Trezor Hacked – A Cautionary Tale for Cryptocurrency Investors

In today’s digital age, the world is undergoing a financial revolution. Cryptocurrency, once an obscure concept, has now become a hot topic in finance and investment. As more and more individuals look for alternative ways to invest and store their wealth, the need for secure and reliable cryptocurrency wallets has become paramount. One such wallet, Trezor, has been praised for its security features and ease of use. However, recent events have cast a shadow on its reputation.

It was a shocking revelation when news broke that Trezor had been hacked. This breach of security sent shockwaves through the cryptocurrency community and served as a stark reminder that even the most trustworthy platforms are not impervious to threats. This cautionary tale serves as a wake-up call for cryptocurrency investors, reminding them of the risks and vulnerabilities inherent in this emerging market.

Trezor, a popular hardware wallet designed to store and protect cryptocurrency, had long been praised for its robust security measures. However, hackers were still able to exploit vulnerabilities and gain unauthorized access to users’ funds. This incident serves as a stark reminder that investors should never underestimate the importance of strong security protocols and constant vigilance in the realm of cryptocurrency.

Investing in cryptocurrency can be an exciting and potentially lucrative venture, but it also comes with its fair share of risks. As the popularity of cryptocurrency continues to soar, hackers are becoming more sophisticated and determined to exploit vulnerabilities. This recent breach highlights the need for investors to do their due diligence and take proactive steps to protect their hard-earned money.

Trezor Hack: Lessons for Cryptocurrency Investors

Recently, the Trezor hardware wallet, known for its secure storage of cryptocurrencies, was hacked, sending shockwaves throughout the cryptocurrency community. This incident highlights the need for investors to be extra cautious and take necessary precautions to protect their digital assets.

Here are some important lessons that cryptocurrency investors can learn from the Trezor hack:

| Lesson #1: Choose Hardware Wallets Wisely |

|---|

| Not all hardware wallets are created equal. It is crucial to thoroughly research and choose a reputable and well-established wallet provider. Look for wallets with strong security features, a track record of no vulnerabilities, and regular software updates. |

| Lesson #2: Don’t Rely Solely on Hardware Wallets |

| Although hardware wallets are considered one of the most secure options for storing cryptocurrencies, they are not foolproof. It is essential to have multiple layers of security, including setting up strong passwords, enabling two-factor authentication, and regularly updating and backing up wallet software. |

| Lesson #3: Stay Informed about Security Measures |

| Cryptocurrency investors should stay up-to-date with the latest security measures and best practices. Following reputable cryptocurrency news sources and forums can help investors stay informed about potential vulnerabilities, emerging threats, and security recommendations. |

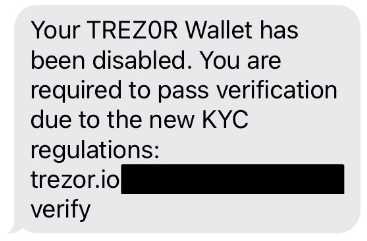

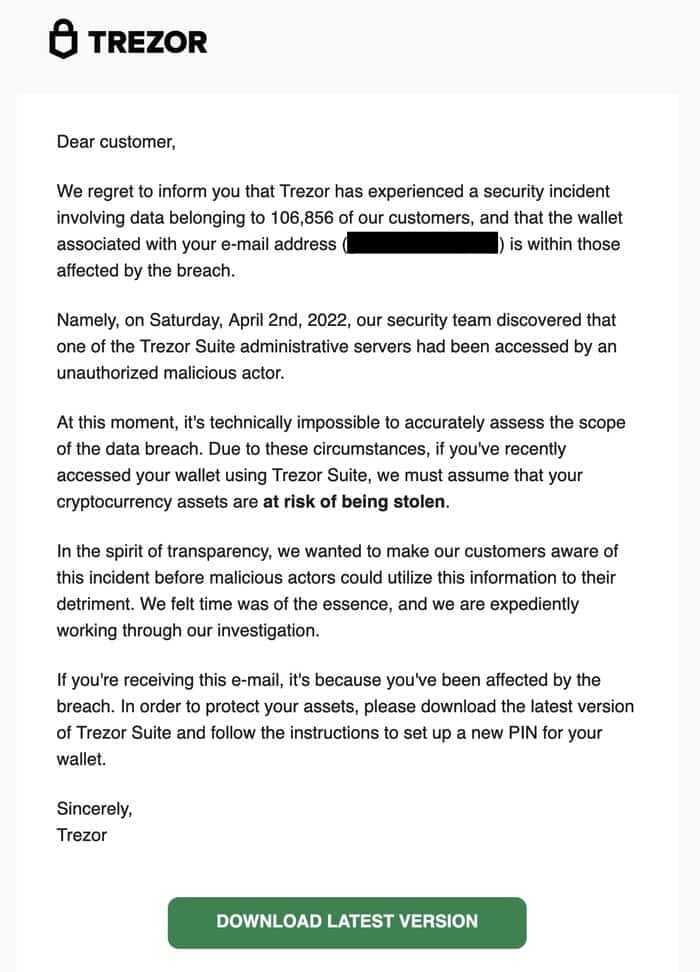

| Lesson #4: Be Wary of Phishing Attempts |

| Phishing is a common tactic used by hackers to trick users into revealing sensitive information. Investors should be cautious of phishing attempts, such as suspicious emails or fake websites that mimic legitimate cryptocurrency platforms. Always double-check URLs, verify the sender’s identity, and avoid clicking on suspicious links. |

| Lesson #5: Consider Offline Storage Options |

| Offline storage options, such as cold wallets or paper wallets, provide an extra layer of security by keeping private keys completely offline. While they may be less convenient for regular transactions, they are highly secure against online threats. |

By learning from incidents like the Trezor hack, cryptocurrency investors can take proactive steps to safeguard their investments and reduce the risks associated with storing and managing digital assets.

Importance of Secure Hardware Wallets

Cryptocurrency investors have become increasingly aware of the importance of securing their digital assets. With the rise in hacking incidents and cyber attacks, it is crucial to store your cryptocurrencies in a safe and secure manner. One of the most effective ways to achieve this is by using a hardware wallet.

What is a hardware wallet?

A hardware wallet is a physical device that is designed to securely store the private keys of your cryptocurrencies. It is usually a combination of software and hardware components, which work together to provide a high level of security. These wallets enable you to safely store and manage your digital assets offline, away from the vulnerabilities of the internet.

Why are hardware wallets important?

Enhanced security: Hardware wallets provide an extra layer of security by keeping your private keys offline. This ensures that they are not exposed to potential hackers or malware that might be present on your computer or mobile device.

Protection against physical theft: Since hardware wallets are physical devices, they can be safely stored in a secure location, such as a safe or a vault. This protects your cryptocurrencies from being stolen in the event of a physical break-in or robbery.

Ease of use: Despite their advanced security features, hardware wallets are user-friendly and easy to use. They typically have intuitive interfaces and simple setup processes, making them accessible even to individuals with limited technical knowledge.

Compatibility: Hardware wallets support a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many others. This allows you to securely store multiple digital assets in a single device, without the need for separate wallets for each cryptocurrency.

Overall, hardware wallets are an essential tool for cryptocurrency investors who want to ensure the security and protection of their digital assets. By storing your private keys offline in a secure physical device, you can minimize the risk of theft and hacking, providing you with peace of mind as you navigate the dynamic world of cryptocurrencies.

The Trezor Hack Incident

Recently, there was an alarming incident involving the Trezor hardware wallet, which serves as a cautionary tale for cryptocurrency investors. The hack exposed a vulnerability in the device’s security measures, leading to potential loss of funds for users.

The hack occurred when a skilled cybercriminal gained unauthorized access to the Trezor wallet through a complex series of hacking techniques. Once inside, they were able to bypass the wallet’s encryption and gain control over the private keys, which are essential for accessing and managing cryptocurrencies.

This incident highlights the importance of maintaining robust security measures when it comes to managing cryptocurrencies. It serves as a reminder that no system is completely immune to hacking attempts, and investors must remain vigilant in protecting their digital assets.

Trezor has since taken immediate action to address the vulnerability and enhance the wallet’s security features. They have released a firmware update that patches the security loophole and strengthens the overall protection of user funds.

However, this incident should not diminish the trust in hardware wallets as a secure means of storing cryptocurrencies. While no system is infallible, hardware wallets like Trezor still provide a higher level of security compared to online wallets or exchanges.

- Investors are advised to keep their firmware up-to-date and apply security patches promptly.

- It is also recommended to enable two-factor authentication and regularly backup private keys to an offline location.

- Furthermore, investors should exercise caution and avoid sharing their private key information with anyone.

- By implementing these best practices, investors can minimize the risks associated with storing cryptocurrencies.

In conclusion, the Trezor hack incident serves as a stark reminder of the ever-evolving nature of cyber threats in the cryptocurrency space. It underlines the need for investors to remain vigilant and take proactive steps to safeguard their digital assets.

The Impact on the Cryptocurrency Community

The hacking of Trezor, one of the most popular hardware wallets for cryptocurrencies, has sent shockwaves throughout the cryptocurrency community. This incident has raised concerns among investors and users about the security of their digital assets and the overall stability of the cryptocurrency market.

One immediate impact of this incident has been a decrease in confidence among cryptocurrency investors. Many individuals who were considering investing in cryptocurrencies or using hardware wallets have now become wary due to the breach. This loss of confidence could have a long-term effect on the adoption and growth of cryptocurrencies, as potential investors may choose to stay away from the market altogether.

Furthermore, the hack has also highlighted the vulnerabilities in hardware wallets that were previously thought to be secure. Hardware wallets are widely regarded as one of the safest ways to store cryptocurrencies, but this incident has shattered that perception. This poses a significant challenge for both hardware wallet manufacturers and the cryptocurrency community as a whole.

In addition to the immediate concerns, there are also long-term implications for the reputation and trustworthiness of the cryptocurrency market. The incident serves as a reminder that the cryptocurrency industry is still relatively young and lacks the robust security measures that traditional financial institutions have in place.

As a result, there may be increased calls for stricter regulations and oversight in the cryptocurrency space. This could change the dynamics of the market and potentially lead to a more controlled and regulated environment for investors. However, it is important to strike a balance that ensures security without stifling innovation and freedom.

| Impact | Description |

|---|---|

| Financial Losses | The hack may result in significant financial losses for affected individuals and the broader cryptocurrency community. |

| Reputation Damage | The incident could tarnish the reputation of the cryptocurrency market, making it harder for new investors to trust the industry. |

| Increased Security Measures | The hack may lead to the implementation of stricter security measures and regulations to protect users and investors. |

| Safety Concerns | Users may become more concerned about the safety of their digital assets and seek alternative storage options. |

Steps to Protect Your Investments

Protecting your cryptocurrency investments is essential to safeguarding your hard-earned money. Here are some steps you can take to ensure the security of your funds:

1. Use a Hardware Wallet: Consider using a hardware wallet like Trezor to store your cryptocurrencies. Hardware wallets provide an extra layer of security by keeping your private keys offline and out of reach from hackers.

2. Enable Two-Factor Authentication (2FA): Enable 2FA on your cryptocurrency exchange accounts and wallets. 2FA adds an extra layer of security by requiring a second form of authentication, such as a code generated by a smartphone app, in addition to your password.

3. Keep Your Software Up to Date: Regularly update your operating system, antivirus software, and cryptocurrency wallets to ensure you have the latest security patches and protections against potential vulnerabilities.

4. Use Strong and Unique Passwords: Create strong and unique passwords for your cryptocurrency accounts. Avoid using easily guessable passwords and consider using a password manager to securely store and generate complex passwords.

5. Be Cautious of Phishing Attempts: Be vigilant of phishing attempts, where scammers try to trick you into providing your login credentials or other sensitive information. Always double-check the URLs and never click on suspicious links in emails or messages.

6. Store Your Recovery Phrases Securely: Ensure that you securely store the recovery phrases associated with your cryptocurrency wallets. These phrases can be used to restore access to your funds in case of device loss or failure.

7. Diversify Your Investments: Consider diversifying your cryptocurrency investments across multiple wallets and exchanges. By spreading your funds across different platforms, you reduce the risk of losing all your investments in a single event.

8. Stay Informed: Stay updated on the latest security practices and news in the cryptocurrency space. Keeping yourself informed about potential risks and security measures will help you make informed decisions and protect your investments.

Remember, safeguarding your cryptocurrency investments is crucial in the ever-evolving digital landscape. By following these steps, you can minimize the risk of hacking and ensure the security of your assets.

Q&A:

What is Trezor?

Trezor is a popular hardware wallet used for storing cryptocurrency securely.

What happened to Trezor?

Trezor was hacked, resulting in the loss of funds for some cryptocurrency investors.

How did the hackers gain access to Trezor?

The hackers used a sophisticated phishing attack to trick users into entering their recovery seed on a fake website.

Can the stolen funds be recovered?

Unfortunately, stolen funds in cryptocurrency transactions are nearly impossible to recover due to the decentralized nature of blockchain technology.