Is the Value of USDT Stable Debunking the 1 1 USD Claim

USDT, or Tether, is a cryptocurrency that has been marketed as a stablecoin pegged to the value of the US dollar. However, there have been growing concerns about the stability and transparency of its value.

According to its creators, each USDT token is backed by a reserve of USD held in a bank account. This claim of a 1:1 peg with the US dollar is what sets USDT apart from other cryptocurrencies. Investors and traders have relied on this claim to provide stability and security to their holdings.

But is the value of USDT really stable? Critics argue that the lack of regular audits and transparency in reporting the reserves raises doubts about the true value of USDT. While the company behind USDT claims to have the same amount of USD in reserves for each token in circulation, there is no way to independently verify this claim.

Is the Value of USDT Stable?

USDT, also known as Tether, is a cryptocurrency that claims to be backed 1:1 by the US dollar. The value of USDT is supposed to remain stable at $1, making it a popular choice for traders and investors looking for a stablecoin.

However, there have been concerns and debates about whether the value of USDT is truly stable and whether it is actually backed by sufficient reserves. Some critics argue that the lack of transparency and auditing of Tether’s reserves raises doubts about the stability of USDT.

The 1:1 USD Claim

USDT’s claim of being backed 1:1 by the US dollar means that for every USDT in circulation, there should be an equivalent amount of US dollars held in reserve. This claim is meant to reassure investors that they can redeem their USDT for US dollars at any time.

However, the lack of a full and independent audit of Tether’s reserves has raised concerns about the validity of this claim. Critics argue that Tether has not provided sufficient evidence to prove that it has enough reserves to back up all the USDT in circulation.

The Impact of Market Demand

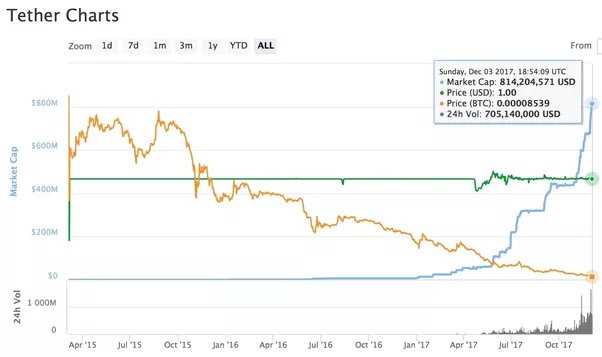

Another factor that questions the stability of USDT is the impact of market demand. The value of USDT is influenced by market factors such as supply, demand, and market sentiment. If there is a sudden increase in demand for USDT, the price can deviate from its intended value of $1.

This deviation from the intended value has been observed in the past, with the price of USDT sometimes dropping below $1 or rising above $1. These fluctuations can lead to concerns about the stability of USDT as a reliable store of value.

It is important for investors and traders to carefully consider the stability of USDT before making financial decisions. Doing thorough research and understanding the risks involved is crucial when dealing with any cryptocurrency, including USDT.

In conclusion, while USDT claims to have a stable value of $1, there are concerns about the lack of transparency and independent auditing of Tether’s reserves. Additionally, market demand can impact the stability of USDT, resulting in price fluctuations that deviate from its intended value.

Debunking the 1:1 USD Claim

The claim that USDT (Tether) maintains a 1:1 ratio with the US dollar has been a subject of controversy and skepticism within the cryptocurrency community. While Tether Limited, the company behind USDT, asserts that each USDT token is backed by an equivalent amount of USD, several issues have raised concerns and cast doubts on this claim.

Lack of Transparency

One of the main reasons for questioning the 1:1 USD claim is the lack of transparency surrounding Tether’s reserves. Tether Limited has repeatedly faced criticism for failing to provide regular audits that would validate the existence of the USD reserves to back each USDT token. Without transparent and independent audits, it becomes difficult to determine if the claim of a 1:1 ratio is accurate.

Legal Concerns

Tether’s claim of a 1:1 USD ratio also raises legal concerns. While Tether Limited states that USDT tokens are “fully backed” by USD reserves, it does not clarify whether these reserves are subjected to third-party scrutiny, regulatory compliance, or legal protections. The lack of legal clarity and regulation surrounding stablecoins like USDT leaves room for potential risks and uncertainties.

Additionally, Tether Limited has faced legal challenges in the past. In 2019, the New York Attorney General accused Tether of using USDT to cover up a loss of $850 million from its sister company Bitfinex. This incident raised concerns about the transparency and stability of USDT, further weakening the trust in the 1:1 USD claim.

Market Manipulation

Another factor that questions the 1:1 USD claim is the possibility of market manipulation. Tether has been accused of artificially inflating the price of Bitcoin by issuing USDT tokens without proper backing and using them to purchase cryptocurrencies. If true, this manipulation could distort the market and undermine the value and stability of USDT, making the 1:1 ratio questionable.

- Overall, the 1:1 USD claim made by Tether for USDT tokens is met with skepticism due to the lack of transparency, legal concerns, and the potential for market manipulation. Without clear and independent audits, it is challenging to fully trust Tether’s assertions. Investors should carefully consider these factors and conduct thorough research before relying on USDT as a stable store of value.

The Controversy Surrounding USDT

USDT, also known as Tether, is a cryptocurrency that claims to be backed by a 1:1 ratio with the US dollar. However, there has been significant controversy surrounding these claims, leading many to question the stability and value of USDT.

One of the main concerns surrounding USDT is the lack of transparency regarding its reserves. Unlike traditional banks, which are required to undergo regular audits and provide proof of their reserves, Tether has not been subject to the same level of scrutiny. This has raised suspicions about whether or not USDT actually has enough US dollars in reserves to back its tokens.

Another point of contention is Tether’s relationship with Bitfinex, a popular cryptocurrency exchange. Both Tether and Bitfinex share common management and have been accused of using USDT to manipulate the price of Bitcoin. Critics argue that Tether has been issuing USDT tokens out of thin air and using them to buy Bitcoin, thereby artificially inflating its price.

The controversy surrounding USDT came to a head in 2018 when it was revealed that Tether had severed ties with its auditor, Friedman LLP. This raised further doubts about the legitimacy of USDT’s claims and its ability to maintain its peg to the US dollar.

The Implications for Investors

Given the controversies surrounding USDT, investors should exercise caution when dealing with this cryptocurrency. The lack of transparency and potential manipulation raise concerns about the stability and value of USDT. Traders relying heavily on USDT should consider diversifying their holdings and exploring alternative stablecoin options.

Regulatory Actions

Regulators have also taken notice of the controversies surrounding USDT. The New York Attorney General’s office launched an investigation into Bitfinex and Tether in 2019, seeking information on their relationship and financial practices. This indicates that authorities are concerned about the potential risks posed by USDT and the need for increased oversight in the cryptocurrency market.

In conclusion, the controversies surrounding USDT have cast doubt on the stability and value of this cryptocurrency. Investors should approach USDT with caution and consider diversifying their holdings. The regulatory scrutiny of Tether and Bitfinex further highlights the need for increased transparency and oversight in the cryptocurrency market.

The Impact of Market Forces on USDT

As one of the most popular stablecoins in the market, USDT’s value is influenced by various market forces. While Tether, the company behind USDT, claims that each token is backed by an equivalent amount of USD, the stability of its value can be impacted by several factors.

One of the main market forces that can affect USDT’s value is the demand and supply dynamics. If there is an increase in demand for USDT, its value is likely to increase as well, as buyers are willing to pay a premium to acquire the stablecoin. Conversely, if there is a decrease in demand, the value of USDT may drop.

Another factor that can impact USDT’s value is market sentiment. If investors have concerns about the transparency or the backing of USDT, they may start selling their tokens, leading to a decrease in its value. On the other hand, if investors have confidence in USDT, they may buy more of it, leading to an increase in value.

Market volatility

Market volatility is another significant factor that can impact the value of USDT. As a stablecoin, USDT is designed to provide stability and a 1:1 peg to the USD. However, if there is a sudden surge of volatility in the cryptocurrency market, USDT’s value may deviate from the 1:1 peg.

During periods of extreme market volatility, such as during a bear or bull market, USDT may experience deviations from its intended value due to the market demand and supply dynamics. Traders may flock to USDT as an alternative to volatile cryptocurrencies, causing its value to increase. Conversely, if there is a lack of demand for USDT during volatile market conditions, its value may drop.

Regulatory concerns

The regulatory environment can also impact USDT’s value. If regulations are imposed on Tether or stablecoins in general, it may create uncertainty and lead to a decrease in demand for USDT. This can negatively impact its value and cause it to deviate from its 1:1 peg with the USD.

It is important for investors and users of USDT to understand and closely monitor these market forces that can impact its value. While Tether aims to maintain a stable 1:1 peg with the USD, it is subject to the forces of supply and demand, market sentiment, market volatility, and regulatory concerns.

Q&A:

How is the value of USDT determined?

The value of USDT is supposed to be pegged to the US dollar at a 1:1 ratio. This means that for every USDT in circulation, there should be an equivalent amount of US dollars held in reserve.

Is the value of USDT stable?

The stability of USDT’s value has been a subject of debate and controversy. While it is claimed to be pegged to the US dollar, there are concerns about whether this claim is accurate.

Why is there doubt about the 1:1 USD claim?

There are doubts about the 1:1 USD claim because there is a lack of transparency and auditing of Tether, the company that issues USDT. This has raised concerns about whether they actually have enough US dollars in reserve to back the value of USDT.

What are the risks of using USDT?

The main risk of using USDT is the possibility that its value could decrease or become unstable. If the 1:1 USD claim is not accurate and Tether does not have enough reserves to back the value of USDT, there could be a significant loss in value for those holding it.

Are there any alternatives to using USDT?

Yes, there are alternatives to using USDT. Some popular stablecoins include USDC, DAI, and BUSD. These stablecoins are also pegged to the US dollar and offer more transparency and auditing compared to USDT.