A Beginner’s Guide to USDT Wallets Where to Start and What to Consider

If you’re new to the world of cryptocurrency, chances are you’ve heard of Tether (USDT). USDT is a type of cryptocurrency known as a stablecoin, which is designed to maintain a stable value by being pegged to a reserve of fiat currency. In the case of USDT, each token is backed by one US dollar.

But before you can start using USDT, you’ll need a wallet to store and manage your tokens. With so many wallet options available, it can be overwhelming to know where to start. That’s why we’ve put together this beginner’s guide to USDT wallets.

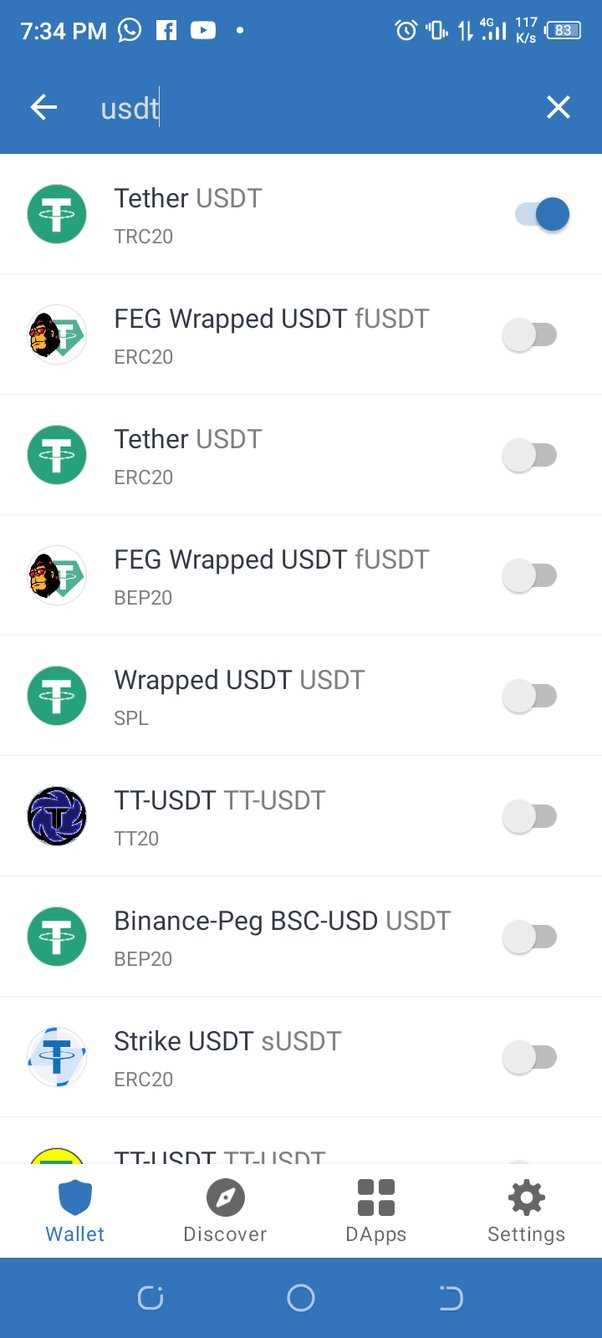

First and foremost, it’s important to choose a wallet that is compatible with USDT. Not all cryptocurrency wallets support USDT, so make sure to do your research and find one that specifically lists USDT as a supported asset. This will ensure that you’ll be able to send, receive, and store your USDT safely and securely.

In addition to compatibility, consider the security features of the wallet. Look for wallets that offer strong encryption and two-factor authentication to protect your funds. You may also want to choose a wallet that allows you to maintain control of your private keys, as this adds an extra layer of security.

Another factor to consider is the user interface of the wallet. Look for a wallet that is intuitive and user-friendly, especially if you’re just starting out with cryptocurrency. A clear and easy-to-navigate interface will make it easier for you to manage your USDT and perform transactions.

Lastly, it’s worth considering the reputation and track record of the wallet provider. Look for wallets that have been around for a while and have a positive reputation within the cryptocurrency community. This will give you peace of mind knowing that your funds are in good hands.

By taking the time to research and choose the right USDT wallet, you can ensure that your cryptocurrency journey starts off on the right foot. Consider compatibility, security, user interface, and reputation when making your decision, and soon you’ll be on your way to managing your USDT with ease.

A Beginner’s Guide to USDT Wallets

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. It is designed to maintain a stable value, often pegged to the US dollar. If you are new to USDT, one of the first things you’ll need to do is set up a USDT wallet.

Why Do I Need a USDT Wallet?

A USDT wallet allows you to store, send, and receive USDT tokens. Similar to other cryptocurrencies, USDT is stored in a digital wallet rather than in a physical wallet or bank account. By having a USDT wallet, you can easily manage your USDT tokens and perform transactions.

Choosing a USDT Wallet

When choosing a USDT wallet, there are a few factors to consider:

- Security: Look for a wallet that offers robust security measures, such as two-factor authentication and private key encryption. Ensuring the safety of your USDT holdings is crucial.

- Compatibility: Check if the wallet is compatible with the platform or exchange you plan to use. Some wallets may offer specific integration options.

- User-Friendliness: A user-friendly interface can make it easier for beginners to navigate their USDT wallet. Look for wallets with simple setup processes and intuitive designs.

- Multi-Functionality: Consider whether you want a USDT wallet that only supports USDT tokens or one that also supports other cryptocurrencies. This can help streamline your overall crypto management.

Types of USDT Wallets

There are several types of USDT wallets available:

- Web Wallets: These wallets run on web browsers and can be accessed from any device with an internet connection. They are convenient but may be more vulnerable to security risks.

- Desktop Wallets: Desktop wallets are software applications that need to be downloaded and installed on your computer. They provide a higher level of security but are only accessible from the device on which they are installed.

- Mobile Wallets: Mobile wallets are smartphone apps that allow you to manage your USDT tokens on the go. They offer convenience and accessibility, but may have limitations in terms of security.

- Hardware Wallets: These wallets store your USDT tokens offline, providing the highest level of security. They are physical devices that you need to connect to your computer or smartphone when making transactions.

Ultimately, the type of USDT wallet you choose depends on your personal preferences, level of security desired, and how you plan to use your USDT tokens. Whichever wallet you choose, remember to always keep your wallet information secure and regularly backup your wallet.

Now that you have a better understanding of USDT wallets and what to consider when setting one up, you can confidently start your journey into the world of USDT and stablecoin transactions!

Where to Start

When you are ready to start using USDT wallets, there are a few things you should consider. First, you’ll need to choose a wallet provider that is compatible with USDT. There are several options available, so it’s important to do your research and find one that suits your needs and preferences.

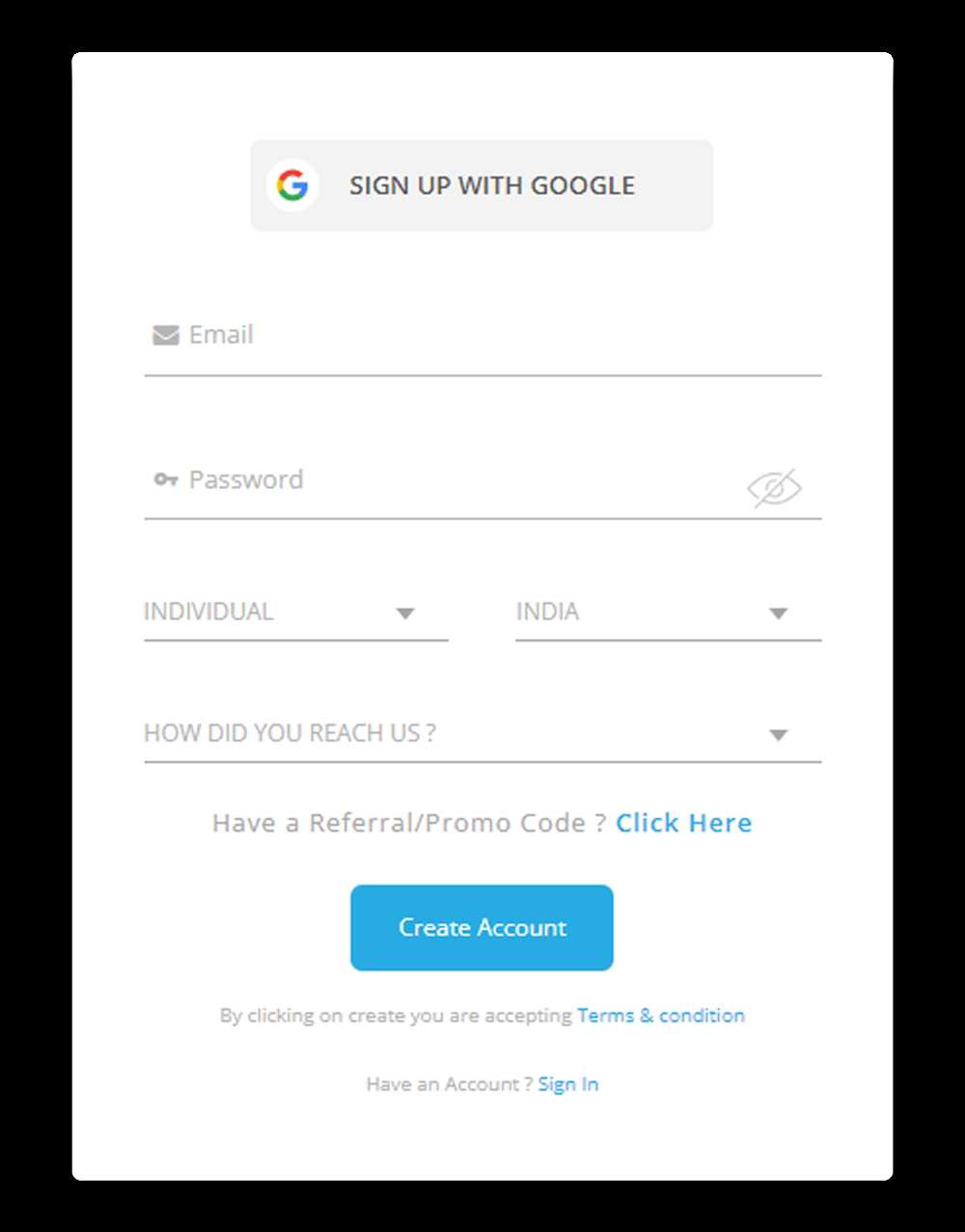

Next, you’ll need to create an account with the chosen wallet provider. This process will typically involve entering some personal information and completing a verification process. It’s important to ensure that the wallet provider you choose has a strong reputation for security and user privacy.

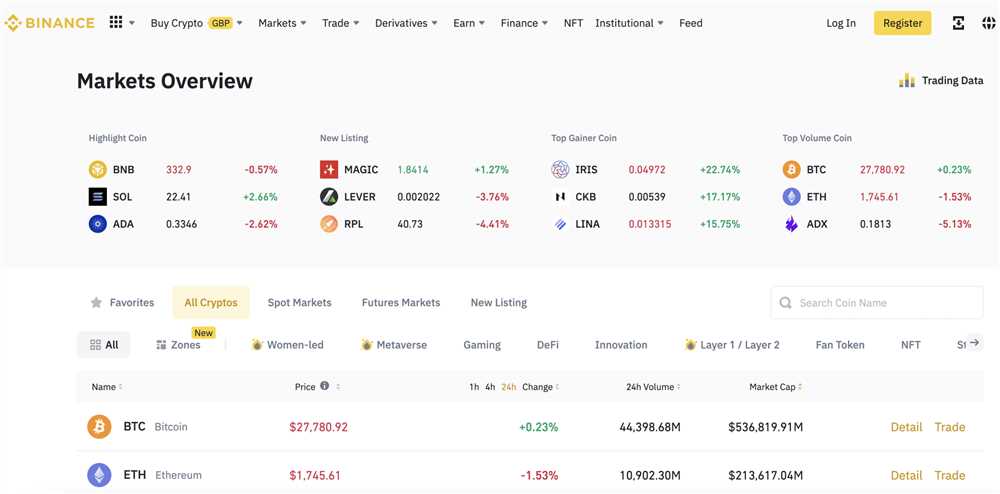

Once you have created your account, you’ll need to fund your USDT wallet. There are several ways to do this, including purchasing USDT directly from an exchange and transferring it to your wallet, or receiving USDT from someone else via a peer-to-peer transaction. Make sure to follow the instructions provided by your wallet provider to ensure a smooth and secure transaction.

After your USDT wallet is funded, you can start using it to send and receive USDT. You can use your wallet address to receive USDT from others, and you can use the wallet’s sending function to send USDT to others. Be sure to double-check the recipient’s address before initiating any transactions to avoid any mistakes or losses.

Finally, it’s important to keep your USDT wallet secure. This includes using strong, unique passwords, enabling two-factor authentication, and keeping your wallet’s private keys in a safe place. Regularly updating your wallet software and keeping an eye out for any security updates or vulnerabilities is also essential.

By following these steps and taking appropriate precautions, you can safely and confidently start using USDT wallets. Remember to always stay informed and up to date with the latest security practices to protect your digital assets.

What to Consider

When choosing a USDT wallet, there are several factors to consider:

Security: The security of your USDT wallet should be the top priority. Look for wallets that offer secure storage, such as cold storage options or multi-signature technology. Make sure the wallet has strong encryption and two-factor authentication to protect your funds.

Compatibility: Consider the compatibility of the wallet with your operating system or device. Make sure the wallet is supported on the platform you plan to use it on, whether it’s a desktop computer, mobile device, or online platform.

Features: Look for wallets that offer features such as the ability to easily send and receive USDT, manage multiple addresses, and access transaction history. Some wallets also offer additional features like built-in exchange services or support for other cryptocurrencies.

User-friendly interface: A user-friendly interface can greatly enhance your experience with a USDT wallet. Look for wallets that have intuitive navigation, easy-to-understand instructions, and a clean design. Consider trying out a demo or reading user reviews to get an idea of the wallet’s usability.

Customer support: Check if the wallet provider offers reliable customer support. This can be crucial if you ever experience any issues with your wallet. Look for wallets that provide multiple support channels, such as email, live chat, or a dedicated support team.

Reputation: Consider the reputation of the wallet provider. Research their track record, read user reviews, and look for any potential security breaches or other negative incidents. Choose a wallet provider that has a strong reputation for security and reliability.

Backup and recovery options: It’s important to have backup and recovery options for your USDT wallet. Look for wallets that offer features like seed phrases or wallet backups that can help you restore your wallet in case of loss or theft.

By considering these factors, you can choose the best USDT wallet that suits your needs and helps keep your funds secure.

Q&A:

What is a USDT wallet?

A USDT wallet is a digital wallet that stores USDT, a stablecoin pegged to the value of the US dollar. It allows you to securely store, send, and receive USDT tokens.

Which wallet should I use to store USDT?

There are several options for storing USDT, including hardware wallets, software wallets, and online wallets. It ultimately depends on your preferences and security needs. Hardware wallets like Ledger and Trezor offer the highest level of security.

How do I choose a USDT wallet?

When choosing a USDT wallet, consider factors such as security, convenience, and compatibility with the platform or exchange you plan to use. Look for wallets that have a good reputation, strong encryption, and multi-factor authentication to protect your funds.