USDT and USD: Coexisting in the Digital Economy

In today’s digital economy, we have witnessed the rise of cryptocurrencies and the widespread adoption of digital assets. One particular topic that has garnered significant attention is the coexistence of USDT (Tether) and USD (United States Dollar) in the digital ecosystem. Understanding the relationship between these two forms of currency is crucial for grasping the intricate dynamics of the digital economy.

USDT, also known as Tether, is a stablecoin that is pegged to the value of the USD. It is designed to provide stability and act as a bridge between traditional financial systems and the emerging world of cryptocurrencies. The value of USDT is maintained at a 1:1 ratio to the USD, meaning that for every USDT in circulation, there should be an equivalent amount of USD held in reserve.

While USD is a traditional fiat currency issued by a central bank, USDT operates on a blockchain network, utilizing the technology of cryptocurrencies. This key difference allows for the seamless transfer and storage of USDT across global borders, offering individuals, businesses, and institutions enhanced speed and accessibility in financial transactions.

Both USDT and USD play distinct roles in the digital economy. USD remains the dominant currency in global trade and commerce, serving as a standard for pricing goods and services. USDT, on the other hand, provides a digital alternative that combines the stability and familiarity of the USD with the advantages of blockchain technology.

Understanding the coexistence of USDT and USD requires recognizing their complementary nature. While USD remains a trusted form of currency, USDT offers additional benefits such as fast transactions, global accessibility, and reduced transaction costs. As the digital economy continues to evolve, the coexistence of these two currencies is likely to play a critical role in shaping the future of finance and commerce.

What is USDT? A Comprehensive Overview

USDT, also known as Tether, is a type of cryptocurrency that is designed to maintain a stable value against the US dollar. It is considered a stablecoin because it is backed by traditional currency reserves.

Launched in 2014, USDT is built on top of the Bitcoin blockchain using the Omni Layer protocol. This means that USDT transactions are recorded on the Bitcoin blockchain, providing transparency and security.

USDT is created through a process called tethering, where the Tether company issues tokens that are backed by an equivalent amount of US dollars. These tokens can be redeemed for US dollars at a 1:1 ratio, enabling users to easily transfer value between the digital and traditional financial systems.

Features of USDT

1. Stability: USDT aims to maintain a stable value by pegging it to the US dollar. This stability makes it suitable for various use cases, such as online purchases, remittances, and trading.

2. Liquidity: As one of the most widely accepted stablecoins, USDT is highly liquid and readily available for trading on various cryptocurrency exchanges.

3. Transparency: The Tether company regularly publishes reports attesting to the reserves backing USDT, providing transparency and accountability to users.

Use Cases of USDT

1. Trading: USDT is commonly used as a trading pair on cryptocurrency exchanges, allowing traders to easily hedge against volatile cryptocurrencies without the need to convert to fiat currency.

2. Remittances: USDT enables fast and low-cost cross-border transactions, making it an attractive option for remittances and international money transfers.

3. Store of Value: Due to its stable value, USDT can be used as a store of value to preserve wealth in times of market uncertainty.

| Advantages | Disadvantages |

|---|---|

| – Stable value | – Centralized control |

| – Easy transfer between digital and traditional financial systems | – Reliance on a trusted third party |

| – High liquidity | – Regulatory concerns |

The Rise of USDT in the Digital Economy

The digital economy has witnessed the remarkable rise of USDT, also known as Tether, in recent years. USDT is a cryptocurrency token that is designed to be pegged to the value of the US dollar. It was created to provide stability and accessibility to the volatile world of cryptocurrencies, offering a one-to-one ratio with the US dollar.

The popularity of USDT can be attributed to several key factors. Firstly, it provides a solution for crypto traders who want to hedge their investments in a stable currency without the need to exit the cryptocurrency market. By using USDT, traders can conveniently convert their holdings into a stable asset, safeguarding their wealth from the volatility of other digital currencies.

Backing and Transparency

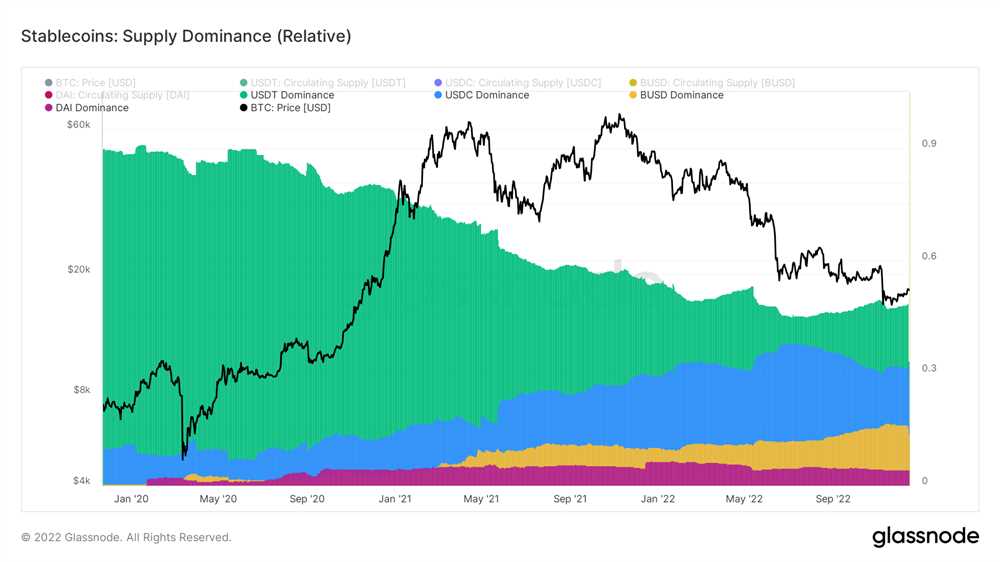

USDT’s rise can also be attributed to its transparent nature. Unlike other stablecoins, such as USDC or BUSD, USDT offers limited transparency regarding its backing. While the company behind USDT has faced scrutiny in the past, it has been working towards increasing its transparency and implementing regular audits of its reserves. This continuous improvement has helped to instill confidence in the cryptocurrency community.

Global Acceptance and Exchange Integration

An additional reason for the rise of USDT is its global acceptance and integration into various cryptocurrency exchanges. USDT is widely accepted as a trading pair on many exchanges and is commonly used as a bridge currency for converting between different cryptocurrencies. Its extensive adoption has made USDT a convenient, widely accepted, and easily usable digital asset.

Overall, the rise of USDT in the digital economy can be attributed to its stability, transparency, and wide acceptance. As the demand for stable, easily tradable assets continues to grow, USDT’s position as a leading stablecoin is likely to strengthen further, making it an essential component of the digital economy.

The Role of USDT in the Cryptocurrency Market

The popularity of USDT (Tether) has grown significantly in the cryptocurrency market. USDT is a stablecoin that is pegged to the value of the US dollar, which makes it a reliable and less volatile digital asset compared to other cryptocurrencies. Its stability makes it a crucial tool for traders and investors.

USDT serves as a bridge between traditional fiat currencies and digital assets. It provides a convenient way for users to store and trade their digital assets without the need to convert them back into fiat currencies. This eliminates the need for complicated and time-consuming processes, such as going through exchanges and dealing with fiat currency regulations.

Furthermore, USDT offers liquidity to the cryptocurrency market. Its consistent value allows traders to quickly and easily enter and exit positions, thereby enhancing market efficiency. Traders can use USDT as a safe-haven asset during times of market volatility, providing a stable and secure option for preserving their wealth.

USDT has also gained popularity in international transactions due to its ability to bypass traditional banking system intermediaries. This enables individuals and businesses to make fast and low-cost cross-border transactions without the need for traditional banking networks.

Overall, USDT plays a vital role in the cryptocurrency market by providing stability, liquidity, and accessibility. Its ability to maintain a one-to-one ratio with the US dollar ensures that it remains a trusted and widely used cryptocurrency in the digital economy.

The Significance of USD in the Digital Economy

The USD, or United States Dollar, plays a crucial role in the digital economy. As one of the most widely accepted and stable currencies in the world, the USD serves as a benchmark for many digital assets, including cryptocurrencies like USDT.

One of the main reasons for the significance of USD in the digital economy is its status as a global reserve currency. Many countries and financial institutions hold USD as part of their reserves, and it is commonly used for international trade and transactions. This global acceptance and trust in USD make it an ideal currency to anchor digital assets and provide stability in the volatile cryptocurrency market.

In the digital economy, USD serves as a bridge between the traditional financial system and the emerging blockchain technology. By having USD-backed stablecoins like USDT, users can easily transact with digital assets while still relying on the stability and familiarity of the USD. This is especially important for individuals and businesses who may be hesitant to fully embrace cryptocurrencies due to their volatility.

USD also provides liquidity in the digital economy. Many exchanges and trading platforms offer USD trading pairs, allowing users to exchange their digital assets directly for USD. This liquidity ensures that users can easily enter or exit the market, which contributes to the overall growth and vibrancy of the digital economy.

The Role of USD-backed Stablecoins

USD-backed stablecoins, such as USDT, have gained popularity in the digital economy for several reasons. These stablecoins are designed to maintain a 1:1 ratio with the USD, offering users the convenience of transacting in a digital currency while still being tied to the stability of the USD.

By using USD-backed stablecoins, users can benefit from the speed and efficiency of blockchain technology without being exposed to the volatility of other cryptocurrencies. This is particularly useful for individuals and businesses that need to transact quickly and securely, without the risk of losing value due to fluctuations in the market.

Furthermore, USD-backed stablecoins provide a level of transparency and accountability that is often lacking in the traditional financial system. By leveraging blockchain technology, users can track the issuance, circulation, and redemption of stablecoins, providing greater confidence in their value and legitimacy.

In summary, the USD’s significance in the digital economy cannot be overstated. As a globally accepted and stable currency, it serves as a benchmark for digital assets and provides stability in the volatile cryptocurrency market. USD-backed stablecoins, like USDT, further enhance the role of USD by offering users the convenience and security of transacting in a digital currency while still being tied to the USD’s stability.

The Role of USD in Global Trade and Commerce

The USD (United States Dollar) plays a significant role in global trade and commerce as one of the world’s primary reserve currencies. It serves as a medium of exchange, a unit of account, and a store of value for individuals, businesses, and governments across the world.

Accepted Worldwide

The USD is widely accepted and recognized as a safe and stable currency, making it the preferred choice for international trade and cross-border transactions. Many countries and businesses settle their international transactions in USD due to its stability and the trust it commands in the global financial markets.

Global Reserve Currency

The USD’s status as the global reserve currency gives it a unique advantage in global trade and commerce. Central banks of various countries hold significant reserves of USD to maintain stability and facilitate international trade. This status provides the US with the ability to influence global economic policies and financial markets.

Liquidity and Accessibility

The USD’s widespread availability and liquidity make it easily tradable and accessible in the global market. This availability facilitates seamless transactions and encourages international trade. Most major banks and financial institutions offer USD exchange services, making it convenient for businesses and individuals to convert their local currencies into USD.

Dominance in Commodity Trading

The USD’s dominance in commodity trading further strengthens its role in global trade and commerce. Most commodities, such as oil and gold, are priced and traded globally in USD. This relationship creates a direct link between the value of the USD and the prices of commodities, influencing global economic trends and market dynamics.

In conclusion, the USD’s role in global trade and commerce is crucial and far-reaching. Its stability, global acceptance, and dominance in financial markets make it an integral part of the digital economy and the international financial system.

Comparing USDT and USD: Similarities and Differences

USDT (Tether) and USD (United States Dollar) are both widely used in the digital economy, but they have some key differences that set them apart. In this article, we will explore the similarities and differences between these two digital currencies.

Similarities

Both USDT and USD are considered stablecoins, which means that their value is pegged to a stable asset, typically the US dollar. This means that their value remains relatively stable, as they are designed to maintain a 1:1 ratio with the underlying asset.

Moreover, both USDT and USD can be used for buying and selling goods and services, making them valuable instruments for online transactions. They are also widely accepted by various merchants and platforms in the digital economy.

Differences

One of the main differences between USDT and USD is their nature. While USD is a physical currency issued by the United States government and regulated by central banks, USDT is a digital currency that operates on blockchain technology.

Another difference lies in the level of transparency and regulation. USD is highly regulated by government authorities, and its issuance and distribution are closely monitored. In contrast, USDT operates on blockchain technology and is subject to less regulatory oversight.

Additionally, the stability of USDT and USD may differ. While USD is backed by the full faith and credit of the US government, USDT’s stability depends on the reserves held by Tether Ltd., the company behind USDT. The transparency and auditing practices of Tether Ltd. have been a subject of controversy in the past, raising concerns about the true value of USDT.

Furthermore, the accessibility of USDT and USD may vary. USD is widely accepted globally and can be easily exchanged for other currencies. USDT, on the other hand, may not be as widely accepted and may require specific platforms or exchanges for conversion.

In conclusion, while USDT and USD share some similarities as stablecoins, they have distinct differences in nature, regulation, stability, and accessibility. Understanding these similarities and differences is crucial when considering their use in the digital economy and making informed financial decisions.

Q&A:

What is USDT?

USDT stands for Tether, which is a cryptocurrency pegged to the value of the U.S. dollar. It is often referred to as a stablecoin because its value is designed to remain stable and equal to one U.S. dollar.

How does USDT coexist with USD in the digital economy?

In the digital economy, USDT coexists with USD by providing a digital representation of the U.S. dollar. While USD is the physical form of the currency, USDT serves as a digital equivalent that can be used for online transactions, trading, and investing.