The Trustworthiness of USDT Evaluating the Risks and Benefits

USDT, or Tether, is a popular cryptocurrency that is pegged to the US dollar on a 1:1 basis. It has gained significant attention in the digital currency market due to its promise of stability and liquidity. However, as with any other cryptocurrency, questions arise about its trustworthiness and the potential risks associated with using it.

One of the main benefits of using USDT is its stability. Being pegged to the US dollar means that its value remains relatively constant, providing users with a sense of security in an otherwise volatile market. This stability makes USDT attractive to traders who are looking for a safe haven amidst cryptocurrency price fluctuations.

However, concerns about the trustworthiness of USDT have emerged in recent years. One of the primary concerns is the lack of transparency and auditability. Unlike other cryptocurrencies, USDT has not undergone a third-party audit to verify its reserves. This has led to speculation about whether USDT has sufficient funds to back every token in circulation, raising doubts about its long-term viability.

Another risk associated with USDT is its potential for regulatory scrutiny. As a centralized cryptocurrency, USDT is subject to regulations and oversight by governments and financial institutions. Any legal or regulatory actions against USDT could have a significant impact on its value and stability. This poses a risk not only to individual investors but also to the cryptocurrency market as a whole.

In conclusion, evaluating the trustworthiness of USDT requires considering its potential risks against its benefits. While USDT offers stability and liquidity, concerns about its lack of transparency and potential regulatory scrutiny should not be ignored. Further research and transparency measures are needed to ensure the long-term viability of USDT as a trusted cryptocurrency option.

Evaluating the Trustworthiness of USDT

In the world of cryptocurrencies, USDT (Tether) has become one of the most popular stablecoins, mainly due to its promise of being backed by US dollars. However, the trustworthiness of USDT has been a subject of debate and speculation among investors and analysts.

The Benefits of USDT:

One of the main benefits of USDT is its stability. Unlike other volatile cryptocurrencies, USDT is pegged to the value of the US dollar, which means that its value remains relatively stable. This stability makes USDT an attractive option for traders and investors who want to hedge against market volatility.

Another benefit of USDT is its widespread adoption. USDT is supported by a large number of cryptocurrency exchanges, which makes it easy for users to trade and convert their cryptocurrencies into USDT. This widespread adoption has also contributed to the liquidity and availability of USDT in the market.

Moreover, USDT offers a convenient way to transfer value across different cryptocurrency exchanges and platforms. As a stablecoin, USDT can be easily transferred between wallets and used for transactions without the need for traditional banking systems. This makes it an efficient and cost-effective solution for users.

The Risks of USDT:

Despite its benefits, there are several risks associated with USDT that investors and users should be aware of. One of the main concerns is the lack of transparency regarding the backing of USDT. While Tether claims that each USDT is backed by one US dollar, there has been a lack of independent audits or verifiable proof to support this claim.

Another risk is the potential for regulatory scrutiny. As USDT is not regulated by any government agency, there is a risk that regulatory authorities could crack down on it in the future. This could lead to restrictions or even a ban on the use of USDT, which would have a significant impact on its value and usability.

Furthermore, there have been concerns about the financial stability of Tether. If Tether does not have sufficient reserves to back all the USDT in circulation, it could potentially lead to a collapse in the value of USDT and cause financial losses for investors.

Evaluating Trustworthiness:

In evaluating the trustworthiness of USDT, it is important to consider both the benefits and risks associated with it. While USDT offers stability, liquidity, and convenience in the cryptocurrency market, it also carries the risks of lack of transparency, regulatory scrutiny, and financial instability.

Ultimately, the trustworthiness of USDT depends on the faith and confidence that investors and users have in Tether and its claims. As the cryptocurrency market evolves and regulatory frameworks are established, it remains to be seen how USDT will be perceived and whether it will be able to overcome these risks and maintain its position as a trusted stablecoin.

Risks Associated with USDT

While USDT offers some benefits, there are also several risks associated with its use. It is important for investors and users of USDT to be aware of these risks in order to make informed decisions.

- Counterparty Risk: One of the main risks associated with USDT is counterparty risk. USDT is issued by Tether Limited, which acts as the custodian of the USD reserves that back the stablecoin. If Tether Limited were to face financial difficulties or become insolvent, there is a risk that the USD reserves may not be sufficient to cover the outstanding USDT in circulation.

- Regulatory Risk: Another risk is regulatory uncertainty. The regulatory landscape for stablecoins, including USDT, is constantly evolving. Changes in regulations or the introduction of new regulations could have a negative impact on the value and use of USDT.

- Market Risk: USDT is also subject to market risks. The value of USDT may fluctuate in relation to the US dollar and other fiat currencies. This volatility can pose risks for investors and users who may experience losses if the value of USDT decreases.

- Transparency Risk: There have been concerns regarding the lack of transparency around USDT’s reserves. Tether Limited has faced criticism for not providing regular audits or detailed information about the composition of its reserves, leading to doubts about the actual backing of USDT.

- Security Risk: Lastly, there is a security risk associated with USDT and other stablecoins. As digital assets, stablecoins can be vulnerable to hacking, fraud, and other cybersecurity threats. If a security breach were to occur, it could result in the loss of user funds.

It is important for investors and users to carefully consider these risks and conduct due diligence before using or investing in USDT. Understanding the potential risks can help individuals make informed decisions and mitigate the associated challenges.

Benefits of Using USDT

USDT, or Tether, is a stablecoin that has gained a lot of popularity in recent years. While there are certainly risks associated with using USDT, there are also benefits that make it an attractive option for many individuals and businesses.

1. Stability

One of the main benefits of using USDT is its stability. Unlike volatile cryptocurrencies like Bitcoin, USDT is pegged to a reserve of real-world assets such as the US dollar. This means that the value of USDT remains relatively constant, making it a reliable store of value and a less risky option for transactions.

2. Instant Transactions

Another benefit of using USDT is the speed of transactions. With traditional banking systems, it can take days for funds to be transferred, especially across borders. However, with USDT, transactions can be completed instantly, allowing for quick and efficient transfer of funds.

3. Low Transaction Costs

Compared to traditional banking systems and some other cryptocurrencies, USDT offers low transaction costs. This can be especially beneficial for businesses that frequently make cross-border transactions or need to send large amounts of money quickly. By using USDT, businesses can save on expensive transaction fees and avoid the hassle of dealing with intermediaries.

4. Increased Accessibility

USDT can be accessed by anyone with an internet connection and a compatible wallet. This level of accessibility makes it a viable option for individuals and businesses around the world, including those in countries with limited access to traditional banking systems. USDT provides an opportunity for financial inclusion and economic empowerment.

5. Global Acceptance

USDT is accepted by a wide range of merchants, online platforms, and exchanges. This global acceptance makes USDT a versatile and widely usable cryptocurrency, allowing users to make purchases and trade in various markets around the world.

Overall, while there are risks to consider, the benefits of using USDT may make it a compelling option for individuals and businesses looking for stability, speed, low costs, accessibility, and global acceptance in their financial transactions.

Q&A:

What is USDT?

USDT, also known as Tether, is a type of cryptocurrency called a stablecoin that is pegged to the value of the US dollar. It is designed to maintain a 1:1 ratio with the US dollar by holding reserves equivalent to the amount of USDT in circulation. This makes USDT a popular choice for traders who want to hedge against the volatility of other cryptocurrencies.

What are the risks associated with USDT?

There are several risks associated with USDT. Firstly, there are concerns about the transparency and verifiability of Tether’s reserves. The company claims to hold enough US dollars to back each USDT in circulation, but there have been doubts about the accuracy of this claim. Secondly, there have been allegations that USDT has been used to manipulate the price of Bitcoin and other cryptocurrencies. Lastly, there is the risk of regulatory scrutiny. If authorities were to crack down on Tether, it could have a significant impact on the value and liquidity of USDT.

What are the benefits of using USDT?

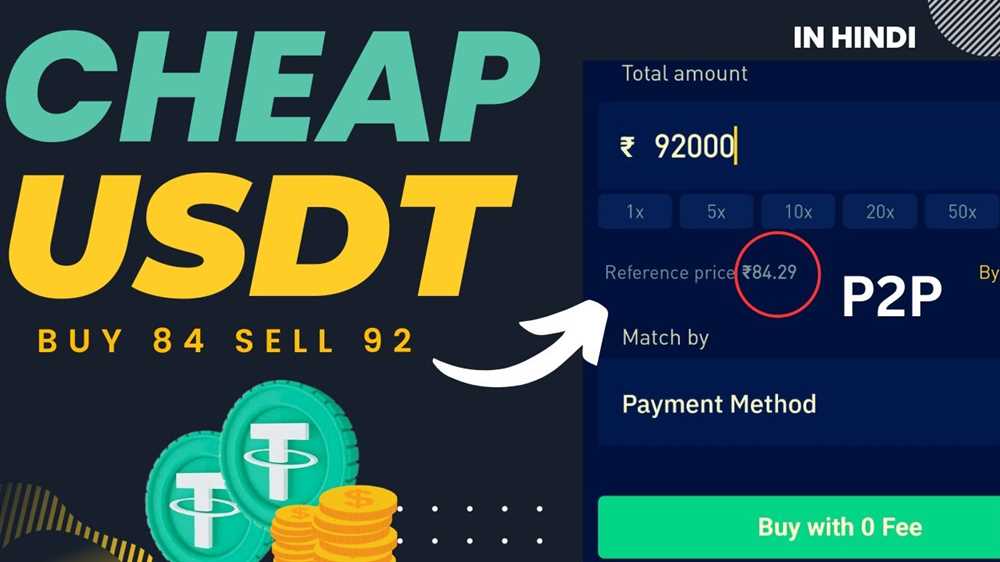

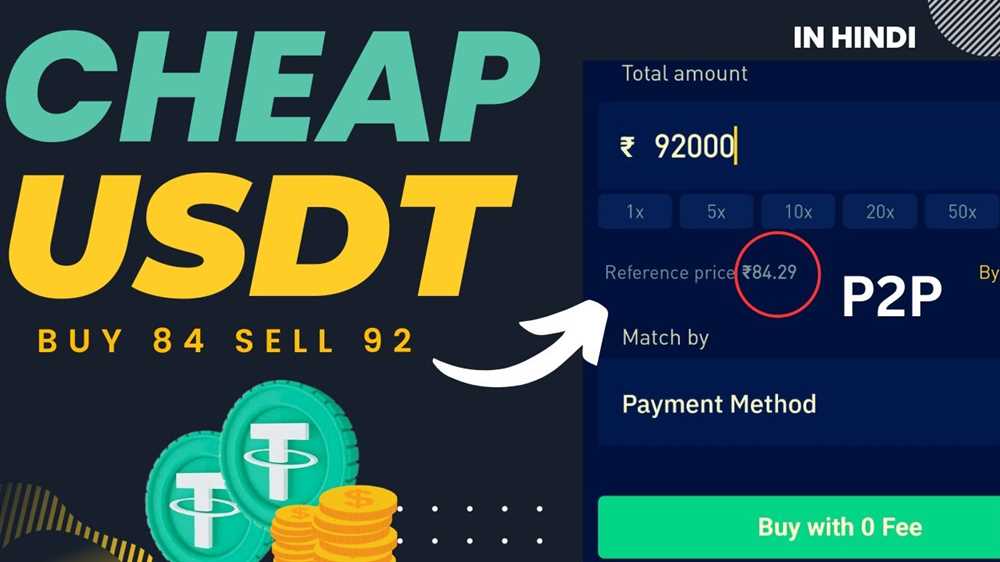

There are several benefits of using USDT. Firstly, it provides stability in the highly volatile cryptocurrency market. Traders can use USDT to hedge against price fluctuations and mitigate risk. Secondly, USDT allows for quick and low-cost transfers between cryptocurrency exchanges. This can be especially useful for traders who want to take advantage of arbitrage opportunities. Lastly, USDT is widely accepted on many cryptocurrency exchanges, making it a convenient and accessible option for traders.

How can I evaluate the trustworthiness of USDT?

Evaluating the trustworthiness of USDT can be challenging, but there are a few factors to consider. Firstly, you can look at the transparency and audibility of Tether’s reserves. The company should regularly undergo audits by reputable third-party firms to verify that they hold enough US dollars to back each USDT in circulation. Secondly, you can assess the reputation and track record of Tether. If the company has been involved in controversies or legal issues in the past, it may be a red flag. Lastly, you can monitor any regulatory developments or warnings related to Tether, as they can provide insights into the trustworthiness of the stablecoin.

What are the alternatives to using USDT?

There are several alternatives to using USDT. One popular alternative is USD Coin (USDC), another stablecoin that is backed by a consortium of cryptocurrency companies. It has similar properties to USDT, but it is issued by a more transparent and regulated organization. Another alternative is using traditional fiat currencies, such as USD or EUR, to trade on cryptocurrency exchanges. However, this may involve additional fees and longer processing times compared to using stablecoins.