Assessing the Stability of USDT Could it be Frozen?

USDT, also known as Tether, is a popular stablecoin in the cryptocurrency market. It’s designed to maintain a stable value equal to one US dollar and is commonly used for trading and transactions. However, recent concerns have emerged regarding the stability of USDT and the potential for it to be frozen.

One of the main concerns surrounding USDT is its lack of transparency. Unlike other cryptocurrencies, USDT claims to be fully backed by reserves of fiat currency. However, there have been doubts and controversies regarding the actual amount of reserves held by Tether. This lack of transparency has led many to question the stability of USDT and whether it is truly backed by sufficient funds.

Another factor that raises concerns about the stability of USDT is its relationship with Bitfinex, a prominent cryptocurrency exchange. Bitfinex is owned by the same company as Tether and is often used to trade USDT. This raises potential conflicts of interest and the possibility of manipulations in the market. If USDT were to be frozen, it could have significant implications for Bitfinex and its users.

Additionally, there have been incidents in the past where USDT was temporarily frozen. In 2017, Tether reported a security breach that resulted in the theft of around $30 million worth of USDT. This incident raised questions about the security and stability of USDT, as well as its ability to be frozen or compromised by external factors.

Overall, while USDT has been widely adopted and used in the cryptocurrency market, concerns about its stability persist. The lack of transparency, potential conflicts of interest, and past incidents of freezing raise legitimate questions about the future of USDT and its role in the crypto ecosystem.

Understanding USDT Stability

USDT (Tether) is a stablecoin that is pegged to the value of the US dollar, meaning that each USDT should be backed by an equivalent amount of dollars held in reserves. This stablecoin is used widely in cryptocurrency trading and is intended to provide stability and liquidity in the volatile digital asset market.

However, there have been concerns raised about the stability of USDT and whether it is truly backed by sufficient reserves. Some critics argue that Tether does not provide enough transparency and has not undergone a proper audit to verify its claims. This lack of transparency has led to speculation that USDT may not be as stable as it claims to be, raising doubts about its long-term viability.

Despite these concerns, Tether has maintained its value and continued to be widely used in cryptocurrency markets. Part of the reason for this is the demand for a stablecoin that can be easily traded and used as a store of value without the volatility associated with other cryptocurrencies. USDT has filled this role effectively and has become an important part of the cryptocurrency ecosystem.

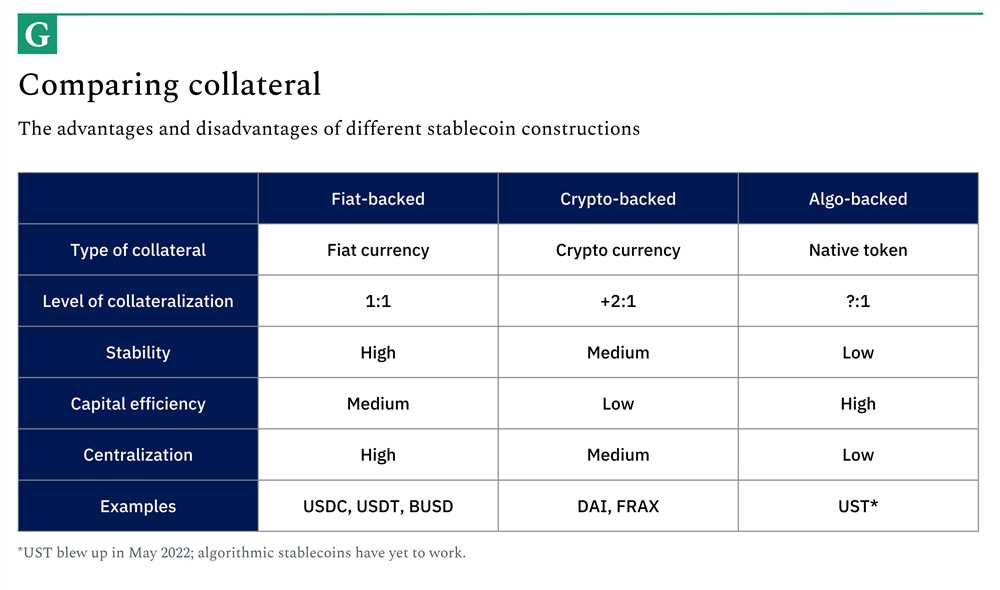

Although USDT has faced criticism and scrutiny, it is important to note that there are other stablecoin alternatives available in the market, such as USDC and BUSD, which are subject to greater regulatory oversight. These stablecoins may offer investors a greater level of confidence in terms of stability and transparency.

The Role of Regulations

Regulations play a crucial role in assessing the stability of stablecoins like USDT. While Tether has faced criticism for its lack of transparency, regulatory bodies around the world are starting to take notice and develop guidelines to ensure the stability and integrity of stablecoins. These regulations may require stablecoin issuers to provide regular audits, hold sufficient reserves, and be more transparent about their operations.

Regulatory oversight can help mitigate concerns about the stability of USDT and other stablecoins by providing greater accountability and transparency. Investors and users can have confidence that stablecoins are being operated in a responsible and trustworthy manner.

Diversification and Risk Management

Investors and traders should exercise caution when using USDT or any stablecoin, as even the most stable assets can face risks. Diversifying holdings and employing risk management strategies can help mitigate the potential impact of a sudden loss in value. It is also important to keep up with the latest news and developments in the stablecoin market to make informed decisions.

Overall, understanding the stability of USDT and other stablecoins requires a comprehensive analysis of factors such as regulatory oversight, transparency, and risk management strategies. By evaluating these factors, investors and users can make informed decisions about the stability and reliability of stablecoin options in the cryptocurrency market.

What is USDT and How Does it Work?

USDT, also known as Tether, is a type of cryptocurrency that is designed to maintain a stable value by being pegged to a fiat currency, such as the US dollar. Each USDT token is supposed to be backed by an equivalent amount of dollars held in reserve.

USDT is part of a family of stablecoins, which are cryptocurrencies that aim to eliminate price volatility by being tied to a stable asset or currency. While other stablecoins may be pegged to commodities like gold or silver, USDT is specifically tied to fiat currencies.

The primary mechanism that allows USDT to maintain its stability is the process of minting and burning tokens. When a user wants to obtain USDT, they can purchase it on an exchange for the equivalent value in dollars. The tokens are then created and sent to the user’s wallet. On the other hand, if a user wants to redeem their USDT for dollars, they can send the tokens back to the issuer, who will then burn the tokens and transfer the equivalent amount of dollars back to the user.

USDT can be used for various purposes within the cryptocurrency ecosystem. It can be used as a stable store of value, allowing users to hedge against market volatility. It can also be used for trading pairs on exchanges, providing a stable benchmark for pricing other cryptocurrencies.

However, it’s important to note that USDT has faced scrutiny and controversy over the years. Questions have been raised about the transparency and reliability of the reserves that back USDT. Some critics argue that Tether may not have sufficient reserves to fully back all the USDT tokens in circulation, which could potentially lead to a lack of stability in its value.

Overall, USDT is a unique cryptocurrency that aims to provide stability in a volatile market. While it has gained popularity and widespread use, it is still important for users to exercise caution and do their own research when using USDT or any other stablecoin.

Factors Affecting USDT Stability

The stability of USDT, or Tether, is influenced by several key factors that can impact its value in the market and its ability to maintain its peg to the US dollar. These factors include:

1. Market Demand and Liquidity

The demand for USDT and its liquidity in the market play a crucial role in determining its stability. If there is high demand for USDT and sufficient liquidity, it becomes easier for holders to buy and sell USDT at the desired price, minimizing the impact of fluctuations and maintaining stability.

2. Tether’s Reserves and Transparency

The transparency and credibility of Tether’s reserves is another important factor affecting USDT stability. It is crucial for Tether to maintain adequate reserves of US dollars to back every issued USDT token. Regular audits and transparent reporting of these reserves help build trust among holders and investors, supporting stability.

3. Regulatory Environment

The regulatory environment impacts USDT stability as it affects the operations and legitimacy of Tether. Regulatory actions or changes in regulations can create uncertainty and undermine the stability of USDT. Clear and favorable regulations can provide a conducive environment for USDT to thrive and maintain stability.

4. Market Confidence and Trust

The overall confidence and trust of market participants in Tether and its underlying technology also influence USDT stability. Any negative news or doubts around Tether’s operations, reserves, or partnerships can erode trust and impact stability. Building and maintaining market confidence is crucial for USDT stability.

5. Market Volatility and External Factors

The volatility of other cryptocurrencies and external market factors can also affect USDT stability. If there are significant and sudden price movements in other cryptocurrencies or financial markets, it can lead to increased demand or selling pressure on USDT, impacting its stability. Monitoring and managing these external factors is essential for ensuring USDT stability.

In conclusion, the stability of USDT is influenced by market demand and liquidity, transparency of Tether’s reserves, the regulatory environment, market confidence and trust, as well as market volatility and external factors. Understanding and addressing these factors is crucial for maintaining the stability of USDT and its peg to the US dollar.

Possible Risks and Concerns

While Tether has become a widely used stablecoin in the cryptocurrency market, there are several risks and concerns associated with its stability. These concerns mainly stem from the fact that Tether is pegged to the value of the US dollar but lacks complete transparency and regulatory oversight.

1. Lack of Transparency

One of the major concerns surrounding Tether is its lack of transparency. The company has faced criticism for its opaque operations and failure to provide a thorough audit of its reserves. Without complete transparency, it is difficult to assess the stability of USDT and whether it is truly backed by US dollars.

2. Regulatory Risks

Another risk associated with Tether is the potential for increased regulatory scrutiny. As stablecoins continue to gain popularity, regulators around the world are starting to pay closer attention to their operations. If Tether fails to meet regulatory requirements or faces legal challenges, it could pose a significant risk to its stability.

Furthermore, if regulators determine that Tether is not adequately backed by US dollars, they could impose restrictions or even shut down its operations. This could lead to a loss of confidence in USDT and a major disruption in the cryptocurrency market.

3. Counterparty Risk

Investors using Tether face counterparty risk, as they are relying on the solvency and integrity of the company behind the stablecoin. If the issuer of USDT faces financial difficulties or goes bankrupt, investors may not be able to redeem their tokens for US dollars at a one-to-one ratio as promised.

This counterparty risk is a major concern, as it undermines the stability of USDT and could result in significant losses for investors.

4. Market Manipulation

There have been allegations of market manipulation involving Tether, specifically in relation to Bitcoin prices. It is suggested that Tether may be used to artificially inflate the price of Bitcoin by issuing unbacked USDT and using it to purchase Bitcoin on crypto exchanges.

If these allegations are true, it could have a significant impact on the stability of USDT and the overall cryptocurrency market. Investors may lose trust in Tether and the entire stablecoin ecosystem.

Overall, while Tether has established itself as a popular stablecoin, there are several risks and concerns that should be considered. The lack of transparency, regulatory risks, counterparty risk, and the possibility of market manipulation all pose potential threats to the stability of USDT.

The Future of USDT Stability

As USDT continues to be a dominant player in the stablecoin market, its stability and future outlook are of great importance. While concerns have been raised about its potential for freezing, there are several factors that suggest a positive future for USDT stability.

Firstly, USDT is backed by reserves held by Tether Ltd, the company behind USDT. These reserves are supposed to match the total amount of USDT in circulation, providing a level of stability to the stablecoin. As long as Tether Ltd is able to maintain these reserves and provide transparency about their holdings, USDT stability should remain intact.

Additionally, Tether Ltd has taken steps to enhance its transparency and address concerns about its stability. The company has engaged in regular audits by reputable accounting firms, providing external verification of its reserves. This increased transparency helps to build trust and confidence in the stability of USDT.

Furthermore, USDT’s role as a widely accepted and used stablecoin contributes to its stability. With a large number of exchanges and platforms accepting USDT, it has become an integral part of the cryptocurrency ecosystem. This widespread adoption helps to further solidify its stability, as it is continually being used and traded across various platforms.

Looking ahead, the future of USDT stability will depend on several factors. Firstly, Tether Ltd must continue to maintain its reserves and demonstrate their transparency. Any indication of insufficient reserves or lack of transparency could lead to a loss of trust in USDT and potential instability. Additionally, regulators and authorities will play a crucial role in shaping the future of stablecoins, including USDT. Increased regulations and oversight can contribute to the stability and trustworthiness of USDT and other stablecoins.

In conclusion, while concerns about USDT stability exist, there are several factors that suggest a positive future for the stablecoin. The backing of reserves, increased transparency, widespread adoption, and regulatory involvement all contribute to the stability of USDT. As long as these factors continue, USDT is likely to remain a stable and widely accepted stablecoin in the cryptocurrency market.

Q&A:

What is USDT?

USDT is a type of cryptocurrency known as a stablecoin, which is designed to maintain a stable value by being pegged to a specific asset, such as the US dollar.

How does USDT maintain its stability?

USDT maintains its stability by being backed by a reserve of assets, usually in the form of fiat currency. This reserve of assets is held by the issuer of USDT to ensure that it can be redeemed at a stable value.

What risks are associated with USDT?

One of the main risks associated with USDT is the potential for the stablecoin to lose its peg to the US dollar. This could happen if the issuer of USDT does not have enough assets to back the stablecoin or if the stablecoin’s value is manipulated by external forces.

Could USDT be frozen?

While it is theoretically possible for USDT to be frozen, as with any other cryptocurrency, it is unlikely to happen in practice. USDT operates on a decentralized blockchain network, which means that it would require widespread consensus among network participants to freeze USDT.