The Controversy Surrounding USDT Can it be Frozen

USDT, short for Tether, is a controversial cryptocurrency that has garnered a significant amount of attention in the digital currency world. Launched in 2014, USDT has become one of the most popular stablecoins, with a market capitalization that rivals that of Bitcoin. However, recent events have raised concerns about the stability and legality of this digital asset.

One of the key controversies surrounding USDT is the possibility of it being frozen. USDT is claimed to be backed by US dollars on a one-to-one basis, making it a stable asset in theory. However, there have been speculations that Tether Limited, the company behind USDT, does not have sufficient funds to back the issued tokens.

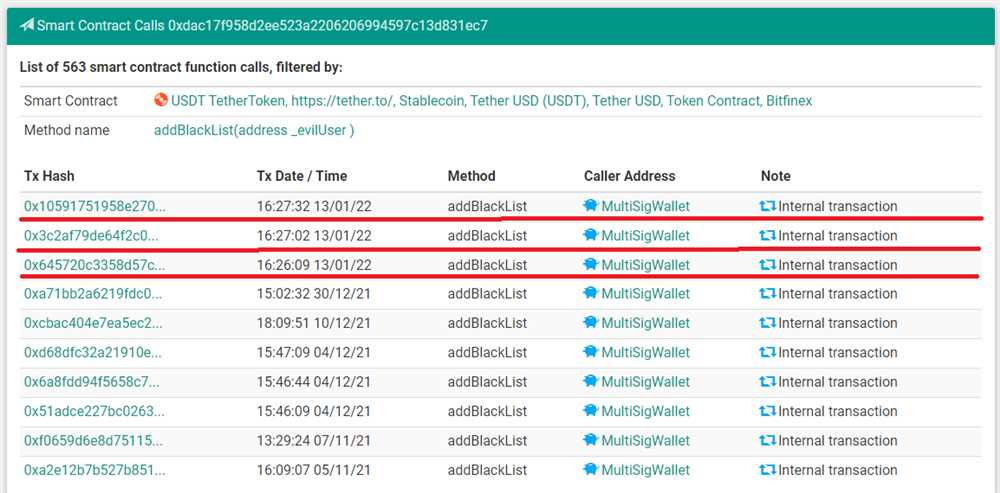

Furthermore, there have been allegations that USDT could be easily frozen or blocked by authorities. Unlike decentralized cryptocurrencies like Bitcoin, USDT relies on centralized entities to maintain its stability. This centralized nature has raised concerns about the vulnerability of USDT to regulatory actions and potential freezing of funds.

The controversy surrounding USDT has led to debates among cryptocurrency enthusiasts and experts. Some argue that the stability and liquidity of USDT are crucial for the overall health of the cryptocurrency market, while others express concerns about its lack of transparency and potential risks for investors.

As the debate continues, it is essential for investors and cryptocurrency users to stay informed and cautious when it comes to USDT. Understanding the controversies and risks associated with this stablecoin can help individuals make informed decisions and navigate the ever-changing landscape of digital currencies.

The USDT Controversy: Understanding the Situation

The controversy surrounding USDT, also known as Tether, has been a hot topic in the cryptocurrency community. USDT is a stablecoin that is supposedly backed 1:1 by the US dollar. However, there have been concerns and doubts about whether this is actually the case.

One of the main issues with USDT is its lack of transparency. Unlike other stablecoins, such as USDC or BUSD, USDT has been criticized for not providing regular audits or third-party verification of its reserves. This has led to speculation that USDT may not be fully backed by USD, and that there may be a significant amount of “phantom” Tether in circulation.

Another point of controversy is the relationship between Tether and its affiliated cryptocurrency exchange, Bitfinex. It has been alleged that Tether and Bitfinex have been involved in shady practices, such as using Tether to manipulate the price of Bitcoin. These allegations have raised concerns about the integrity and stability of USDT.

The Potential Consequences

If the allegations against USDT turn out to be true, it could have severe consequences for the entire cryptocurrency market. USDT is one of the most widely used stablecoins and serves as a key liquidity provider for many cryptocurrency exchanges. If USDT were to collapse or lose its peg to the US dollar, it could lead to a liquidity crisis and significant price volatility in the crypto market.

Furthermore, if USDT is found to be involved in fraudulent activities, it could trigger regulatory scrutiny and increased oversight of the stablecoin industry. This could affect not only USDT but also other stablecoins, as regulators may impose stricter regulations and auditing requirements to prevent similar incidents in the future.

The Path Forward

In order to address the concerns surrounding USDT, it is crucial for Tether to enhance its transparency and accountability. Regular audits by reputable third-party firms would help to establish confidence in the backing of USDT and ensure that there is no “phantom” Tether in circulation.

Additionally, it is important for regulators to step in and provide proper oversight of stablecoins like USDT. Clear guidelines and regulations surrounding stablecoins could help to protect investors and maintain the stability of the cryptocurrency market.

Overall, the USDT controversy highlights the importance of transparency and trust in the cryptocurrency industry. As the market continues to evolve, it is crucial for stablecoins to prove their legitimacy and demonstrate their commitment to maintaining a stable and reliable value.

The Concerns and Debates

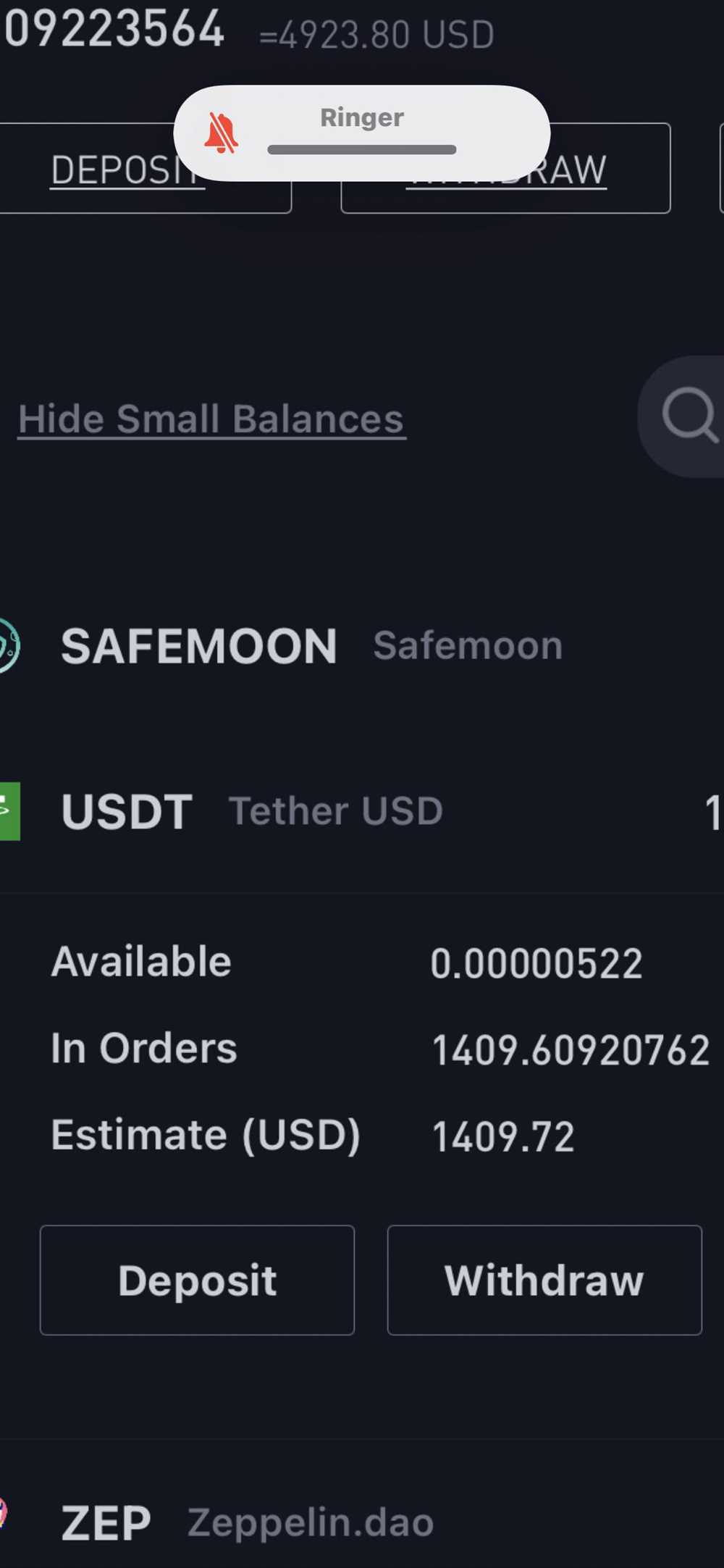

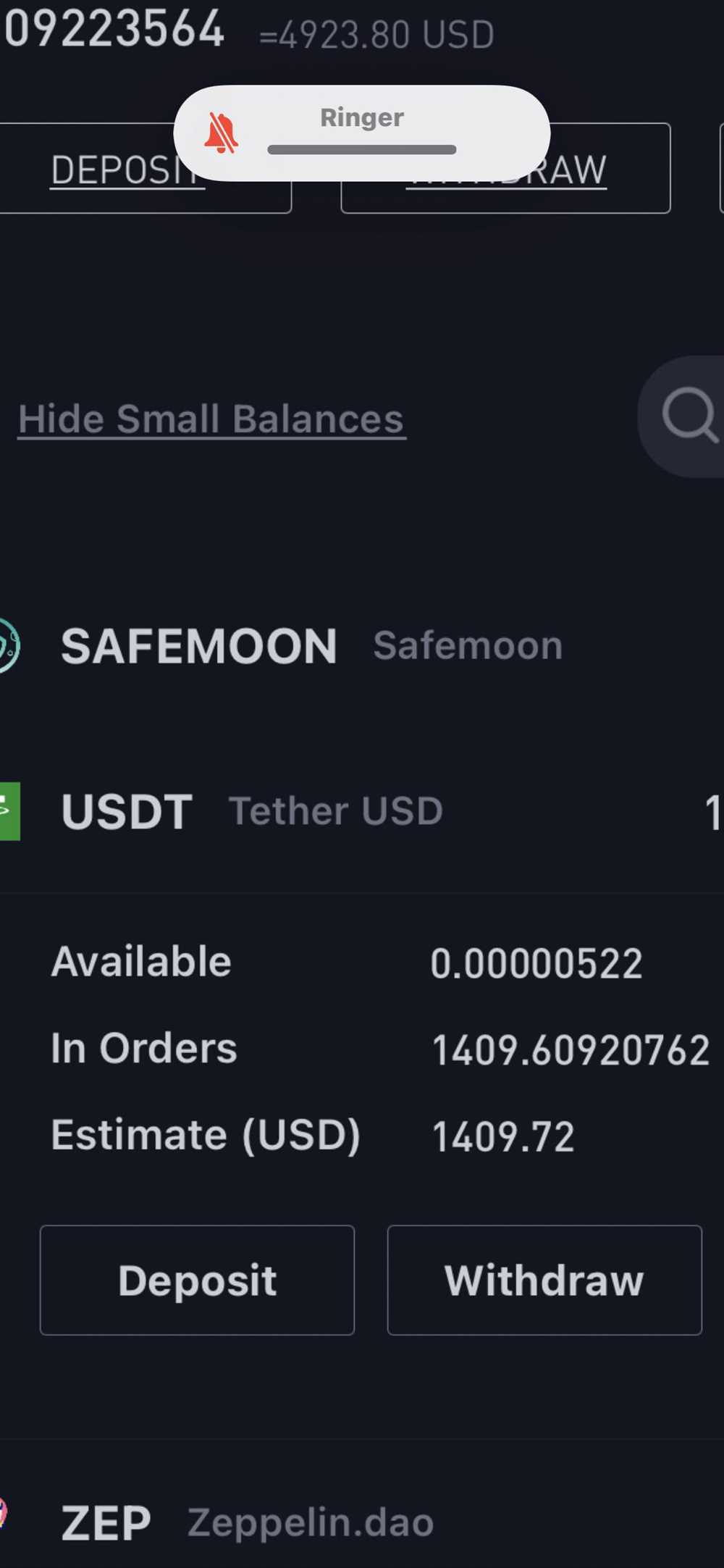

USDT, also known as Tether, has been the subject of much controversy and debate in recent years. One of the main concerns surrounding USDT is whether or not it can be frozen. This concern stems from the fact that USDT is a stablecoin, meaning it is designed to maintain a constant value by being backed by a reserve of assets.

While the creators of USDT claim that it is fully backed by assets such as US dollars, there have been doubts about the transparency and veracity of these claims. This has led to concerns that if USDT were to be frozen, it could have a significant impact on the stability of the cryptocurrency market.

Another concern regarding USDT is the potential for it to be used for illegal activities, such as money laundering and fraud. Due to its ability to facilitate easy and anonymous transactions, some argue that USDT poses a risk to the integrity and security of the financial system.

There has also been much debate about the impact of USDT on the cryptocurrency market as a whole. Some argue that the issuance of USDT has artificially inflated the prices of cryptocurrencies, creating a bubble that could burst at any moment. Others believe that USDT has provided much-needed stability to the market, allowing for greater liquidity and reducing price volatility.

Overall, the concerns and debates surrounding USDT highlight the need for greater transparency and regulatory oversight in the cryptocurrency industry. As the use of stablecoins continues to grow, it is important to address these concerns and ensure that the financial system remains secure and stable.

The Potential Implications and Risks

The controversy surrounding USDT and its potential for being frozen has raised several implications and risks that need to be considered. These include:

| Implication/Risk | Description |

|---|---|

| Influence on the Crypto Market | If USDT, one of the most widely used stablecoins, were to be frozen, it could have a significant impact on the cryptocurrency market. USDT is often used as a key trading pair and a means of liquidity for many exchanges. Its freeze would disrupt trading activities, potentially leading to market instability and price volatility. |

| Loss of Trust | A frozen USDT would likely result in a loss of trust from investors and users. Stablecoins are designed to maintain a stable value and act as a reliable store of value. If USDT fails to live up to these expectations due to freeze or regulatory actions, it could erode confidence in not only USDT but also the broader stablecoin ecosystem. |

| Legal and Regulatory Scrutiny | USDT’s potential freeze could invite increased regulatory scrutiny. The controversy surrounding its reserves and lack of transparency has already attracted regulatory attention. A freeze event would likely lead to further investigations and potential legal action, introducing additional regulatory uncertainty and potential restrictions in the stablecoin space. |

| Systemic Risk | The freezing of USDT could pose systemic risks to the broader financial system. As USDT has become deeply integrated into the cryptocurrency market, any disruption or freezing of its operations could have widespread consequences. It could impact not only exchanges and traders but also other cryptocurrencies that rely on stablecoins for liquidity and trading. |

| Shift in Investor Preferences | The controversy surrounding USDT may result in a shift in investor preferences towards other stablecoins or alternative options. If USDT’s reputation is severely damaged or if its freeze event is viewed as a major failure, investors may seek alternatives that offer greater transparency, better regulatory compliance, or more reliable asset backing. This could lead to increased adoption of competing stablecoins. |

Overall, the potential freeze of USDT presents significant implications and risks for the cryptocurrency market. It highlights the need for increased transparency, improved regulatory oversight, and diversification in stablecoin offerings to ensure the stability and trustworthiness of the ecosystem.

Question-answer:

What is USDT?

USDT, also known as Tether, is a cryptocurrency that is pegged to the value of the U.S. dollar. Each USDT token is supposed to be backed by one U.S. dollar held in reserve by Tether Ltd., the company behind USDT.

Why is there controversy surrounding USDT?

The controversy surrounding USDT stems from concerns about the transparency of Tether Ltd. and whether or not they actually have enough reserves to back the USDT tokens in circulation. There have been allegations and investigations into Tether Ltd.’s finances, which has raised doubts about the legitimacy and stability of USDT.

Can USDT be frozen?

While Tether Ltd. has the ability to freeze USDT tokens in certain circumstances, such as in cases of suspected fraud or illegal activity, it is generally believed that USDT tokens are not easily frozen. However, the controversy surrounding USDT has led to calls for greater regulation and oversight, which could potentially result in stricter controls and the ability to freeze USDT in the future.