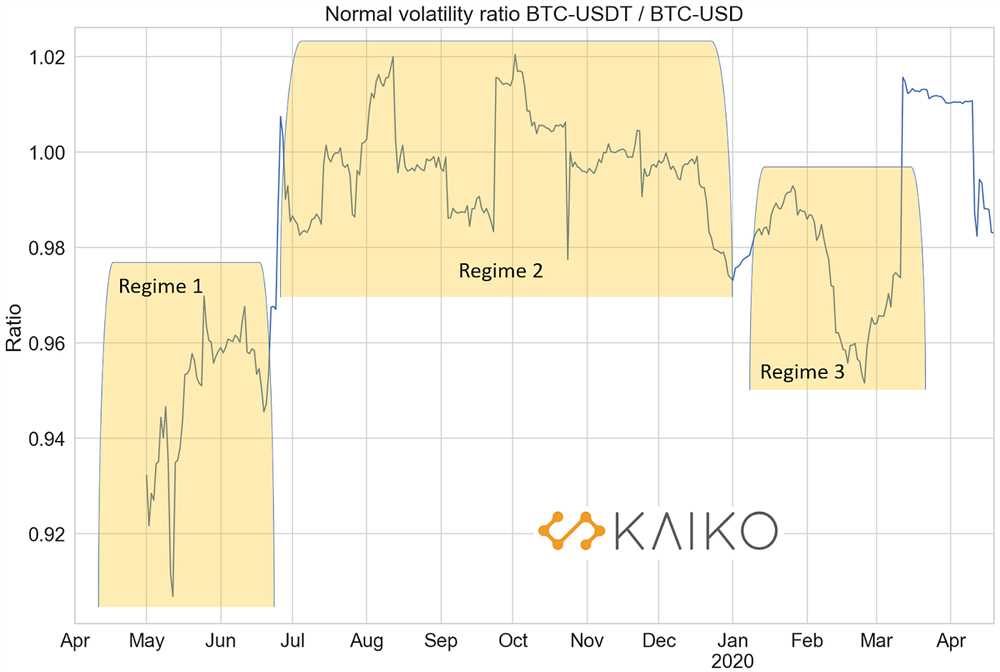

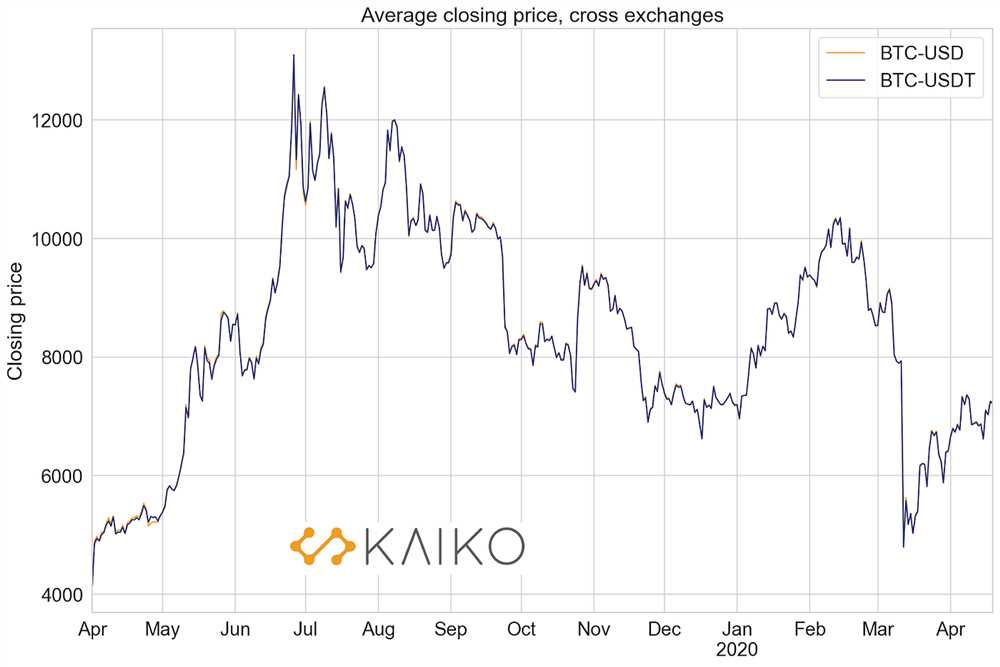

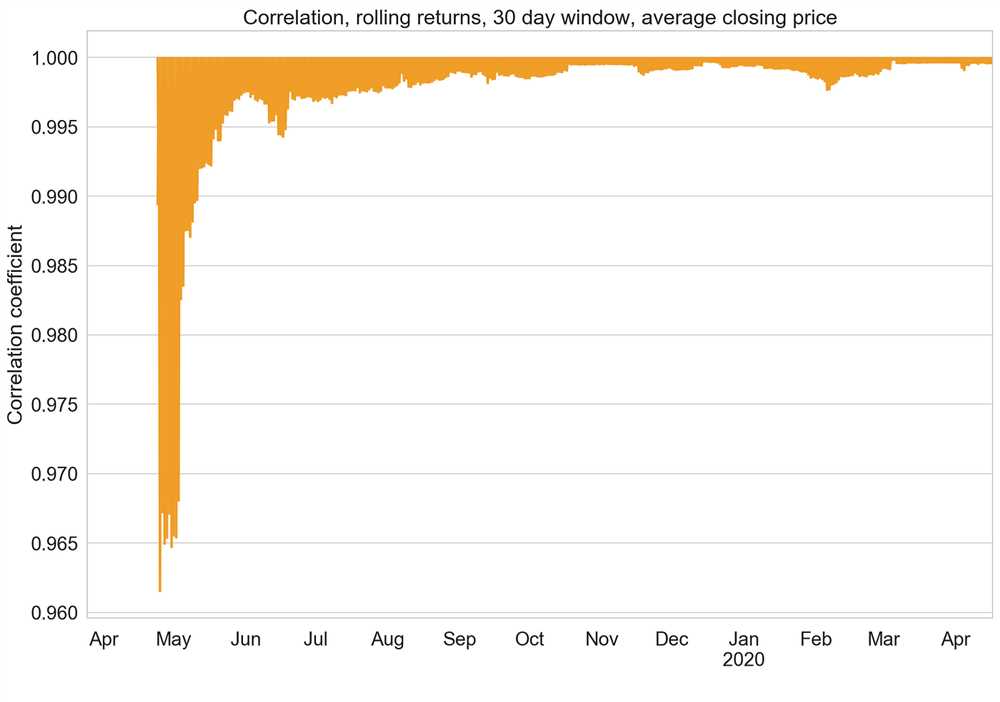

One common misconception is that the 1-1 parity between USDT and USD implies a fixed exchange rate. In reality, the value of USDT can fluctuate slightly due to supply and demand dynamics in the cryptocurrency market. However, reputable stablecoin issuers like Tether aim to keep the value within a narrow range around the 1-1 ratio.

Myth: USDT lacks transparency

Another myth surrounding USDT is that it lacks transparency. While it’s true that Tether initially faced scrutiny over its lack of audits, the company has taken steps to address this issue. Tether now undergoes regular audits from reputable firms to provide greater transparency and confidence in the stability of its reserves.

Myth: USDT is not backed by real USD

One of the most common misconceptions is that USDT is not fully backed by real USD. This misunderstanding often stems from confusion about the mechanics of stablecoins. Contrary to popular belief, Tether claims to hold reserves equivalent to the amount of USDT in circulation.

While critics have raised concerns about the lack of a comprehensive audit, Tether has provided periodic attestations from legal and accounting firms to support its claims. However, it’s important for investors to conduct their own due diligence to fully understand the risks involved.

Overall, it’s crucial to dispel these myths and misconceptions surrounding the 1-1 parity of USDT and USD. Stablecoins provide a valuable tool for individuals and businesses to transact in cryptocurrencies without being exposed to the high volatility typically associated with the crypto market.

Factors Influencing Parity

There are several factors that can influence the parity between USDT and USD. These factors include:

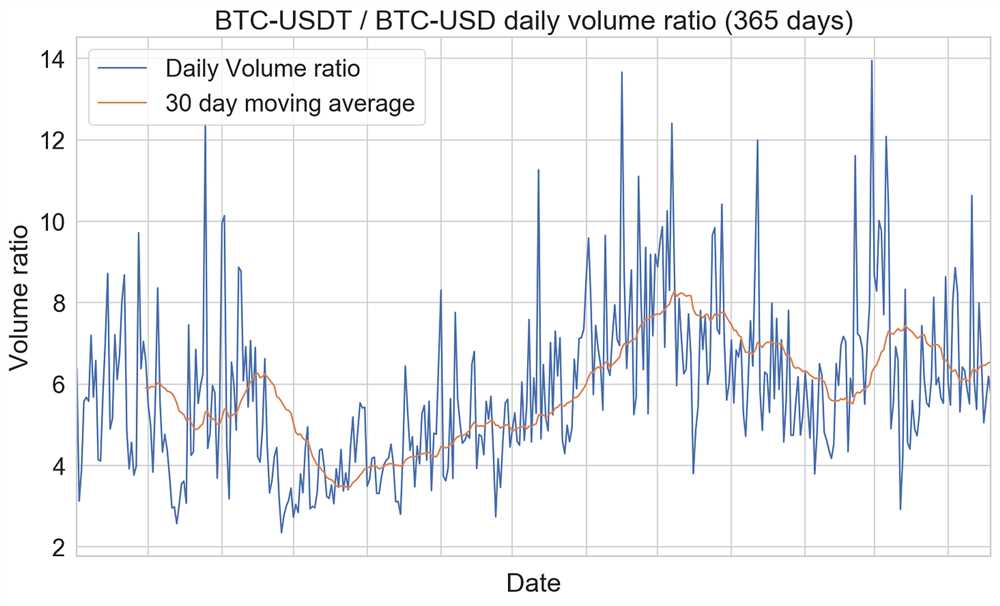

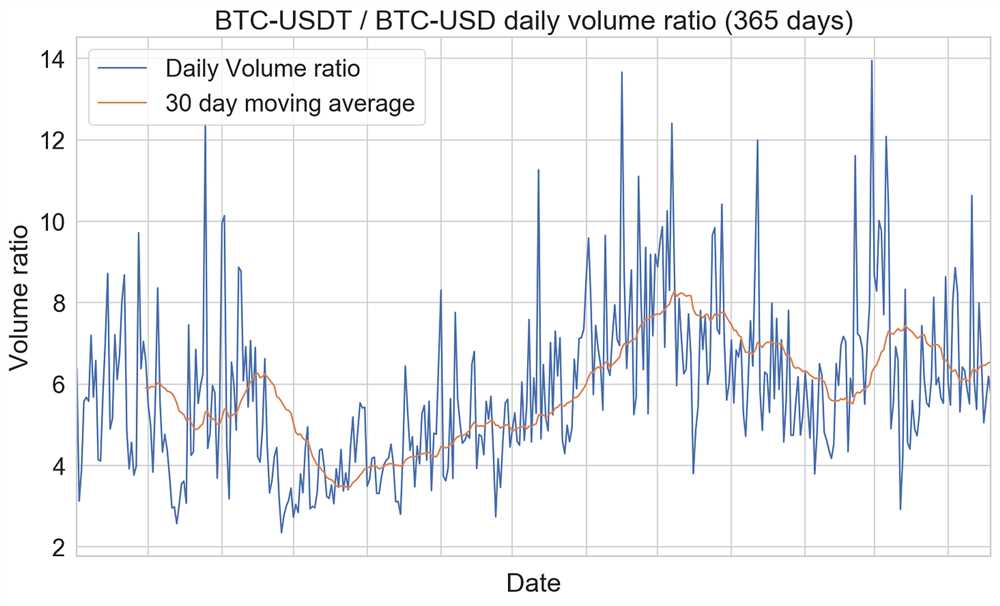

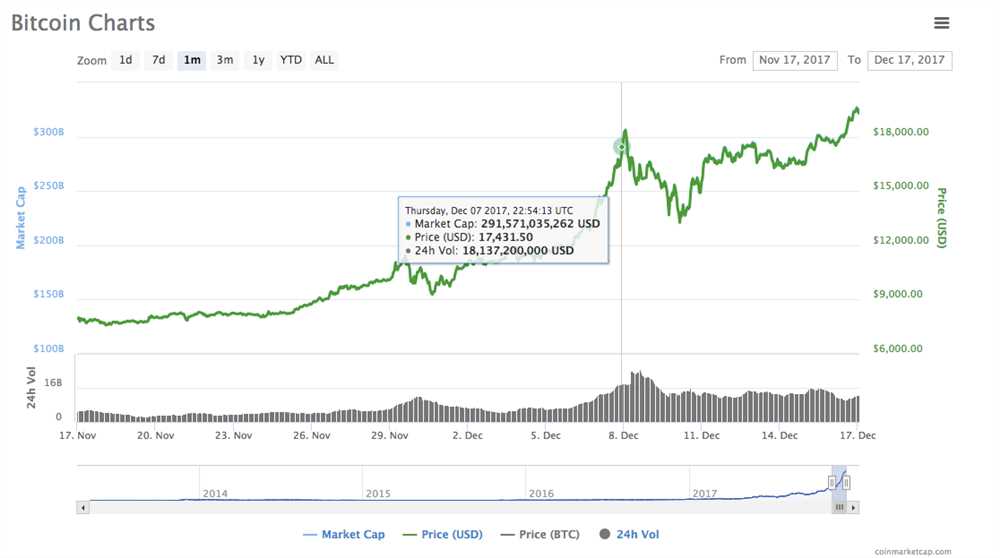

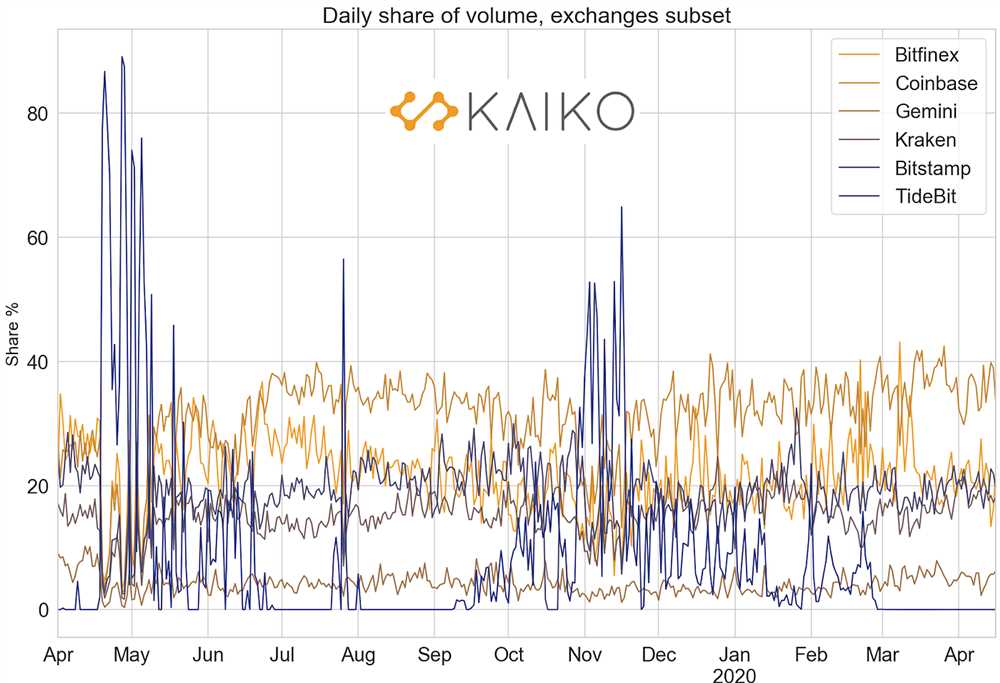

1. Market demand and supply: The overall demand and supply of USDT and USD on the market can affect their parity. If there is high demand for USDT, its price may increase, leading to a deviation from the 1-1 parity with USD.

2. Confidence and trust: The confidence and trust of market participants in the stability and reliability of USDT can also impact its parity with USD. If there are concerns about the backing and transparency of USDT, it may lead to a deviation from the 1-1 parity.

3. Regulatory environment: The regulatory environment surrounding stablecoins, including USDT, can influence their parity with USD. Changes in regulations or the introduction of new regulations can affect market dynamics and lead to deviations from parity.

4. Liquidity: The liquidity of USDT and USD markets can impact their parity. If there is low liquidity in either market, it may result in price discrepancies between USDT and USD, leading to a deviation from the 1-1 parity.

5. Market sentiment: Market sentiment and investor sentiment can play a role in determining the parity between USDT and USD. If there is overall pessimism or optimism in the market, it may affect the demand and price of USDT, leading to deviations from parity.

It is important to note that while the goal of USDT is to maintain a 1-1 parity with USD, fluctuations and deviations from this parity are possible due to the various factors influencing the market.

The Implications of Parity

The concept of parity between USDT and USD has significant implications for the world of cryptocurrency and beyond. Here are some key implications to consider:

1. Stability

One of the main implications of a 1-1 parity between USDT and USD is stability. With a guaranteed 1-1 exchange rate, users of USDT can have confidence that their digital assets are equal in value to the underlying fiat currency. This stability can help to alleviate concerns about price fluctuations and volatility in the cryptocurrency market.

2. Trust and Transparency

Parity between USDT and USD is closely linked to trust and transparency. If USDT truly maintains a 1-1 peg to the USD, it provides reassurance to users and investors that the stablecoin is backed by real assets and accurately reflects the value of the underlying fiat currency. This trust and transparency can help to foster greater adoption of USDT and other stablecoins as a reliable store of value and medium of exchange.

3. Relationship with Traditional Financial Systems

The concept of parity also raises important questions about the relationship between cryptocurrencies and traditional financial systems. If stablecoins like USDT can achieve and maintain a 1-1 peg to traditional fiat currencies, it could pave the way for increased integration between cryptocurrency markets and traditional financial systems. This could have far-reaching implications for cross-border transactions, remittances, and other aspects of global finance.

4. Regulatory Considerations

Parity between USDT and USD may also have implications for regulatory frameworks governing cryptocurrencies. If stablecoins can consistently maintain a 1-1 peg to fiat currencies, it may influence regulatory decisions regarding the classification and treatment of stablecoins. This could lead to clearer guidelines and regulations surrounding stablecoins, which could benefit both users and businesses operating in the cryptocurrency space.

In conclusion, the concept of parity between USDT and USD has wide-reaching implications for stability, trust, integration with traditional financial systems, and regulatory considerations. As the cryptocurrency market continues to evolve, the concept of parity will likely play an increasingly important role in shaping the future of stablecoins and their role in the broader economy.

Q&A:

What is the 1-1 parity of USDT and USD?

The 1-1 parity of USDT and USD refers to the claim made by Tether, the company behind USDT (a type of stablecoin), that each USDT token is backed by one US dollar.

Is the 1-1 parity of USDT and USD real?

The 1-1 parity of USDT and USD has been a topic of debate and skepticism. While Tether claims that each USDT is backed by one USD, there have been concerns about the company’s transparency and the availability of adequate reserves to support this claim.

What are some criticisms of the 1-1 parity of USDT and USD?

Some critics argue that there is insufficient evidence to prove that each USDT is indeed backed by one USD. There have been accusations of Tether engaging in fractional reserve banking and not having enough reserves to maintain the 1-1 parity.

What could happen if the 1-1 parity of USDT and USD is not maintained?

If the 1-1 parity of USDT and USD is not maintained, it could lead to a loss of confidence in the stability of USDT and a subsequent decrease in its value. This could have significant implications for individuals and businesses that rely on USDT as a form of digital currency.