The Price of Security: Can You Lose Your Crypto on a Cold Wallet?

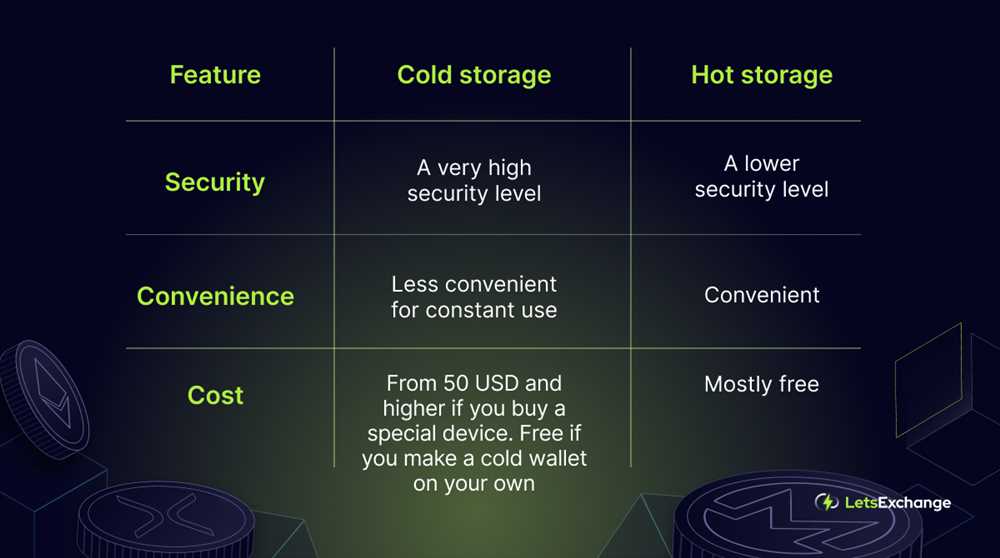

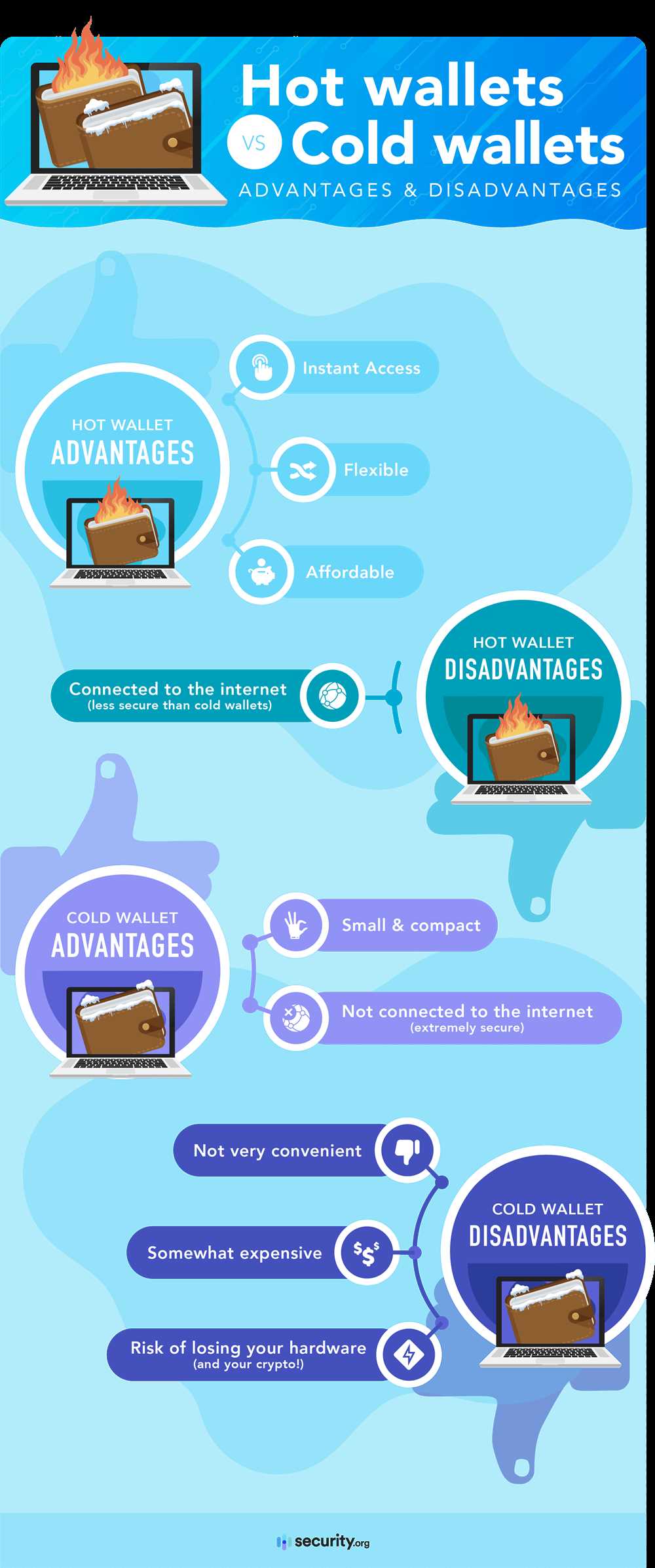

With the rise of cryptocurrencies, many investors are turning to cold wallets as a secure way to store their digital assets. Cold wallets, also known as offline wallets, are devices or physical forms of storage that are not connected to the internet. This isolation is seen as a way to protect crypto holdings from hackers and other potential risks.

While cold wallets offer enhanced security, they are not without their own set of risks. One of the main concerns is the possibility of losing access to the wallet, resulting in the loss of all the crypto stored within. Unlike online wallets, where you can easily recover your account with a password reset or account recovery process, cold wallets offer a higher level of protection for your assets, but also require a higher level of responsibility from the user.

One common scenario where users can lose access to their cold wallet is through physical damage or loss. Since cold wallets are often physical devices, they can be lost or damaged just like any other personal item. If a cold wallet is lost or destroyed and there is no backup of the private keys, there is a high chance that the crypto stored within will be permanently lost.

Another risk associated with cold wallets is the potential for user error. Users who are not familiar with the technical aspects of cold wallets may make mistakes when setting them up or managing their crypto assets. These mistakes can lead to the loss of access to the wallet or even accidental transfers of funds to incorrect addresses. It is crucial for users to thoroughly understand how cold wallets work and to follow best practices to minimize the risk of user error.

The Risks of Cold Wallets

While cold wallets offer enhanced security for storing cryptocurrencies, they are not without their own set of risks. It’s important for crypto holders to be aware of these risks and take necessary precautions to protect their digital assets.

One of the primary risks associated with cold wallets is the potential for loss or damage. Unlike online wallets, cold wallets are physical devices that can be lost, stolen, or damaged. If a cold wallet is lost or damaged and the owner doesn’t have a backup, there is a high risk of permanently losing access to the stored cryptocurrencies.

Another risk is the possibility of human error. Cold wallets typically require the user to manually perform certain actions, such as copying and pasting wallet addresses or entering PIN codes. If the user makes a mistake during these processes, it could result in the loss of funds.

There is also the risk of technological obsolescence. As technology advances, older cold wallets may become outdated and incompatible with newer systems and protocols. If this happens, the user may need to transfer their funds to a new wallet or risk losing access to their cryptocurrencies.

Additionally, cold wallets are not immune to hacking attempts. While online wallets are generally more prone to hacking due to their connection to the internet, cold wallets can still be vulnerable if not properly secured. If a hacker gains physical access to a cold wallet or finds a way to exploit its security features, they can potentially steal the stored cryptocurrencies.

Lastly, relying solely on a cold wallet for storing cryptocurrencies can also pose risks in terms of accessibility. Cold wallets are typically not as convenient to use as online wallets, as they require connecting to a computer or mobile device to make transactions. This can pose challenges for users who need frequent or immediate access to their funds.

Overall, while cold wallets offer enhanced security, it’s important for users to carefully consider these risks and take appropriate measures to mitigate them. This includes regularly backing up wallets, using strong passwords and PIN codes, keeping wallets up to date with the latest firmware, and being cautious of potential security threats.

Potential Loss of Crypto

Although cold wallets are generally considered to be safe for storing cryptocurrencies, there are still potential risks that could result in the loss of your crypto assets. It is important to be aware of these risks and take necessary precautions to minimize them.

One of the main risks is the physical loss or damage of the cold wallet device. If you lose or damage your cold wallet device, you may not be able to access your cryptocurrencies and could potentially lose your funds permanently. Therefore, it is essential to keep your cold wallet device in a safe and secure location and consider having a backup device or a recovery phrase in case of any accidents.

Another risk is the risk of human error. When using a cold wallet, you need to be cautious and ensure that you are entering the correct addresses and information when making transactions. Mistakenly sending funds to the wrong address or incorrectly inputting your recovery phrase could result in the loss of your crypto assets. It is crucial to double-check all the information before confirming any transactions.

Furthermore, there is the risk of hacking or malware attacks. Although cold wallets are generally immune to online attacks, if your computer or mobile device is compromised by malware, it could potentially compromise the security of your cold wallet. It is important to regularly update your devices, use strong antivirus software, and be cautious of phishing attempts to prevent any unauthorized access to your crypto assets.

Lastly, there is the risk of regulatory actions and legal issues. The regulatory landscape for cryptocurrencies is still evolving, and there might be changes in legislation that could affect the ownership and transfer of crypto assets. If you are not compliant with the existing regulations or if new regulations are introduced, you could potentially lose access to your crypto assets. It is important to stay informed about the legal environment and ensure that you are complying with the relevant regulations.

| Potential Loss of Crypto |

|---|

| – Physical loss or damage of the cold wallet device |

| – Risk of human error |

| – Hacking or malware attacks |

| – Regulatory actions and legal issues |

Vulnerability to Theft

While cold wallets are generally considered to be more secure than hot wallets, they are not immune to theft. Cold wallets can still be vulnerable if they are not properly safeguarded.

One of the main risks of cold wallets is physical theft. Since cold wallets are typically stored offline, there is a chance that they can be stolen during a break-in or other physical theft. This is especially true if the cold wallet is not stored in a secure location, such as a safe or a safety deposit box.

Additionally, cold wallets can also be vulnerable to digital theft. If a hacker gains access to the private keys or mnemonics used to access the cold wallet, they can potentially steal the funds stored in the wallet. While the private keys are typically stored securely, there is always a risk of a security breach and unauthorized access.

Another potential vulnerability is social engineering attacks. Scammers may attempt to deceive or manipulate individuals into revealing their private keys or mnemonics, allowing them to access the cold wallet and steal the funds. These attacks can be difficult to detect and prevent, making it crucial for users to exercise caution and be mindful of potential scams.

Protecting Your Cold Wallet

Despite the risks, there are steps you can take to protect your cold wallet from theft:

- Store your cold wallet in a secure location, such as a safe or a safety deposit box.

- Use a strong password to secure your cold wallet.

- Enable two-factor authentication (2FA) for an additional layer of security.

- Be cautious of phishing attempts and do not click on suspicious links or provide sensitive information to unknown sources.

- Regularly update your cold wallet’s firmware and software to ensure it is protected against any known vulnerabilities.

By taking these precautions, you can reduce the risk of theft and ensure that your cryptocurrency remains secure in your cold wallet.

Human Error and Accessibility

While cold wallets provide significant security advantages, they are not without their own risks. One of the biggest threats to the safety of your crypto assets is human error. Unlike online wallets or exchanges, which typically have user-friendly interfaces and guides to help prevent mistakes, cold wallets often operate with no or minimal user interfaces. This lack of accessibility can make it easier for users to make errors and potentially lose their crypto.

For example, when setting up a cold wallet, users are usually required to generate a unique recovery phrase or private key. If a user fails to properly record or securely store this key, they risk losing access to their funds. Losing a private key can be disastrous, as it essentially becomes impossible to recover the crypto assets associated with it.

Additionally, cold wallets can be more susceptible to physical damage or loss. For instance, if a user misplaces or accidentally damages their cold wallet device, it can lead to the loss of their crypto assets. In contrast, online wallets and exchanges often have backup and recovery options in place, making it easier to regain access to funds in case of device loss or damage.

It is crucial for users to be aware of these risks and take appropriate precautions when using cold wallets. This includes securely storing recovery phrases or private keys in offline and multiple locations, using reputable wallet brands, and regularly updating and testing backup and recovery systems.

While cold wallets offer enhanced security measures compared to online wallets, it is important for users to weigh the risks and benefits before making a decision. With proper care and attention, the risk of losing crypto assets due to human error or accessibility issues can be minimized.

Q&A:

What is a cold wallet and how does it work?

A cold wallet is a cryptocurrency storage solution that is not connected to the internet. It is typically a physical device or a piece of paper that contains the private keys necessary to access the funds. By keeping the private keys offline, cold wallets provide an additional layer of security against online threats.

Are cold wallets completely safe?

Cold wallets are generally considered safer than hot wallets, which are connected to the internet. However, they are not completely immune to risks. There are still potential vulnerabilities such as physical theft, loss of the device, or user error in handling the private keys. It’s important to take precautions and follow best practices when using a cold wallet.

Can I lose my crypto if I lose my cold wallet?

If you lose your cold wallet without any backup, there is a high chance that you will lose access to your cryptocurrency. Cold wallets usually generate a recovery phrase or a seed backup, which can be used to restore access to the funds. It’s crucial to securely store this backup in a separate location to prevent loss in case of device damage or theft.

What happens if a cold wallet gets damaged?

If a cold wallet gets damaged, it can potentially result in the loss of access to the cryptocurrency stored in it. That is why it is important to have a backup of the wallet’s recovery phrase or seed. By using the recovery phrase, you can restore the wallet’s contents on a new device and regain access to your funds.

Is there any way to recover funds if I forget the PIN or password to my cold wallet?

If you forget the PIN or password to your cold wallet and don’t have the recovery phrase, it can be extremely difficult or even impossible to recover the funds. Cold wallets are designed to prioritize security, which means that there are typically limited options for password recovery. This emphasizes the importance of storing the recovery phrase securely and making sure it is easily accessible if needed.