The Complete Guide on Converting USDT to Cash

If you’re one of the many cryptocurrency investors, you’re likely no stranger to USDT (USD Tether). This stablecoin is designed to be a digital representation of the US dollar, offering stability in an otherwise volatile market. While it can be a great way to store value and make transactions within the cryptocurrency space, there may come a time when you want to convert your USDT to cash.

Converting USDT to cash can be a straightforward process if you know the right steps to take. In this comprehensive guide, we’ll walk you through the different methods you can use to convert your USDT holdings into traditional currency. Whether you prefer to use an online exchange, a peer-to-peer platform, or even a physical ATM, we’ll cover all the options available to you.

It’s important to note that the process of converting USDT to cash may vary depending on your location and the specific platform or service you choose to use. However, by following our guide, you’ll gain a solid understanding of the general steps involved and be well-equipped to navigate the process with confidence.

The Ultimate Guide to Exchanging USDT for Cash

Are you looking to convert your USDT (Tether) cryptocurrency into cash? Whether you want to use the cash for everyday expenses or simply want to diversify your assets, converting USDT to cash can be a straightforward process. In this guide, we’ll walk you through the steps to exchange your USDT for cash.

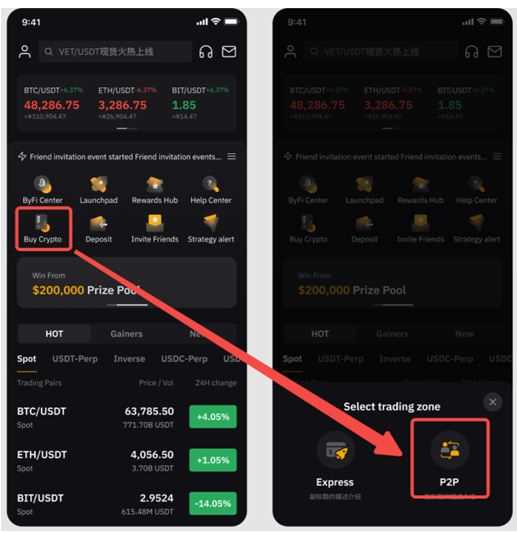

Step 1: Choose a Reliable Exchange Platform

The first step in converting USDT to cash is to choose a reliable exchange platform. Make sure to do thorough research and select a platform that offers competitive exchange rates, low fees, and excellent customer service. Some popular exchange platforms for converting USDT include Coinbase, Binance, and Kraken.

Step 2: Set Up an Account

Once you’ve chosen an exchange platform, you’ll need to set up an account. Provide the required information and complete the necessary verification process. This step is essential to ensure the security of your transactions.

Step 3: Deposit USDT

After you’ve set up your account, you’ll need to deposit your USDT into the exchange platform. Follow the provided instructions to generate a wallet address for your USDT and transfer the desired amount from your USDT wallet to the exchange platform’s wallet.

Step 4: Convert USDT to Cash

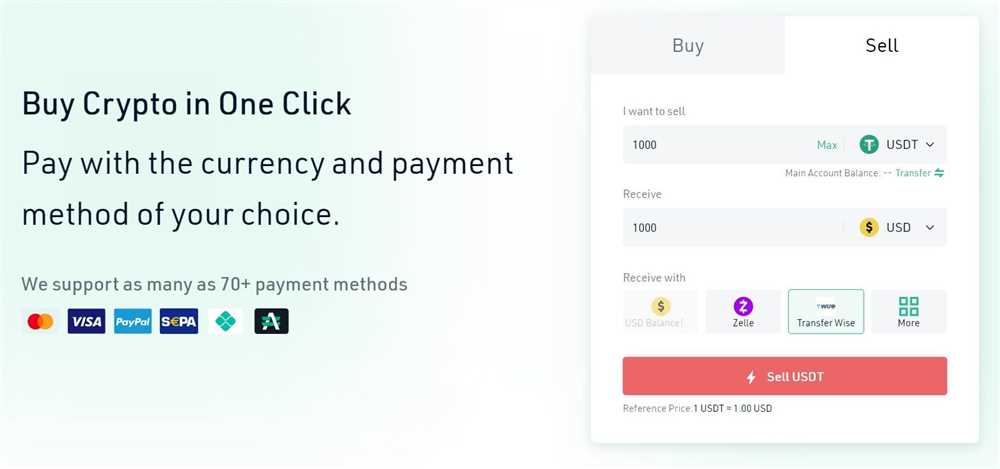

Once your USDT has been deposited into your exchange platform account, you can convert it to cash. Different platforms may offer various options for converting cryptocurrency to cash, including bank transfers, PayPal, or credit card withdrawals. Choose the option that best suits your needs.

Step 5: Withdraw Cash

After converting your USDT to cash, choose the method of cash withdrawal offered by the exchange platform. Depending on the platform, you may be able to withdraw cash directly to your bank account, receive a check, or use a supported payment service.

Step 6: Monitor the Market

It’s always a good idea to keep an eye on the market trends and exchange rates. Cryptocurrency markets can be volatile, and the value of USDT may fluctuate. By staying informed, you can choose the most opportune time to convert your USDT to cash.

Step 7: Consider Tax Implications

Before converting your USDT to cash, it’s important to consider the tax implications. Cryptocurrency transactions may be subject to capital gains tax or other tax obligations. Consult with a tax professional to understand the tax regulations in your jurisdiction and ensure compliance.

Conclusion

Converting USDT to cash can be a relatively straightforward process when you follow the right steps. By choosing a reliable exchange platform, depositing your USDT, converting it to cash, and monitoring the market, you can successfully exchange your cryptocurrency for cash. Remember to consider any tax implications and consult with a tax professional if needed. Now you’re ready to turn your USDT into cash and use it as you please!

Understanding the Basics of USDT

USDT, or Tether, is a type of cryptocurrency that is tied to the value of a stable asset, usually the US dollar. It is commonly referred to as a stablecoin because its value is designed to remain relatively stable in comparison to other cryptocurrencies, which can be highly volatile.

How does USDT work?

USDT operates on the blockchain technology, specifically the Omni Layer Protocol. This protocol allows USDT to be issued, transferred, and redeemed on the blockchain. Each USDT token is backed by an equivalent amount of the underlying asset, which is usually held by an issuer or custodian.

When someone wants to obtain USDT, they can either purchase it from a cryptocurrency exchange or be granted it through a process called minting. Minting involves the creation of new USDT tokens by the issuer, typically in exchange for traditional currency. These newly minted tokens are then added to circulation.

On the other hand, if someone wants to convert USDT back into cash, they can do so by redeeming it through the issuer or a designated exchange. The redeemed USDT tokens are destroyed, and the equivalent amount of the underlying asset is returned to the user.

Advantages and risks of using USDT

One of the main advantages of using USDT is its stability. As a stablecoin, it is designed to maintain a 1:1 ratio with the underlying asset, which provides a sense of reliability and predictability for users. This stability can be particularly useful for those who want to avoid the volatility often associated with other cryptocurrencies.

However, it’s important to note that USDT is not entirely without risks. The most significant risk is the potential lack of transparency and regulatory oversight. While the issuer of USDT claims to have reserves equivalent to the amount of tokens in circulation, audits and financial disclosures have raised questions about the actual backing of USDT.

Additionally, the stability of USDT is only as reliable as the backing asset itself. If the underlying asset experiences significant fluctuations, it may impact the value and stability of USDT. Users should also be mindful of potential security risks associated with holding and transacting USDT on various platforms.

Overall, understanding the basics of USDT is crucial for individuals who want to engage with this cryptocurrency. It offers stability and accessibility, but it’s essential to be aware of the potential risks and limitations associated with its use.

Step-by-Step Guide for Converting USDT to Cash

If you are looking to convert your USDT to cash, follow these easy steps to ensure a smooth and secure transaction:

Step 1: Choosing a Trusted Exchange Platform

The first step in converting your USDT to cash is to select a reputable and trustworthy exchange platform. Look for platforms with a good track record, strong security measures, and a user-friendly interface.

Step 2: Creating an Account

Once you have chosen an exchange platform, the next step is to create an account. Provide the necessary information as requested by the platform, such as your email address, name, and password. Make sure to choose a strong and unique password to protect your account.

Step 3: Verifying Your Identity

Many exchange platforms require users to verify their identity before they can convert USDT to cash. This is done to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations. Follow the platform’s instructions to complete the verification process.

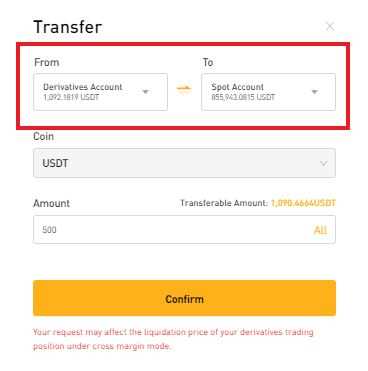

Step 4: Depositing USDT

After your account has been created and verified, you can proceed to deposit your USDT. The exchange platform will provide you with a wallet address where you can send your USDT from your existing wallet or exchange.

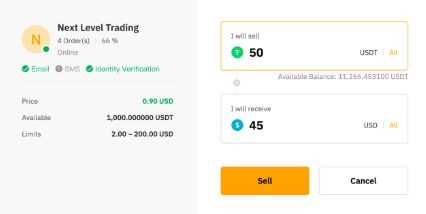

Step 5: Initiating the Conversion

Once your USDT deposit has been confirmed, you can initiate the conversion process. Look for the “Convert” or “Sell” option on the platform and select the amount of USDT you wish to convert to cash.

Tip: Before converting your USDT, make sure to check the current exchange rate and any applicable fees on the platform.

Step 6: Withdrawing the Cash

After the conversion is complete, you can withdraw the cash to your bank account. Ensure that you have provided the correct bank details to avoid any issues. The withdrawal process may take some time, depending on the platform and the chosen withdrawal method.

Step 7: Double-Check and Confirm

Before finalizing the conversion and withdrawal, carefully double-check all the details to ensure accuracy. Confirm that the amount of cash you will receive matches your expectations and that the withdrawal details are correct.

Following these step-by-step instructions will help you convert your USDT to cash efficiently and securely. Always exercise caution and research the exchange platform thoroughly before proceeding with any transactions.

Tips and Precautions for a Successful USDT to Cash Conversion

Converting USDT to cash can be a convenient way to access your funds. However, it is essential to exercise caution and follow these tips to ensure a successful conversion:

1. Choose a Reliable Exchange or Platform

Before initiating the conversion process, it is crucial to select a reputable exchange or platform that supports USDT to cash transactions. Research and compare different options based on factors such as security, fees, and user reviews. Opting for a well-established and trusted platform will minimize the risk of fraud or loss of funds.

2. Verify the Exchange’s Compliance

Ensure that the exchange or platform you choose is compliant with local laws and regulations. This step is particularly important as it will help you avoid any legal issues or complications during the conversion process. Verify the exchange’s KYC (Know Your Customer) requirements to ensure a smooth transaction.

3. Determine the Conversion Rate and Fees

Before proceeding with the conversion, it is essential to determine the exchange rate and any associated fees. Compare the rates offered by different platforms to get the best value for your USDT. Pay attention to hidden fees or charges that may significantly impact the final cash amount you receive.

4. Secure Your Funds

Prioritize the security of your funds throughout the conversion process. Use strong and unique passwords for your accounts and enable two-factor authentication if available. Keep your private keys and recovery phrases secure and never share them with anyone. Regularly monitor your accounts for any suspicious activities and report them immediately.

5. Start with a Small Transaction

If you are using a new exchange or platform for the first time, start with a small transaction to test the process and evaluate its reliability. This precautionary step will help you assess the platform’s performance and ensure that your funds are secure before proceeding with larger transactions.

6. Double-Check Transaction Details

Before finalizing the conversion, double-check all transaction details, including the recipient’s wallet address and the converted cash amount. An error in any of these details can result in irreversible loss of funds. Take your time to review the information carefully and confirm the transaction only when you are certain that everything is accurate.

Conclusion

Converting USDT to cash can provide liquidity and access to your funds. By following these tips and taking precautions, you can ensure a successful conversion process while minimizing potential risks. Stay informed, vigilant, and cautious throughout the process to safeguard your assets and enjoy the benefits of converting USDT to cash.

Question-answer:

What is USDT?

USDT (Tether) is a type of cryptocurrency called a stablecoin, which is designed to be pegged to the value of a fiat currency, such as the US dollar. It is often used as a medium of exchange and store of value in the world of crypto trading.

How can I convert USDT to cash?

There are several ways to convert USDT to cash. One common method is to use a cryptocurrency exchange that supports USDT trading pairs with fiat currencies, such as USD or EUR. You can sell your USDT for fiat currency and withdraw it to your bank account. Another option is to find an OTC (over-the-counter) trading service that allows you to sell your USDT for cash directly to another individual or organization.

Are there any fees associated with converting USDT to cash?

Yes, there are usually fees involved when converting USDT to cash. When using a cryptocurrency exchange, you may have to pay a trading fee for selling your USDT for fiat currency. Additionally, there may be withdrawal fees when transferring the cash to your bank account. OTC trading services may also charge fees for facilitating the transaction. It’s important to research and compare fees before choosing a method for converting USDT to cash.

What are the risks of converting USDT to cash?

There are several risks to consider when converting USDT to cash. One major risk is the potential for scams or fraudulent activity. Always use reputable exchanges or OTC services to minimize the risk of falling victim to a scam. Additionally, the value of USDT can fluctuate, so there is a risk of losing money if the value of USDT decreases before you are able to convert it to cash. Lastly, there may be legal and regulatory risks depending on your jurisdiction, so it’s important to be aware of any applicable laws or regulations.