What Are the Fees Associated with Sending USDT to a Bank

Are you interested in sending USDT to a bank? Before you make your transaction, it’s essential to be aware of the fees involved. Understanding these fees can help you plan your finances better and avoid any unexpected costs.

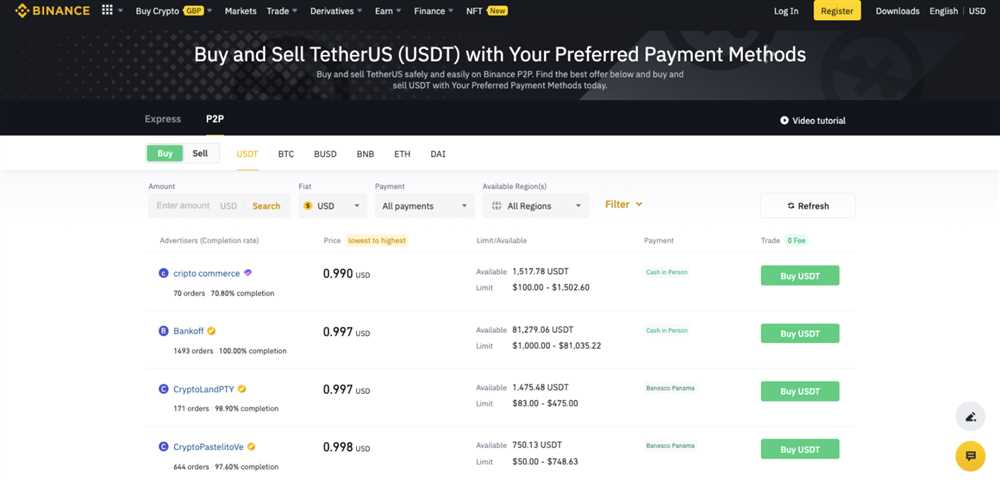

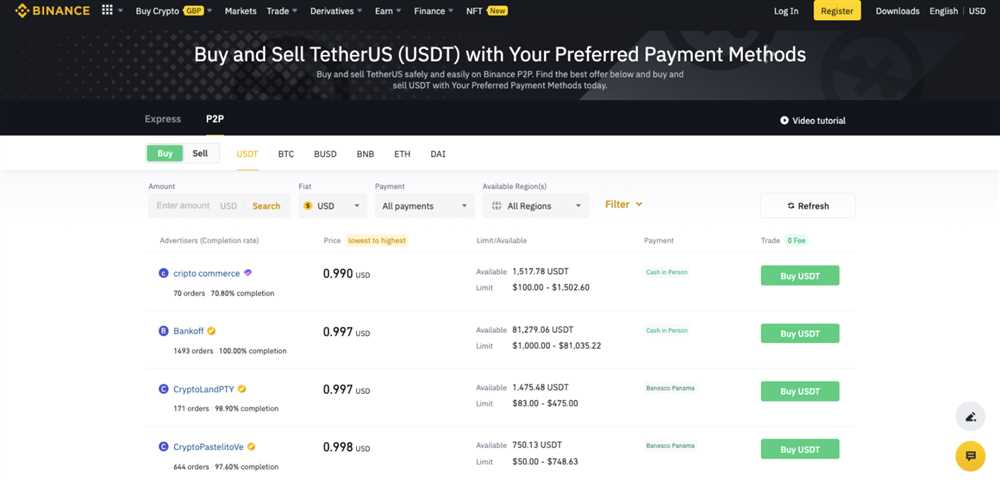

Transaction Fee: When sending USDT to a bank, there is usually a transaction fee associated with the transfer. This fee covers the cost of processing and securing your transaction. It’s important to research and compare different platforms or services to find the one with the lowest transaction fee.

Exchange Rate: When converting USDT to your local currency, you should also consider the exchange rate offered by the platform or service. Exchange rates can vary, so it’s worth checking multiple sources to ensure you are getting the best rate possible.

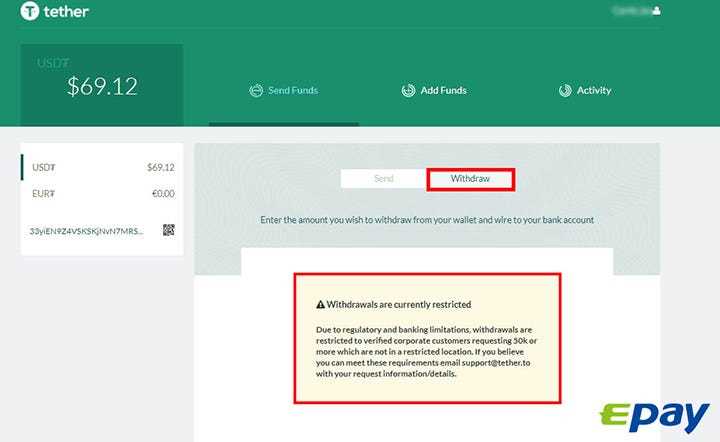

Additional Charges: Depending on the platform or service you use, there may be additional charges for specific services. These could include withdrawal fees, bank processing fees, or any other fees associated with your transfer. Make sure to read the terms and conditions carefully to understand all potential charges.

By being aware of the fees involved in sending USDT to a bank, you can make informed decisions and avoid unnecessary expenses. Take the time to research different platforms and services to find the most cost-effective option for your needs.

Main Fees for Sending

When sending USDT to a bank, there are several main fees to be aware of. These fees can vary depending on the provider and the specific transaction details. Here are the key fees to consider:

1. Transaction Fee

Every transfer of USDT to a bank will likely incur a transaction fee. This fee covers the cost of processing the transaction and ensuring that the funds are safely transferred to the recipient’s bank account. The specific amount of the transaction fee can vary and may be a fixed fee or a percentage of the transfer amount.

2. Exchange Rate Fee

If you are sending USDT to a bank in a different currency, you may also incur an exchange rate fee. This fee is charged to convert the USDT into the desired currency at the current exchange rate. The exchange rate fee can vary depending on the provider and the specific exchange rate used for the transaction.

3. International Transfer Fee

If you are sending USDT to a bank located outside of your country, you may also be charged an international transfer fee. This fee is imposed by banks to cover the additional costs and risks associated with processing international transfers. The international transfer fee can vary depending on the provider and the specific countries involved in the transaction.

It is important to carefully review these fees and understand the total cost of sending USDT to a bank before initiating the transaction. Oftentimes, different providers will have different fee structures, so it is worth comparing options to ensure you are getting the best deal.

International Bank Transfers

When it comes to international bank transfers, there are a few things you need to know. Whether you are sending money to a family member abroad or paying for goods and services, understanding the process and associated fees can help you make informed decisions.

1. Choose the right bank: Not all banks offer international transfer services, so it’s important to find a bank that specializes in this area. Look for banks with a strong network and relationships with international banks to ensure smooth transactions.

2. Exchange rates: When sending money internationally, exchange rates play a crucial role. Be aware that banks often add a margin to the exchange rate, which can result in higher fees. Consider using a reputable foreign exchange provider to potentially get better rates.

3. Transfer fees: Banks typically charge fees for international transfers. These fees can vary depending on the bank, the amount being transferred, and the destination country. Make sure you understand the fee structure and compare different banks to find the most cost-effective option.

4. Transfer speed: The speed of international bank transfers can vary significantly. Some banks offer same-day transfers, while others may take several business days. If timing is important, check with your bank to see how long the transfer is likely to take.

5. Transfer limits: Banks often have limits on the amount of money you can transfer internationally. These limits can vary depending on your account type and the destination country. Make sure you are aware of any limits before initiating a transfer.

6. Additional documentation: Depending on the destination country, you may be required to provide additional documentation for international transfers. This can include proof of identity, purpose of the transfer, and supporting documents for large transfers. Familiarize yourself with the requirements to avoid any delays or complications.

7. Monitoring the transfer: Once you have initiated the transfer, it’s important to keep an eye on the progress. Most banks provide tracking services or updates on the status of the transfer. This allows you to ensure that the funds reach the intended recipient in a timely manner.

International bank transfers can be convenient and secure, but it’s essential to understand the process and associated fees. By following these tips, you can make the most of your international transfers and avoid any unnecessary costs or delays.

Domestic Bank Transfers

When it comes to domestic bank transfers, sending USDT to a bank account within the same country can be a seamless process. By using our user-friendly platform, you can easily transfer your USDT to your desired domestic bank account.

With our reliable system, you can expect quick and secure transactions without any hassle. Whether you need to send USDT to your personal bank account or make a payment to a business partner, our domestic bank transfer service ensures that your funds arrive promptly and safely.

By utilizing our platform, you can conveniently convert your USDT to your local currency and deposit it into your domestic bank account. We offer competitive exchange rates and minimal fees to provide you with a cost-effective solution for your banking needs.

Benefits of Domestic Bank Transfers:

- Fast and secure transactions

- Convenient conversion of USDT to local currency

- Minimal fees

- Reliable service

With our domestic bank transfer service, you can confidently manage your USDT transactions, whether it’s for personal or business purposes. Join us today and experience the convenience and efficiency of sending USDT to a domestic bank account.

Q&A:

What are the fees for sending USDT to a bank?

The fees for sending USDT to a bank can vary depending on the platform or service you are using. It is important to check with the specific platform or service provider for their fee structure.

Can I send USDT to any bank?

While USDT is a digital asset that can be sent electronically, not all banks may support or accept USDT. It is best to check with your bank to see if they support USDT transactions.

Are there any withdrawal limits for sending USDT to a bank?

Withdrawal limits for sending USDT to a bank can vary depending on the platform or service you are using. Some platforms may have daily or monthly withdrawal limits in place. It is recommended to check with the platform or service provider for their specific withdrawal limits.