Cash Out Your USDT Holdings A Guide for Crypto Investors

Are you a crypto investor looking to cash out your USDT holdings? Look no further! Our comprehensive guide will walk you through the steps to easily and securely convert your USDT into traditional currency.

Step 1: Choose a Reliable Exchange

First and foremost, it’s important to select a reliable cryptocurrency exchange platform. Look for platforms that offer a seamless user experience, high liquidity, and robust security measures.

Step 2: Verify Your Account

Once you’ve chosen an exchange, you’ll need to create and verify your account. This typically involves providing your personal information, such as your name, email address, and sometimes even a government-issued ID.

Step 3: Deposit Your USDT

After your account is verified, it’s time to deposit your USDT holdings. Follow the exchange’s instructions to generate a unique deposit address and send your USDT to that address.

Step 4: Convert USDT to Fiat Currency

Once your USDT deposit is confirmed, you can proceed to convert it into fiat currency. Most exchanges offer various trading pairs, so you can easily exchange your USDT for your preferred currency.

Step 5: Withdraw Your Funds

After successfully converting your USDT to fiat currency, you’re almost there! Withdraw your funds to your bank account or any other preferred payment method supported by the exchange.

Remember, it’s always crucial to stay informed and cautious when cashing out your cryptocurrency holdings. Follow these steps carefully, and you’ll be on your way to turning your USDT into real-world assets.

Start cashing out your USDT holdings today and enjoy the rewards of your crypto investments!

Why You Should Cash Out USDT Holdings

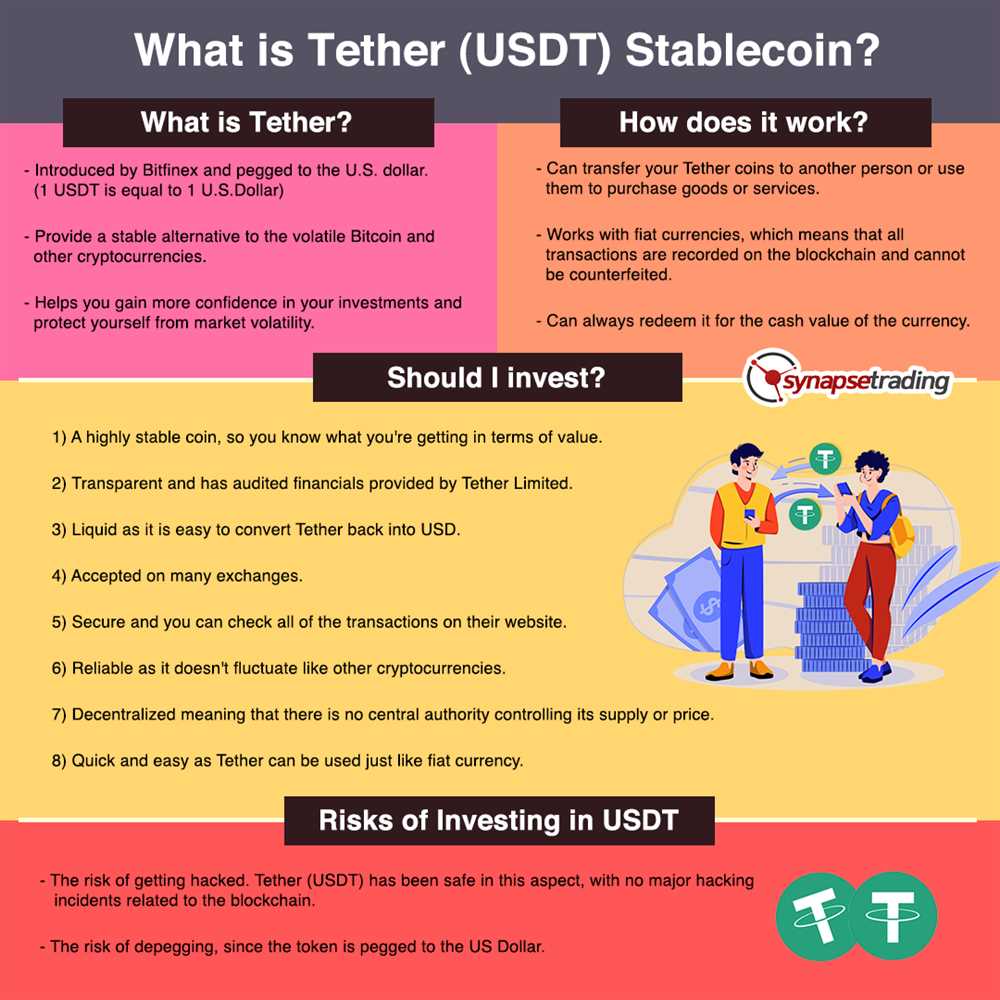

As a crypto investor, it is essential to carefully consider when and why to cash out your USDT holdings. While USDT, or Tether, is a stablecoin that is pegged to the US dollar, there are several reasons why you might want to convert your USDT to cash:

- Market Volatility: The cryptocurrency market is known for its volatility, with prices fluctuating rapidly. Cashing out your USDT holdings can help you protect your capital during times of market uncertainty.

- Diversification: Holding USDT exposes you to the risk of Tether’s stability. By converting your USDT to cash, you can diversify your portfolio and reduce the risk associated with a single asset.

- Opportunity Cost: Holding USDT means tying up your funds in a stablecoin that does not generate any returns. By cashing out your USDT holdings, you can explore other investment opportunities that may provide higher potential returns.

- Emergencies: In case of emergencies or unforeseen circumstances, having cash readily available can be crucial. By cashing out your USDT holdings, you ensure that you have immediate access to funds that can be used for any purpose.

- Regulatory Concerns: The cryptocurrency industry is still relatively young and regulatory environments can change quickly. Cashing out your USDT holdings can help mitigate the risk associated with potential regulatory changes or uncertainties.

- Personal Financial Goals: Finally, cashing out USDT holdings aligns with your personal financial goals. Whether it’s making a major purchase, investing in traditional assets, or simply having cash on hand, converting your USDT to cash allows you to achieve your specific objectives.

While holding USDT can be beneficial in providing stability, it is important to evaluate your financial situation and risk tolerance before deciding to cash out. By considering the factors mentioned above, you can make an informed decision that aligns with your investment goals and circumstances.

The Benefits of Liquidating USDT

USDT, also known as Tether, has become a popular stablecoin in the cryptocurrency market. Its value is pegged to the US dollar, making it a stable and reliable digital asset. While holding USDT can be beneficial in some situations, there are also advantages to liquidating your USDT holdings. Here are some of the benefits:

1. Access to Immediate Funds

By liquidating USDT, you can convert it into cash or other cryptocurrencies, providing you with immediate access to funds. This can be especially useful in situations where you need quick liquidity for personal or business expenses. Instead of waiting for the value of USDT to fluctuate, liquidating allows you to secure the current value of your holdings in a more tangible form.

2. Capitalize on Opportunities

The cryptocurrency market is known for its volatility and fast-paced nature. By liquidating your USDT, you can take advantage of investment opportunities that arise. Whether it is investing in a promising project or taking advantage of a price dip in another cryptocurrency, having access to funds allows you to make quick decisions and maximize potential returns.

Overall, while holding USDT can provide stability, liquidating your USDT holdings offers various benefits such as immediate access to funds and the ability to capitalize on investment opportunities. It allows you to take control of your assets and make the most of the dynamic cryptocurrency market.

Step-by-Step Guide to Cashing Out USDT

Are you ready to cash out your USDT holdings? Follow our step-by-step guide to safely and efficiently convert your USDT into cash.

Step 1: Choose a Reliable Exchange

Before you begin the cashing out process, it is essential to select a reliable cryptocurrency exchange that supports USDT withdrawals. Look for an exchange with a good reputation, high security measures, and excellent customer reviews.

Step 2: Verify Your Account

Once you have chosen an exchange, create an account and complete the verification process. This typically involves providing your personal information, submitting identification documents, and potentially completing a KYC (Know Your Customer) procedure. Verification helps ensure the security and legitimacy of your transactions.

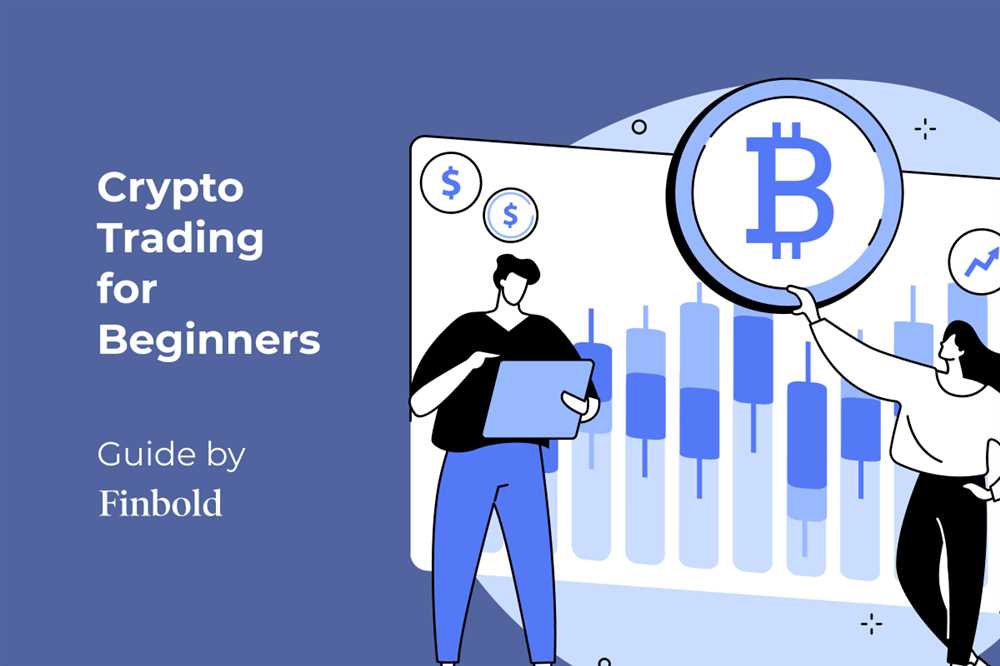

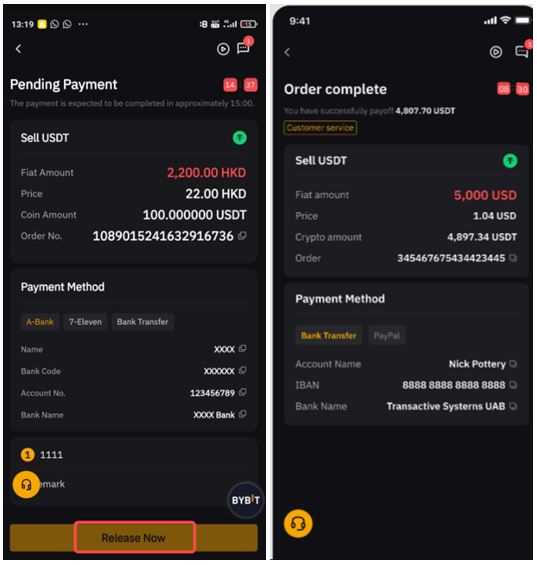

Step 3: Transfer USDT to the Exchange

After your account is verified, navigate to the deposit section of the exchange’s platform. Generate a USDT deposit address and transfer your USDT holdings from your personal cryptocurrency wallet to the exchange.

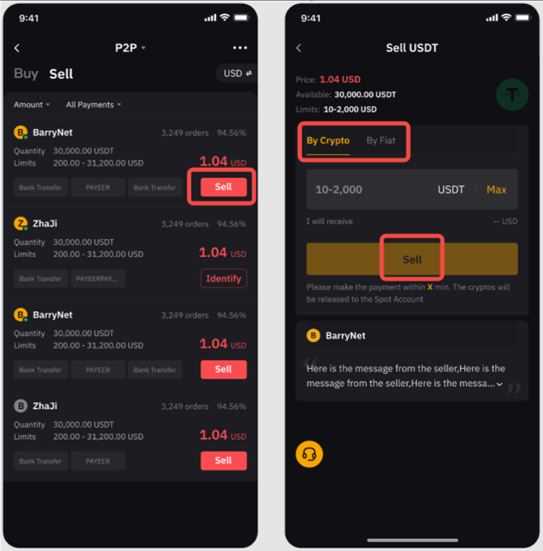

Step 4: Convert USDT to USD or Other Fiat Currency

Once your USDT is successfully deposited into your exchange account, navigate to the trading section and locate the USDT trading pairs. Choose the trading pair that corresponds to the fiat currency you wish to cash out into, such as USD. Place a sell order for your desired amount of USDT and wait for a buyer to fulfill the order.

Step 5: Withdraw Funds to Your Bank Account

After your USDT is sold, you will have funds in your exchange account in the desired fiat currency. Proceed to the withdrawal section of the exchange platform and provide your bank account details. Follow the instructions to transfer the funds from your exchange account to your bank account. Depending on the exchange and your location, this process may take several business days.

That’s it! By following these step-by-step instructions, you can safely cash out your USDT holdings and convert them into cash. Always remember to be cautious and perform thorough research when selecting an exchange to ensure the security of your funds.

Selecting a Reliable Exchange

When it comes to cashing out your USDT holdings, selecting a reliable exchange is crucial. With the growing number of cryptocurrency exchanges in the market, it’s essential to do your research and choose a platform that best suits your needs and offers a secure trading environment.

Here are some factors to consider when selecting a reliable exchange:

| Factor | Description |

|---|---|

| Security | Ensure that the exchange has proper security measures in place, such as two-factor authentication (2FA), encryption protocols, and cold storage for funds. |

| Liquidity | Check the exchange’s liquidity and trading volume to ensure that you can easily buy or sell your USDT at your desired price. |

| Reputation | Research the exchange’s reputation by reading reviews and feedback from other traders. Look for exchanges with a solid track record and positive user experiences. |

| Supported Currencies | Make sure the exchange supports USDT and offers a wide range of other cryptocurrencies in case you want to diversify your holdings in the future. |

| Transaction Fees | Consider the exchange’s transaction fees and compare them to other platforms. Look for exchanges with competitive rates and transparent fee structures. |

| User Interface | Evaluate the exchange’s user interface and trading tools. A clean and intuitive interface can make the trading process more efficient and user-friendly. |

By carefully considering these factors, you can select a reliable exchange that provides a safe and smooth experience for cashing out your USDT holdings.

Selling USDT for Fiat Currency

When it comes to cashing out your USDT holdings and converting them into fiat currency, there are a few important steps to consider. This comprehensive guide will walk you through the process, ensuring a smooth transition from the digital to the traditional financial world.

Step 1: Choose a Reliable Exchange

The first step in selling your USDT for fiat currency is to find a trustworthy and reputable cryptocurrency exchange. Look for an exchange that supports USDT and offers a fiat currency withdrawal option. It’s important to do thorough research and read user reviews to ensure that the exchange has a good reputation and provides reliable customer support.

Step 2: Verify Your Account

Before you can sell your USDT for fiat currency, you will need to complete the verification process on the chosen exchange. This typically involves providing your personal information, such as your name, address, and identification documents. The exchange may also require additional documentation to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Note: It’s crucial to choose an exchange that takes security seriously and implements robust security measures to protect your personal information and funds.

Step 3: Create a Sell Order

Once your account is verified, you can proceed to create a sell order for your USDT holdings. Specify the amount of USDT you want to sell and select the fiat currency you wish to receive. The exchange will provide you with a quote showing the conversion rate and the estimated amount you will receive in fiat currency after fees and commissions.

Tip: Pay attention to the conversion rate and any additional fees charged by the exchange. It’s important to compare rates across different exchanges to ensure you are getting the best deal.

Step 4: Execute the Sell Order

After reviewing the quote and confirming the details, you can proceed to execute the sell order. The USDT will be transferred from your account to the exchange, and once the transaction is confirmed, the corresponding amount in fiat currency will be credited to your account.

Step 5: Withdraw Fiat Currency

Once the amount of fiat currency is credited to your account, you can request a withdrawal. Follow the instructions provided by the exchange to initiate the withdrawal process. Depending on the exchange’s policies and procedures, the withdrawal may be processed to your bank account via wire transfer or to a supported payment gateway.

Important: Ensure that you have entered the correct bank account or payment gateway details to avoid any delays or potential issues with the withdrawal.

Note that the specific steps and procedures may vary depending on the exchange and its requirements. Always refer to the exchange’s official documentation and seek assistance if needed.

By following these steps, you can successfully convert your USDT holdings into fiat currency. Remember to stay informed about the latest regulations and guidelines concerning cryptocurrency transactions and consult with financial professionals if needed.

Q&A:

What is the purpose of this guide?

The purpose of this guide is to provide a comprehensive step-by-step process for crypto investors to cash out their USDT holdings.

Is this guide suitable for beginners?

Yes, this guide is designed to be accessible for beginners and provides detailed instructions that are easy to follow.

What are the different methods discussed in this guide for cashing out USDT holdings?

This guide covers various methods such as using cryptocurrency exchanges, peer-to-peer platforms, and over-the-counter services to cash out USDT holdings.

Are there any fees involved in the cashing out process?

Yes, there may be fees associated with certain methods, such as transaction fees charged by exchanges or service fees charged by over-the-counter platforms. The guide provides information on these fees.

Is it possible to convert USDT to other cryptocurrencies?

Yes, the guide discusses the option of converting USDT to other cryptocurrencies, such as Bitcoin or Ethereum, through various exchanges.