A Step-by-Step Guide for Sending USDT to Your Bank

Welcome to our comprehensive guide on how to transfer USDT (Tether) to your bank account. USDT is a popular cryptocurrency that is backed by the US dollar, providing stability and ease of use for traders and investors. In this guide, we will walk you through the process of converting your USDT to fiat currency and transferring it to your bank account, ensuring a seamless and secure transaction.

Firstly, it’s important to note that there are several platforms and exchanges that support the withdrawal of USDT to fiat currency. Before you proceed, make sure to choose a reputable and trustworthy platform that offers this service. Conduct thorough research and read user reviews to ensure you select the best option for your needs.

Once you have chosen a platform, you will need to create an account and complete the necessary verification process. This typically includes providing your personal information, such as your full name, address, and proof of identity. It’s crucial to provide accurate and verifiable information to ensure compliance with regulatory requirements and prevent any potential issues during the withdrawal process.

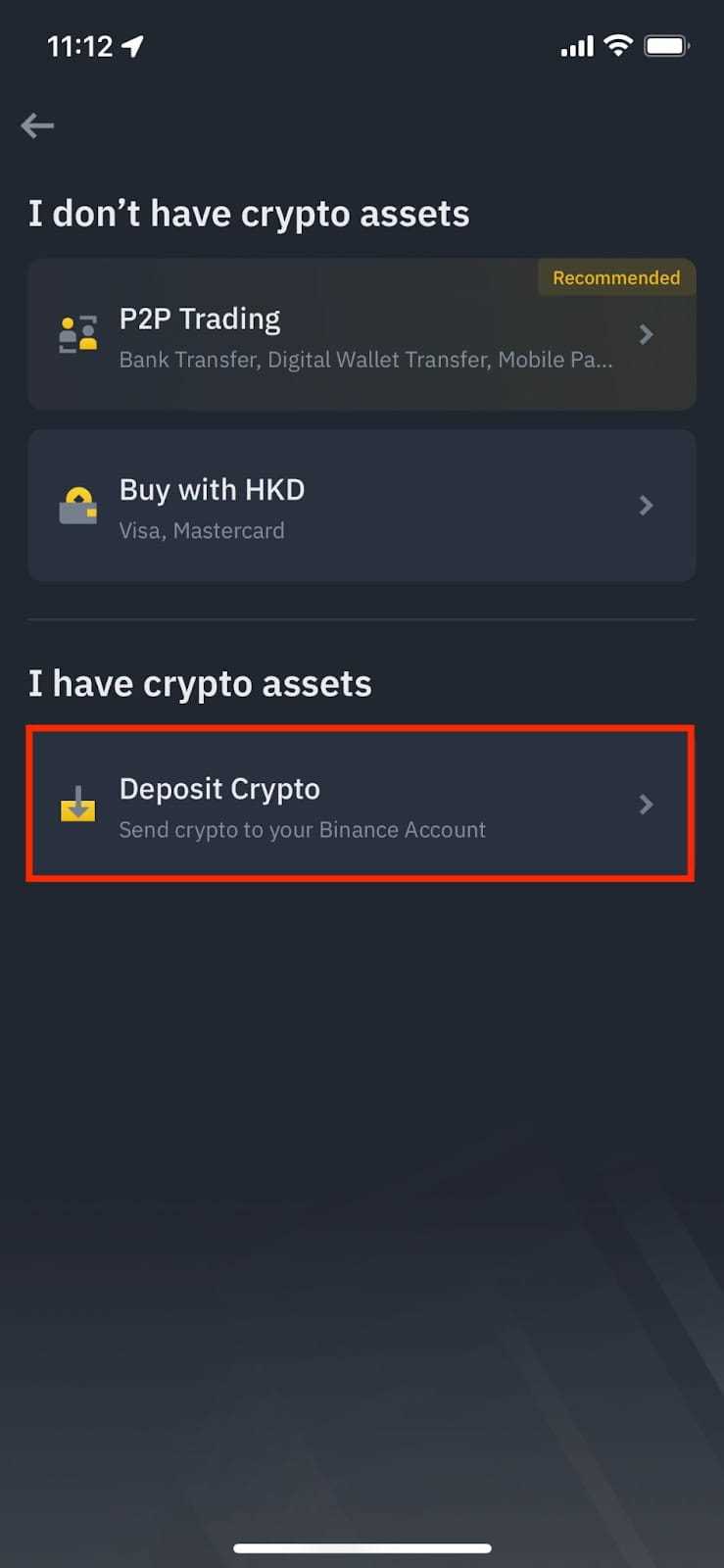

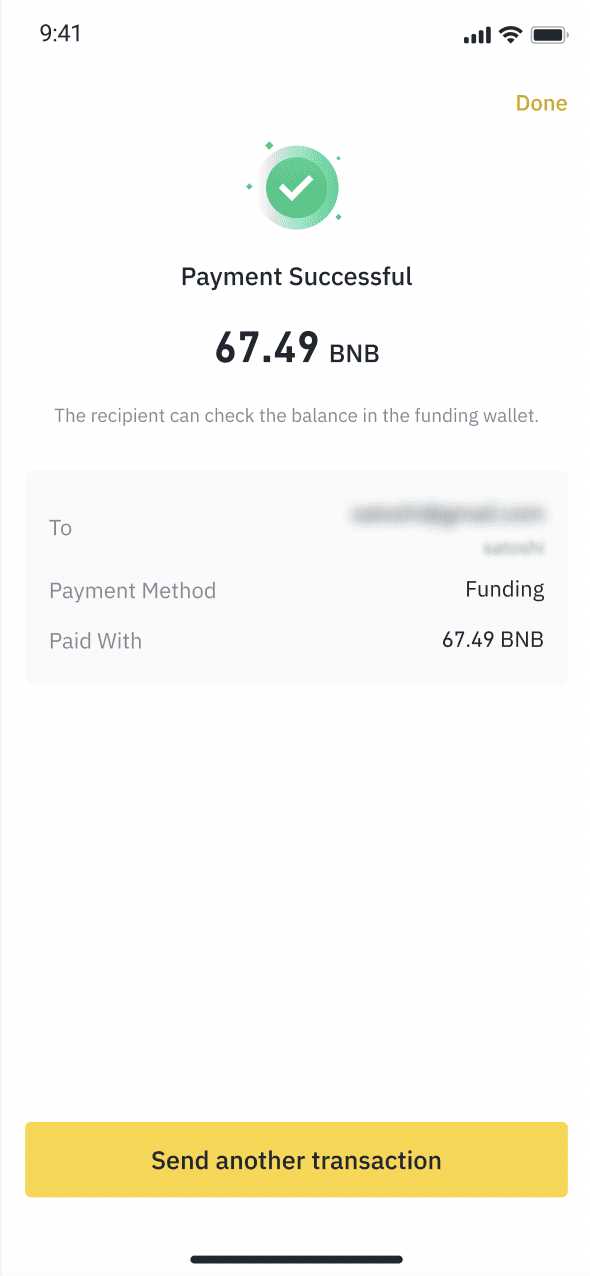

After your account is verified, you can proceed with the transfer of your USDT to your chosen platform. Depending on the platform, you may be required to deposit your USDT into a specific wallet or exchange account. Follow the instructions provided by the platform to initiate the transfer.

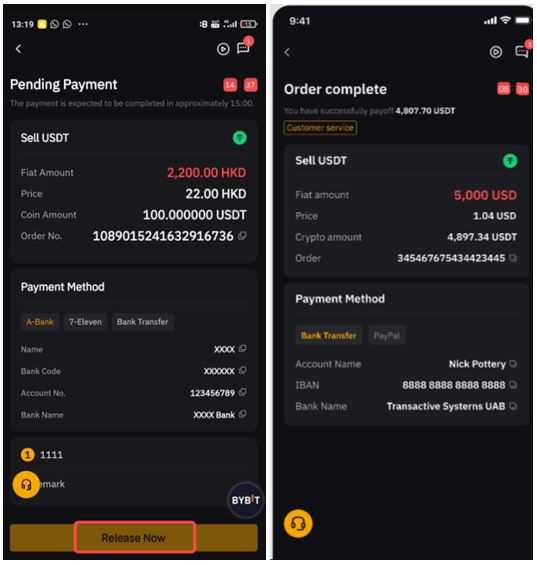

Once your USDT is successfully deposited into your platform account, you can proceed with converting it to fiat currency. Most platforms offer various options for converting your USDT, such as selling it for USD or other supported fiat currencies. Select the option that best suits your needs and follow the provided instructions to complete the conversion process.

After your USDT is converted to fiat currency, you can now transfer it to your bank account. The process may vary depending on the platform you are using, but typically involves providing your bank account details, such as your account number and routing number. Double-check the information you provide to ensure accuracy and avoid any delays or potential errors.

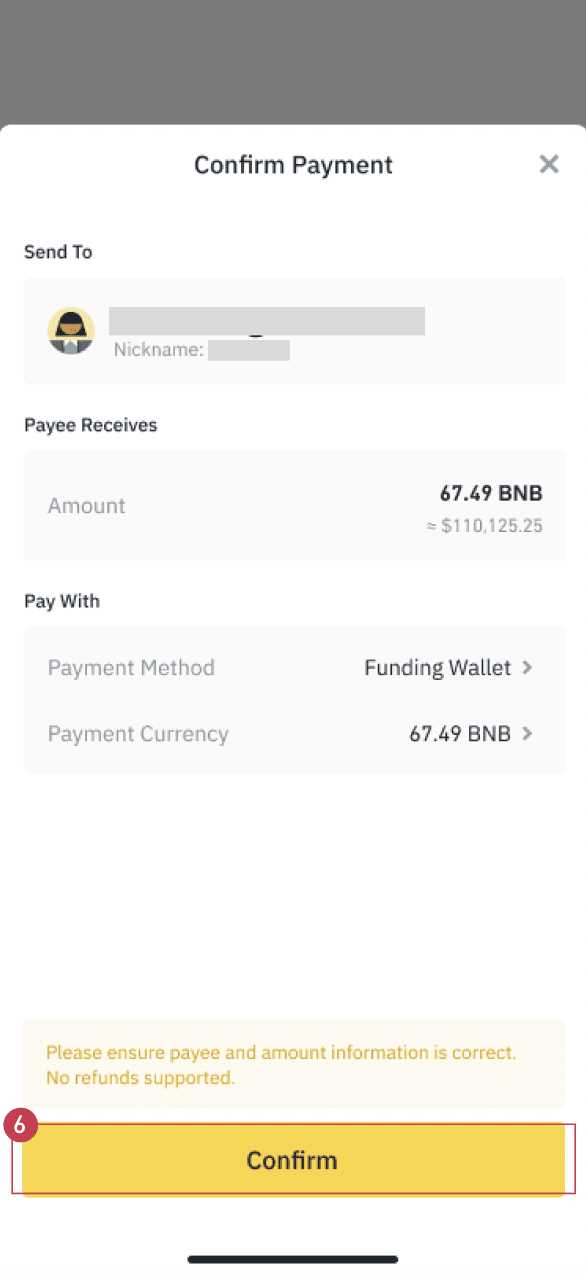

Once you have entered the required information, review your transaction details and confirm the transfer. It’s essential to review all the details carefully to prevent any mistakes that could result in the loss of funds or delays in the transfer process. After confirming, the platform will initiate the transfer, and the funds should be deposited into your bank account within a specified timeframe, usually within a few business days.

It’s important to note that transferring USDT to your bank account may involve fees and additional processing time, depending on the platform and your bank’s policies. Make sure to familiarize yourself with the associated costs and estimated transfer timeframes before proceeding with the transaction.

Now that you have a comprehensive guide on transferring USDT to your bank account, you can proceed with confidence and peace of mind. Remember to exercise caution and conduct thorough research before choosing a platform, and always double-check your transaction details to ensure a smooth and successful transfer. Happy transferring!

Why Transfer USDT to Your Bank Account?

Transferring USDT (Tether) to your bank account can provide you with several benefits and opportunities. Whether you are an individual or a business, converting USDT to your local currency through your bank offers various advantages. Below are some reasons why you may want to transfer USDT to your bank account:

1. Accessibility

By transferring USDT to your bank account, you gain access to the funds in a format that is widely accepted and can be easily used for daily transactions. You can withdraw the funds through an ATM, make online payments, or use your debit card for purchases. This accessibility allows you to leverage your USDT holdings in the real world.

2. Stability

While cryptocurrencies can be highly volatile, transferring your USDT to your bank account offers a level of stability. Your funds are converted into your local currency, which is a more established and stable form of money. This provides protection against the volatility of the crypto market and ensures that the value of your funds remains relatively constant.

3. Convenience

Converting USDT to your bank account provides convenience in managing your finances. You can easily integrate your bank account with other financial services like budgeting apps, investment platforms, and tax software. This integration allows you to have a holistic view of your finances and simplifies various financial tasks.

Moreover, transferring USDT to your bank account eliminates the need for additional exchanges or complicated processes to access your funds. You can seamlessly manage and use your funds through your existing banking infrastructure.

With the rapidly increasing adoption of cryptocurrencies, converting USDT to your bank account opens up opportunities for using your funds in traditional financial systems. It combines the advantages of digital currencies with the stability and convenience of traditional banking, offering flexibility and ease of use in managing your finances.

Benefits of Transferring USDT

Transferring USDT to your bank account has several benefits, including:

| 1. Convenience | By transferring USDT to your bank account, you can easily convert your cryptocurrency into fiat currency and use it for everyday transactions. |

| 2. Accessibility | Once you have transferred USDT to your bank account, you can access and manage your funds through traditional banking channels, such as online banking or ATMs. |

| 3. Stability | Transferring USDT to your bank account provides a sense of stability, as the funds are held in a regulated and secure financial institution. |

| 4. Diversification | By transferring USDT to your bank account, you can diversify your investment portfolio by holding both cryptocurrencies and traditional fiat currencies. |

| 5. Security | Transferring USDT to your bank account reduces the risk of losing your cryptocurrency due to hacks or technical glitches in cryptocurrency exchanges. |

| 6. Regulatory Compliance | By transferring USDT to your bank account, you ensure compliance with any applicable regulations regarding the use and transfer of cryptocurrencies. |

Overall, transferring USDT to your bank account offers convenience, accessibility, stability, diversification, security, and regulatory compliance, making it a desirable option for cryptocurrency holders.

How to Transfer USDT to Your Bank Account

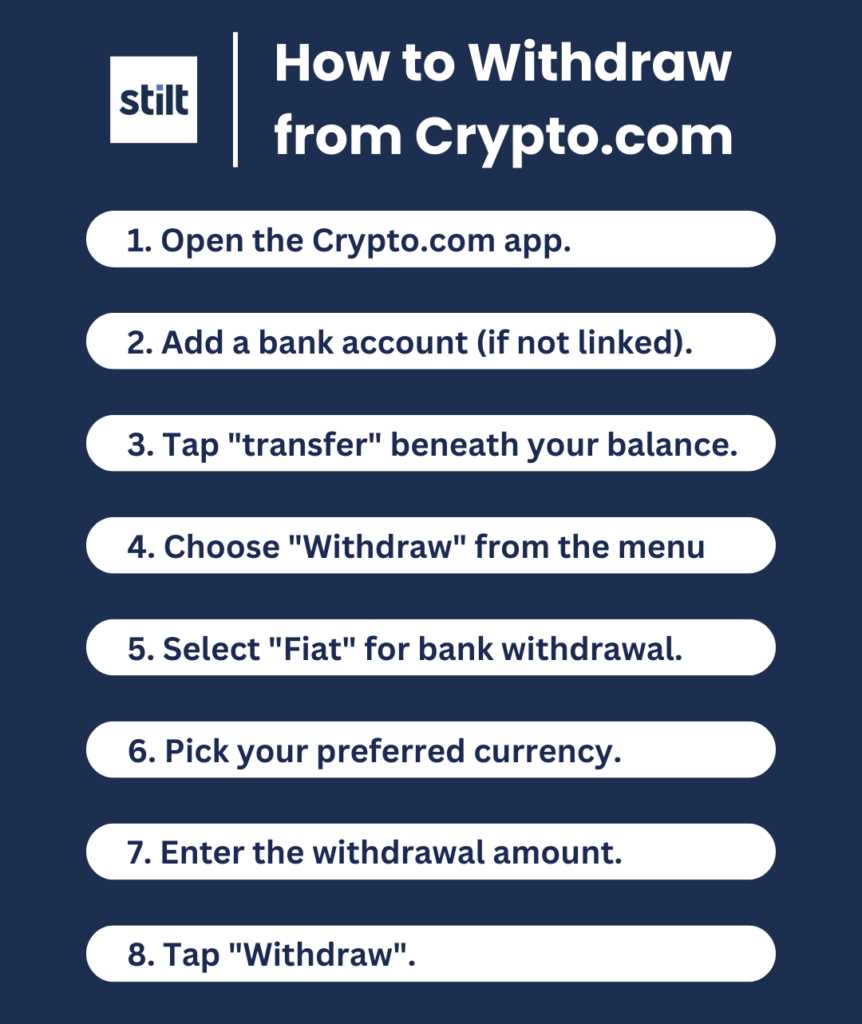

If you are looking to transfer USDT (Tether) to your bank account, here is a step-by-step guide on how to do it:

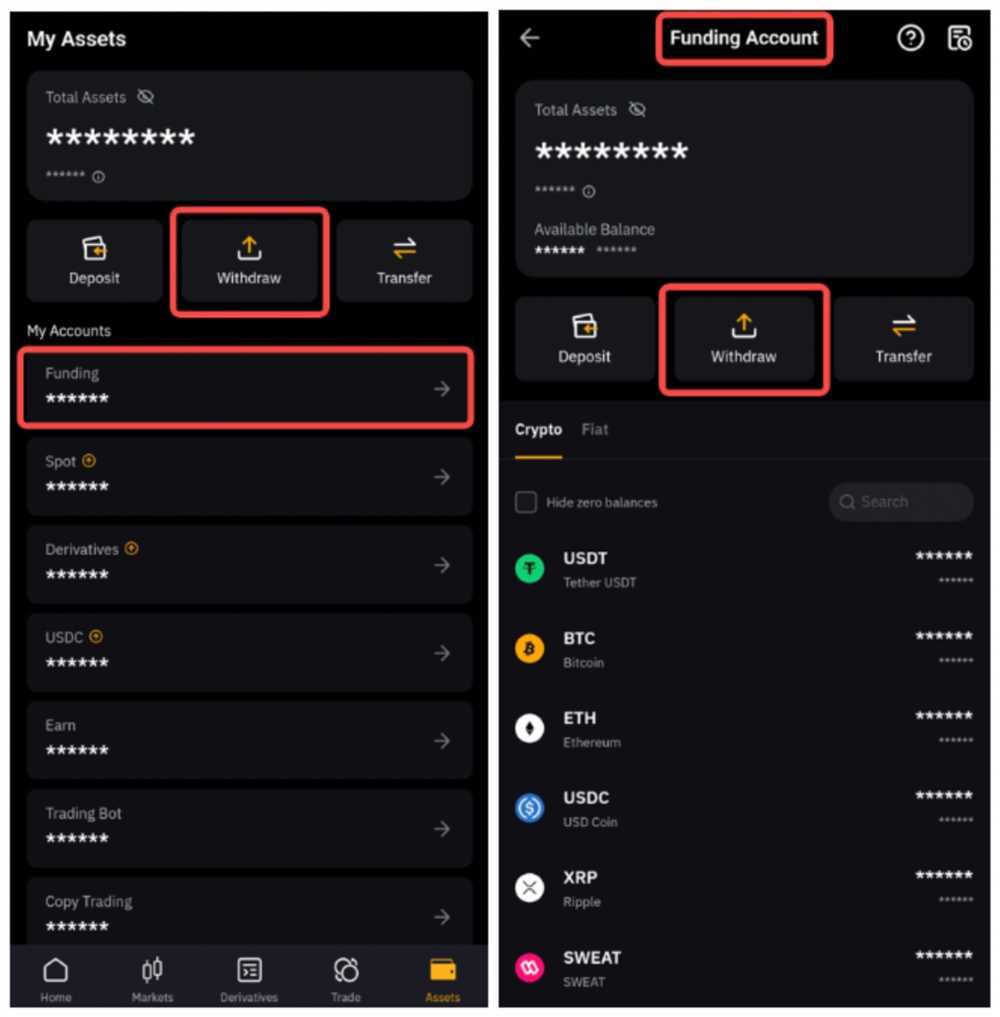

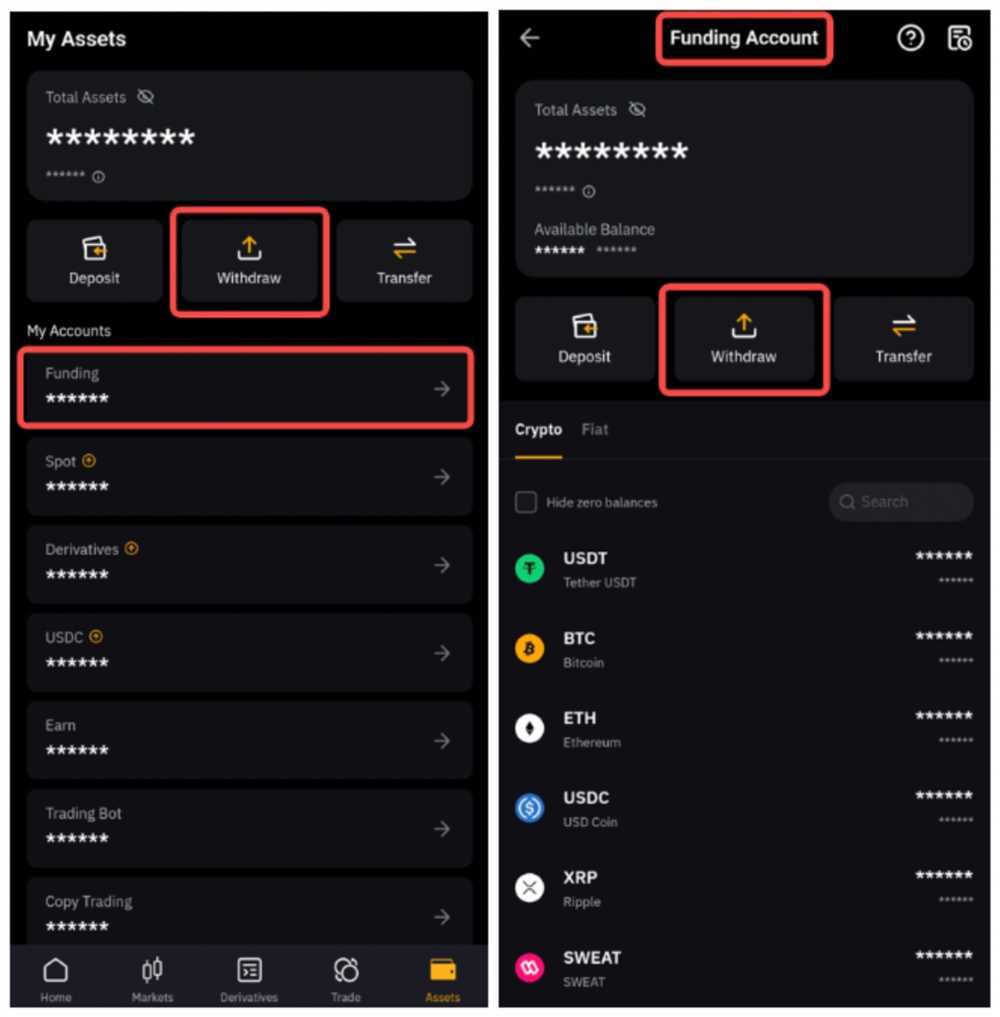

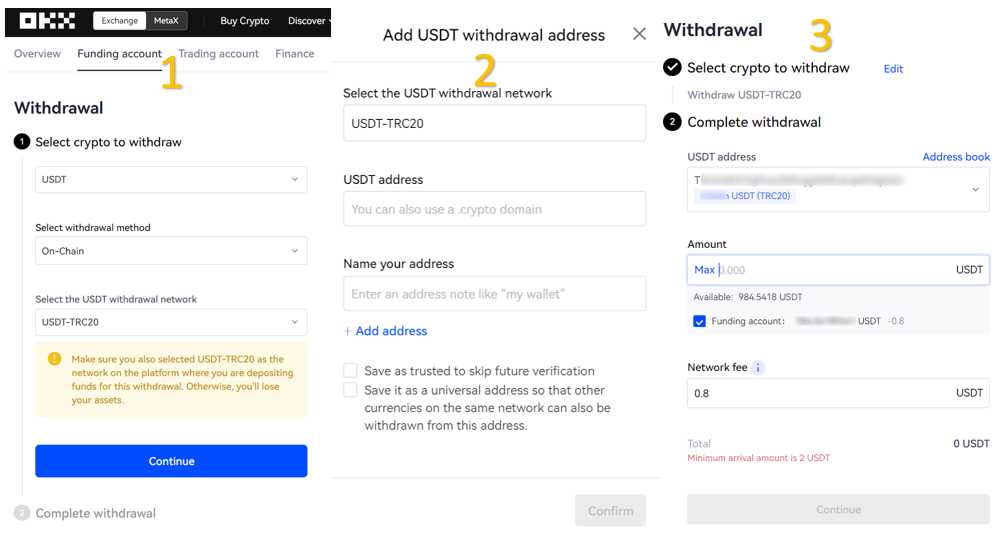

- Open your preferred cryptocurrency exchange platform and log in to your account.

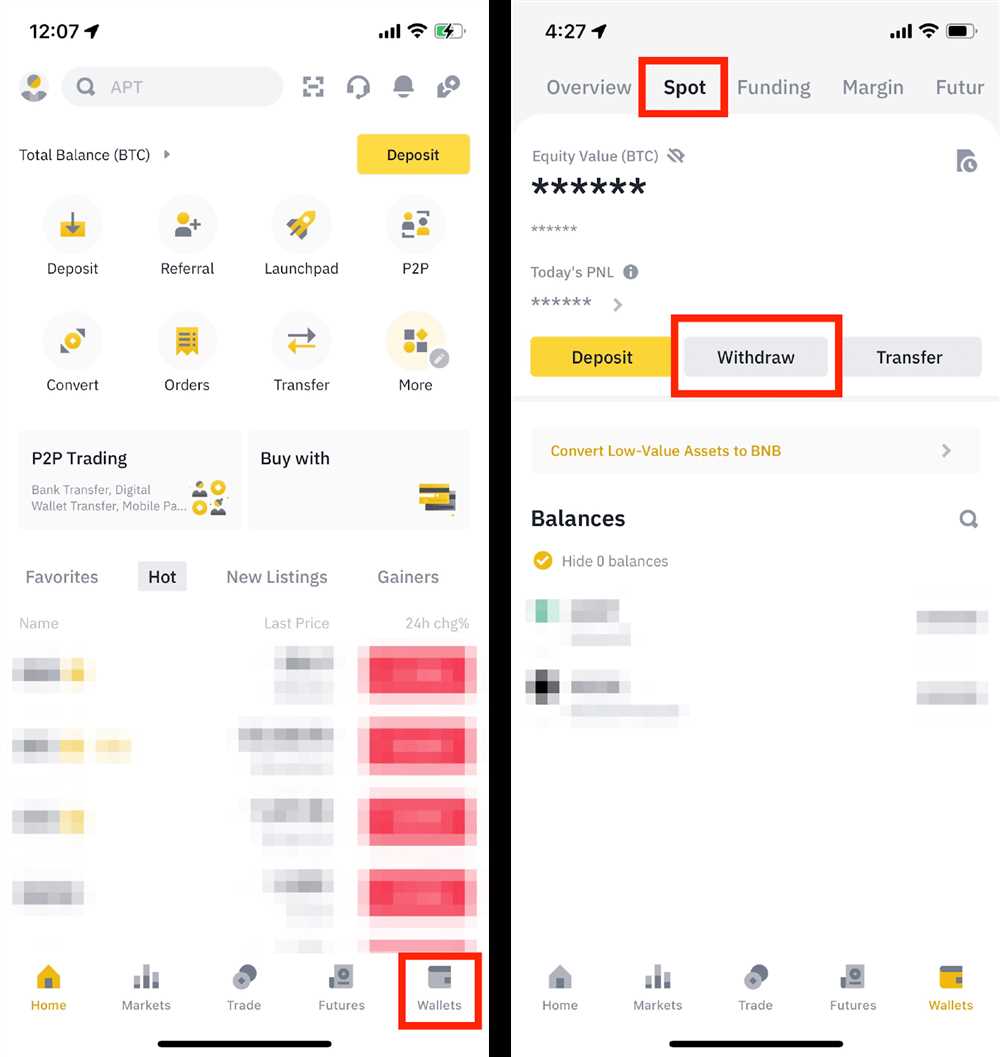

- Navigate to the “Wallet” or “Balance” section of the platform.

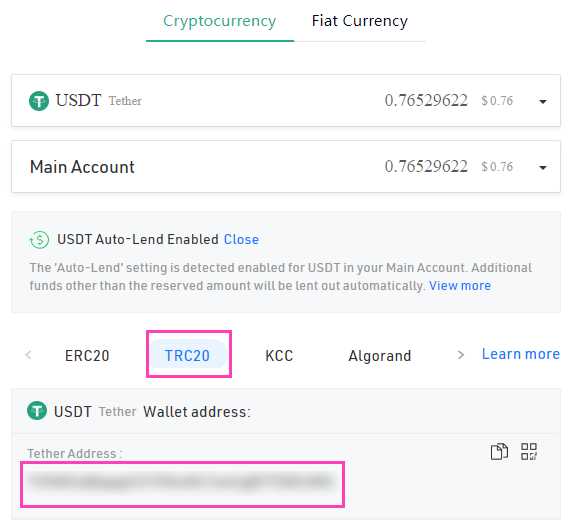

- Find your USDT balance and click on the “Withdraw” or “Send” button.

- Enter the amount of USDT you want to transfer to your bank account.

- Choose the option to withdraw to a bank account.

- Provide the required details, such as your bank account number and any other necessary information.

- Double-check all the information you’ve entered to ensure it is accurate.

- Review any fees or charges associated with the withdrawal and confirm the transaction.

- Wait for the platform to process your request. The processing time can vary depending on the platform.

- Once the withdrawal is processed, the USDT will be converted to your local currency and transferred to your bank account.

It’s important to note that the availability of this withdrawal option may vary depending on the cryptocurrency exchange platform you are using. Additionally, there may be limitations or restrictions on the amount you can withdraw or the countries where bank withdrawals are supported. Be sure to check the platform’s terms and conditions or contact their customer support for more information.

Always exercise caution and verify the legitimacy of the cryptocurrency exchange platform before making any transfers or providing personal information.

Choosing an Exchange for Transferring USDT

When it comes to transferring USDT to your bank account, choosing the right exchange is crucial. There are several factors to consider before deciding on an exchange:

- Reputation: Look for an exchange with a good reputation and positive customer reviews. Check if the exchange is regulated and licensed.

- Liquidity: Consider the liquidity of the exchange. Higher liquidity means you can easily buy or sell USDT without significant price fluctuations.

- Fees: Compare the fees charged by different exchanges. Look for exchanges with competitive rates and transparent fee structures.

- Security: Security should be a top priority when choosing an exchange. Look for exchanges that offer strong security measures, such as two-factor authentication, cold storage, and regular security audits.

- User Experience: Consider the user experience offered by the exchange. Look for a platform that is easy to navigate and provides a seamless trading experience.

- Supported Currencies: Check if the exchange supports the currency you want to transfer USDT to. Some exchanges may have limited options for fiat currency withdrawals.

By carefully considering these factors, you can choose an exchange that best meets your needs and ensures a smooth and secure transfer of USDT to your bank account.

Factors to Consider in Choosing an Exchange

When it comes to transferring USDT to your bank account, choosing the right exchange is crucial. There are several factors you should consider before making your decision:

1. Security: The security of your funds should be your top priority. Look for an exchange that offers strong security measures such as two-factor authentication, cold storage for funds, and regular security audits.

2. Liquidity: Liquidity is important when it comes to trading cryptocurrencies. Choose an exchange that has high trading volumes and a large number of active traders. This will ensure that you can easily buy or sell your USDT without experiencing delays or price slippage.

3. User Interface: A user-friendly interface can make a huge difference in your trading experience. Look for an exchange that offers a clean and intuitive design, with easy-to-navigate menus and clear trading charts.

4. Fees: Consider the fees charged by the exchange for trading, depositing, and withdrawing funds. Different exchanges have different fee structures, so be sure to compare them before making your decision.

5. Customer Support: In case you encounter any issues or have questions, it’s essential to choose an exchange that offers responsive and helpful customer support. Look for exchanges that provide multiple channels of communication and have a reputation for addressing customer concerns promptly.

By considering these factors, you can choose an exchange that meets your needs and ensures a smooth and secure USDT to bank account transfer process.

Steps to Transfer USDT to Your Bank Account

Transferring USDT to your bank account is a straightforward process. Follow these steps to get started:

-

Create an Account

If you don’t already have an account on a blockchain platform that supports USDT, you’ll need to create one. Choose a reputable platform and complete the registration process.

-

Verify Your Identity

In order to transfer USDT to your bank account, you may need to complete a verification process. This typically involves providing identification documents to comply with the platform’s regulations and security measures.

-

Link Your Bank Account

Once your account is set up and verified, you’ll need to link your bank account. This usually involves providing your bank account details and following any additional steps required by the platform.

-

Transfer USDT to Your Account

After your bank account is linked, you can initiate the transfer of USDT to your account. This process will vary depending on the platform you are using, but usually involves selecting the USDT balance you want to transfer and specifying your bank account as the destination.

-

Review and Confirm

Before completing the transfer, carefully review the details to ensure accuracy. This includes double-checking the transfer amount and destination bank account. Confirm the transfer and wait for the transaction to be processed.

-

Wait for the Funds to Arrive

Once the transaction is processed, it may take some time for the funds to arrive in your bank account. The timeframe can vary depending on the platform and your bank. Be patient and keep an eye on your bank account for the arrival of the funds.

-

Monitor the Transaction

After the transfer is complete, monitor the transaction and ensure that the funds are successfully deposited into your bank account. If there are any issues or delays, contact the platform’s customer support for assistance.

Q&A:

How can I transfer USDT to my bank account?

To transfer USDT to your bank account, you will need to follow a few steps. First, you need to find a reputable cryptocurrency exchange platform that supports USDT. Then, you will need to create an account and complete the necessary verification process. Once you have done that, you can deposit your USDT to your exchange account. After that, you can sell your USDT for a fiat currency such as USD or EUR. Finally, you can withdraw the fiat currency to your bank account.

Are there any fees associated with transferring USDT to a bank account?

Yes, there are usually fees associated with transferring USDT to a bank account. The fees can vary depending on the cryptocurrency exchange platform you use and the withdrawal method you choose. It is important to carefully review the fee schedule of the exchange platform before initiating the transfer to avoid any surprises.

How long does it take to transfer USDT to a bank account?

The transfer time can vary depending on several factors, including the cryptocurrency exchange platform you use, the withdrawal method you choose, and your bank’s processing time. In general, the transfer process can take anywhere from a few minutes to several business days. It is recommended to check with the exchange platform and your bank for more accurate estimates.

Is it safe to transfer USDT to my bank account?

Transferring USDT to your bank account can be safe if you take the necessary precautions. It is important to choose a reputable cryptocurrency exchange platform that has a strong security infrastructure in place. Additionally, make sure to enable two-factor authentication and use strong, unique passwords for your exchange account. It is also recommended to double-check the withdrawal address before initiating the transfer to avoid sending your USDT to the wrong account.

What are the alternatives if I don’t want to transfer USDT to my bank account?

If you don’t want to transfer USDT to your bank account, there are several alternatives you can consider. One option is to use the USDT to purchase other cryptocurrencies or invest in different investment products. Another option is to use the USDT to make online purchases or payments at merchants that accept cryptocurrencies as a form of payment. Additionally, you can trade USDT for other digital assets or use it to participate in decentralized finance projects.