Which Currency is Safer USD or USDT

In the world of digital currencies, two popular options stand out: the USD and USDT. Both currencies have their advantages and disadvantages, making it important for investors and traders to understand the differences between the two.

The USD, or United States dollar, is the most widely accepted and recognized currency in the world. It is backed by the United States government and is considered a safe and stable form of money. In times of economic uncertainty, many investors turn to the USD as a reliable store of value. The USD is regulated by the Federal Reserve, which helps maintain its stability and prevent excessive inflation.

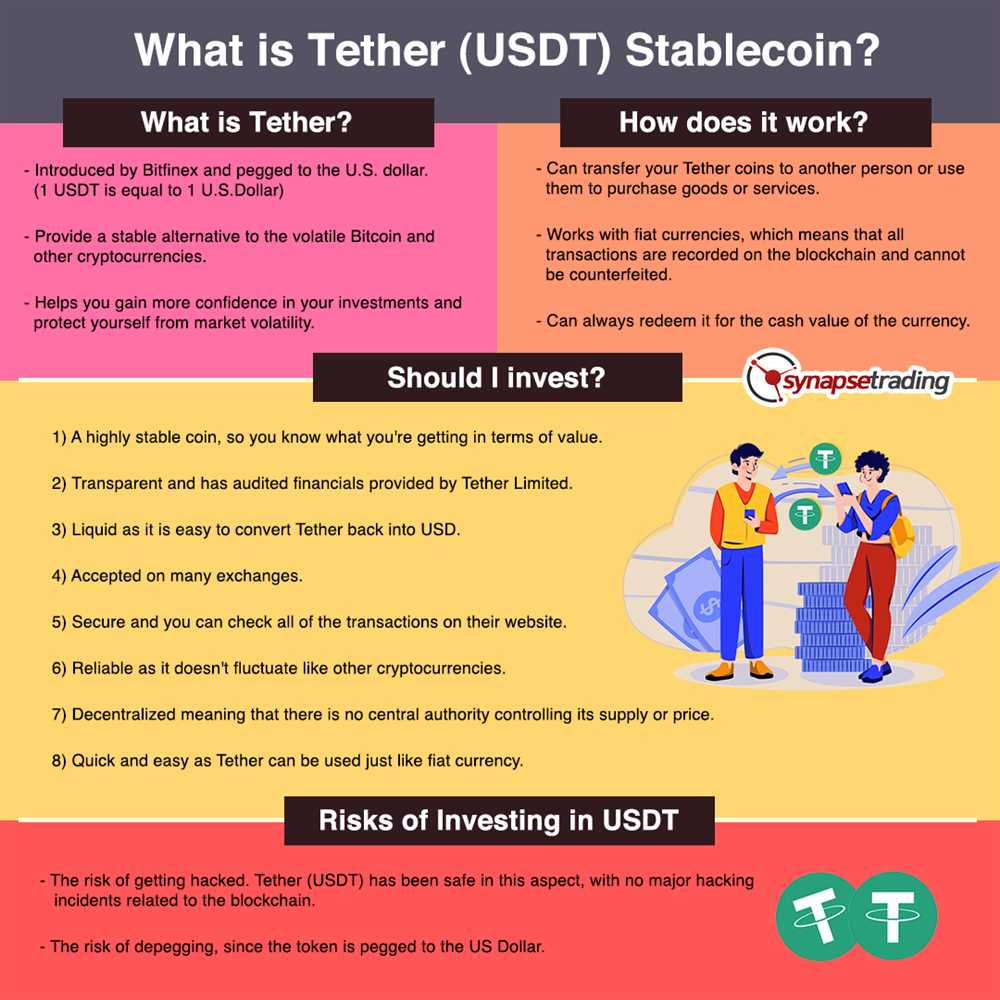

On the other hand, USDT, or Tether, is a digital currency known as a stablecoin. It is designed to maintain a stable value by pegging its price to a reserve of traditional currencies, such as the USD. Each USDT token is supposed to be backed by an equivalent amount of real-world currency, providing a sense of security and stability. However, some critics have raised concerns about the transparency and reliability of the reserves backing USDT.

In conclusion, both the USD and USDT have their merits and drawbacks. The USD is a widely accepted and stable currency backed by the United States government. On the other hand, USDT provides investors with a digital alternative that aims to maintain a stable value. Ultimately, the choice between the two currencies depends on individual preferences and risk tolerance.

USD vs USDT: A Comparison of Security and Stability

When it comes to choosing between USD and USDT, one of the key considerations is the level of security and stability that each currency offers. Let’s take a closer look at how USD and USDT compare in terms of these important factors.

Security:

The United States Dollar (USD) is the world’s reserve currency and is backed by the full faith and credit of the U.S. government. It is issued by the Federal Reserve, which implements various measures to maintain the security and integrity of the currency. The USD’s widespread acceptance and trusted status make it a highly secure currency.

On the other hand, USDT, also known as Tether, is a stablecoin that is pegged to the value of the USD. It is issued by the company Tether Limited, which claims to back every USDT token with an equivalent amount of USD reserves. However, the lack of regulatory oversight and transparency surrounding Tether has raised some concerns about its security. There have been controversies and legal issues surrounding Tether, which have led some to question its stability and authenticity.

Stability:

The stability of a currency refers to its ability to maintain a consistent value over time. Historically, the USD has been relatively stable compared to other currencies, especially in times of economic uncertainty. Its stability is a result of factors such as the strength of the U.S. economy, the country’s political stability, and the confidence of investors and markets in the currency.

USDT, as a stablecoin, is designed to maintain a 1:1 ratio with the USD. This means that each USDT token should be backed by an equivalent amount of USD reserves. The goal is to provide stability in the value of USDT, regardless of market fluctuations. However, the controversies and lack of transparency surrounding Tether have raised doubts about the stability of USDT, especially during times of market stress.

In conclusion, while the USD offers a higher level of security and stability as the world’s reserve currency, USDT’s security and stability are subject to more uncertainty due to its controversial history and lack of regulatory oversight. It is important for individuals and businesses to carefully consider these factors when choosing between the two currencies.

Understanding USD: The Traditional Currency

The United States Dollar (USD) is the official currency of the United States, and it is widely regarded as one of the most powerful and stable currencies in the world. Denoted by the symbol “$”, the USD is used as the primary medium of exchange for both domestic and international transactions.

The history of the USD dates back to the 18th century when it was established as the currency of the newly independent United States. Since then, the USD has evolved into an integral part of the global economy, serving as the reserve currency for many countries and playing a prominent role in international trade and finance.

Features of the USD

1. Stability: The USD is known for its stability and consistent value, making it a reliable store of wealth. Its stability is a result of various factors, including the strong and resilient US economy and the independence of the Federal Reserve System, which is responsible for monetary policy.

2. Wide Acceptance: The USD is widely accepted both domestically and globally, which enhances its liquidity and ease of use. It is the main currency used in international transactions, particularly in commodities trading and foreign exchange markets.

3. Reserve Currency: The USD is considered the world’s primary reserve currency, meaning that central banks and other financial institutions hold significant amounts of USD to support their own currencies and ensure stability in their economies.

Advantages of Using USD

1. Stability: As mentioned earlier, the USD is highly stable, which means it is less prone to large fluctuations in value compared to other currencies. This stability can protect against inflation and provide a sense of security for individuals and businesses.

2. Global Trade: The widespread acceptance of the USD makes it easier to engage in global trade and conduct cross-border transactions. Many countries, especially those with underdeveloped financial systems, prefer to use USD as a medium of exchange due to its stability and reliability.

3. Investment Opportunities: The stability and strength of the USD also make it an attractive currency for investment purposes. Investors often seek to hold USD to diversify their portfolios and protect against currency risks.

In conclusion, the USD is a widely recognized and reliable currency that has stood the test of time. Its stability and wide acceptance have made it a cornerstone of the global economy, reinforcing its position as a secure and stable currency.

Exploring USDT: The Stablecoin Alternative

When it comes to stablecoins, one of the most popular options in the market is USDT, also known as Tether. Unlike the USD, which is a fiat currency issued by the Federal Reserve, USDT is a type of cryptocurrency that is pegged to the value of the USD.

USDT is an ERC-20 token that operates on the Ethereum blockchain. This means that it can be stored in any Ethereum-compatible wallet and can be easily transferred between users. USDT has gained popularity due to its stability and the convenience it offers for trading and investing in the cryptocurrency market.

One of the key features of USDT is its pegged value to the USD. This means that for every USDT in circulation, there is supposed to be an equivalent amount of USD held in reserve by the issuer. This is intended to ensure that USDT remains stable and maintains its 1:1 ratio with the USD.

However, the stability of USDT has been a topic of debate in the cryptocurrency community. Critics have raised concerns about the transparency of Tether’s reserves and whether they actually hold enough USD to back all the USDT in circulation. This has led to questions about the true value and security of USDT.

Despite these concerns, USDT continues to be widely used in the cryptocurrency market. It is often used as a trading pair on various crypto exchanges, and many traders and investors find it to be a convenient way to hedge against market volatility. Additionally, USDT can also be used as a stable store of value in times of economic uncertainty.

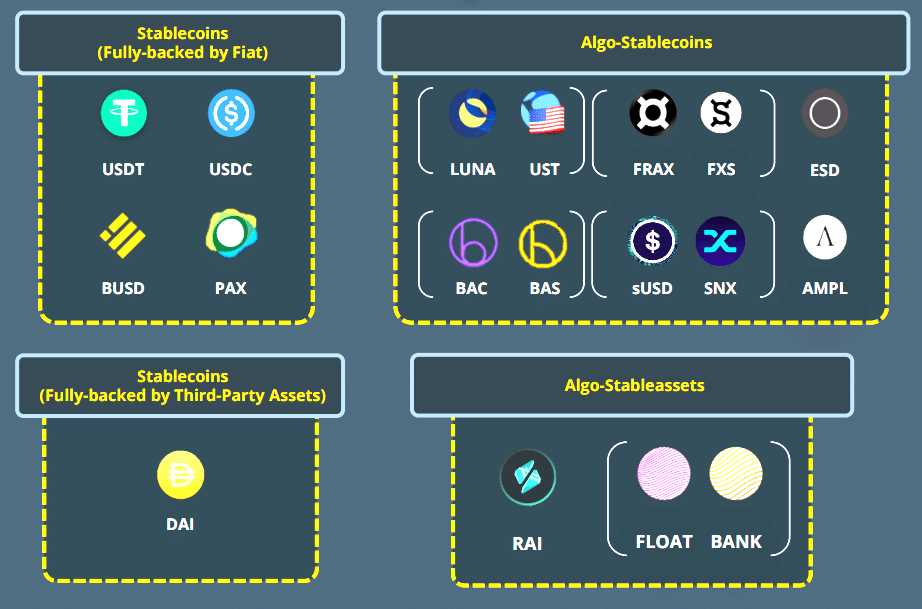

It is important to note that USDT is not the only stablecoin available in the market. There are several other alternatives, such as USD Coin (USDC) and Dai (DAI), that offer similar features and aims to provide stability in the cryptocurrency market. These alternatives may be worth exploring for those who have concerns about the reliability of USDT.

| USDT | USD |

|---|---|

| USDT is a cryptocurrency. | USD is a fiat currency. |

| USDT is pegged to the value of USD. | USD’s value is determined by economic factors. |

| USDT operates on the Ethereum blockchain. | USD is issued by the Federal Reserve. |

| The stability of USDT is a topic of debate. | USD is considered a stable currency. |

In conclusion, USDT offers a stablecoin alternative to the USD in the cryptocurrency market. While concerns about its stability and transparency exist, USDT continues to be widely used and provides a convenient way to trade and invest in cryptocurrencies. However, it is important to explore other stablecoin options and carefully consider the risks before making any investment decisions.

Evaluating Security and Stability: USD vs USDT

When it comes to evaluating the security and stability of currencies, USD and USDT are often compared. While USD is the official currency of the United States, USDT is a stablecoin, backed by USD reserves.

Security

When evaluating the security of a currency, we need to consider factors such as counterfeiting risk and data security.

- Counterfeiting Risk: USD has a long history and robust security features, making it difficult to counterfeit. On the other hand, USDT is a digital currency, which lowers the risk of physical counterfeiting but introduces other cybersecurity risks.

- Data Security: USD transactions are primarily carried out using traditional banking systems, which have established security protocols in place. However, USDT transactions are conducted on the blockchain, which relies on cryptographic principles and decentralized networks to ensure the security of transactions.

Overall, both USD and USDT have their own security measures in place, but they differ in terms of the risks they face due to their respective nature.

Stability

Stability is a crucial aspect when evaluating a currency’s value retention and ability to serve as a medium of exchange.

- USD Stability: As the official currency of the United States and a globally accepted reserve currency, USD is considered stable. It is backed by the economic strength of the United States, making it relatively resistant to extreme fluctuations in value.

- USDT Stability: USDT, being a stablecoin, is designed to be pegged to the value of USD. Its stability mainly depends on the reserves backing it. If the issuer maintains sufficient reserves and transparency, USDT can provide a stable value similar to USD.

It’s important to note that stability can be subject to external factors such as market demand and economic conditions. Both USD and USDT have their unique characteristics and usage scenarios, resulting in variations in their stability.

In conclusion, evaluating the security and stability of USD and USDT requires a consideration of their distinct features. While USD relies on established banking systems and physical security measures, USDT leverages cryptography and blockchain technology. Additionally, USD’s stability is rooted in its status as a reserve currency, whereas USDT’s stability is maintained through adequate backing and transparency. Understanding these differences can help individuals make informed decisions when choosing between the two currencies.

Question-answer:

What is the difference between USD and USDT?

The main difference between USD and USDT is that USD is a fiat currency issued and regulated by the United States government, while USDT is a cryptocurrency known as a stablecoin, which is designed to maintain a stable value by pegging it to the value of a fiat currency, such as the US dollar.

Is USDT secure and stable as compared to USD?

USDT is designed to be stable and maintain a 1:1 value with the US dollar, and its stability is enforced by the reserves held by the company that issues it. However, it’s important to note that USDT is not regulated in the same way as USD, and its stability can be influenced by market factors and trust in the issuing company.