USDT vs Traditional Banking: Which is the Safer Option for Storing Your Money?

In today’s digital age, the financial landscape is rapidly evolving. With the rise of cryptocurrencies, such as USDT (Tether), many individuals are questioning the safety and security of traditional banking. In this article, we will explore the key differences between USDT and traditional banking and discuss which option may be the safest for storing your hard-earned money.

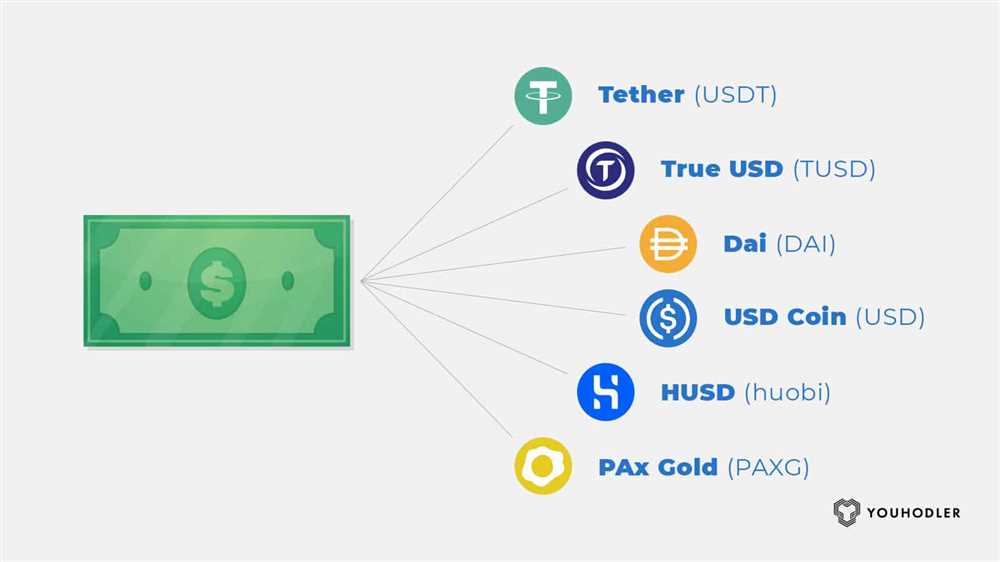

Firstly, let’s discuss USDT, a stablecoin that is pegged to the US dollar. USDT operates on the blockchain technology, providing users with seamless and borderless transactions. One of the key advantages of USDT is its decentralization, which means that it is not controlled by any central authority or government. This decentralized nature offers a level of security and transparency that traditional banking may struggle to provide.

On the other hand, traditional banking has been the backbone of the financial system for centuries. With well-established regulations and safeguards in place, banks offer a certain level of trust and assurance. Deposits in traditional banks are typically insured by government schemes, providing additional security in the event of bank failure. Additionally, banks often provide access to a wide range of financial services, such as loans, mortgages, and investment opportunities.

While both USDT and traditional banking have their own merits, it is essential to assess your own risk tolerance and financial goals. If you value decentralization, fast and secure transactions, and a level of anonymity, USDT may be the safer option for you. However, if you prioritize stability, government-backed insurance, and a wide array of banking services, traditional banking may be the more secure choice.

In conclusion, the decision between USDT and traditional banking ultimately depends on your individual needs and preferences. Both options offer their own set of advantages and disadvantages, and it is crucial to carefully consider your financial priorities before making a decision. As with any financial decision, it is advisable to seek professional advice and do thorough research to ensure the safety of your hard-earned money.

Understanding USDT and Traditional Banking

When it comes to storing your money, there are two main options to consider: USDT and traditional banking. Both options have their own advantages and disadvantages, and it is important to understand the differences between them before making a decision on where to keep your funds.

USDT

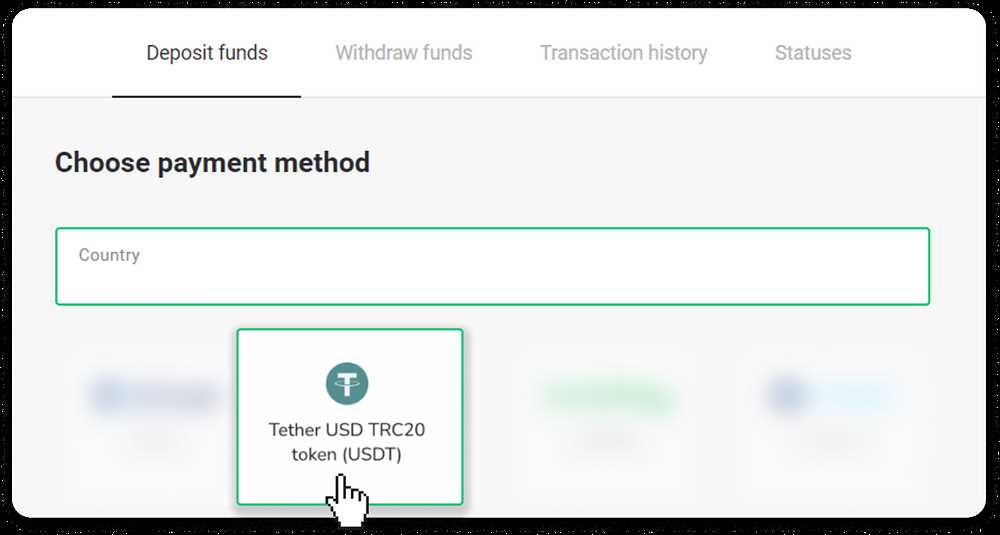

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. It is designed to have a value pegged to a traditional currency, such as the US dollar. USDT is often used as a means of transferring value between different cryptocurrency exchanges, as it offers a stable and easy-to-use alternative to traditional fiat currencies.

One of the main advantages of storing money in USDT is the potential for higher returns compared to traditional banking. Cryptocurrencies can be highly volatile, which means that the value of USDT can increase significantly over time. This can lead to greater profits for investors.

However, it is important to note that USDT also carries certain risks. Cryptocurrencies are subject to regulatory uncertainty and security vulnerabilities, which can lead to loss of funds. Additionally, the value of USDT is tied to the stability of the underlying fiat currency, meaning that if the dollar were to depreciate in value, so too would USDT.

Traditional Banking

Traditional banking refers to the use of brick-and-mortar banks to store and manage money. It offers a secure and regulated environment for individuals to keep their funds. Banks provide services such as checking accounts, savings accounts, and loans.

One of the main advantages of traditional banking is the stability and trust associated with it. Banks are regulated by government authorities, which means that they are required to follow certain standards and practices to protect customer funds. Additionally, banks typically offer deposit insurance, which guarantees that a certain amount of money will be reimbursed to depositors in the event of a bank failure.

However, traditional banking also comes with limitations. Banks may impose fees for certain services, and interest rates on savings accounts may be lower compared to the potential returns from USDT investments. Additionally, traditional banking can be less convenient, as it often requires visiting a physical branch to perform transactions.

In conclusion, both USDT and traditional banking have their own pros and cons. USDT offers the potential for higher returns but carries certain risks associated with cryptocurrencies. Traditional banking provides stability and trust but may have lower returns and limited convenience. Ultimately, the choice between the two will depend on your personal financial goals and risk tolerance.

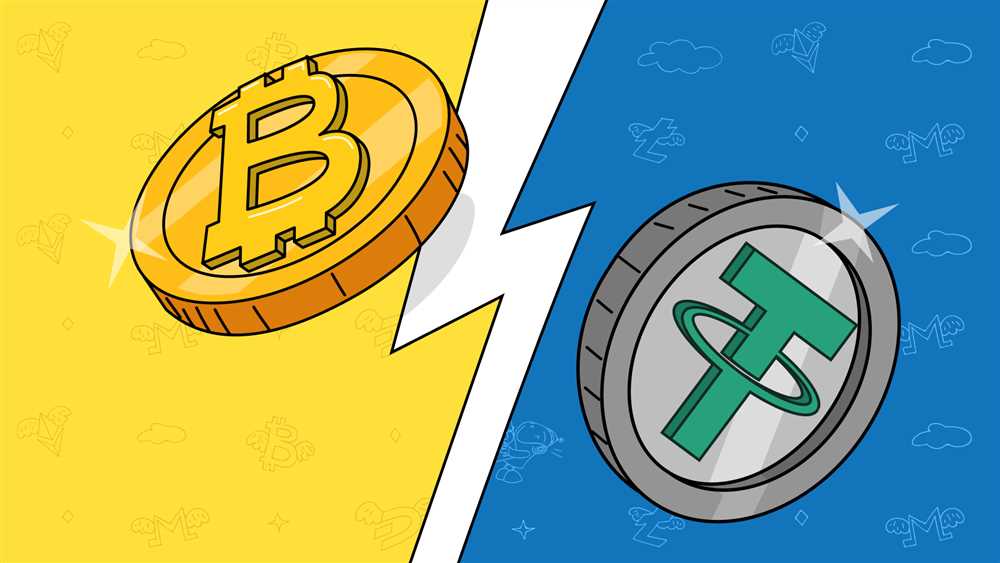

The Security Features of USDT

USDT, also known as Tether, is a cryptocurrency that is designed to mimic the value of traditional fiat currencies like the US dollar. While it offers several benefits, one of the key advantages of using USDT is its robust security features.

1. Blockchain Technology

USDT is built on a blockchain network, which is a decentralized and tamper-proof ledger of transactions. Blockchain technology ensures that all transactions made with USDT are secure and verifiable. It eliminates the risk of fraud or manipulation, as each transaction is recorded and permanently stored on the blockchain.

2. Smart Contract Technology

USDT utilizes smart contract technology, which is a self-executing contract with the terms of the agreement directly written into the code. Smart contracts eliminate the need for intermediaries and ensure that transactions are carried out automatically when pre-defined conditions are met. This enhances the security of USDT transactions and reduces the risk of human error or manipulation.

3. Multi-Factor Authentication

When it comes to securing your USDT wallet, multi-factor authentication is available to provide an additional layer of security. This means that in addition to your username and password, you may need to enter a verification code sent to your mobile device or use biometric authentication to access your wallet. Multi-factor authentication significantly reduces the risk of unauthorized access to your USDT funds.

4. Cold Wallet Storage

USDT employs a storage system known as cold wallet storage for offline storage of funds. Cold wallets are devices or applications that are not connected to the internet, making them immune to hacking attempts. By storing a significant portion of their reserve funds in cold wallets, USDT ensures the security of the stored assets even in the event of a security breach.

5. Transparency and Auditing

USDT is committed to maintaining transparency and ensuring the integrity of its operations. Regular audits are conducted by reputable third-party firms to verify the amount of USDT in circulation and ensure that it is fully backed by reserves. This level of transparency helps build trust among users and assures them that their funds are secure.

In conclusion, USDT provides a range of security features that make it a safe option for storing your money. From blockchain technology to multi-factor authentication and cold wallet storage, USDT employs various measures to safeguard user funds and ensure the integrity of transactions.

The Safety of Traditional Banking

Traditional banking has long been seen as a safe and reliable option for storing your money. With a history dating back centuries, banks have established systems and regulations in place to protect your funds. Here are some key reasons why traditional banking is considered a secure way to store your money:

Federal Deposit Insurance Corporation (FDIC) Protection

One of the main reasons why traditional banking is considered safe is because of the existence of the Federal Deposit Insurance Corporation (FDIC) in the United States. The FDIC is an independent agency that insures deposits in banks and savings associations. If a bank fails, the FDIC steps in to protect depositors by reimbursing them for their losses, up to a certain limit.

This means that even if your bank were to face financial difficulties and go out of business, your deposits would still be protected by the FDIC, up to a certain amount. This provides peace of mind and ensures that you will not lose your hard-earned money.

Regulatory Oversight

Another factor that contributes to the safety of traditional banking is the strict regulatory oversight that banks are subject to. Banks are heavily regulated by government agencies such as the Office of the Comptroller of the Currency (OCC), the Federal Reserve System, and the Consumer Financial Protection Bureau (CFPB), among others.

These regulatory bodies have the power to monitor and supervise banks to ensure that they are following the rules and regulations designed to protect consumers. They also conduct regular audits to evaluate banks’ financial health and risk management practices. This oversight helps to prevent fraud, money laundering, and other illicit activities that can put depositors’ funds at risk.

Physical Security Measures

In addition to regulatory oversight, traditional banks have physical security measures in place to protect their customers’ funds. Banks invest in high-level security systems and employ security personnel to safeguard their premises and the money they hold.

These security measures include features such as surveillance cameras, access controls, alarms, and secure vaults. The physical presence of these security measures in bank branches adds an extra layer of protection to your money.

| Pros of Traditional Banking | Cons of Traditional Banking |

|---|---|

| FDIC protection | Limited access to funds |

| Regulatory oversight | Potential for fees |

| Physical security measures | Dependence on bank hours and locations |

| Convenience of in-person services | Lower interest rates compared to other options |

In conclusion, traditional banking is generally seen as a safe option for storing your money due to the protection provided by the FDIC, regulatory oversight, and physical security measures. While there are some limitations and potential drawbacks, the overall safety and reliability of traditional banking make it a popular choice for many individuals and businesses.

Comparing the Safety of USDT and Traditional Banking

When it comes to storing your money, safety is of utmost importance. In this article, we will compare the safety of USDT (Tether) and traditional banking to help you make an informed decision.

USDT Safety

USDT, also known as Tether, is a digital currency that aims to provide stability by maintaining a 1:1 ratio with the US dollar. One of the main advantages of USDT is its transparency. It operates on the blockchain, which means that all transactions are recorded and can be verified. This provides a certain level of security as there is no central authority controlling the currency. Additionally, USDT is backed by reserves, which are regularly audited to ensure that the currency is fully backed by fiat currency.

However, it is important to note that USDT has faced some controversies in the past. Concerns have been raised about the transparency of its reserves, and there have been allegations of market manipulation. Although these issues have not affected the stability of USDT in a significant way, they highlight the potential risks associated with using digital currencies.

Traditional Banking Safety

Traditional banking has been the go-to option for storing money for centuries. It provides various safety measures to protect deposits, such as federal deposit insurance. In the United States, deposits in federally insured banks are protected by the Federal Deposit Insurance Corporation (FDIC), up to $250,000 per depositor per insured bank. This means that even if the bank were to fail, depositors would be able to recover their funds.

Furthermore, traditional banks have rigorous security measures in place to prevent unauthorized access to accounts and protect against fraud. They employ advanced encryption technologies and have dedicated security teams to monitor and respond to any suspicious activity.

Conclusion

Both USDT and traditional banking have their own safety measures in place to protect your money. USDT offers transparency through its blockchain technology and reserves backing, while traditional banking provides deposit insurance and advanced security measures. Ultimately, the choice between the two options will depend on your personal preferences and risk tolerance.

It is always recommended to do thorough research and carefully consider the potential risks before making any decisions regarding the safety of your money.

Question-answer:

Is USDT a safe option for storing money?

USDT is considered to be a relatively safe option for storing money. It is backed by reserves of fiat currency, making it less volatile than other cryptocurrencies. However, there is still some level of risk involved as the stability of the reserves can be questioned.

How does USDT compare to traditional banking in terms of safety?

USDT and traditional banking have different levels of safety. Traditional banks are regulated and insured, providing a higher level of security for storing money. USDT, on the other hand, relies on the trust in the reserves and the stability of the cryptocurrency market, which can be more volatile and less secure.

What are the advantages of storing money in traditional banks instead of USDT?

Storing money in traditional banks offers several advantages over USDT. Firstly, traditional banks are regulated and insured, providing more security and peace of mind. Secondly, banks offer a range of financial services such as loans, credit cards, and investment options, which are not available with USDT. Lastly, traditional banks have physical branches and ATMs for easy access to funds.

Are there any risks associated with storing money in USDT compared to traditional banking?

There are risks associated with storing money in USDT compared to traditional banking. USDT is a cryptocurrency and its value can be volatile. Additionally, the stability of the reserves backing USDT can be questioned, as there have been controversies and concerns raised in the past. Traditional banks, on the other hand, are regulated, insured, and provide a higher level of security for stored money.