Legal Issues Surrounding USDT and the Potential for Asset Freezing

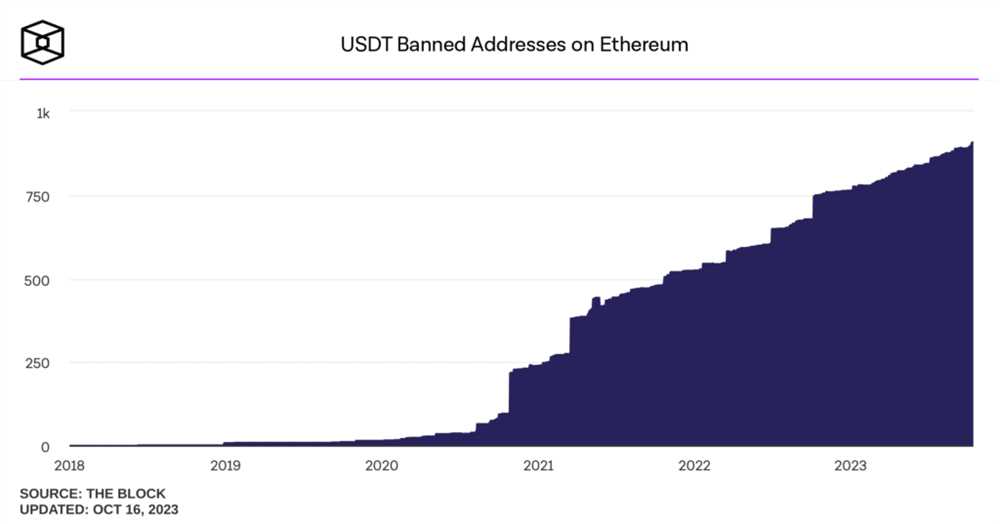

As the popularity of cryptocurrency continues to grow, so does the attention it receives from regulators and law enforcement agencies. One of the major concerns surrounding cryptocurrencies like Bitcoin is their potential for use in illegal activities such as money laundering and terrorism financing. Tether (USDT), a stablecoin pegged to the US dollar, has recently come under scrutiny for its role in facilitating such activities.

USDT is one of the most widely-used stablecoins in the crypto market, with a market capitalization that often exceeds billions of dollars. Its popularity stems from its ability to maintain a stable value, which makes it attractive for traders and investors as a hedge against market volatility. However, this stable value and the anonymity offered by cryptocurrencies can also make USDT an ideal tool for illicit activities.

Regulators are increasingly concerned about the potential for cryptocurrencies like USDT to be used in money laundering schemes. They fear that the anonymity provided by cryptocurrencies can make it difficult to trace the source and destination of funds, allowing criminals to easily transfer large sums of money without detection. To address these concerns, regulators around the world are looking to implement stricter regulations and oversight on cryptocurrencies, including USDT.

One potential legal challenge that USDT faces is the possibility of being frozen or seized by authorities. This could happen if law enforcement agencies suspect that funds held in USDT wallets are connected to illegal activities. In recent years, there have been several cases where authorities have frozen or seized cryptocurrencies in connection with criminal investigations.

While USDT aims to provide stability and convenience to cryptocurrency users, it also faces legal challenges and scrutiny. As regulators tighten their grip on the cryptocurrency industry, it becomes increasingly important for users and investors to ensure they are compliant with legal requirements and vigilant against potential risks. The future of USDT and other stablecoins will depend on how effectively they can navigate these legal challenges and maintain trust and transparency in the cryptocurrency ecosystem.

Overview of Legal Challenges Surrounding USDT Freezing

The freezing of USDT has become a contentious legal issue, raising questions surrounding its legality and jurisdiction. The legal challenges stem from the decentralized nature of USDT and the lack of a central authority that can enforce such actions.

One of the key challenges is determining the legal status of USDT. Since it is a form of digital currency that is not backed by a government or regulated by a central bank, it falls into a legal gray area. This has led to a lack of clarity on how it should be treated under existing laws.

Additionally, the decentralized and global nature of USDT poses challenges in terms of jurisdiction. Since USDT can be traded and used by individuals around the world, it is difficult to determine which legal framework should apply. This has led to conflicts between different countries and regulatory bodies.

Furthermore, the concept of freezing USDT raises concerns regarding individual rights and privacy. If USDT can be frozen by a central authority, it raises questions about financial autonomy and the potential for abuse of power. This leads to debates about the balance between security and individual freedom.

In conclusion, the legal challenges surrounding USDT freezing are complex and multifaceted. Determining its legality and jurisdiction, balancing individual rights and security, and addressing conflicts between different countries are some of the key challenges that need to be addressed in order to provide a clear legal framework for USDT freezing.

Understanding the Complex Legal Landscape

The legal challenges surrounding USDT and the possibility of freezing accounts have created a complex landscape that requires a thorough understanding of various aspects of the law. To navigate this landscape, it is important to look at different legal perspectives and analyze potential implications.

Regulatory Framework

The regulatory framework for cryptocurrencies and stablecoins like USDT is still evolving, with different countries taking different approaches. Some countries have implemented comprehensive regulations, while others have taken a more cautious or permissive stance. This lack of uniformity adds to the complexity of the legal landscape.

In the United States, the Securities and Exchange Commission (SEC) is the primary regulatory body responsible for overseeing cryptocurrency-related activities. However, its jurisdiction and specific regulations remain subject to interpretation, leading to uncertainty and legal challenges.

Contractual and Property Rights

One of the key legal considerations surrounding USDT and similar stablecoins is the nature of the rights and obligations associated with them. Determining whether USDT constitutes a contract or a property right can significantly impact the legal framework under which they are regulated.

Contractual rights are typically governed by contract law, while property rights are subject to property law. The classification of stablecoins as either contracts or property rights can have implications for issues such as ownership, transferability, and enforceability.

| Legal Challenge | Implication |

|---|---|

| Freezing of Accounts | If stablecoins are deemed property rights, account freezing could be subject to due process and other legal protections. If they are considered contractual rights, freezing accounts may be easier for regulators. |

| Liability for Losses | The classification of stablecoins could impact the liability of issuers for any losses suffered by users. Contractual rights may impose stricter obligations on issuers, while property rights may limit liability. |

| Legal Jurisdiction | Depending on the legal classification of stablecoins, different jurisdictions may have varying levels of authority or responsibility over their regulation. This can lead to conflicts and challenges in determining the applicable laws. |

These are just a few examples of the legal challenges and implications that arise from the complex legal landscape surrounding USDT. To navigate this landscape effectively, it is essential to stay updated on regulatory developments, consult with legal experts, and consider the potential impact on various legal frameworks.

Analyzing the Implications of USDT Freezing

The possibility of freezing the stablecoin USDT, also known as Tether, raises several important legal and financial implications. While Tether has been widely used in the cryptocurrency industry as a stable digital asset, its potential freezing would have far-reaching consequences.

Liquidation Risk

If USDT were to be frozen, many cryptocurrency exchanges that rely on it as a trading pair would face significant liquidation risks. USDT is often used as a bridge between cryptocurrencies and traditional fiat currencies, with many traders using it to hedge against market volatility. In the event of USDT freezing, traders may be forced to quickly convert their holdings into other stablecoins or fiat, leading to potential market instability and increased selling pressure.

Legal Challenges

The legal challenges arising from the freezing of USDT are complex. Tether has faced scrutiny in the past regarding its financial reserves and transparency. If USDT were to be frozen due to legal concerns, it could trigger a wave of lawsuits and regulatory actions. The uncertainty surrounding the legality of USDT could also impact investor confidence in stablecoins, potentially leading to a broader regulatory crackdown on the industry as a whole.

Market Confidence

USDT is currently one of the largest stablecoins in circulation, with a market capitalization in the billions. Its freezing would likely erode confidence in the stability of stablecoins and have a negative impact on the broader cryptocurrency market. Investors may become wary of holding or transacting in stablecoins, leading to increased volatility and potential capital flight from the cryptocurrency market.

Overall, the possibility of USDT freezing has significant implications for the cryptocurrency industry. Liquidity risks, legal challenges, and reduced market confidence are all potential outcomes of such an event. The future of stablecoins and the regulatory landscape surrounding them will undoubtedly be shaped by any developments related to the freezing of USDT.

Exploring Legal Remedies and Solutions

The legal challenges surrounding USDT and the possibility of freezing funds have raised concerns among investors and the cryptocurrency community. However, there are potential legal remedies and solutions that can be explored to address these issues.

1. Regulation and Compliance

One way to mitigate legal challenges related to USDT is through increased regulation and compliance. By implementing strict guidelines and oversight for stablecoins like USDT, authorities can ensure transparency and accountability in the operation of these digital assets. This would help prevent fraudulent activities and reduce the risk of fund freezing.

Regulatory bodies can also establish measures to monitor the reserves backing stablecoins and ensure they are held in full. By mandating regular audits and reporting requirements, investors can have more confidence in the value and stability of these digital assets.

2. Dispute Resolution Mechanisms

To address potential disputes between investors and issuers of USDT, implementing effective dispute resolution mechanisms can be beneficial. This can involve creating specialized forums or arbitration panels that are knowledgeable in cryptocurrency and blockchain technology.

These dispute resolution mechanisms can offer a faster and more cost-effective way to resolve legal disputes, compared to traditional litigation. By providing a dedicated platform to address USDT-related issues, investors can seek remedies and solutions in a timely manner, minimizing potential losses and damages.

Furthermore, these mechanisms can help establish precedents and uniform interpretations of the law regarding stablecoins, which can contribute to legal clarity and consistency in the industry.

In conclusion, the legal challenges and potential freezing of USDT funds can be addressed through regulatory measures and the establishment of dispute resolution mechanisms. By promoting transparency, accountability, and efficient solutions, the cryptocurrency community can navigate these legal issues in a more secure and stable manner.

Factors Influencing the USDT Freezing Debate

The debate surrounding the freezing of USDT has been influenced by various factors. These factors include:

1. Legal Concerns:

One of the main factors influencing the USDT freezing debate is the legal concerns surrounding the stability and regulatory compliance of stablecoins. Questions have been raised about the lack of transparency and oversight in the issuing and management of USDT, which has led to calls for increased regulations and scrutiny.

2. Market Manipulation:

Another factor contributing to the debate is the concern over market manipulation. USDT, being one of the most widely used stablecoins, has the potential to impact cryptocurrency markets significantly. There have been allegations of price manipulation and artificial inflation of the cryptocurrency market through the use of USDT, leading to calls for stricter regulations and safeguards.

3. Counterparty Risk:

The risk associated with the counterparty of USDT has also influenced the debate. Tether Limited, the company behind USDT, has faced criticism for its lack of transparency regarding USD reserves backing the stablecoin. Concerns have been raised about the counterparty risk associated with Tether, and the potential impact it could have on the stability of the cryptocurrency market.

4. Regulatory Compliance:

The debate has also been influenced by the need for regulatory compliance. As cryptocurrencies continue to gain mainstream adoption, there is growing pressure for stablecoins like USDT to adhere to established regulatory standards. The lack of clarity and transparency regarding regulatory compliance has fueled concerns and debates surrounding the freezing of USDT.

5. Investor Protection:

The protection of investors and their interests is another key factor influencing the debate. Given the significant role USDT plays in the cryptocurrency market, any potential issues or risks associated with it could have far-reaching consequences for investors. The debate surrounding the freezing of USDT is driven by the desire to protect investors and ensure the stability and integrity of the cryptocurrency market.

In conclusion, the debate surrounding the freezing of USDT is influenced by various factors, including legal concerns, market manipulation, counterparty risk, regulatory compliance, and investor protection. These factors highlight the need for greater transparency, accountability, and regulatory oversight in the stablecoin industry.

Q&A:

What are the legal challenges associated with USDT?

The legal challenges associated with USDT primarily center around concerns of transparency and regulatory compliance. There have been allegations that Tether, the company behind USDT, may not have sufficient reserves to back up the token’s value. Additionally, there have been inquiries into Tether’s practices, such as how it generates new USDT and the potential impact on the larger cryptocurrency market. These legal challenges highlight the need for increased regulation and oversight in the cryptocurrency space.

Is there a possibility of USDT being frozen?

While it is technically possible for USDT to be frozen, as it is a centralized cryptocurrency, the likelihood of this happening is quite low. Tether, the company behind USDT, has the ability to freeze or block specific USDT tokens, but they have stated that they would only do so in accordance with applicable laws and regulations. However, the decentralized nature of other cryptocurrencies like Bitcoin makes them much less susceptible to being frozen or blocked.

What are the implications of USDT being frozen?

If USDT were to be frozen, it would have significant implications for the cryptocurrency market. USDT is one of the most widely used stablecoins and is used by many traders and exchanges as a trading pair. If USDT were to be frozen, it could disrupt trading and liquidity in the market, leading to increased volatility and uncertainty. Additionally, it could also raise concerns about the stability of other stablecoins and cryptocurrencies, as many are closely tied to USDT’s value.