The Dangers of Cold Wallets: Can You Lose Your Crypto?

Investing in cryptocurrencies has become increasingly popular, with many individuals looking to capitalize on the potential gains offered by this volatile market. As the value of digital assets continues to soar, so does the need for secure storage solutions. One option that has gained traction among investors is storing crypto on a cold wallet.

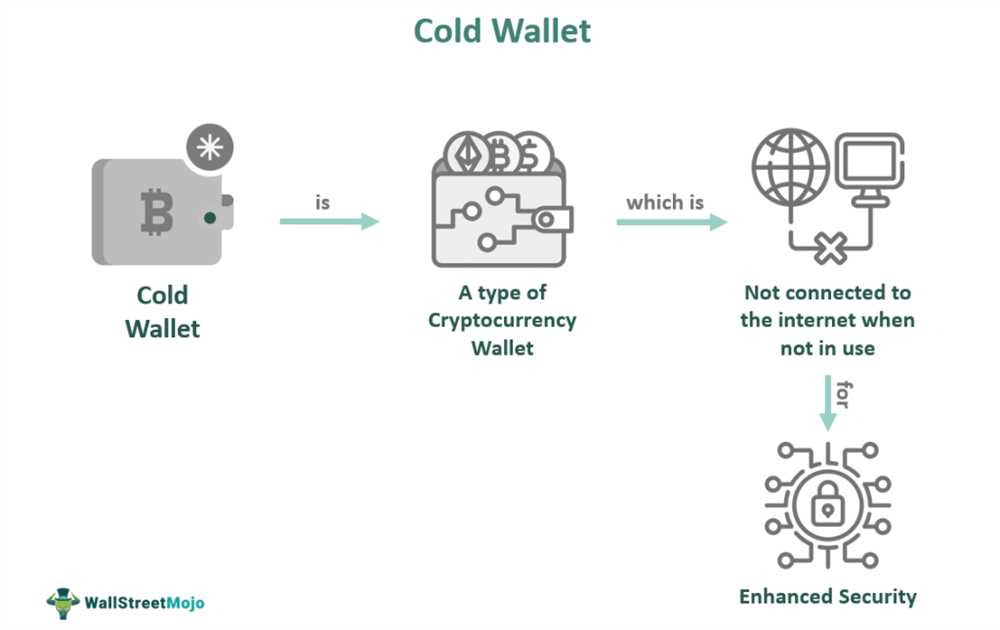

A cold wallet, also known as a hardware wallet, is a physical device that securely stores cryptocurrency offline. It keeps the private keys necessary for accessing and transacting digital assets offline, away from potential hackers and online threats. While cold wallets are generally considered to be one of the safest ways to store crypto, there are still potential risks involved.

One of the main risks of storing crypto on a cold wallet is the possibility of losing or damaging the device. Unlike digital wallets or exchanges, cold wallets are physical objects that can be lost, stolen, or damaged. If a cold wallet is lost or damaged and there is no backup of the private keys, the owner may permanently lose access to their cryptocurrency holdings. This makes it crucial for users to take extra precautions, such as creating multiple backups and storing them in secure locations.

Why Choose a Cold Wallet for Storing Crypto

When it comes to storing your cryptocurrencies, security should be your top priority. One of the best ways to ensure the safety of your digital assets is to use a cold wallet.

A cold wallet, also known as a hardware wallet, is a physical device that stores your crypto offline. Unlike hot wallets, which are connected to the internet and vulnerable to hacking, cold wallets provide an extra layer of protection.

Here are some reasons why you should consider using a cold wallet for storing your crypto:

- Enhanced Security: Cold wallets store your private keys offline, eliminating the risk of them being exposed to online threats. This significantly reduces the chances of your crypto being stolen or hacked.

- Protection Against Malware: Since cold wallets are not connected to the internet, they are immune to malware attacks. This ensures that your cryptocurrencies remain safe even if your computer or smartphone is infected.

- Peace of Mind: By using a cold wallet, you can have peace of mind knowing that your digital assets are secure. You don’t have to worry about online vulnerabilities or potential hacking attempts.

- Offline Accessibility: With a cold wallet, you can access your crypto offline, which can be especially useful in areas with limited internet access. This allows you to have complete control over your digital assets at all times.

- Compatibility: Cold wallets are compatible with multiple cryptocurrencies, making them a versatile option for storing your digital assets. Whether you have Bitcoin, Ethereum, or any other supported crypto, you can easily store them in a cold wallet.

While cold wallets offer numerous advantages for storing your crypto, it’s important to note that they are not completely foolproof. It’s crucial to ensure that you keep your recovery phrase or seed phrase in a secure location and follow best practices for using and storing your cold wallet.

In conclusion, if you value the security and protection of your cryptocurrencies, choosing a cold wallet for storing your digital assets is a wise decision. It offers a higher level of security compared to hot wallets and allows you to have complete control over your crypto offline.

The Increased Security of Cold Wallets

When it comes to storing cryptocurrencies, security is of utmost importance. One approach that has gained popularity in recent years is using cold wallets. Cold wallets are hardware devices that store the private keys needed to access cryptocurrencies offline, providing a higher level of security compared to hot wallets stored on internet-connected devices.

There are several reasons why cold wallets are considered more secure:

1. Protection against hacking:

Since cold wallets are offline, they are not susceptible to online attacks, such as phishing attempts, malware, or hacking. This significantly reduces the risk of unauthorized access to the private keys and the subsequent loss of funds.

2. Physical security:

Cold wallets are physical devices that can be stored securely in a safe or other locked location. This adds an extra layer of protection as the physical presence of the wallet makes it much more difficult for hackers to gain access to the private keys.

In addition to the security benefits, cold wallets often come with additional features and safeguards, such as backup options and built-in encryption. These features further enhance the security and peace of mind for cryptocurrency holders.

However, it is important to note that while cold wallets provide increased security, they are not completely immune to risks. Users must still exercise caution and follow best practices, such as keeping the device updated with the latest firmware, using strong and unique passwords, and keeping backups of the private keys in a separate secure location.

In conclusion, cold wallets offer a higher level of security for storing cryptocurrencies compared to hot wallets. Their offline nature, protection against hacking, and physical security measures make them an attractive option for individuals and businesses looking to safeguard their digital assets.

The Potential Risks Associated with Cold Wallets

While cold wallets are generally considered a safe way to store cryptocurrencies, there are still potential risks that users should be aware of. These risks can include:

1. Loss or Damage

Just like any physical object, cold wallets can be lost or damaged. If you lose your cold wallet or it gets damaged, you might lose access to your cryptocurrencies forever. It’s important to keep your cold wallet in a secure location and take precautions to prevent loss or damage.

2. Human Error

When using a cold wallet, there is always a risk of human error. For example, you might input the wrong passphrase or private key when accessing your cold wallet, resulting in a loss of funds. It’s crucial to double-check all information and take care when handling your cold wallet.

3. Security Breaches

While cold wallets offer a higher level of security compared to hot wallets, they are not immune to security breaches. There have been cases where hackers have successfully compromised cold wallets, either through physical theft or malware. It’s essential to use reputable cold wallet providers and regularly update the firmware to minimize the risk of a security breach.

Overall, cold wallets are a great option for secure cryptocurrency storage, but it’s important to be aware of the potential risks involved. By taking the necessary precautions and staying informed about the latest security practices, you can mitigate these risks and enjoy the benefits of using a cold wallet.

Protecting Your Assets with Proper Cold Wallet Use

When it comes to securing your cryptocurrency assets, using a cold wallet can provide an extra layer of protection. However, it’s important to understand and adopt proper cold wallet use practices to ensure the safety of your funds.

Here are some key steps to help you protect your assets with proper cold wallet use:

- Choose a reputable cold wallet: Selecting a trusted and reliable cold wallet is crucial. Research different options available in the market and consider factors such as security features, user interface, and community reviews.

- Keep your wallet offline: The primary advantage of a cold wallet is that it is completely disconnected from the internet, making it immune to online threats such as hacking or phishing attacks. Only connect your cold wallet to the internet when necessary.

- Set up strong security measures: Implement strong passwords, PIN codes, and encryption for your cold wallet. This will add an extra layer of protection in case your wallet falls into the wrong hands.

- Create a backup: Regularly backup your cold wallet’s recovery phrase or private keys. Store these backups in a secure location, preferably offline, to ensure that you can regain access to your funds even if your cold wallet is lost or damaged.

- Be cautious with software updates: Before updating the firmware or software of your cold wallet, ensure that the update is legitimate and from the official source. Unofficial updates may introduce vulnerabilities that could compromise the security of your wallet.

- Practice safe storage: Store your cold wallet in a secure physical location, such as a safe or safety deposit box. Keep it away from potential risks like fire, water damage, or theft.

- Keep your actions private: When using your cold wallet, make sure you are in a private and secure environment. Avoid making transactions on public networks or computers, as they may be compromised.

- Regularly monitor your assets: Keep track of your cryptocurrency holdings and monitor your cold wallet transactions. Promptly report any suspicious activity to your wallet provider or relevant authorities.

By following these steps and implementing proper cold wallet use practices, you can significantly reduce the potential risks associated with storing your crypto assets. Remember, your security is in your hands, so stay informed and take proactive measures to protect your hard-earned funds.

Important Considerations Before Using a Cold Wallet

When it comes to securing your cryptocurrency assets, using a cold wallet can offer an added layer of protection. However, before choosing to use a cold wallet, there are several important considerations to keep in mind:

Security

While cold wallets are generally considered to be more secure than hot wallets, it is important to note that they are not completely immune to hacking or physical theft. It is crucial to choose a reputable cold wallet provider and ensure that the device is always kept in a safe and secure location. Additionally, practicing proper security measures such as enabling two-factor authentication and regularly updating firmware can help minimize risks.

Usability

Using a cold wallet often involves a more technical process compared to hot wallets. It typically requires additional steps such as generating and storing private keys offline. This added complexity may not be suitable for beginners or individuals who prefer a simpler user experience. It is important to evaluate your own technical knowledge and comfort level before deciding to use a cold wallet.

Backup and Recovery

In the event of a lost, damaged, or stolen cold wallet device, it is crucial to have a proper backup and recovery plan in place. This involves securely storing and regularly updating backups of your private keys or recovery phrases. Without a proper backup plan, the risk of permanently losing access to your cryptocurrency assets is significantly increased.

Updates and Compatibility

Cold wallet technology is constantly evolving, with new features and security enhancements being released regularly. It is important to stay informed about firmware updates and to ensure that your cold wallet is compatible with the latest software versions. Failure to do so may lead to vulnerabilities that could be exploited by hackers.

Research and Education

Before using a cold wallet, it is essential to conduct thorough research and educate yourself about the different options available. This includes understanding the various types of cold wallets, their features, and any potential limitations or risks associated with each option. By staying informed, you can make an informed decision and choose the best cold wallet solution for your specific needs.

In conclusion, while using a cold wallet can provide enhanced security for your cryptocurrency assets, it is important to carefully consider the factors mentioned above before making a decision. By understanding the potential risks and taking necessary precautions, you can confidently store your crypto on a cold wallet and mitigate potential threats to your digital wealth.

Q&A:

What is a cold wallet and how does it work?

A cold wallet is a form of offline storage for cryptocurrencies. It is considered to be a more secure way of storing digital assets because it is not connected to the internet, reducing the risk of cyber attacks and hacking attempts. Cold wallets typically come in the form of hardware devices, such as USB drives or specialized devices, and they store the private keys necessary to access and manage the cryptocurrencies.

What are the potential risks of storing crypto on a cold wallet?

One potential risk of storing crypto on a cold wallet is the possibility of losing or damaging the physical device. If the cold wallet is lost, destroyed, or stolen, it can be difficult or even impossible to retrieve the private keys and access the cryptocurrencies. Another risk is human error – if the user forgets the password or misplaces the recovery phrase, they may be locked out of their funds forever. Additionally, if the cold wallet is not securely manufactured or purchased from a reputable source, there is a risk of tampering or backdoors that could compromise the security of the cryptocurrencies stored on it.

Is it possible to transfer the cryptocurrencies from a cold wallet to an online wallet?

Yes, it is possible to transfer cryptocurrencies from a cold wallet to an online wallet. However, it is important to note that transferring the funds from a cold wallet to an online wallet introduces a potential security risk. Once the cryptocurrencies are connected to the internet, they become more vulnerable to cyber attacks and hacking attempts. It is advisable to only transfer funds to an online wallet when necessary and to use a secure and reputable online wallet.

What are some best practices for storing crypto on a cold wallet?

There are several best practices for storing crypto on a cold wallet. Firstly, it is crucial to choose a reputable and trusted cold wallet manufacturer or seller to ensure the device is secure. Secondly, it is recommended to keep multiple backups of the private keys or recovery phrases in secure and separate locations. This ensures that if one backup is lost or damaged, the cryptocurrencies can still be accessed. It is also advised to regularly update the cold wallet’s firmware and software to benefit from the latest security features and bug fixes. Lastly, it is important to educate oneself about the proper use and maintenance of the cold wallet to avoid common mistakes and ensure maximum security.