Can you send USDT to any wallet besides Tether

USDT, also known as Tether, has gained significant popularity as a stablecoin in the cryptocurrency world. It is a cryptocurrency that is widely used as a digital representation of fiat currencies, such as the US Dollar or the Euro. Tether is designed to maintain a stable value relative to the respective fiat currency, making it an attractive option for traders and investors.

While Tether is primarily used as a transfer of value within the Tether ecosystem, it is also possible to send USDT to wallets other than Tether. This opens up a world of possibilities for USDT holders, as they can now transfer their USDT to other wallets and platforms for a variety of purposes.

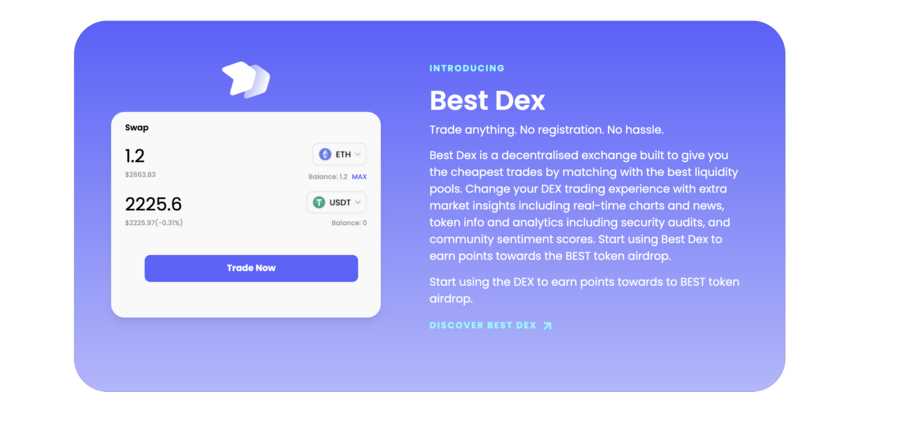

Sending USDT to wallets other than Tether allows users to access a wide range of decentralized finance (DeFi) platforms, decentralized exchanges (DEXs), and even use USDT as collateral for loans or yield farming. By expanding the transfer possibilities of USDT, users have more flexibility and freedom in managing their cryptocurrency holdings.

In this article, we will explore the various ways in which users can send USDT to wallets other than Tether and unlock new opportunities in the crypto space. We will delve into the process of transferring USDT to different wallet types, such as hardware wallets, software wallets, and crypto exchanges, and discuss the potential benefits and risks associated with each option.

Understanding USDT Transfer Options

Transferring USDT, or Tether, to wallets other than Tether is an essential aspect of managing your digital assets. To maximize your options and flexibility, it is crucial to understand the various USDT transfer options available to you.

1. Wallet to Wallet Transfer: The most straightforward method of transferring USDT is from one wallet to another. This can be done by generating a unique wallet address for the recipient and initiating the transfer from the sending wallet. Make sure to double-check the address to avoid any mistakes, as cryptocurrency transactions are irreversible.

2. Exchange Transfer: If you hold your USDT on a cryptocurrency exchange, you can transfer it to another exchange or your personal wallet. This involves initiating a withdrawal request from the exchange, providing your USDT wallet address, and confirming the transaction. Keep in mind that exchanges may have withdrawal fees and minimum withdrawal limits.

3. Peer-to-Peer Transfer: Some platforms and services allow users to transfer USDT directly to other individuals, similar to sending money through a peer-to-peer payment app. These transfers can be done using the receiver’s wallet address or by scanning their QR code. Peer-to-peer transfers offer convenience and faster transactions, but it’s essential to use trusted platforms and exercise caution when dealing with unknown individuals.

4. Smart Contract Transfer: USDT is based on the Ethereum blockchain, which enables smart contracts. Smart contracts can be programmed to automatically execute transfers based on predefined conditions. Utilizing smart contracts can provide an additional layer of security and facilitate automated transfers without the need for manual intervention.

5. Third-Party Service Transfers: Various third-party services specialize in facilitating USDT transfers between wallets, exchanges, or individuals. These services often offer additional features, such as instant transfers, conversion between different cryptocurrencies, or the ability to purchase USDT with fiat currency. When using third-party services, it is important to research and choose reputable providers with good reviews to ensure the safety of your funds.

Exploring and understanding the different USDT transfer options allows you to choose the method that aligns with your specific needs, whether it’s speed, cost-effectiveness, security, or convenience. Keep in mind that each transfer method may have its unique considerations, such as transaction fees, processing times, and potential security risks.

Conclusion: Being aware of the available USDT transfer options empowers you to take better control of your digital assets. Evaluate the pros and cons of each method and choose the one that best suits your requirements and preferences. Always double-check the recipient’s address and exercise caution during transfers to ensure the safe and efficient movement of your USDT.

Benefits of Sending USDT to Non-Tether Wallets

While Tether is one of the most widely used stablecoins, there are several benefits to sending USDT to non-Tether wallets:

1. Diversification

By sending USDT to non-Tether wallets, users can diversify their holdings and reduce the potential risk associated with keeping all their assets in a single wallet or platform. This allows for greater flexibility and protection against any unforeseen issues that may arise with Tether or its associated platforms.

2. Access to Different Features

Non-Tether wallets often offer additional features and functionalities that are not available within Tether’s ecosystem. By sending USDT to these wallets, users can take advantage of these features, such as enhanced security measures, integrated exchanges, or decentralized applications (DApps). This can greatly enhance the overall user experience and provide more opportunities for managing and utilizing USDT.

3. Interoperability

Transferring USDT to non-Tether wallets promotes interoperability within the cryptocurrency ecosystem. It allows users to seamlessly interact with different platforms, wallets, and exchanges, making it easier to transfer USDT between different networks and participate in various blockchain-based activities. This not only improves accessibility but also facilitates the seamless integration of USDT within different decentralized finance (DeFi) protocols.

4. Reduced Counterparty Risk

When sending USDT to non-Tether wallets, users can mitigate counterparty risk associated with Tether and its platforms. By choosing reputable non-Tether wallets with strong security measures and a proven track record, users can ensure the safety of their USDT holdings without relying solely on Tether’s infrastructure. This provides an additional layer of protection and peace of mind.

5. Market Opportunities

Sending USDT to non-Tether wallets opens up possibilities for taking advantage of various market opportunities. Non-Tether wallets may offer features such as staking, lending, or yield farming, enabling users to earn passive income or participate in different investment strategies. These opportunities may not be available within Tether’s ecosystem, allowing users to explore different avenues for maximizing their USDT holdings.

| Benefits | Explanation |

|---|---|

| Diversification | Reduce risk by spreading USDT across different wallets |

| Access to Different Features | Utilize additional functionalities provided by non-Tether wallets |

| Interoperability | Seamless interaction with different platforms and DeFi protocols |

| Reduced Counterparty Risk | Mitigate risk associated with Tether’s infrastructure |

| Market Opportunities | Explore various investment strategies and earning potentials |

Exploring Different Wallet Options for USDT Transfers

When it comes to transferring USDT, or Tether, to different wallets, there are several options available. Each wallet has its own features and benefits, so it’s important to choose the right one for your specific needs.

1. Tether Wallet

The Tether Wallet is the official wallet provided by Tether. It allows users to securely store, send, and receive USDT. This wallet is available as a mobile app and offers a user-friendly interface. It also supports different blockchain networks, including Ethereum, TRON, and more.

2. Hardware Wallets

Hardware wallets are physical devices that provide an extra layer of security for storing cryptocurrencies like USDT. Some popular hardware wallet options include Ledger and Trezor. These wallets store the private keys offline, making it nearly impossible for hackers to gain access.

3. Exchange Wallets

Many cryptocurrency exchanges offer wallets where you can store USDT and other cryptocurrencies. These wallets are convenient if you frequently trade on the exchange. However, they may not be the most secure option, as exchanges have been targets for hacking in the past.

4. Web Wallets

Web wallets, also known as online wallets, are wallets that can be accessed through a web browser. They are convenient as they can be accessed from any device with an internet connection. However, security risks are higher compared to other wallet options, as web wallets are more susceptible to hacking and phishing attacks.

When choosing a wallet for USDT transfers, it’s important to prioritize security and convenience according to your individual needs. Consider factors such as ease of use, security features, and compatibility with the blockchain network you plan to use.

Q&A:

Can I transfer USDT to wallets other than Tether?

Yes, it is possible to transfer USDT to wallets other than Tether. USDT is based on the Ethereum blockchain, so you can send it to any Ethereum-compatible wallet.

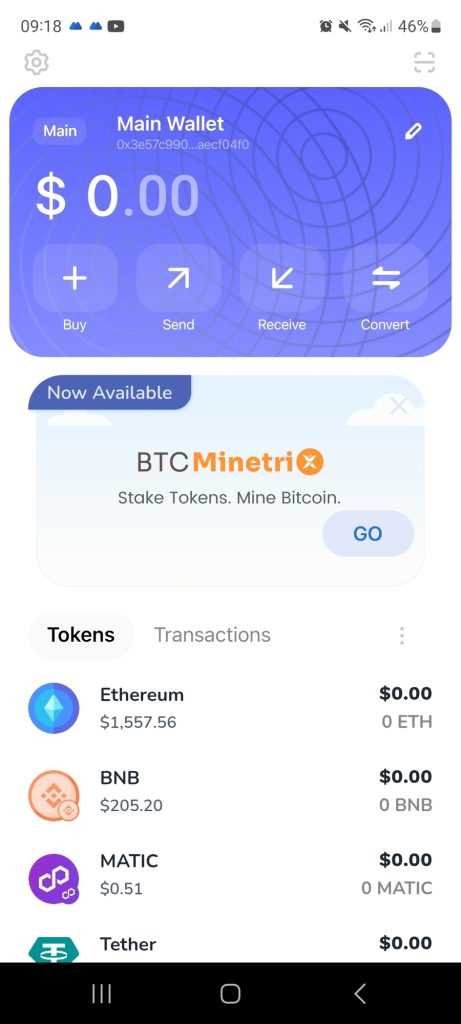

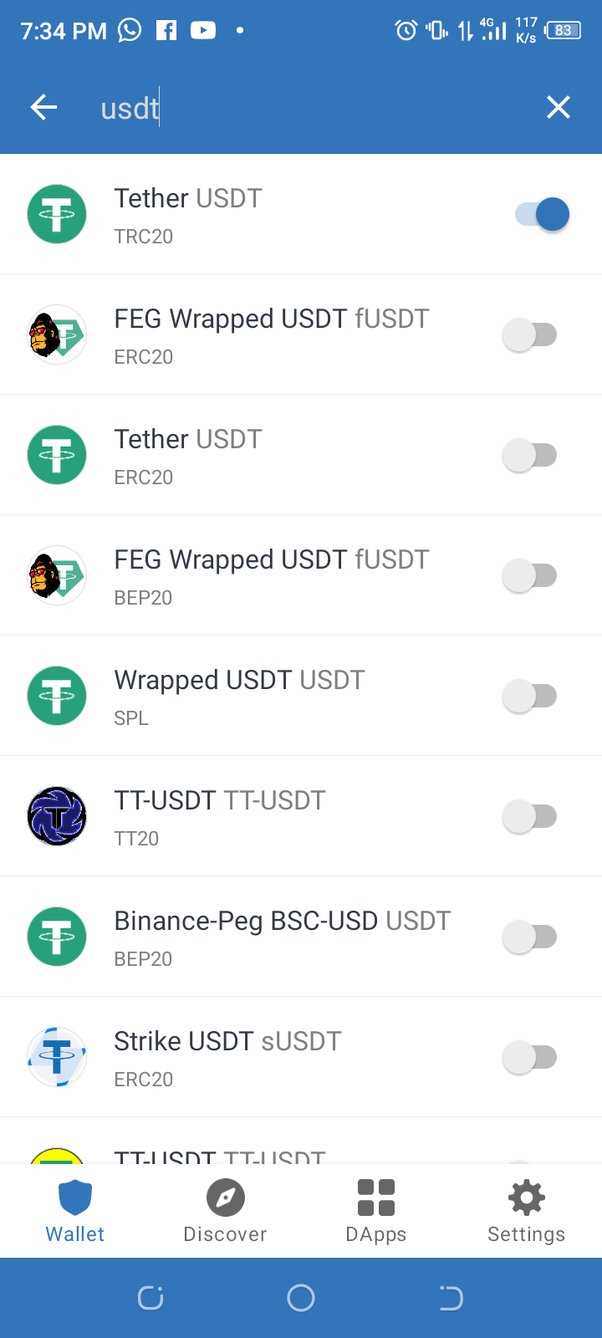

What are some popular Ethereum-compatible wallets for USDT?

Some popular Ethereum-compatible wallets that support USDT include MetaMask, MyEtherWallet, Trust Wallet, Ledger Live, and Exodus.

Are there any fees associated with transferring USDT to another wallet?

Yes, there may be fees associated with transferring USDT to another wallet. These fees can vary depending on the wallet you are using and the network congestion at the time of the transaction.

How long does it take to transfer USDT to another wallet?

The time it takes to transfer USDT to another wallet can vary depending on the network congestion and the confirmation speed set for the transaction. It can range from a few minutes to several hours.

Is it safe to transfer USDT to wallets other than Tether?

Transferring USDT to wallets other than Tether can be safe as long as you use a reputable and secure wallet. It is crucial to double-check the wallet address before initiating any transfer to avoid sending USDT to the wrong recipient.