Exploring the Connection Between USDT and USD: Debunking the Myth or Confirming the Reality

Over the past few years, the rise of cryptocurrencies has sparked a lot of intrigue and debate. One of the most talked-about cryptocurrencies is Tether (USDT), which claims to have a 1:1 backing with the US dollar (USD). But is this really the case? Are USDT and USD truly linked together? In this article, we will delve into the subject and explore whether the connection between USDT and USD is a myth or a reality.

USDT is a type of cryptocurrency known as a stablecoin, designed to provide stability and mitigate the volatility associated with other cryptocurrencies like Bitcoin. It was launched in 2014 by a Hong Kong-based company called Tether Limited. According to Tether, each USDT token is backed by an equivalent amount of USD held in reserve. This means that for every USDT in circulation, there should be an equivalent amount of USD in Tether’s reserves.

However, skeptics have raised concerns about the transparency and validity of Tether’s claims. Some argue that there isn’t enough concrete evidence to prove the 1:1 peg between USDT and USD. They point to Tether’s history of legal troubles and the lack of a comprehensive audit as reasons to doubt the connection. Additionally, there are concerns about Tether’s unregulated nature, as it operates outside of the traditional banking system.

Despite the doubts and controversies surrounding USDT, it remains one of the most widely used stablecoins in the cryptocurrency market. Its convenience and potential for arbitrage have made it a popular choice for traders and investors. However, the ongoing scrutiny and regulatory pressure on Tether have put the stability of the USDT-USD link under a microscope.

In conclusion, the link between USDT and USD is a subject of much debate and controversy in the cryptocurrency world. While Tether claims that each USDT is backed by an equivalent amount of USD, doubts persist regarding the transparency and validity of this connection. Only time will tell whether USDT and USD are truly intertwined or if the link is nothing more than a myth.

The Connection Between USDT and USD

One of the ongoing debates in the cryptocurrency world is the relationship between USDT (Tether) and USD (United States dollar). While some argue that USDT is fully backed by and pegged to the USD, others question its stability and transparency.

USDT is a type of cryptocurrency known as a stablecoin, which is designed to maintain a stable value by being pegged to a specific asset, in this case, the USD. The idea is that for every USDT in circulation, there should be an equivalent amount of USD held in reserve by the issuer, Tether Limited.

To support their claims, Tether Limited has stated that they undergo regular audits to prove the existence and sufficiency of their USD reserves. However, these audits have faced criticism for their lack of transparency and reliance on self-reported information.

Some advocates for USDT argue that its connection to the USD is essential for the cryptocurrency market. They argue that USDT provides stability during times of market volatility, acting as a safe haven for traders and investors. Additionally, USDT offers the advantages of faster transactions and increased liquidity compared to traditional fiat currencies.

However, skeptics point out that USDT has faced controversy in the past, including legal issues and concerns about whether its reserves are truly sufficient. They argue that the lack of regulatory oversight and transparency makes USDT a risky investment and undermines its supposed connection to the USD.

In conclusion, the connection between USDT and USD is a subject of ongoing debate and skepticism. While USDT claims to be fully backed by and pegged to the USD, concerns about transparency and stability persist. Investors and traders should carefully consider these factors before engaging in any transactions involving USDT.

The Truth Behind the USDT and USD Relationship

There has been much speculation and debate surrounding the relationship between USDT and USD. USDT, or Tether, is a type of cryptocurrency known as a stablecoin that is designed to maintain a 1:1 parity with the US dollar. This means that for every USDT in circulation, there should be an equivalent amount of USD held in reserve.

However, there have been concerns and accusations that Tether may not actually have enough USD in reserve to back all of the USDT in circulation. These allegations have led to a lack of trust in the stability of USDT and have raised questions about its true value and relationship to the USD.

The Controversy Surrounding Tether

One of the main issues surrounding Tether is the lack of transparency regarding its reserves. Unlike traditional banks, which are required to undergo regular audits and provide proof of their assets, Tether has not undergone a full, independent audit. This lack of transparency has led to skepticism and skepticism about the amount of USD held in reserve.

Another controversy surrounding Tether is its connection to Bitfinex, a cryptocurrency exchange. In 2018, it was revealed that Bitfinex and Tether shared common shareholders and management. This led to allegations that Tether was being used to manipulate the price of Bitcoin, as it was alleged that Tether was being created and used to artificially inflate the price of Bitcoin on Bitfinex.

The Reality of the USDT and USD Relationship

While the concerns and controversies surrounding Tether are valid, it is important to note that there is currently no definitive proof that Tether does not have enough USD in reserve. Tether has stated that it has conducted a private audit of its reserves, but this has not been made available to the public for scrutiny.

It is also worth noting that many cryptocurrency exchanges and traders continue to use USDT as a means of trading and transferring value. This suggests that despite the controversies, there is still some level of trust and belief in the 1:1 parity between USDT and USD.

Ultimately, until there is a comprehensive and independent audit of Tether’s reserves, the true relationship between USDT and USD will remain uncertain. It is important for investors and traders to be aware of the risks and controversies surrounding Tether and to make informed decisions based on their own risk tolerance and understanding of the situation.

Examining Whether the Link Between USDT and USD is Myth or Reality

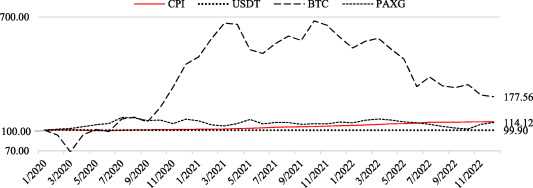

The relationship between USDT (Tether) and USD (US Dollar) has been a topic of much debate and speculation in the cryptocurrency community. USDT is a stablecoin that is pegged to the value of the USD at a 1:1 ratio, making it an attractive option for traders and investors looking to mitigate volatility in the crypto market.

However, there have been concerns raised about the true nature of the link between USDT and USD. Some critics argue that USDT does not have sufficient reserves to back up its peg to the USD, leading to doubts about its true value and stability. This has led to a widespread belief that the link between USDT and USD is more of a myth than a reality.

The Case for USDT’s Link to USD

Proponents of USDT argue that there is a robust and reliable link between USDT and USD. They point to the fact that Tether Limited, the company behind USDT, claims to hold a reserve of USD that is equivalent to the total supply of USDT in circulation. This, they argue, ensures that USDT can always be redeemed for USD at a 1:1 ratio.

Furthermore, Tether Limited has undergone audits by independent third-party firms, although the results of these audits have not been made publicly available. Supporters also highlight the fact that USDT is widely accepted and used on major cryptocurrency exchanges, indicating that it is trusted and treated as equivalent to USD.

The Case Against USDT’s Link to USD

On the other hand, skeptics raise valid concerns about the lack of transparency and accountability in Tether Limited’s operations. The company has faced legal and regulatory scrutiny in the past, including allegations of manipulating the cryptocurrency market. These incidents have fueled doubts about the true value of USDT and its link to the USD.

In addition, the limited availability of information about Tether Limited’s reserves has raised suspicions that it may not have sufficient USD to back up the total supply of USDT. This could potentially lead to a situation where the value of USDT deviates from its peg to the USD, undermining its stability and trustworthiness.

| Arguments For USDT’s Link to USD | Arguments Against USDT’s Link to USD |

|---|---|

| Claims of USD reserves backing USDT | Lack of transparency and accountability in Tether Limited’s operations |

| Third-party audits (not publicly available) | Legal and regulatory scrutiny |

| Widespread acceptance on major exchanges | Potential lack of sufficient USD reserves |

In conclusion, the true nature of the link between USDT and USD remains a hotly debated topic. While proponents argue that there is a strong link supported by reserve holdings and third-party audits, skeptics highlight the lack of transparency and past controversies surrounding Tether Limited. As with any investment, it is important for traders and investors to conduct their own research and due diligence before placing their trust in USDT or any other cryptocurrency.

Q&A:

What is USDT?

USDT, also known as Tether, is a type of cryptocurrency that is designed to be stable and backed by traditional fiat currencies, such as the US dollar. It is a popular stablecoin used as a substitute for traditional government-issued currencies in the world of cryptocurrency trading.

Is USDT pegged to the US dollar?

Yes, USDT is supposed to be pegged to the US dollar. The company behind USDT claims that for every unit of USDT in circulation, there is an equivalent amount of US dollars held in reserve. This is done to maintain a 1:1 ratio with the US dollar and provide stability to the cryptocurrency.

Are there any concerns about the link between USDT and the US dollar?

Yes, there are concerns about the link between USDT and the US dollar. Critics argue that there is a lack of transparency and proof regarding the reserves backing USDT. The company behind USDT has faced scrutiny and legal issues in the past, which has raised doubts about the true value and stability of the cryptocurrency.

What is the impact of the USDT and USD link on the cryptocurrency market?

The link between USDT and the US dollar has a significant impact on the cryptocurrency market. USDT is widely used as a trading pair on many cryptocurrency exchanges, and its stability is crucial for traders to hedge against market volatility. Any uncertainty or doubt about the link between USDT and the US dollar can lead to a loss of trust, affecting the overall market sentiment and stability.