Is Sending USDT to a Bank Safe and Secure?

As the popularity of cryptocurrencies continues to grow, more and more people are looking for ways to safely and securely transfer their digital assets. One option that has gained significant traction is using bank transfers to move USDT, the widely used stablecoin.

USDT, or Tether, is a cryptocurrency that is pegged to the US dollar, making it a stable asset in the turbulent world of cryptocurrencies. While bank transfers have long been the preferred method of moving traditional fiat currencies, many are still unsure about the safety and security of using this method for USDT transactions.

There are several factors to consider when assessing the safety and security of USDT bank transfers. Firstly, it is important to note that USDT is built on blockchain technology, which provides a high level of security and transparency. Each transaction is recorded on the blockchain, making it nearly impossible to alter or tamper with the data.

Additionally, most reputable cryptocurrency exchanges and platforms have stringent security measures in place to protect their users’ funds. This includes employing top-notch encryption algorithms, multi-factor authentication, and cold storage solutions to safeguard the private keys that control access to the USDT wallets.

However, it is crucial to remain vigilant and take necessary precautions when conducting USDT bank transfers. It is advisable to choose well-established and regulated platforms, and double-check the recipient’s wallet address before initiating the transfer. Keeping your devices secure and up-to-date with the latest security patches is also essential to mitigate the risk of hackers gaining unauthorized access to your digital assets.

In conclusion, USDT bank transfers can be safe and secure if the necessary precautions are taken. While there are risks involved in any financial transaction, the blockchain technology underlying USDT and the security measures implemented by reputable platforms provide a solid foundation for conducting these transfers. By staying informed and taking appropriate security measures, individuals can confidently and securely transfer their USDT using bank transfers.

The Security of USDT Bank Transfers

USDT bank transfers are considered safe and secure due to the following reasons:

1. Compliance with Regulations

The use of USDT (Tether) is subject to anti-money laundering (AML) and know-your-customer (KYC) regulations, which ensure that all transactions are monitored and verified.

By adhering to these regulatory measures, USDT bank transfers offer an added layer of security, minimizing the risk of fraudulent activities and promoting transparency within the financial system.

2. Blockchain Technology

USDT operates on the Ethereum blockchain, utilizing smart contracts and cryptographic techniques to secure transactions.

The decentralized nature of blockchain technology ensures that USDT bank transfers are highly resistant to hacking and tampering. Each transaction is recorded on multiple nodes in the network, making it nearly impossible for any single point of failure to compromise the security of the transfers.

3. Two-Factor Authentication (2FA)

Many USDT wallet providers and exchanges offer two-factor authentication as an additional security measure for bank transfers.

With 2FA enabled, users are required to provide a second form of verification, such as a unique code generated by an authentication app or received via SMS, further safeguarding their accounts and transactions from unauthorized access.

4. Secure Wallets

When conducting USDT bank transfers, it is essential to use a reputable and secure wallet provider.

Choosing a wallet that implements strong encryption and security protocols can help protect stored USDT tokens and prevent unauthorized access or loss of funds.

- Users should opt for wallets that offer cold storage options, keeping the majority of funds offline and inaccessible to hackers.

- It is also important to regularly update wallet software and firmware to benefit from the latest security enhancements.

5. Verifiable Audit and Transparency

USDT has been audited by reputable third-party accounting firms to ensure the backing of each token by an equivalent amount of fiat currency.

Transparent and regularly published reports provide users with the confidence that USDT bank transfers are backed by real-world assets, enhancing the security of the transfers.

In conclusion, USDT bank transfers are secure largely due to compliance with regulations, the use of blockchain technology, two-factor authentication, secure wallets, and the availability of audit reports. By adopting these security measures, USDT bank transfers offer users a reliable and trustworthy method for transferring value.

Safety Measures for USDT Bank Transfers

When it comes to USDT bank transfers, ensuring safety and security is of utmost importance. Here, we discuss some key safety measures that users should follow to minimize risks associated with USDT bank transfers:

1. Choose Reliable and Regulated Exchanges

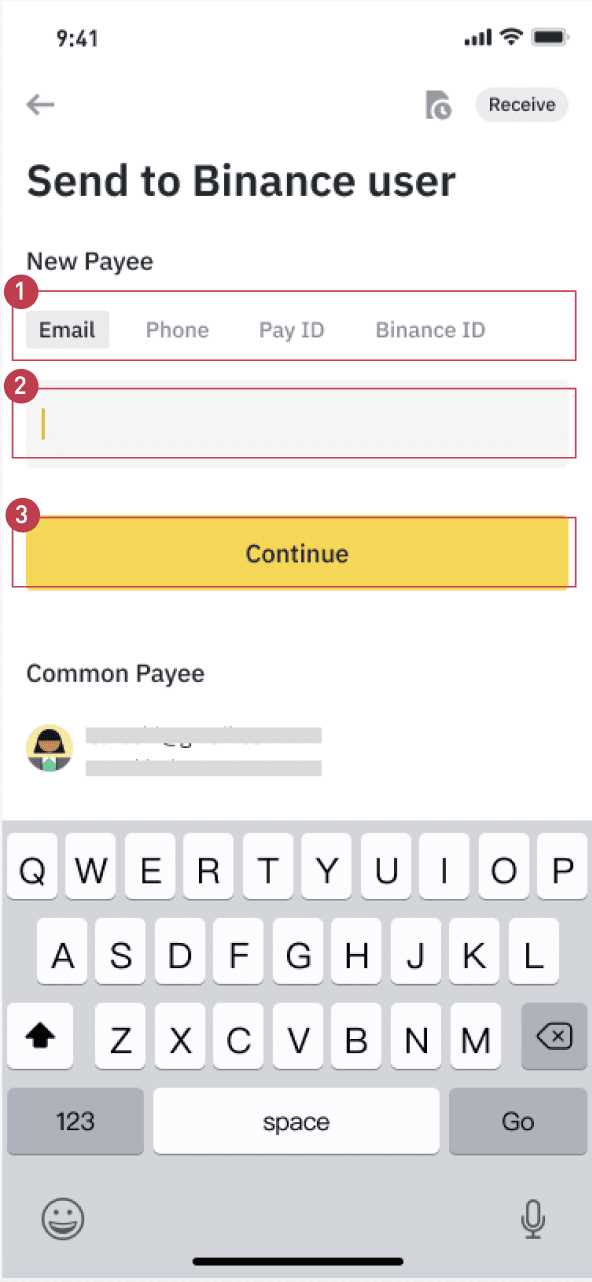

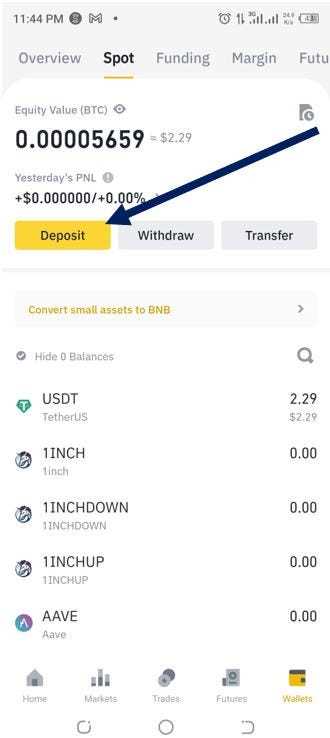

It is crucial to select reliable and regulated exchanges for USDT bank transfers. Look for platforms that have a good reputation and are known for their strong security measures. Conduct thorough research and read user reviews before making a decision.

2. Enable Two-Factor Authentication (2FA)

Enabling two-factor authentication adds an extra layer of security to your USDT bank transfers. By requiring a verification code in addition to your password, it significantly reduces the risk of unauthorized access to your funds. Make sure to enable 2FA whenever possible.

3. Keep Software and Systems Updated

Regularly updating your software and systems is critical in safeguarding your USDT bank transfers. Updates often include security patches and bug fixes that address vulnerabilities. Set up automatic updates or check for updates frequently to ensure you have the latest security measures in place.

4. Use Strong Passwords

Using strong, unique passwords for your USDT accounts is essential. Avoid easy-to-guess passwords and consider using a password manager to generate and store complex passwords securely. It is also advisable to change your passwords regularly for added security.

5. Be Cautious of Phishing Attempts

Be vigilant and cautious of phishing attempts when it comes to USDT bank transfers. Fraudulent emails, messages, or websites may try to trick you into providing sensitive information. Always verify the authenticity of the source and never click on suspicious links or provide personal information unless you are certain it is safe.

6. Regularly Monitor Your Accounts

Regularly monitoring your USDT accounts is an important safety measure. Keep an eye on transaction history and any suspicious activities. If you notice any unauthorized or suspicious transactions, report them to the exchange immediately.

7. Backup Your Wallet Information

It is crucial to regularly back up your wallet information, such as private keys or recovery phrases. Store this information securely offline, preferably in multiple locations. This ensures that even if your device is compromised or lost, you can still access your USDT funds.

By following these safety measures, you can enhance the security of your USDT bank transfers and minimize the risk of unauthorized access or fraudulent activities.

Benefits and Risks of USDT Bank Transfers

USDT bank transfers offer several benefits for users who want to transact using stablecoins:

1. Stability: USDT is a stablecoin pegged to the value of the US dollar, which means that its price remains relatively constant. This stability makes it a reliable option for transferring funds, as the value of the USDT tokens will not fluctuate drastically.

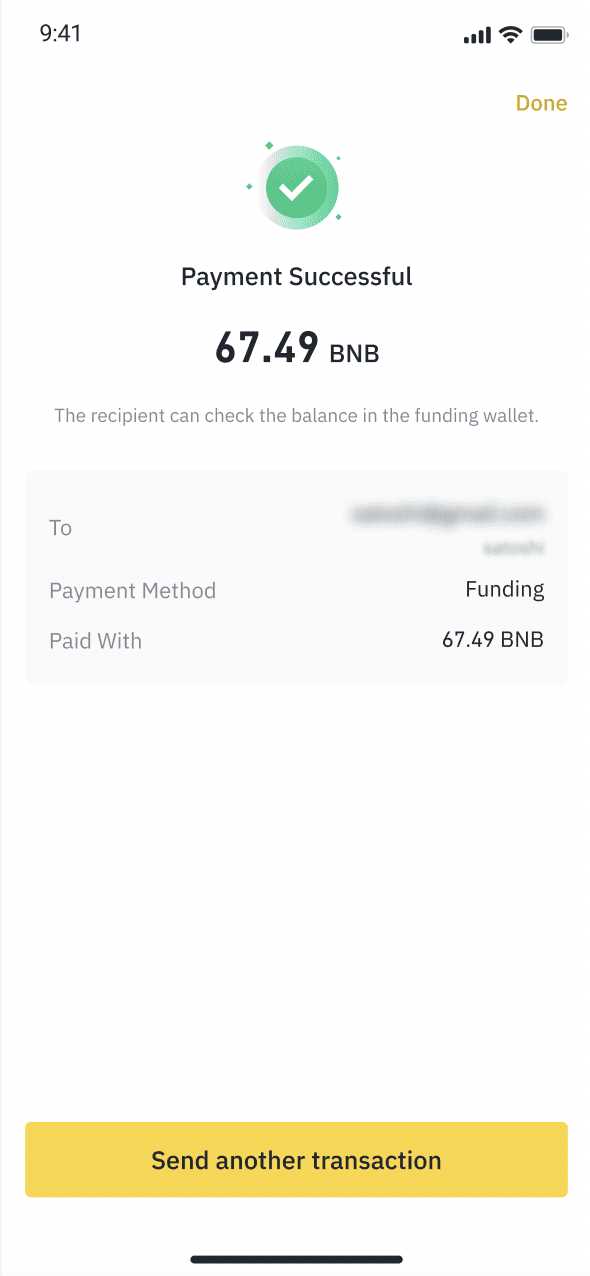

2. Speed: USDT bank transfers can be processed quickly, often within minutes or even seconds. This makes it convenient for users who need to send or receive funds in a timely manner.

3. Lower transaction costs: Traditional bank transfers can be expensive, especially for international transactions. USDT bank transfers often have lower fees compared to traditional banking methods, making them a cost-effective option for transferring funds.

Despite these benefits, there are also some risks associated with USDT bank transfers:

1. Counterparty risk: USDT bank transfers rely on trusted third-party entities, such as banks or cryptocurrency exchanges, to facilitate the transaction. Users should ensure that they are using reputable platforms to minimize the risk of fraud or loss of funds.

2. Regulatory risks: Stablecoins like USDT are still relatively new and are subject to evolving regulations. Changes in regulations or government crackdowns on stablecoins could impact the availability or legality of USDT bank transfers.

3. Technical risks: The use of blockchain technology and smart contracts introduces technical risks, such as glitches or vulnerabilities in the system. Users should be cautious and take appropriate security measures to protect their funds when using USDT bank transfers.

Overall, USDT bank transfers can offer benefits such as stability, speed, and lower transaction costs. However, users should be aware of the risks involved and take necessary precautions to ensure the safety and security of their funds.

Q&A:

Is transferring USDT via banks safe and secure?

Transferring USDT via banks is generally considered safe and secure. Banks are regulated financial institutions that have security measures in place to protect customer funds and transactions. However, it is important to ensure that you are using a reputable and trustworthy bank to minimize any potential risks.

What security measures are in place to protect USDT bank transfers?

When transferring USDT via banks, various security measures are in place to protect the transactions. These measures may include encryption technology, multi-factor authentication, secure sockets layer (SSL) certificates, and anti-fraud systems. Additionally, banks regularly monitor and audit their systems to detect and prevent any unauthorized access or fraudulent activities.

Are there any risks associated with USDT bank transfers?

While USDT bank transfers are generally safe, there are still some risks involved. These risks can include potential account breaches, fraudulent transactions, or technical glitches in the banking system. It is important to be aware of these risks and take appropriate precautions, such as using strong passwords, regularly monitoring account activity, and reporting any suspicious transactions to the bank.

Can USDT bank transfers be reversed?

USDT bank transfers cannot be reversed in the same way as traditional fiat currency transfers. Once the transaction is sent and confirmed, it becomes extremely difficult to reverse or cancel the transfer. Therefore, it is essential to double-check all the details before initiating a USDT bank transfer to ensure accuracy and prevent any potential loss of funds.

Are there any fees associated with USDT bank transfers?

Yes, there may be fees associated with USDT bank transfers. Banks often charge fees for transferring funds, both domestically and internationally. These fees can vary depending on the bank and the specific transfer method used. It is recommended to check with your bank for details on the fees associated with USDT bank transfers.