The Influence of USDT Stability on the Performance of Cryptocurrency Markets

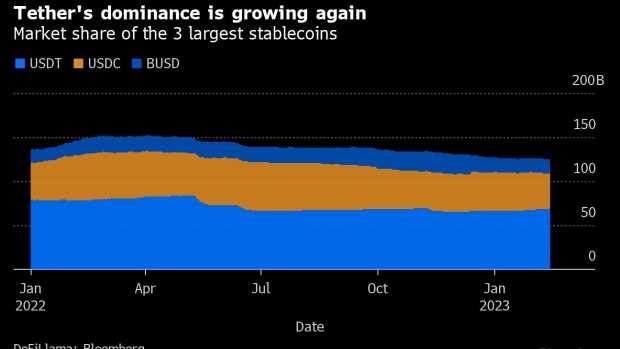

The stability of any cryptocurrency is crucial for its success in the market. One particular stablecoin, Tether (USDT), has been gaining a lot of attention recently due to its impact on the overall cryptocurrency market. As one of the largest and most widely used stablecoins, USDT has the potential to significantly influence the prices and trading volumes of other cryptocurrencies.

USDT is a fiat-backed stablecoin, meaning that each USDT is theoretically backed by one US dollar. This peg to the US dollar is what gives USDT its stability, as it allows traders to easily convert their cryptocurrencies into a stable value. The availability and use of USDT as a trading pair on various cryptocurrency exchanges have made it a popular choice for traders looking to hedge their positions or protect their gains during market downturns.

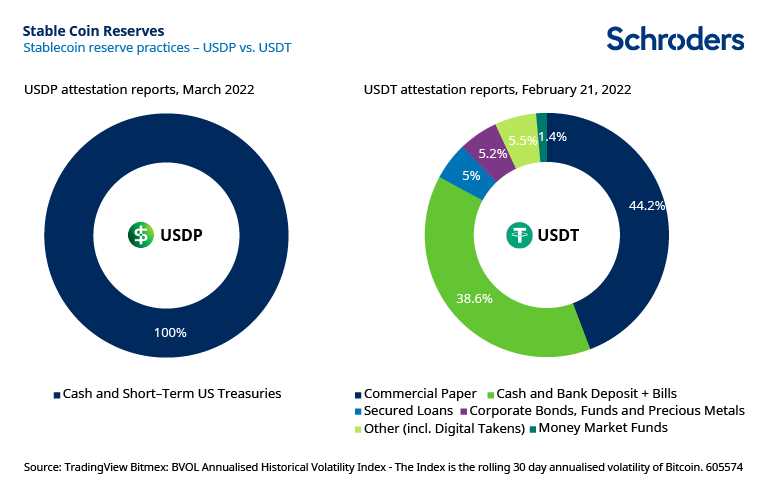

However, the stability of USDT has come under scrutiny in recent years. There have been concerns about whether Tether has sufficient reserves to back all the USDT in circulation. These concerns have led to uncertainty in the market and have the potential to negatively impact the prices and trading volumes of other cryptocurrencies. Traders may be hesitant to use USDT if they doubt its stability, which could lead to increased volatility in the market.

Despite these concerns, USDT continues to play a significant role in the cryptocurrency market. Its widespread use as a trading pair and its ability to provide stability during periods of market volatility have made it an essential tool for many traders. However, it is essential for traders and investors to remain vigilant and stay informed about the potential impact of USDT stability on the wider cryptocurrency market.

The Role of USDT in Cryptocurrency Markets

USDT, also known as Tether, is a stablecoin that plays a crucial role in the cryptocurrency markets. As a USD-pegged cryptocurrency, USDT offers stability in an otherwise volatile market.

One of the main functions of USDT is to provide a stable store of value for cryptocurrency traders and investors. While most cryptocurrencies experience significant price fluctuations, USDT maintains a value of approximately $1. This stability allows traders to easily convert their digital assets into USDT during times of market uncertainty, protecting their wealth from potential losses.

Additionally, USDT serves as a bridge between the crypto and fiat economies. Traditional financial institutions often have limited access to cryptocurrencies due to regulatory constraints. USDT provides a way for traders and investors to enter and exit the cryptocurrency market easily, as it can be easily converted to and from fiat currencies.

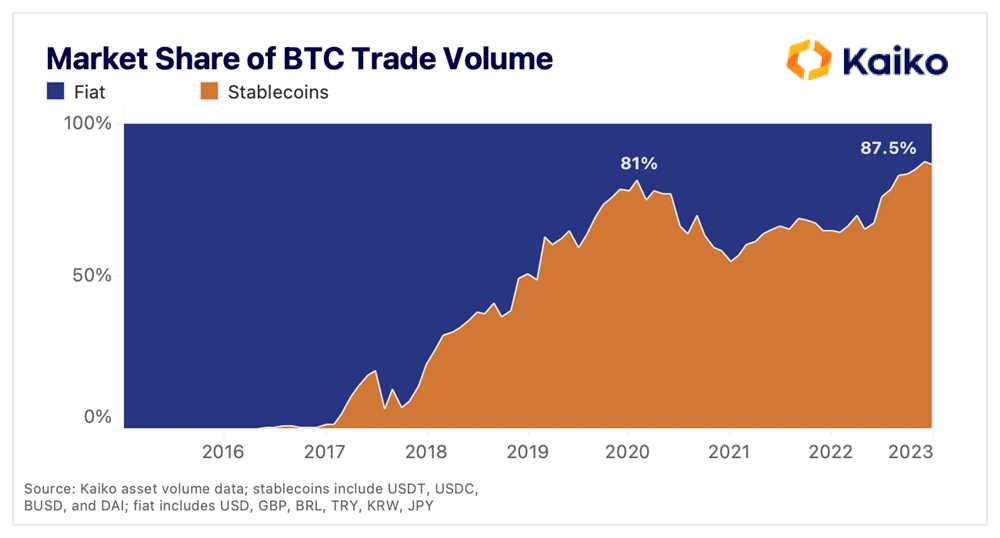

Furthermore, USDT is widely used as a trading pair for other cryptocurrencies. Many cryptocurrency exchanges offer trading pairs with USDT, allowing users to trade their cryptocurrencies against a stable value. This helps mitigate the risk associated with volatile cryptocurrencies and provides liquidity to the market.

USDT’s role in cryptocurrency markets extends beyond trading and stability. It also plays a vital role in the decentralized finance (DeFi) sector. USDT can be used as collateral for lending and borrowing platforms, allowing users to access liquidity by using their USDT holdings as collateral.

In conclusion, USDT plays a pivotal role in cryptocurrency markets by providing stability, enabling easy entry and exit from the market, serving as a trading pair, and supporting the growth of decentralized finance. Its importance cannot be understated, as it helps enhance the overall efficiency and reliability of the cryptocurrency ecosystem.

The Importance of USDT Stability

The stability of USDT (Tether) is of utmost importance in the cryptocurrency markets. USDT is a type of stablecoin, which means that its value is pegged to an underlying asset, typically the US dollar. This stability is achieved through a combination of factors, such as proper management of reserves and regular audits.

One of the key reasons why USDT stability is essential is its role as a trading pair in various cryptocurrency exchanges. Many traders and investors use USDT as a base currency to trade and exchange other cryptocurrencies. If USDT were to experience significant fluctuations or lose its peg to the US dollar, it would create uncertainty and chaos in the markets.

Moreover, the stability of USDT provides a safe haven for traders during times of market volatility. When the price of other cryptocurrencies is highly volatile, traders can convert their holdings into USDT, effectively preserving the value of their investments. This helps to mitigate the risks associated with sudden market downturns and allows traders to re-enter the market at a more opportune time.

Furthermore, the stability of USDT is crucial for maintaining public trust in the cryptocurrency ecosystem. Cryptocurrencies have often been criticized for their inherent volatility and lack of stability. However, the presence of stablecoins like USDT helps to alleviate these concerns and attract more mainstream users to the space. The ability to transact and hold a stable value in the form of USDT provides users with a sense of security and familiarity.

In conclusion, the stability of USDT plays a significant role in the cryptocurrency markets. It serves as a reliable trading pair, a safe haven during market volatility, and a means of attracting more users to the crypto space. Ensuring the stability of USDT is therefore vital for the overall health and growth of the cryptocurrency ecosystem.

Influence of USDT on Market Liquidity

USDT, or Tether, is a stablecoin commonly used in cryptocurrency markets. Its purpose is to maintain a stable value by pegging its price to a fiat currency, usually the US dollar. The presence of USDT in the market has a significant impact on market liquidity.

One of the main reasons why USDT influences market liquidity is its widespread usage as a trading pair for other cryptocurrencies. Many trading platforms offer USDT pairs, allowing traders to easily convert their cryptocurrencies into USDT and vice versa. This convenience and availability make USDT a highly liquid asset in the cryptocurrency market.

Increased Trading Volume

The availability of USDT pairs attracts a large number of traders, leading to increased trading volume. When traders convert their cryptocurrencies into USDT, they can quickly enter or exit positions in various markets, contributing to overall liquidity. This increased trading volume not only benefits traders but also provides liquidity for other participants in the market.

Price Stability

USDT’s stability against its pegged fiat currency also plays a crucial role in market liquidity. As a stablecoin, USDT generally maintains a predictable value, which helps reduce volatility and price fluctuations in the market. This stability attracts more participants to engage in trading activities, as they can rely on USDT to preserve the value of their assets.

The stability of USDT also provides market makers with a valuable tool for arbitrage opportunities. They can exploit price differentials between various exchanges by using USDT as an intermediary. This arbitrage activity further enhances market liquidity by bridging gaps between different trading platforms.

Overall Impact

The influence of USDT on market liquidity cannot be overstated. Its availability as a trading pair, increased trading volume, price stability, and arbitrage opportunities all contribute to a more liquid and efficient cryptocurrency market. However, it is important to note that USDT’s impact is not without its risks. As a centralized stablecoin, its value is dependent on the trust placed in the issuing company and its reserves.

In conclusion, USDT’s presence in cryptocurrency markets greatly influences market liquidity. Its widespread usage as a trading pair, increased trading volume, price stability, and arbitrage opportunities all contribute to a more liquid and efficient market environment. Traders and participants benefit from the convenience and reliability of USDT, but caution should be exercised in monitoring the stability and trustworthiness of this stablecoin.

USDT as a Key Indicator of Crypto Market Sentiment

USDT, or Tether, is a stablecoin that is pegged to the US dollar, making it a key indicator of sentiment in the cryptocurrency markets. As one of the most widely used stablecoins, USDT plays a crucial role in the crypto ecosystem.

When investors and traders are uncertain about the direction of the market, they often turn to USDT as a safe haven. This is because USDT is designed to maintain a stable value, unlike other cryptocurrencies that can experience volatility. By converting their holdings into USDT, investors can protect their capital and wait for a clearer market trend.

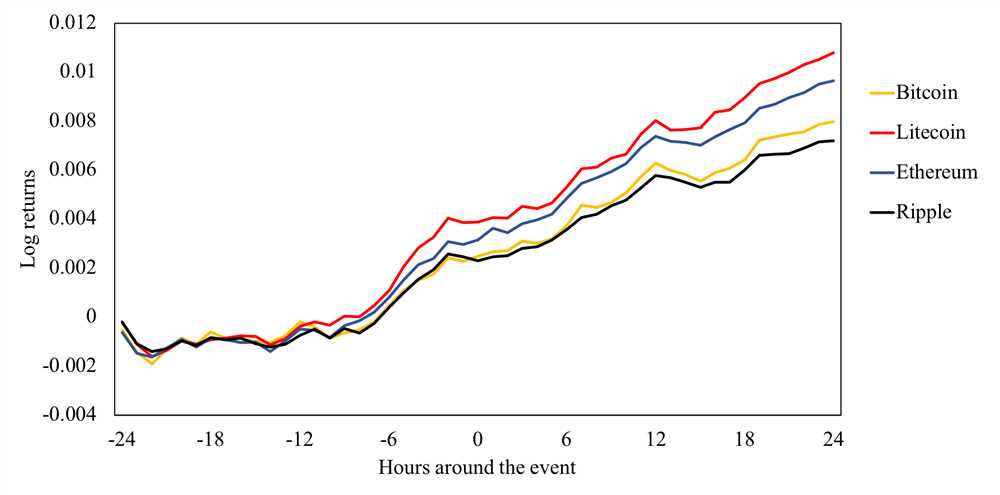

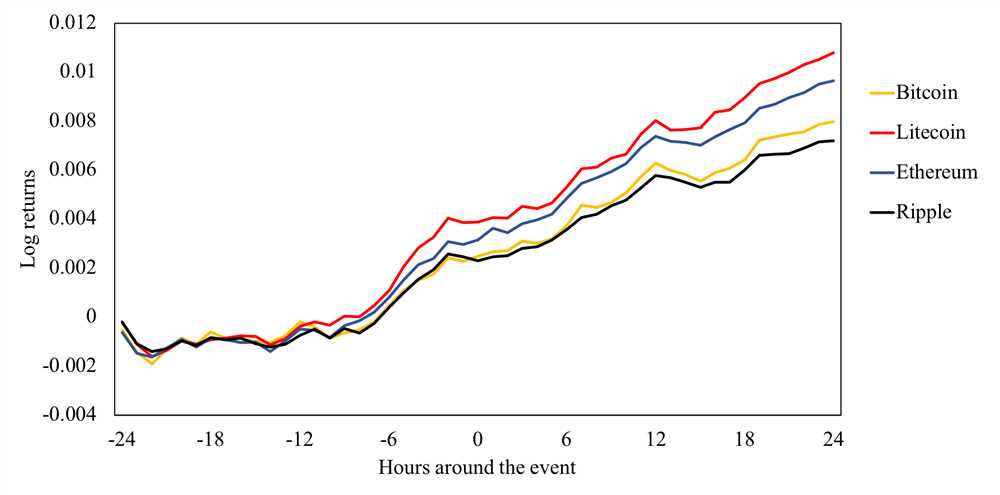

Monitoring the movement of USDT can provide valuable insights into market sentiment. When there is a significant increase in the trading volume of USDT, it may indicate that investors are moving their funds out of other cryptocurrencies and into USDT. This can be a sign of increased uncertainty and a bearish sentiment in the market.

Conversely, a decrease in the trading volume of USDT may suggest that investors are becoming more confident in the market and are moving their funds back into other cryptocurrencies. This can indicate a bullish sentiment and a potential upward trend in the market.

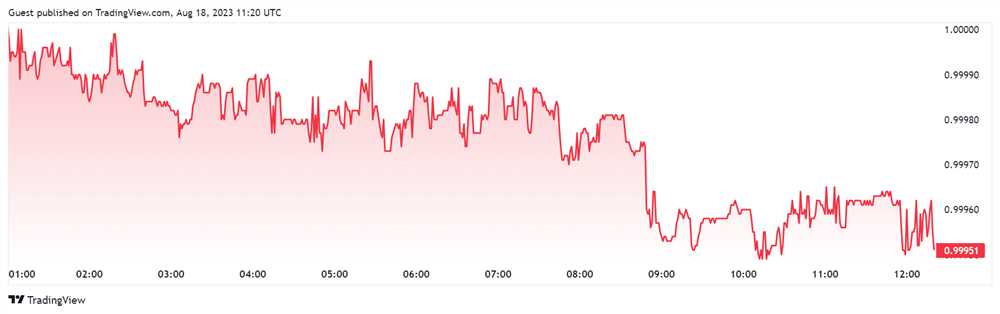

In addition to trading volume, the price of USDT can also serve as an indicator of market sentiment. If the price of USDT deviates significantly from its pegged value of $1, it may suggest a lack of trust in the stability of the cryptocurrency markets. Conversely, if the price of USDT remains consistently close to $1, it can indicate a high level of confidence in the market.

| Indicator | Implication |

|---|---|

| Increase in USDT trading volume | Bearish sentiment, uncertainty |

| Decrease in USDT trading volume | Bullish sentiment, confidence |

| Deviation of USDT price from $1 | Lack of trust, instability |

| Consistent USDT price close to $1 | High confidence, stability |

In conclusion, USDT serves as a key indicator of sentiment in the cryptocurrency markets. By monitoring the trading volume and price of USDT, investors and traders can gain insights into the overall market sentiment and make more informed decisions.

Q&A:

What is USDT?

USDT is a stablecoin pegged to the US dollar, meaning that its value is designed to stay the same as the value of the US dollar. It is issued by Tether Limited, a company that claims to hold reserves equal to the amount of USDT in circulation.

How does USDT stability impact cryptocurrency markets?

The stability of USDT plays a significant role in the cryptocurrency markets. Due to its popularity and widespread use, USDT acts as a common trading pair for many cryptocurrencies. When the stability of USDT is compromised, it can lead to increased volatility and uncertainty in the market, affecting the prices of other cryptocurrencies.

What happens if USDT loses its peg to the US dollar?

If USDT loses its peg to the US dollar, it can have severe consequences for the cryptocurrency markets. Investors may lose confidence in USDT, leading to a mass sell-off and a decrease in its value. This can also cause a ripple effect on other cryptocurrencies that are traded against USDT, impacting their prices as well.

Is USDT stability guaranteed?

Tether Limited claims that USDT is fully backed by reserves equal to the amount of USDT in circulation. However, there have been concerns and controversies surrounding the transparency and auditability of these reserves. The stability of USDT is not guaranteed, and there is a risk of it losing its peg to the US dollar.