The USDT-USD Parity Exploring the Facts and Myths

In recent years, the rise of cryptocurrencies has taken the financial world by storm. One of the most popular digital assets is Tether (USDT), a stablecoin pegged to the value of the US dollar. However, there has been much speculation and confusion surrounding the relationship between USDT and USD. In this article, we will debunk common myths and reveal the facts behind the USDT-USD parity.

First and foremost, it is important to understand that USDT is not a traditional cryptocurrency like Bitcoin or Ethereum. Instead, it is classified as a stablecoin, designed to maintain a stable value by being pegged to a fiat currency, in this case, the US dollar. Each USDT token is supposed to represent one US dollar in value, making it a popular choice for traders and investors seeking stability in the highly volatile crypto market.

However, there have been concerns raised about the true backing of USDT and its relationship with the US dollar. Some skeptics argue that Tether does not hold enough USD reserves to support the number of USDT tokens in circulation. They claim that Tether is engaging in fractional reserve banking or even running a Ponzi scheme, where new investors’ funds are used to pay off existing investors.

Contrary to these allegations, Tether has repeatedly claimed to hold sufficient reserves to back every USDT token in circulation. They have undergone audits by reputable firms to provide transparency and prove their solvency. Although these audits have faced criticism for lacking full independence and thoroughness, the fact remains that Tether has not been proven to be operating fraudulently.

Overall, the USDT-USD parity is a complex and controversial topic in the world of cryptocurrencies. While skeptics raise concerns about the true backing of USDT and its relationship with the US dollar, Tether maintains that they have sufficient reserves to support their tokens. As the crypto market continues to evolve, it will be crucial for regulators, investors, and market participants to closely monitor the developments surrounding USDT and its relationship with the US dollar.

The Truth About USDT-USD Parity: Dispelling Misconceptions and Exposing Reality

With the rise of cryptocurrency trading, Tether (USDT) has emerged as one of the most widely used stablecoins in the market. However, there has been a lot of confusion and misconceptions surrounding the USDT-USD parity, leading to skepticism and doubts among traders and investors.

Myth: USDT is equivalent to USD at a 1:1 ratio

One of the most common misconceptions about USDT is that each token is backed by one US dollar and is therefore equivalent to USD at a 1:1 ratio. While it is true that Tether claims to have a reserve of USD to back the USDT tokens in circulation, the reality is not as straightforward as it seems.

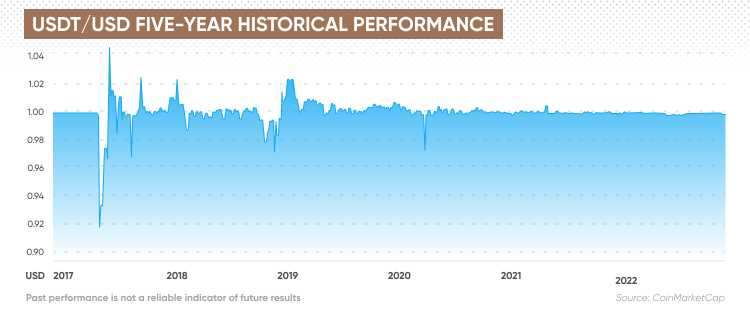

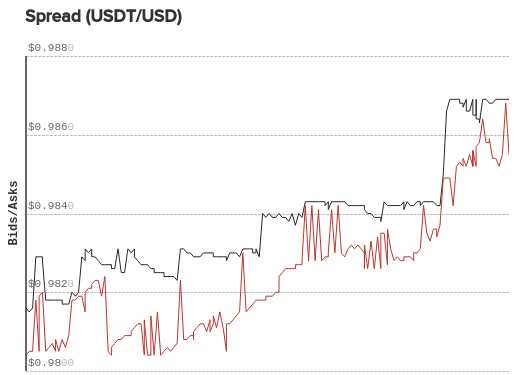

It is important to understand that the value of USDT is determined by market demand and supply. The exchange rate between USDT and USD can fluctuate and may deviate from the 1:1 ratio. Factors such as market conditions, liquidity, and Tether’s reserves can impact the stability and value of USDT.

Myth: Tether has complete transparency and regularly audits its reserves

Another misconception is that Tether regularly audits its reserves to provide transparency and ensure that each USDT token is fully backed by USD. However, the reality is quite different. Tether has faced criticism for its lack of transparency and has not provided a full and independent audit of its reserves.

While Tether has claimed to undergo audits, these audits have been limited in scope and have not provided the level of transparency that the market demands. This lack of transparency has fueled concerns about the actual amount of USD reserves backing the USDT tokens.

Myth: USDT-USD parity is always maintained

One misconception is that the USDT-USD parity is always maintained, regardless of market conditions. In reality, the correlation between USDT and USD can fluctuate, especially during periods of market volatility or disruptions. During these times, the peg can weaken, leading to a deviation from the 1:1 ratio.

It is important for traders and investors to stay informed about market developments and monitor the stability of USDT-USD parity. Understanding the potential risks and limitations of USDT can help mitigate any negative impact on trading strategies and investment decisions.

The Reality: USDT-USD parity is not guaranteed

It is important for market participants to recognize that USDT is not a risk-free asset and that the USDT-USD parity is not guaranteed. While Tether has been widely used as a substitute for USD in cryptocurrency trading, it is crucial to approach it with caution and be aware of the potential risks and uncertainties.

To make informed decisions, traders and investors should diversify their holdings, consider alternative stablecoins, and stay updated on regulatory developments and controversies surrounding Tether. By understanding the truth about USDT-USD parity, traders can navigate the cryptocurrency market with greater confidence and make well-informed investment choices.

Understanding the Concept of USDT-USD Parity

USDT-USD parity is a concept that refers to the equivalency between USDT (Tether) and USD (United States Dollar). This concept is important to understand in the context of cryptocurrency trading and stablecoins.

Tether (USDT) is a popular stablecoin that is designed to maintain a 1:1 ratio with the US dollar. The purpose of stablecoins like USDT is to provide stability in the volatile cryptocurrency market by pegging their value to a fiat currency, in this case, the USD. This means that for every USDT token in circulation, there should be an equivalent amount of USD held in reserve.

The idea behind USDT-USD parity is to ensure that the price of 1 USDT remains consistent with the price of 1 USD. This is achieved by Tether Limited, the company behind USDT, maintaining reserves of USD that are equal to the number of USDT tokens in circulation. The reserves serve as a guarantee that USDT can be redeemed for USD at a 1:1 ratio.

It’s important to note that achieving and maintaining USDT-USD parity requires trust in Tether Limited and the transparency of its reserve holdings. Critics have raised concerns about whether Tether actually has the necessary reserves and whether the company has been completely transparent in its operations.

Despite the controversies surrounding Tether and USDT, it remains one of the most widely used stablecoins in the cryptocurrency market. Traders and investors often use USDT as a way to preserve the value of their cryptocurrency holdings during periods of market volatility.

In conclusion, understanding the concept of USDT-USD parity is crucial for anyone involved in cryptocurrency trading. It represents the equivalency between Tether’s stablecoin USDT and the US dollar, and relies on Tether Limited’s ability to maintain the necessary reserves to support that equivalency.

Common Myths Surrounding USDT-USD Parity

As the popularity and usage of cryptocurrencies continue to grow, there are often misconceptions and myths that surround their nature and functionality. This is no different for the relationship between USDT (Tether) and USD (United States Dollar) and their supposed parity. Let’s debunk some of the most common myths below:

Myth 1: USDT and USD are always 1:1 interchangeable

It is commonly believed that 1 USDT is always equal to 1 USD and can be freely exchanged. However, this is not entirely true. While USDT was initially created to be pegged to the US dollar, fluctuations in the market can cause the price of USDT to deviate from the 1:1 ratio. These fluctuations can be influenced by various factors such as demand, supply, and market sentiment.

Myth 2: USDT is backed 100% by USD

Another prevailing myth is that USDT is fully backed by USD reserves, providing stability and security for investors. In reality, Tether Limited, the company behind USDT, has stated that the reserves backing USDT include not only USD, but also additional assets like cash equivalents and other investments. The exact composition of these reserves is not publicly disclosed, leading to concerns about transparency and the potential for over-issuance.

Myth 3: USDT always maintains its value even during market volatility

During times of market volatility, it is often assumed that USDT will remain stable and maintain its value. However, this is not always the case. Like any other cryptocurrency, USDT can experience price fluctuations, albeit to a lesser extent compared to more volatile cryptocurrencies. Investors should be aware that USDT is not immune to market changes and can be affected by factors such as liquidity and trading volume.

Myth 4: USDT can be freely converted to USD at any time

While USDT can be converted to USD on various exchanges, the process may not always be seamless or instantaneous. Exchanges often have their own requirements, restrictions, and fees for converting USDT to USD. Additionally, high demand for USD withdrawals during periods of market stress can result in delays or limited availability. It is important for investors to familiarize themselves with the specific policies of their chosen exchange before attempting to convert USDT to USD.

Myth 5: USDT-USD parity is guaranteed

Lastly, many individuals believe that USDT-USD parity is guaranteed, meaning that the value of 1 USDT will always be equal to 1 USD. However, market dynamics and external factors can affect this parity. It is essential to stay informed about the latest news and developments in the cryptocurrency space to have a better understanding of the relationship between USDT and USD.

In conclusion, it is important to dispel these common myths and have a clear understanding of the true nature of the relationship between USDT and USD. While USDT can provide a convenient means of holding value in a digital format, investors should remain vigilant and informed to make sound financial decisions.

Unveiling the Facts About USDT-USD Parity

USDT-USD parity has been a subject of speculation and controversy in the cryptocurrency community. There have been various myths and misconceptions surrounding the relationship between USDT and USD. In this article, we aim to debunk these myths and reveal the facts about USDT-USD parity.

Myth: USDT is always equivalent to 1 USD

One common myth is that USDT, also known as Tether, is always equivalent to 1 USD. While it is true that Tether Limited, the company behind USDT, claims to peg it to the US dollar, the reality is more complex. The value of USDT is not solely determined by the company, but also by supply and demand on the market.

Although Tether Limited maintains a reserve of USD to back the USDT in circulation, there have been concerns about the transparency and adequacy of this reserve. Some critics argue that Tether might not have enough USD reserves to fully support the existing supply of USDT, potentially leading to a loss of parity with USD.

Fact: USDT-USD arbitrage opportunities

Contrary to popular belief, there have been instances where USDT and USD have deviated from parity, creating arbitrage opportunities. Arbitrageurs take advantage of these price discrepancies by buying USDT when it is trading below 1 USD and selling it when the price rises above 1 USD.

This suggests that the market does not always perceive USDT as being equivalent to 1 USD and that there can be fluctuations in its value. It is important for traders and investors to be aware of these arbitrage opportunities and the potential risks involved.

Myth: USDT-USD parity guarantees price stability

Another myth is that USDT-USD parity guarantees price stability for cryptocurrencies. The argument goes that since USDT is pegged to the USD, cryptocurrencies paired with USDT will have a stable value. However, this assumption overlooks the volatile nature of cryptocurrencies themselves.

Cryptocurrency prices are influenced by a variety of factors, including market demand, adoption, regulations, and technological advancements. While USDT-USD parity may provide a degree of stability in terms of the US dollar value, it does not guarantee stability in the cryptocurrency’s value against other assets or currencies.

Fact: Market sentiment and USDT-USD parity

Market sentiment plays a crucial role in determining the perception and value of USDT-USD parity. If there are doubts or concerns about the veracity of Tether Limited’s claims or the adequacy of its USD reserves, it can have an impact on the market’s trust in USDT-USD parity.

News and events related to Tether or the broader cryptocurrency market can also influence market sentiment and potentially affect USDT-USD parity. Traders and investors should stay informed about developments in the cryptocurrency industry and be cautious of the potential impact on USDT-USD parity.

- To summarize, USDT-USD parity is not a fixed and guaranteed value but is subject to market forces.

- There have been instances where USDT and USD have deviated from parity, creating arbitrage opportunities.

- USDT-USD parity does not guarantee price stability for cryptocurrencies.

- Market sentiment and external factors play a significant role in determining the perception and value of USDT-USD parity.

By understanding these facts and debunking the myths, traders and investors can make more informed decisions when it comes to USDT-USD parity and its implications for the cryptocurrency market.

The Implications of USDT-USD Parity for the Crypto Market

The convergence of the USD Tether (USDT) and the US dollar (USD) has significant implications for the crypto market. The USDT-USD parity refers to the situation where the value of 1 USDT equals 1 USD. This is important because USDT is one of the most widely used stablecoins in the cryptocurrency industry.

Firstly, the establishment of USDT-USD parity provides stability and confidence to traders and investors. Stablecoins like USDT aim to maintain a fixed value, usually pegged to a fiat currency like the USD. When USDT is equal in value to the USD, it assures market participants that USDT can be used as a reliable store of value within the crypto ecosystem.

Secondly, USDT-USD parity has implications for cryptocurrency exchanges and trading platforms. Many exchanges use USDT as a trading pair with other cryptocurrencies, allowing users to easily trade between different digital assets. When USDT and USD are at parity, it ensures that the trading pairs involving USDT remain accurate and consistent.

Furthermore, USDT-USD parity has regulatory implications as well. The convergence of USDT and USD values supports the argument that stablecoins are effectively equivalent to traditional fiat currencies. This could influence the way stablecoins are regulated and treated under existing financial regulations.

Moreover, USDT-USD parity may impact the overall market sentiment and stability. If USDT maintains parity with USD, it reduces the potential for price manipulation within the cryptocurrency market. Traders and investors can rely on stablecoin prices remaining steady, leading to a more predictable and transparent market environment.

Lastly, the establishment of USDT-USD parity increases the potential for wider adoption of stablecoins in various financial applications, such as remittances and cross-border transactions. As stablecoins become more reliable and stable, they can offer an efficient alternative to traditional banking systems, particularly in regions with limited access to traditional financial services.

In conclusion, the USDT-USD parity has far-reaching implications for the crypto market. It provides stability, confidence, and transparency to the industry, while also influencing regulatory discussions and fostering the adoption of stablecoins. As the crypto market continues to evolve, the convergence of USDT and USD values will remain a crucial aspect to monitor and understand.

Q&A:

What is the USDT-USD parity?

The USDT-USD parity refers to the relationship between the price of USDT (Tether) and USD (United States Dollar). It is the belief that 1 USDT is equivalent to 1 USD in terms of value.

Is the USDT-USD parity real?

There is a lot of debate surrounding the USDT-USD parity. Tether, the company behind USDT, claims that each USDT token is backed 1-to-1 by a reserve of USD. However, there are concerns about whether this is actually the case and some people believe that the USDT-USD parity is not real.