Exploring the Factors that Affect Risks in USD and USDT Investments

Investing in USD and USDT can provide investors with opportunities for profit and stability. However, it is crucial to understand the risk factors associated with holding these investments. By analyzing these risk factors, investors can make informed decisions and minimize potential losses.

Exchange Rate Risk: One of the main risk factors of holding USD and USDT investments is the fluctuation in exchange rates. Currencies, including the USD and USDT, are influenced by economic and political factors, which can cause significant changes in their values. Investors need to monitor and evaluate these factors to mitigate the potential impact on their investments.

Inflation Risk: Another risk factor to consider is inflation, which is the decrease in purchasing power over time. Both USD and USDT investments can be affected by inflation as the value of these currencies may erode. It is crucial for investors to assess the inflation rate and adjust their investment strategies accordingly to protect their wealth.

Counterparty Risk: Holding USD and USDT investments also carries counterparty risk. This refers to the risk of the counterpart, such as a bank or financial institution, failing to fulfill their obligations. In the case of USDT, investors must be cautious about the stability and credibility of the issuer. Understanding the counterparty risk is essential to ensure the safety of investments.

Liquidity Risk: Finally, investors should be mindful of the liquidity risk of holding USD and USDT investments. Liquidity refers to the ease of buying and selling an investment without causing significant price changes. If there is limited liquidity, it can be challenging to liquidate investments at a desirable price, potentially resulting in losses. Therefore, investors need to assess the liquidity conditions of these currencies to manage this risk effectively.

By carefully analyzing and monitoring these risk factors, investors can make informed decisions when holding USD and USDT investments. A comprehensive understanding of these risks is crucial for managing portfolios and maximizing returns while minimizing potential losses.

The Importance of Risk Analysis for Holding USD and USDT Investments

When it comes to investing in USD and USDT, it is crucial to conduct a thorough risk analysis. This analysis helps individuals and institutions make informed decisions, minimize potential losses, and preserve their capital.

One of the main reasons why risk analysis is important for holding USD and USDT investments is the volatility of the market. The value of these currencies can fluctuate rapidly due to various factors such as economic conditions, political instability, and market sentiments. By analyzing these risks, investors can better understand the potential downsides and adjust their investment strategies accordingly.

Another important aspect of risk analysis is assessing the credit risk associated with USD and USDT investments. Both currencies are subject to counterparty risk, which refers to the possibility of the issuing institution defaulting on its obligations. Investors should assess the credibility and financial stability of the institutions behind these currencies to minimize the risk of losing their investments.

Furthermore, risk analysis helps investors identify and mitigate liquidity risk. Liquidity risk refers to the difficulty of converting an investment into cash quickly and at a fair price. By analyzing the liquidity of USD and USDT investments, investors can avoid situations where they are unable to sell their assets when needed or forced to do so at unfavorable prices.

Additionally, risk analysis helps investors understand the regulatory risks associated with holding USD and USDT investments. Regulatory changes, such as new laws or regulations, can significantly impact the value and availability of these currencies. By staying informed and analyzing these risks, investors can adapt their investment strategies accordingly.

In conclusion, conducting a comprehensive risk analysis is essential for individuals and institutions holding USD and USDT investments. It helps them understand the volatility, credit, liquidity, and regulatory risks associated with these currencies. By analyzing these risks, investors can make informed investment decisions and protect their capital in an unpredictable market.

Understanding the Volatility of USD

When considering the risk factors of holding USD investments, it is crucial to understand the volatility of the currency. The United States dollar (USD) is one of the most widely traded currencies in the world, used as a global reserve currency and for international trade transactions.

One of the key factors that contribute to the volatility of the USD is macroeconomic data. Various economic indicators, such as GDP growth, inflation rates, and unemployment figures, can greatly influence the value of the currency. Positive economic data tends to strengthen the USD, while negative data can weaken it.

Another factor that impacts the volatility of the USD is monetary policy. The Federal Reserve plays a crucial role in determining interest rates and implementing monetary policies, which directly affect the value of the currency. Changes in interest rates can lead to fluctuations in the USD exchange rate, making it more or less attractive to investors.

Political and geopolitical events also have a significant impact on the volatility of the USD. Elections, policy announcements, and international conflicts can cause fluctuations in the currency value. For example, uncertainty surrounding trade tensions or geopolitical risks can lead to increased volatility in the USD.

Furthermore, market sentiment and investor behavior can also contribute to the volatility of the USD. Market participants react to news, economic data, and other factors, leading to shifts in demand and supply for the currency. Speculative trading and investor sentiment can create additional volatility in the USD’s exchange rate.

It is important for investors to closely monitor these factors and keep up with the latest news and developments that may impact the volatility of the USD. By understanding and managing the risks associated with the currency, investors can make informed decisions when it comes to holding USD investments.

Evaluating the Stability of USDT

When investing in USD, stability is usually one of the key factors considered by investors. However, when it comes to USDT (Tether), there are some significant concerns about its stability. USDT is a type of stablecoin that claims to be backed by the US dollar, but its stability has been questioned by many experts.

There are several risk factors that contribute to the potential instability of USDT. One of the main concerns is the transparency of its reserves. Tether claims that each USDT is backed by one US dollar held in reserve, but there have been doubts about the legitimacy of this claim. In the past, Tether faced accusations of printing USDT without adequate reserves, which further raised concerns about its stability.

Another risk factor is the potential legal and regulatory issues surrounding USDT. The lack of clear regulations in the cryptocurrency industry makes it difficult to assess the risks associated with stablecoins like USDT. If there are any legal or regulatory actions taken against Tether, it could have a significant impact on the stability of USDT and its value.

Moreover, the centralized nature of USDT is also considered a risk factor. Unlike decentralized cryptocurrencies, USDT is managed by a single entity, which means there is a central point of failure. If this entity faces any operational or financial difficulties, it could affect the stability of USDT.

Lastly, the potential influence of market sentiment on USDT stability should not be overlooked. The perception of USDT as a stablecoin can be affected by negative news or speculations, leading to a decrease in demand and ultimately impacting its stability.

| Risk Factors | Description |

|---|---|

| Transparency of reserves | Doubts about the legitimacy of US dollar reserves backing USDT |

| Legal and regulatory issues | Potential legal actions or regulatory actions against Tether |

| Centralized nature | USDT managed by a single entity, creating a central point of failure |

| Market sentiment | Negative news or speculations impacting the demand for USDT |

Comparing the Risk Factors of Holding USD and USDT

When it comes to choosing between holding USD (United States Dollar) or USDT (Tether), there are several risk factors that should be considered. While both currencies have their advantages, they also come with their own set of risks. Understanding these risks can help investors make more informed decisions.

1. Exchange Rate Risk

One of the main risk factors associated with holding USD is the exchange rate risk. The value of the USD can fluctuate against other currencies, which can impact the purchasing power of the investment. On the other hand, USDT is a stablecoin pegged to the value of the USD. While this may reduce exchange rate risk, there is still a potential risk if the peg is not maintained.

2. Counterparty Risk

Counterparty risk refers to the risk of default by the party with whom the investment is held. When holding USD, the counterparty risk typically involves a financial institution or a government. In the case of USDT, the risk is associated with Tether, the company behind the stablecoin. It is important to assess the credibility and trustworthiness of the counterparty to mitigate this risk.

3. Regulatory Risk

Regulatory risk is a factor that could affect both USD and USDT investments. As a traditional currency, the USD is subject to government regulations and policies that could impact its value or accessibility. As for USDT, the stablecoin has faced regulatory scrutiny and concerns about its transparency and reserves. Any regulatory actions or changes in regulations could pose a risk to the stability of USDT.

4. Liquidity Risk

Liquidity risk refers to the risk of not being able to sell or convert an investment into cash quickly without significant loss. While USD is a widely accepted and traded currency, there may still be instances where liquidity can be an issue. On the other hand, USDT is traded on cryptocurrency exchanges and its liquidity can be affected by market conditions and demand.

- Conclusion: When comparing the risk factors of holding USD and USDT, it is important to consider factors such as exchange rate risk, counterparty risk, regulatory risk, and liquidity risk. Each currency has its own unique risks, and investors should assess their risk tolerance and objectives before making a decision.

Strategies for Mitigating the Risks of Holding USD and USDT Investments

Investing in USD and USDT carries certain risks that investors should be aware of. However, there are strategies you can implement to help mitigate these risks and protect your investments.

1. Diversify Your Portfolio

One of the most effective ways to reduce risk is by diversifying your portfolio. Instead of solely holding USD or USDT, consider investing in a variety of assets, such as stocks, bonds, commodities, or foreign currencies. By diversifying, you can spread out your risk and minimize the impact of any potential losses.

2. Stay Updated on Market News

Keeping yourself informed about market news and events can help you make better investment decisions. Stay up to date on economic indicators, geopolitical developments, and central bank policies that may impact the value of USD and USDT. This information can alert you to potential risks and allow you to adjust your investment strategy accordingly.

Furthermore, make use of reputable financial news sources and consider consulting with financial professionals to get expert opinions and insights.

3. Set Clear Risk Management Goals

Before investing in USD or USDT, it is important to set clear risk management goals. Determine your risk tolerance level and establish a plan for managing potential losses. Consider setting stop-loss orders or trailing stops to protect your investments from significant downturns.

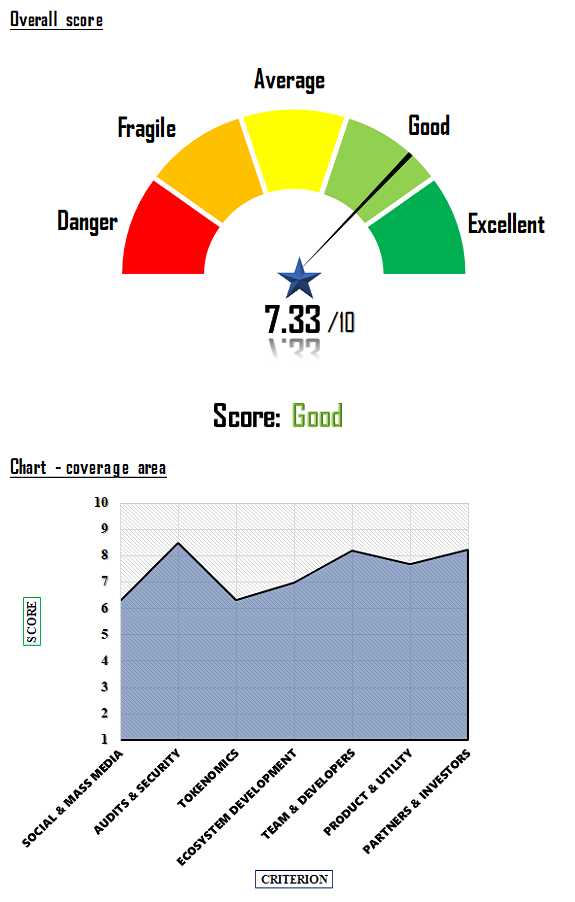

4. Conduct Thorough Due Diligence

Performing thorough due diligence is crucial when investing in USD or USDT. Research the stability and credibility of the currency issuer or the institution behind the stablecoin. Check for any regulatory approval or audits that have been conducted. Understanding the underlying mechanisms and security measures of USD and USDT can help you make informed investment decisions.

5. Regularly Review and Rebalance Your Portfolio

Investments should be regularly reviewed and rebalanced to ensure they align with your financial goals and risk tolerance. Monitor the performance of your USD and USDT investments and adjust your portfolio if necessary. If one asset becomes too dominant or if its risk profile changes significantly, consider reallocating your investments to maintain a balanced portfolio.

Remember, while these strategies can help mitigate risk, investing always carries some level of risk. It is important to conduct thorough research and evaluate your personal investment goals and risk tolerance before making any investment decisions.

Q&A:

What are the main risk factors of holding USD and USDT investments?

The main risk factors of holding USD and USDT investments include market volatility, currency devaluation, economic uncertainty, and geopolitical risks. These factors can lead to potential losses or fluctuations in the value of the investments.

How does market volatility affect USD and USDT investments?

Market volatility can have a significant impact on USD and USDT investments. During periods of high volatility, the value of these investments can fluctuate greatly, potentially resulting in losses or reduced returns for investors.

What is currency devaluation and how does it affect USD and USDT investments?

Currency devaluation refers to a decrease in the value of a currency relative to other currencies. When a currency is devalued, it can negatively affect USD and USDT investments by reducing the purchasing power of the currency and potentially leading to losses for investors.

What are some examples of geopolitical risks that can impact USD and USDT investments?

Geopolitical risks that can impact USD and USDT investments include political instability, trade disputes, economic sanctions, and military conflicts. These risks can create uncertainties in the market and lead to fluctuations in the value of USD and USDT investments.