Understanding the Value of USDT: Is 1 USDT Really Equal to 1 USD?

When it comes to stablecoins, one name that has gained significant attention in recent years is USDT (Tether). USDT is a cryptocurrency pegged to the value of the US dollar, with a fixed exchange rate of 1:1. This means that for every USDT in circulation, there should be an equivalent amount of US dollars held in reserves.

However, there has been some controversy surrounding USDT and its claim of maintaining a 1:1 parity with USD. Critics argue that Tether Limited, the company behind USDT, does not provide sufficient transparency and audits to verify the amount of USD reserves backing the stablecoin.

Despite these concerns, USDT remains one of the most widely used stablecoins in the cryptocurrency market. Its popularity can be attributed to its ability to provide a stable alternative to other volatile cryptocurrencies, allowing traders and investors to hedge against market fluctuations.

So, how does USDT maintain its 1:1 parity with USD? The answer lies in the concept of fiat collateralization. Tether Limited claims that for every USDT in circulation, there is an equivalent amount of USD held in its reserves. These reserves are audited periodically to ensure transparency and maintain the stability of the stablecoin.

While it is true that USDT has faced scrutiny and skepticism, it continues to play a crucial role in the cryptocurrency ecosystem. As the demand for stablecoins grows, it is important for projects like USDT to address concerns and provide verifiable proof of their reserves to maintain trust among users and investors.

Understanding USDT: Examining the USD Parity

USDT, also known as Tether, is a type of cryptocurrency called a stablecoin that claims to maintain a 1:1 parity with the United States dollar (USD). In other words, each unit of USDT should be equivalent to one US dollar.

But how does USDT achieve this stability and what mechanisms are in place to ensure the USD parity? Let’s dive deeper.

How USDT is backed by USD

According to Tether’s claims, each USDT token is backed by an equivalent amount of USD held in reserves. These reserves are supposed to be held in bank accounts and other secure assets to ensure the stability and 1:1 parity.

However, the specifics of these reserves have been a point of controversy and skepticism in the cryptocurrency community. Tether’s transparency has been questioned, and some critics believe that the company may not have enough USD reserves to back all the issued USDT tokens.

It’s important to note that Tether has repeatedly claimed to undergo audits to prove its USD parity. However, these audits have not been fully transparent, and doubts regarding their legitimacy persist.

The role of market liquidity

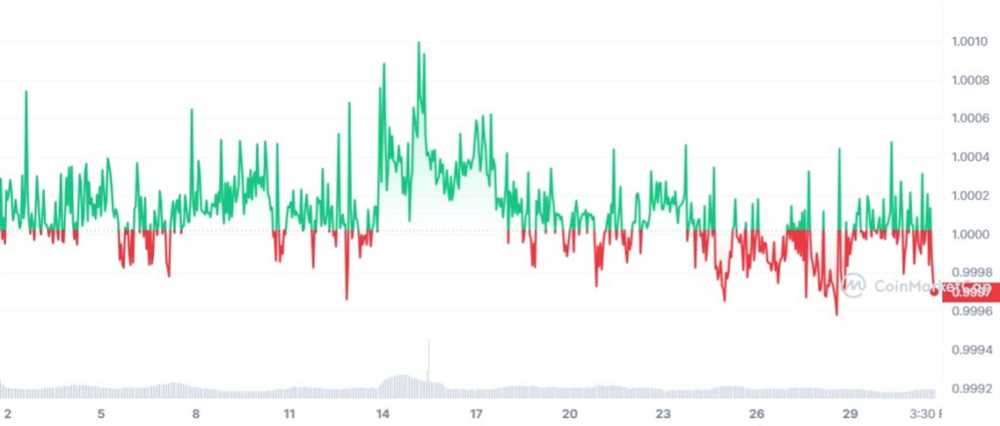

In addition to the reserve-backed model, USDT’s USD parity is also influenced by market liquidity. The supply and demand dynamics in the cryptocurrency markets can impact the value and stability of USDT.

If the demand for USDT increases, its price could rise above the 1:1 parity with USD. Conversely, if the demand decreases, the price of USDT may fall below the USD parity.

These fluctuations in market liquidity can lead to deviations from the 1:1 USD parity, although Tether has mechanisms in place to try to maintain stability.

The risks and controversies surrounding USDT

Due to the doubts and lack of complete transparency regarding Tether’s USD reserves, there are inherent risks associated with using USDT. The potential mismanagement of reserves or insolvency could lead to a loss of value or even a collapse of USDT.

Furthermore, Tether has faced legal scrutiny and investigations surrounding its operations. These controversies have raised concerns about the stability and credibility of USDT as a stablecoin.

| Pros | Cons |

|---|---|

| Provides a stable alternative to volatile cryptocurrencies | Risks associated with lack of transparency and doubts about USD reserves |

| Can be used as a hedge against market volatility | Potential legal and regulatory implications |

| Widely accepted and used in the cryptocurrency ecosystem | Market liquidity fluctuations can impact stability |

Overall, understanding the USD parity of USDT requires a critical examination of Tether’s claims, transparency, and the potential risks associated with stablecoins in general. Investors and users should carefully consider these factors before engaging with USDT.

Background on USDT

USDT, or Tether, is a cryptocurrency that was created by the company Tether Limited. It was launched in 2014 and is designed to be a stablecoin, which means that its value is supposed to remain consistent and have a 1:1 parity with the US dollar.

The idea behind USDT is to provide a digital currency that can be easily used for transactions, like other cryptocurrencies, but without the volatility and price fluctuations often associated with them. It aims to combine the advantages of blockchain technology with the stability of traditional fiat currencies.

To achieve this stability, Tether Limited claims that each USDT token is backed by an equivalent amount of fiat currency, typically US dollars, held in reserve. This is meant to provide assurance to users that the value of USDT is secure and that they can trust it as a reliable form of digital payment.

However, there has been criticism and controversy surrounding USDT, especially regarding its transparency and the extent to which it is truly backed by fiat currency. Some skeptics argue that Tether Limited has not provided sufficient evidence to prove its claims, leading to concerns about the legitimacy and trustworthiness of USDT.

Despite the controversy, USDT has gained significant popularity and is widely used in the cryptocurrency market. It is used by traders and investors as a way to hedge against market volatility or as a stable alternative to other cryptocurrencies. Its stable value also makes it a useful tool for merchants who want to accept digital payments without being exposed to price fluctuations.

Overall, USDT plays an important role in the cryptocurrency ecosystem and continues to be a topic of debate and speculation within the industry.

Exploring the 1:1 Parity with USD

USDT, or Tether, is a stablecoin that claims to maintain a 1:1 parity with the US dollar. This means that for every USDT in circulation, there is supposed to be an equivalent amount of USD held in reserves. The idea behind this is to provide stability and confidence to users of the cryptocurrency by tying its value to a trusted fiat currency.

But how exactly does USDT achieve this 1:1 parity with USD? The answer lies in the concept of backing reserves. Tether claims to have enough USD reserves to cover all issued USDT tokens. These reserves are held in bank accounts and are supposed to be audited regularly to ensure transparency and accountability.

The Controversy

While the idea of a stablecoin tied to the US dollar may seem appealing, the 1:1 parity of USDT with USD has come under scrutiny. There have been concerns about whether Tether actually holds enough reserves to back all issued USDT. Some have even accused Tether of engaging in fractional reserve banking, where the amount of reserves held is less than the amount of USDT in circulation.

The lack of a comprehensive audit by a reputable third-party has fueled these concerns. Tether has undergone various audits and claimed to be fully backed, but these audits have been criticized for their limited scope and lack of transparency. This has led to doubts about the actual 1:1 parity of USDT with USD.

The Impact

The controversy surrounding USDT’s 1:1 parity with USD has had implications for the broader cryptocurrency market. As one of the most widely used stablecoins, any doubts about the stability and liquidity of USDT can have a ripple effect on other cryptocurrencies. In times of uncertainty, traders may seek safer alternatives, leading to increased demand for other stablecoins or even traditional fiat currencies.

Furthermore, the lack of a clear audit trail and transparency can undermine trust in the cryptocurrency ecosystem as a whole. Trust is essential for the long-term viability and adoption of cryptocurrencies, and any doubts about the stability and backing of stablecoins can erode that trust.

In conclusion, the 1:1 parity of USDT with the USD is a concept that is still subject to debate and scrutiny. While Tether claims to maintain the necessary reserves to back all issued USDT, the lack of transparency and comprehensive audits has raised concerns about the true backing of the stablecoin. These concerns have broader implications for the cryptocurrency market and the overall trust in the ecosystem.

Debunking Common Misconceptions

There are several misconceptions surrounding USDT that need to be clarified. Let’s debunk some of the most common ones:

Myth 1: USDT is not backed by real dollars

Contrary to popular belief, USDT is indeed backed by actual USD reserves held by Tether Limited. The company claims to maintain a 1:1 ratio between USDT and the USD reserves, ensuring the stability and parity of the cryptocurrency.

Myth 2: USDT cannot be redeemed for actual dollars

USDT is designed to be redeemable for US dollars. Tether Limited provides the option for users to convert their USDT holdings back into USD. However, it is important to note that there may be certain requirements and limitations for the redemption process, such as minimum redemption amounts or fees.

Myth 3: USDT is not regulated

While USDT is not directly regulated by any specific government agency, Tether Limited has implemented compliance measures to ensure transparency and legality. The company has undergone audits and claims to comply with anti-money laundering (AML) and know your customer (KYC) requirements.

Myth 4: USDT is a stablecoin with zero price volatility

Although USDT aims to maintain a stable value equivalent to one US dollar, it can experience minimal fluctuations in price. These fluctuations are usually driven by market demand and supply dynamics, especially during periods of high trading activity.

Myth 5: USDT is the same as holding USD

While USDT is designed to mimic the value of USD, it is important to understand that holding USDT is not the same as holding actual USD. USDT is a cryptocurrency that operates on blockchain technology, offering certain advantages like faster transactions and global accessibility. However, it also carries inherent risks associated with the cryptocurrency market.

It is crucial to separate fact from fiction when it comes to USDT. By debunking these misconceptions, we can gain a clearer understanding of its mechanisms and role within the cryptocurrency ecosystem.

Benefits and Risks of USDT

USDT, also known as Tether, offers several benefits and risks that investors should consider before engaging in transactions with this cryptocurrency.

Benefits:

1. Stability: USDT aims to maintain a 1:1 parity with the US dollar, providing stability and predictability to investors.

2. Liquidity: USDT is widely accepted by many cryptocurrency exchanges and trading platforms, offering high liquidity and easy access to trading opportunities.

3. Accessibility: USDT can be easily purchased and sold, making it accessible to a wide range of investors, regardless of their location.

4. Efficient transactions: USDT transactions can be performed quickly and at a low cost, thanks to its integration with blockchain technology.

5. Diversification: USDT offers investors an opportunity to diversify their cryptocurrency holdings, reducing their exposure to the volatility of other cryptocurrencies.

Risks:

1. Centralized nature: USDT is issued and managed by a centralized company, which raises concerns regarding transparency and potential risks of hacks or mismanagement.

2. Regulatory challenges: The regulatory environment for USDT and other stablecoins is still evolving, and changes in regulations could affect its value and usability for investors.

3. Counterparty risk: As USDT is pegged to the US dollar, its value is dependent on the trustworthiness and solvency of the company behind it.

4. Volatility of underlying assets: While USDT aims to maintain a stable value, the underlying assets, such as bonds and commercial paper, may experience fluctuations in value, which could impact the stability of USDT.

5. Lack of audit: The company behind USDT has faced criticism for not providing regular audits of their reserves, which has raised concerns among investors about the true amount of backing for USDT.

Investors should carefully weigh these benefits and risks when considering USDT as part of their investment portfolio. It is important to conduct thorough research and consult with financial professionals before making any investment decisions.

Q&A:

What is USDT?

USDT, or Tether, is a stablecoin that is pegged to the value of the US dollar. It is designed to maintain a 1:1 parity with the US dollar, meaning that each USDT should always be worth $1.

How does USDT maintain its 1:1 parity with USD?

USDT is backed by reserve assets, primarily cash and cash equivalents, which are held by the issuing company. These assets are meant to provide a reserve of value to ensure the stability of USDT. The company claims that for every USDT in circulation, there is an equivalent amount of US dollars held in reserve.

Is USDT really backed by enough reserves to maintain its parity?

This is a point of debate and concern within the cryptocurrency community. While the company behind USDT claims to hold enough reserves to back every USDT with an equivalent US dollar, they have faced scrutiny and legal challenges regarding the transparency of their reserves. Some critics argue that USDT may not be fully backed, which could put its 1:1 parity at risk.

What are the risks of using USDT?

There are several risks associated with using USDT. Firstly, the potential lack of transparency regarding its reserves raises concerns about the stability of its value. If USDT is not fully backed, its 1:1 parity with the US dollar could be compromised. Additionally, USDT’s value can be affected by market demand and other factors, leading to fluctuation and potential loss of value.