Understanding the Recent Controversy: Can USDT Be Frozen?

The recent controversy surrounding USDT, the leading stablecoin in the cryptocurrency market, has raised concerns among investors and traders alike. With its value pegged to the US dollar, USDT has been widely used as a popular alternative to traditional fiat currencies for trading and storing value.

However, recent reports have suggested that USDT could potentially be frozen, leading to panic and uncertainty among the cryptocurrency community. This has prompted many to question the stability and reliability of USDT, and whether it can truly live up to its promise of being a stable and secure digital asset.

USDT is issued by Tether, a company that claims to maintain a 1:1 reserve of US dollars for every USDT token in circulation. This backing by real-world assets has been the main selling point for USDT, as it provides investors with a sense of security and stability in an otherwise volatile market.

Despite these claims, there have been allegations that Tether does not have sufficient reserves to back up the USDT tokens in circulation. This has led to speculation that USDT could potentially be frozen or rendered worthless in the event of a financial crisis or regulatory crackdown.

While Tether has repeatedly denied these allegations and reassured investors of its financial integrity, the recent controversy has cast a shadow of doubt over the future of USDT. Traders and investors are now left wondering whether USDT can truly be trusted as a stable and secure digital asset, or if it is just another ticking time bomb waiting to explode.

The Background of the Recent USDT Controversy

The recent controversy surrounding USDT, also known as Tether, has sparked concerns and debates within the cryptocurrency community. USDT is a stablecoin, meaning it is designed to maintain a stable value by being pegged to a reserve of real-world assets, typically the US dollar. It is one of the most widely used stablecoins in the crypto market.

The controversy began with allegations that the company behind USDT, Tether Limited, did not have sufficient reserves to back up the USDT tokens in circulation. These allegations raised concerns about the solvency and transparency of Tether, as well as the potential impact on the broader cryptocurrency market.

In response to these allegations, Tether Limited released periodic attestations from accounting firm Friedman LLP, which claimed that Tether’s reserve holdings were fully backed by an equivalent amount of fiat currency. However, the lack of a full audit conducted by a reputable third-party has perpetuated doubts and speculation among skeptics.

Furthermore, in February 2021, Tether reached a settlement with the New York Attorney General’s office over allegations that it had misrepresented the backing of USDT tokens and had not disclosed the loss of $850 million in customer funds held by a payment processor called Crypto Capital. As part of the settlement, Tether agreed to provide regular reports on its reserves and undergo quarterly reviews of its finances.

However, the controversy surrounding USDT was reignited in June 2021 when the company announced that it had reversed its earlier claims and that USDT was only backed by 2.9% cash and equivalents. This revelation caused panic among cryptocurrency investors and led to increased scrutiny of Tether’s operations.

As the debate continues, there are concerns that a loss of trust in USDT could have far-reaching consequences for the broader cryptocurrency market. USDT is widely used as a trading pair for many cryptocurrencies and is often used as a liquidity provider for various decentralized exchanges. If USDT loses its peg to the US dollar or encounters any significant issues, it could have a destabilizing effect on the entire market.

In conclusion, the recent USDT controversy has raised serious questions about the transparency and reliability of one of the largest stablecoins in the market. The lack of a comprehensive audit and the frequent changes in the company’s claims have fueled skepticism and concerns among investors. It is crucial for the cryptocurrency community to closely monitor the developments surrounding USDT and ensure the stability and trustworthiness of the stablecoin market.

The Debate Over the Freezing of USDT

The recent controversy surrounding USDT, the popular stablecoin, has sparked a heated debate within the cryptocurrency community. The question at the center of this debate is whether or not it is truly possible for USDT to be frozen.

USDT, also known as Tether, is a cryptocurrency that is pegged to the value of the US dollar. It is designed to provide stability in an otherwise volatile market by maintaining a constant value. However, recent events have raised concerns about the security and legitimacy of USDT.

The Argument for Freezing USDT

Advocates for the freezing of USDT argue that it is necessary to prevent fraud and protect investors. They argue that USDT operates in a decentralized manner, making it vulnerable to malicious actors who could manipulate the value of the coin or engage in fraudulent activities.

Furthermore, they point to the fact that USDT is not backed by actual dollars held in reserve, but instead relies on reserves that may include other assets. This lack of transparency and verification raises concerns about the stability and solvency of USDT.

Proponents of freezing USDT believe that freezing the stablecoin would provide an opportunity to investigate and address these concerns. By temporarily freezing USDT, regulators and auditors would have the chance to conduct a thorough investigation and ensure that the cryptocurrency is operating in a transparent and secure manner.

The Argument Against Freezing USDT

On the other side of the debate, opponents of freezing USDT argue that doing so would undermine the very principles of decentralization and censorship resistance that cryptocurrencies are built upon. They argue that freezing USDT would set a dangerous precedent and open the door to further censorship and control over cryptocurrencies.

They also point out that USDT has been in operation for several years without any major incidents, and that the recent controversy is merely the result of speculation and fear-mongering. They argue that freezing USDT would create unnecessary panic and disrupt the market, potentially causing more harm than good.

Opponents of freezing USDT believe that a more measured approach, such as increased transparency and audits, would be a better solution. They argue that these measures would address the concerns surrounding USDT without compromising the fundamental principles of cryptocurrencies.

- In conclusion, the debate over the freezing of USDT is a complex and multifaceted issue. Advocates for freezing USDT argue that it is necessary to protect investors and prevent fraud, while opponents argue that it would undermine the principles of decentralization. Ultimately, the decision on whether or not to freeze USDT will have far-reaching implications for the future of cryptocurrencies.

Examining the Possibility of USDT Being Frozen

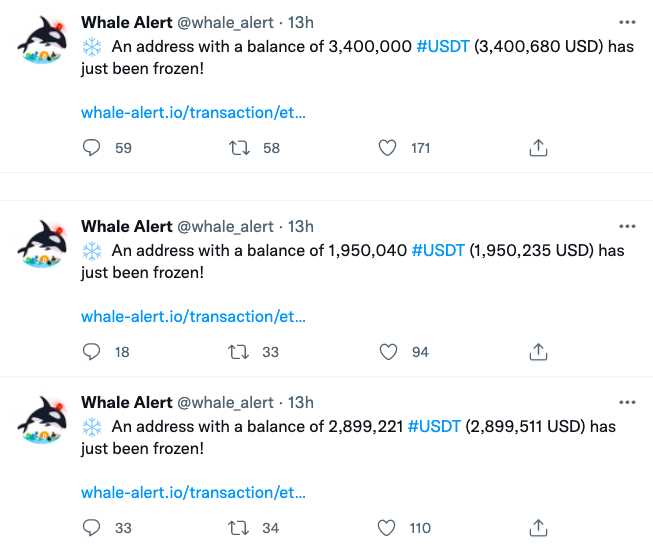

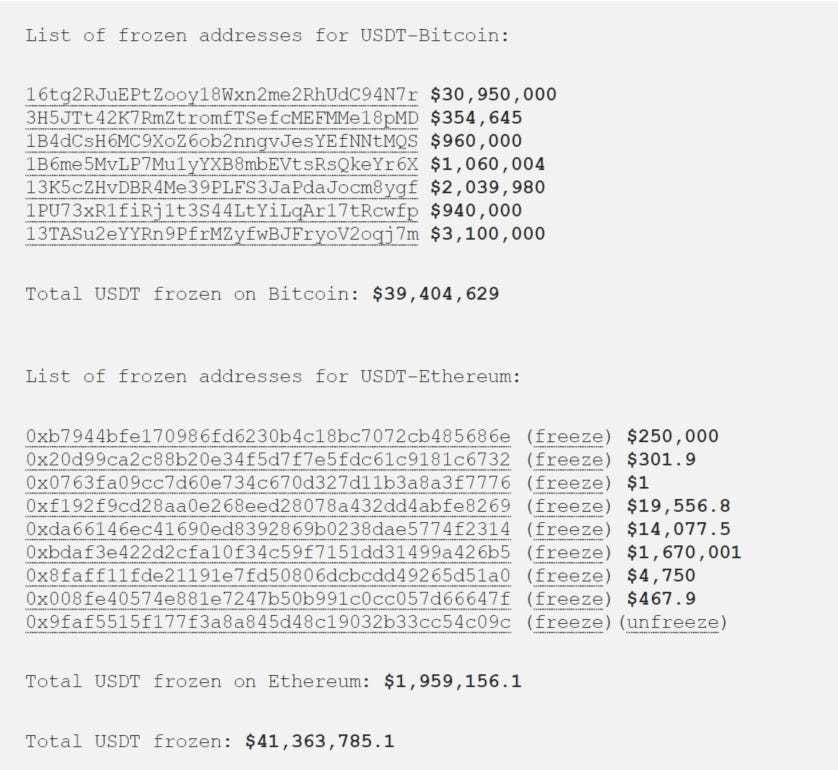

Recent controversies surrounding USDT have raised concerns about the stability and security of the popular stablecoin. One of the major concerns is the possibility of USDT being frozen by the company that issues it, Tether Limited.

The Role of Tether Limited

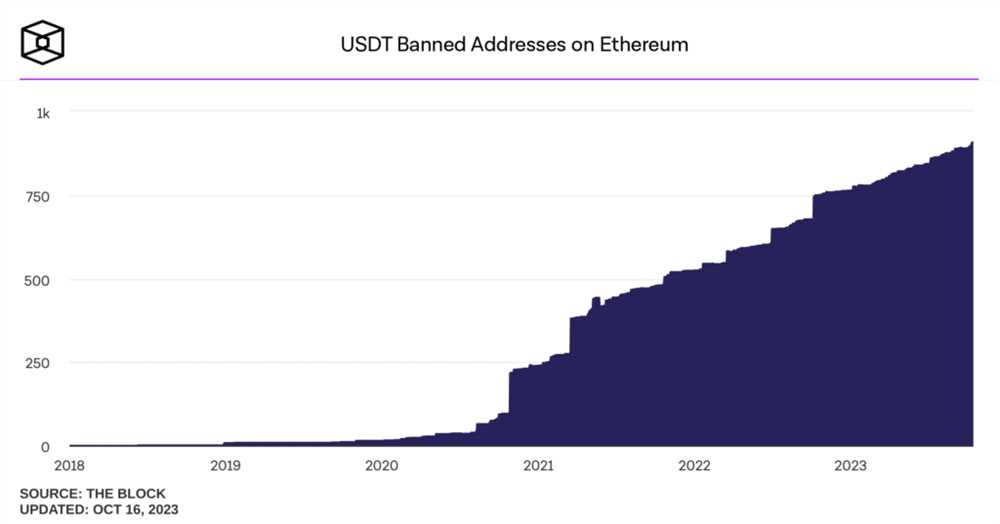

Tether Limited is responsible for issuing and maintaining the USDT stablecoin. As the issuer, they have the power to freeze USDT holdings, meaning that they can prevent users from transferring or redeeming their tokens.

While Tether Limited claims that they have never frozen any USDT holdings, some skeptics argue that the possibility still exists. They point out that the terms of service for USDT explicitly state that Tether Limited has the right to refuse service to anyone for any reason, including freezing or blocking transactions.

Implications and Controversies

If USDT were to be frozen, it could have significant implications for the cryptocurrency market. USDT is one of the most widely used stablecoins and acts as a convenient bridge between fiat currencies and cryptocurrencies in many exchanges.

Controversies surrounding USDT freezing would likely lead to a loss of trust in the stablecoin and could cause investors and traders to seek alternative stablecoin options. This could potentially disrupt liquidity in the cryptocurrency market and cause price instability.

There have been instances in the past where concerns about Tether’s reserves and freezing of funds led to market volatility. The fear of USDT holders being unable to access their funds can lead to panic selling and a downward spiral in prices.

| Possibility | Implications |

|---|---|

| If USDT is frozen | – Loss of trust in USDT

– Potential disruption of liquidity – Price instability |

| If USDT is not frozen | – Increased confidence in USDT

– Stability in the cryptocurrency market – Continued usage and adoption of USDT |

Ultimately, the possibility of USDT being frozen by Tether Limited raises concerns about the centralized nature of the stablecoin. Unlike decentralized cryptocurrencies like Bitcoin, USDT relies on a single entity to maintain and regulate it. This centralization introduces risks and vulnerabilities that could undermine the stability and trustworthiness of USDT.

As the cryptocurrency market continues to evolve, it is crucial for investors and users to carefully consider the risks and implications associated with different cryptocurrencies, including stablecoins like USDT.

Q&A:

What is the recent USDT controversy about?

The recent USDT controversy revolves around the possibility of USDT being frozen. There have been concerns raised about whether or not Tether, the company behind USDT, has the ability to freeze or seize funds held in USDT wallets.

Is it really possible for USDT to be frozen?

The possibility of USDT being frozen is a matter of debate. Tether claims that USDT is backed by reserves and can be redeemed for fiat currency at any time. However, there have been concerns raised about the lack of transparency and auditing in Tether’s operations, which has led to doubts about the true value and stability of USDT.

Why are there concerns about USDT being frozen?

There are concerns about USDT being frozen because if it were to happen, it could have significant implications for the cryptocurrency market. USDT is one of the most widely used stablecoins and plays a crucial role in facilitating trading and providing liquidity in the crypto space. If USDT were to be frozen, it could create a panic in the market and potentially lead to a loss of trust in other stablecoins as well.

What are the potential consequences if USDT were to be frozen?

If USDT were to be frozen, it could have several consequences. Firstly, it could create a liquidity crisis in the crypto market as USDT is widely used for trading and providing liquidity. This could lead to a decrease in trading volumes and potentially a decrease in the value of other cryptocurrencies. It could also lead to a loss of trust in stablecoins in general, as investors may become wary of other stablecoins due to the possibility of them being frozen as well.