The Safety Dilemma: Evaluating the Reliability of USD and USDT

As the world becomes increasingly interconnected, the demand for cross-border transactions has grown exponentially. This has led to the rise of digital currencies as a means of facilitating these transactions. Among the most popular digital currencies are USD (United States Dollar) and USDT (Tether), which are designed to have a 1:1 value ratio with the US dollar. However, questions have been raised about the reliability and safety of these currencies.

One of the main concerns regarding the reliability of USD and USDT is their ability to maintain a stable value. The value of traditional fiat currencies, such as the US dollar, is backed by the trust and confidence that people have in the issuing government. However, digital currencies like USDT do not have a central authority or government backing them, which has raised doubts about their long-term stability.

Another factor that affects the reliability of USD and USDT is their transparency and accountability. Traditional financial institutions undergo rigorous audits and regulatory oversight to ensure the safety of their customers’ funds. However, the same level of transparency and accountability is not always present in the world of digital currencies. This lack of oversight has led to concerns about potential fraud and manipulation in the market.

Despite these concerns, both USD and USDT have gained widespread acceptance and are used by millions of individuals and businesses around the world. Their convenience and ease of use have made them attractive options for those seeking to transact across borders quickly and efficiently. However, it is essential for users to understand the potential risks involved and take appropriate measures to protect their investments.

In conclusion, evaluating the reliability of USD and USDT requires a careful consideration of various factors, such as stability, transparency, and accountability. While these digital currencies offer convenience and efficiency, they also come with inherent risks. Users need to stay informed and make educated decisions to navigate the safety dilemma in the digital currency landscape.

Evaluating the Reliability of USD and USDT

The reliability of digital currencies has become increasingly important as more people adopt them in everyday transactions. Two popular digital currencies that are often used in the crypto space are the USD (United States Dollar) and USDT (Tether).

USD is the traditional fiat currency of the United States and is widely recognized and accepted around the world. It is backed by the US government and is regulated by various financial institutions, making it a reliable and stable currency.

On the other hand, USDT is a stablecoin that is pegged to the value of the USD. It is issued by Tether Limited, a private company, and is supposed to be backed one-to-one by USD reserves held in their bank accounts. The main purpose of USDT is to provide stability in the volatile cryptocurrency market.

However, the reliability of USDT has been the subject of controversy and skepticism. There have been concerns about whether Tether actually holds enough USD reserves to fully back the amount of USDT in circulation. The company has faced allegations of not being transparent with its reserves and has been under scrutiny from regulators.

While USD is backed by a government and subject to regulatory oversight, USDT is not. This key difference raises questions about the long-term reliability and safety of USDT. If Tether is unable to prove that it holds sufficient reserves, it could potentially lead to a loss of confidence in USDT and a subsequent decline in its value.

Investors and users of digital currencies need to carefully evaluate the reliability of USD and USDT before engaging in transactions. While USD offers the stability and legitimacy of a government-backed currency, USDT presents additional risks due to its opaque reserve backing and lack of regulatory oversight.

In conclusion, the reliability of USD and USDT differs greatly due to their underlying structure and regulatory oversight. It is important for individuals to do their research and understand the risks involved before deciding which currency to use in their transactions.

The Importance of Fiat Currency in Modern Economy

Fiat currency, also known as paper money or legal tender, plays a crucial role in the functioning of modern economies. Unlike commodity money, which has intrinsic value based on the material it’s made of (like gold or silver), fiat currency has value only because the government decrees it as legal tender. While cryptocurrencies like USD and USDT have gained popularity in recent years, fiat currency remains an essential tool for economic stability and prosperity.

1. Medium of Exchange

Fiat currency serves as a widely accepted medium of exchange for the buying and selling of goods and services. It provides a convenient and universally recognized means of transactions, allowing individuals and businesses to engage in economic activities seamlessly. The widespread acceptance of fiat currency instills confidence and trust in the economic system.

2. Store of Value

Fiat currency acts as a reliable store of value, preserving wealth for future use. Unlike other assets that may be subject to significant fluctuations in value, such as stocks or real estate, fiat currency allows individuals to preserve their purchasing power over time. This stability makes it easier for individuals to plan for long-term financial goals and protects against inflationary pressures.

Furthermore, fiat currency allows for the accumulation of savings, which contributes to capital formation and investment in the economy. It provides individuals with the ability to accumulate wealth and make future investments, fostering economic growth and development.

In conclusion, fiat currency plays a critical role in the modern economy by serving as a universally accepted medium of exchange and a stable store of value. While cryptocurrencies have emerged as alternative forms of currency, fiat currency remains essential for economic stability and growth. It provides the foundation for economic transactions and enables individuals and businesses to plan for the future with confidence.

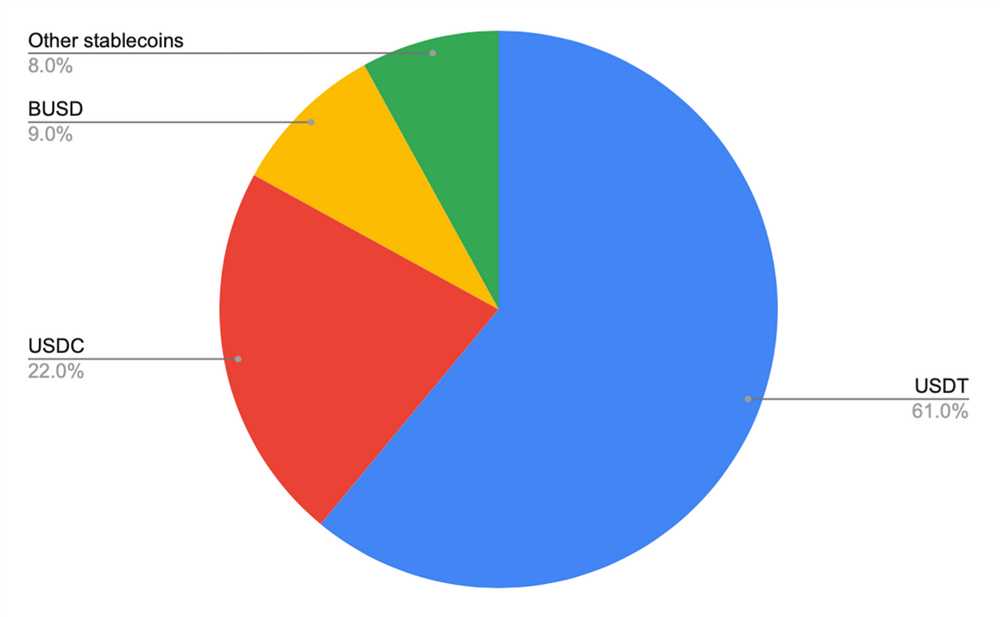

Understanding the Role of Stablecoins

Stablecoins play a crucial role in the world of cryptocurrencies and digital assets. Unlike other cryptocurrencies such as Bitcoin or Ethereum, stablecoins are designed to maintain a stable value. This stability is achieved by pegging these digital assets to a more stable asset, often a fiat currency like the US Dollar.

The primary purpose of stablecoins is to provide a safeguard against the volatile nature of other cryptocurrencies. While the value of Bitcoin, for example, can fluctuate dramatically in a short period, stablecoins aim to provide a reliable and constant value that users can trust.

Stablecoins have gained significant popularity due to their ability to offer stability and act as a bridge between the traditional financial system and the digital asset space. They can be a useful tool for traders who want to avoid the hassle of converting fiat currencies to cryptocurrencies every time they make a transaction.

In addition to their role in day-to-day transactions, stablecoins can also be used for remittances and cross-border payments. With stablecoins, individuals and businesses can send and receive funds quickly and at low costs, bypassing the traditional banking system’s inefficiencies.

Another important use case for stablecoins is their potential in decentralized finance (DeFi) applications. Stablecoins can serve as a stable store of value within DeFi platforms, enabling users to lend, borrow, and earn interest on their digital assets without exposing themselves to the volatility of other cryptocurrencies.

- Stablecoins provide stability and act as a reliable store of value.

- They bridge the gap between traditional finance and digital assets.

- Stablecoins enable fast and low-cost remittances and cross-border payments.

- They play a crucial role in decentralized finance applications.

Overall, stablecoins offer a practical solution for individuals and businesses seeking stability in the digital asset space. Their ability to maintain a constant value makes them an attractive option for various use cases, from everyday transactions to DeFi applications. However, it is essential to evaluate the reliability and trustworthiness of stablecoins before fully embracing them.

Assessing the Reliability of USD

As the dominant global reserve currency, the United States dollar (USD) plays a vital role in international trade and finance. The reliability of the USD is crucial to maintaining stability in the global economy.

There are several key factors to consider when assessing the reliability of the USD:

1. Central Bank Policies: The decisions made by the U.S. Federal Reserve have a significant impact on the value and stability of the USD. The Federal Reserve’s ability to implement effective monetary policies, such as adjusting interest rates and managing inflation, is crucial in maintaining the reliability of the currency.

2. Economic Performance: The overall economic performance of the United States, including factors such as GDP growth, employment levels, and fiscal policies, can affect the reliability of the USD. A strong and stable economy generally contributes to the confidence in the currency.

3. Political Stability: Political stability and a transparent legal framework are important for maintaining the reliability of a currency. The stability of the U.S. government, its commitment to upholding property rights, and the rule of law are key factors in assessing the reliability of the USD.

4. International Acceptance: The USD’s status as the world’s primary reserve currency provides a level of reliability. The widespread acceptance and use of the USD in international transactions, trade, and finance make it a preferred currency for many countries and investors.

5. Market Confidence: The confidence and trust of market participants, including businesses, investors, and consumers, are essential for the reliability of any currency. The USD’s reputation as a stable and reliable currency is built on the trust it has garnered over the years.

Overall, evaluating the reliability of the USD requires an analysis of various economic, political, and market factors. While no currency is completely immune to risks and fluctuations, the USD has historically demonstrated a strong level of reliability, making it a trusted currency globally.

The Safety Dilemma of USDT

USDT, also known as Tether, is a cryptocurrency that claims to be backed by US dollars at a ratio of 1:1. This has led to its widespread use as a stablecoin, providing a stable value in a volatile crypto market. However, there are concerns about the safety and reliability of USDT, which have raised a safety dilemma for investors and traders.

One of the main concerns with USDT is the lack of transparency and auditability. The company behind USDT, Tether Limited, has faced scrutiny for its lack of a comprehensive audit, leading to doubts about whether the promised 1:1 ratio between USDT and USD is accurate. Without an independent audit, it is difficult to verify the actual reserves backing USDT, which poses a risk for investors who rely on its stability.

Another safety concern is the potential for regulatory issues. As USDT operates in a regulatory grey area, there is a risk that it could face regulatory crackdowns or legal challenges. This could result in frozen funds or even the collapse of USDT, causing significant losses for investors. The lack of clarity on the legal and regulatory status of USDT adds to the safety dilemma surrounding its use.

In addition, there have been instances where USDT has faced liquidity issues. During times of high market volatility or uncertainty, there have been reports of difficulty in redeeming USDT for USD at the promised 1:1 ratio. This raises concerns about the ability to convert USDT back to USD when needed, potentially resulting in financial losses for users.

Furthermore, USDT has faced allegations of market manipulation. There have been concerns that Tether Limited may be artificially inflating the price of Bitcoin by issuing and buying USDT. These allegations add another layer of uncertainty to the safety of USDT, as it raises questions about its integrity and the trustworthiness of its operators.

Overall, the safety dilemma surrounding USDT arises from its lack of transparency, potential regulatory issues, liquidity concerns, and allegations of market manipulation. Investors and traders should carefully evaluate the risks associated with USDT and consider alternative stablecoin options to ensure the safety of their investments.

Question-answer:

What is USD and USDT?

USD stands for United States Dollar, which is the official currency of the United States. USDT is a cryptocurrency known as Tether, which is pegged to the value of the USD.

Why is there a safety dilemma when evaluating the reliability of USD and USDT?

The safety dilemma arises because USD is a traditional fiat currency that is backed by the trust people have in the US government and their economic stability. On the other hand, USDT is a cryptocurrency that claims to be backed by an equal amount of USD in reserves. However, there have been concerns and controversies regarding the transparency and legitimacy of Tether’s reserves, raising doubts about its true reliability.