Investigating the Security Measures of USDT: Can it be Frozen

USDT, or Tether, is a popular stablecoin in the cryptocurrency market that has gained significant attention in recent years. As a stablecoin, USDT is designed to maintain a stable value by pegging it to a fiat currency, typically the US dollar. However, like any other digital form of currency, there are concerns about its security measures and the possibility of it being frozen.

One of the main reasons people are drawn to cryptocurrencies is their decentralized nature, which means they are not controlled or regulated by any central authority, such as a government or a financial institution. This aspect has also been a source of concern, as it raises questions about the security and stability of digital currencies like USDT.

When it comes to the security measures of USDT, the team behind the stablecoin claims to have implemented several measures to safeguard its users’ funds. One of the key security features is the use of blockchain technology, which provides transparency and immutability to the transactions made with USDT. This means that once a transaction is recorded on the blockchain, it cannot be altered or tampered with.

In addition to blockchain technology, USDT also incorporates smart contract technology, which adds an additional layer of security. Smart contracts are self-executing contracts with the terms of the agreement directly written into the code. These contracts ensure that transactions occur only when certain predefined conditions are met, reducing the risk of fraud or unauthorized access.

While USDT has implemented these security measures, it is not completely immune to potential risks. One of the concerns surrounding USDT is the possibility of it being frozen. Since USDT is a centralized stablecoin, it is issued and controlled by a single entity. This has raised concerns about the potential for censorship or freezing of funds by the issuing authority, which could undermine the decentralized nature of cryptocurrencies and pose a risk to users.

Overall, while USDT has implemented security measures such as blockchain and smart contract technology, it is important for users to be aware of the potential risks associated with centralized stablecoins. It is always recommended to carefully research and consider the security measures and the track record of any digital currency before investing or using it for transactions.

The Importance of Security Measures for USDT

USDT, also known as Tether, is a popular stablecoin in the cryptocurrency market. It is designed to maintain a stable value in relation to a specific reference currency, such as the US dollar. As USDT has gained significant traction and adoption, it is crucial to understand the importance of security measures for this digital asset.

Security is paramount in the world of cryptocurrencies. With the growing number of cyber threats and attacks, it is essential to ensure the safety and integrity of USDT transactions and holdings. The following are some reasons why security measures are important for USDT:

- Protection against hacks and theft: Since USDT is a digital asset, it is susceptible to hacking attempts and theft. By implementing robust security measures, such as encryption and multi-factor authentication, the risk of unauthorized access and theft can be minimized.

- Mitigation of counterfeiting: Counterfeiting is a prevalent issue in the cryptocurrency space. With USDT being a stablecoin, the risk of counterfeit tokens can affect its stability and reliability. Implementing security measures, such as smart contract audits and token verifications, can help detect and prevent counterfeiting attempts.

- Ensuring trust and transparency: Security measures play a crucial role in establishing trust and transparency in the USDT ecosystem. It gives users confidence that their funds are secure and that the USDT issuer follows strict security protocols. This trust is vital for the widespread adoption of USDT and its overall stability in the market.

- Compliance with regulations: To operate in a regulated environment, USDT issuers need to adhere to various security standards and compliance regulations. Implementing robust security measures ensures compliance, reduces the risk of legal issues, and builds credibility with regulators and financial institutions.

In conclusion, security measures are of utmost importance for USDT. By implementing strong security protocols, USDT issuers can protect against hacks, theft, counterfeiting, and ensure trust and compliance. These security measures are crucial for the stability, reliability, and widespread adoption of USDT in the cryptocurrency market.

What Makes USDT Secure?

USDT, also known as Tether, is a popular stablecoin that is backed by U.S. dollars. It is designed to provide stability to cryptocurrency traders by maintaining a 1:1 ratio with the U.S. dollar.

1. Transparency and Auditing

USDT maintains regular transparency audits to ensure that the number of tokens in circulation is backed by an equivalent amount of U.S. dollars. These audits are conducted by reputable accounting firms, providing confidence to users about the stablecoin’s security.

2. Smart Contract Security

USDT operates on the Ethereum blockchain, utilizing smart contracts to facilitate transactions. Smart contracts are programmable and self-executing, reducing the risk of human error and ensuring the secure transfer of funds.

| Security Measure | Description |

|---|---|

| Multi-signature technology | USDT uses multi-signature technology, requiring multiple users to authorize a transaction. This adds an extra layer of security by preventing unauthorized access to funds. |

| Cold storage reserves | The majority of USDT funds are held in cold storage, offline wallets that are not connected to the internet. This reduces the risk of hacking and unauthorized access to user funds. |

| Continuous monitoring | USDT constantly monitors transactions and addresses for suspicious activity. This helps to identify and prevent potential security breaches or fraudulent activities. |

| KYC and AML compliance | To ensure the security of its users, USDT follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This helps to prevent fraud, money laundering, and other illegal activities. |

These security measures collectively contribute to the overall security and stability of USDT, making it a trusted and secure stablecoin option for users.

Understanding the Freezing Mechanism of USDT

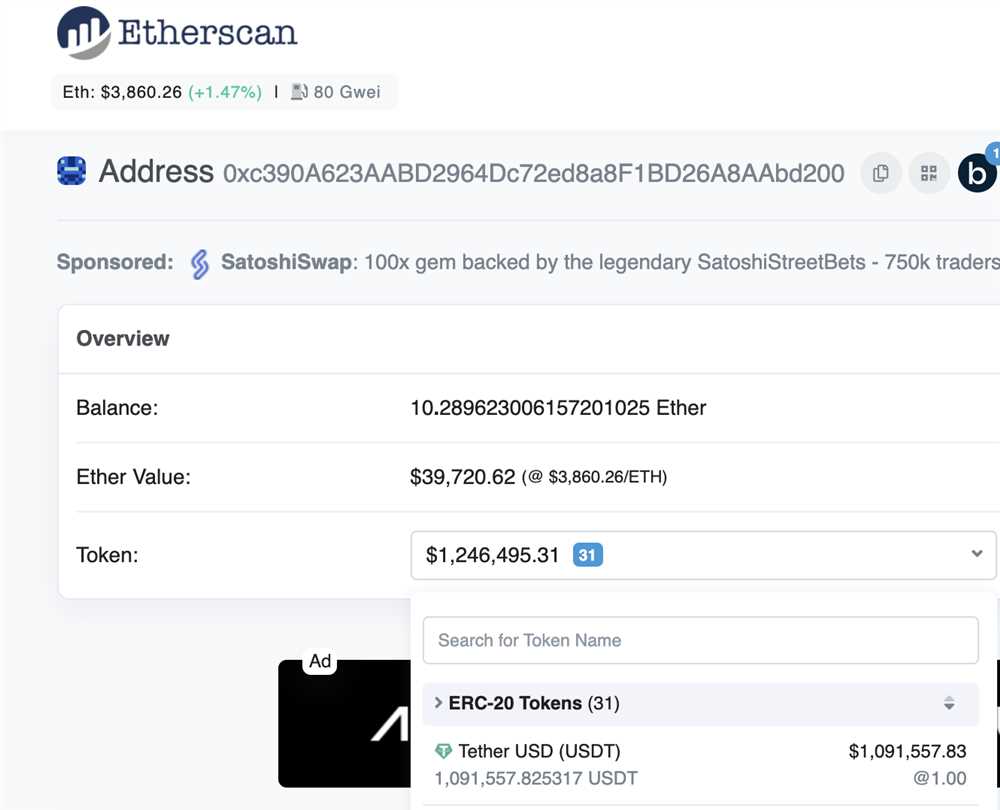

USDT, or Tether, is a popular stablecoin tied to the value of the US dollar. While it aims to provide stability and security, there have been concerns about the ability to freeze USDT tokens. In order to address these concerns, it is important to understand the freezing mechanism of USDT.

USDT tokens can be frozen or blocked by Tether Limited, the company behind USDT. This gives them the ability to control the movement of USDT tokens and prevent any unauthorized or suspicious activities. The freezing mechanism is primarily in place to protect users and maintain the stability of the stablecoin.

When USDT tokens are frozen, it means that they cannot be transferred or redeemed. This can happen for various reasons, such as complying with legal requests, investigating potential fraudulent activities, or protecting the security of the network. Tether Limited has the authority to initiate the freezing process when it deems necessary.

One important aspect to note is that the freezing of USDT tokens is not a common occurrence. Tether Limited follows strict protocols and guidelines to ensure that freezing is done responsibly and transparently. The company aims to maintain the trust of its users and the broader cryptocurrency community.

Transparency is crucial in the freezing process. Tether Limited provides regular updates on the status of frozen USDT tokens to promote accountability and demonstrate that the freezing mechanism is used judiciously. This ensures that users can have confidence in the security measures implemented by Tether Limited.

It is also worth mentioning that the freezing of USDT tokens does not affect the overall stability of the stablecoin. The value of USDT remains tied to the US dollar, and the freezing mechanism is primarily used to address security concerns and protect users.

In conclusion, the freezing mechanism of USDT allows Tether Limited to block or freeze tokens in order to maintain security and prevent unauthorized activities. Tether Limited follows strict protocols to ensure transparency and accountability in the freezing process. Users can have confidence in the stability and security of USDT, while also understanding the need for such security measures.

How Safe is USDT from Being Frozen?

USDT (Tether) is one of the most popular stablecoins in the cryptocurrency market. It is designed to be pegged to the value of the US dollar, providing stability and acting as a hedge against market volatility. However, concerns have been raised about the safety and security of USDT, including the possibility of it being frozen.

Security Measures to Prevent Freezing

USDT is built on the Ethereum blockchain, which offers a high level of security and immutability. The decentralized nature of blockchain technology makes it difficult to freeze or censor transactions. Once a transaction is confirmed and recorded on the blockchain, it becomes part of an unchangeable and transparent ledger.

Furthermore, Tether Limited, the company behind USDT, has implemented various security measures to safeguard against freezing or seizure of funds. These measures include:

- Multi-signature Wallets: Tether uses multi-signature wallets to secure its funds. This means that multiple private keys are required to authorize transactions, making it more difficult for funds to be frozen by a single party.

- Transparent Reserves: Tether claims that each USDT is backed by an equivalent amount of fiat currency held in its reserves. This transparency is intended to provide reassurance to users that their funds are safe and will not be frozen or confiscated.

- Regular Audits: Tether has committed to conducting regular audits of its reserves by reputable accounting firms. These audits are meant to verify the company’s claims of having adequate funds to back each USDT in circulation.

The Risks of Freezing

While USDT is designed to be resistant to freezing or seizure, it is not entirely free from risks. In extreme cases, governments or regulatory authorities may attempt to freeze or confiscate USDT funds if they suspect illegal activities or non-compliance with regulations. This could potentially disrupt the operation of USDT and cause a loss of funds for its users.

It is important to note that the risks of freezing or seizure are not unique to USDT, but apply to any centralized or regulated cryptocurrency. Users should always be aware of the potential risks and exercise caution when dealing with cryptocurrencies.

In conclusion, USDT has implemented various security measures to prevent freezing or seizure of funds. However, there are still inherent risks involved, as with any centralized cryptocurrency. Users should understand these risks and take appropriate precautions when using USDT or any other cryptocurrency.

Q&A:

Can USDT be frozen by the authorities?

No, USDT cannot be frozen by the authorities. USDT is a decentralized cryptocurrency, which means that no central authority has the power to freeze or seize the funds.

What security measures are in place to protect USDT?

USDT is built on the Ethereum blockchain, which provides a high level of security. Additionally, Tether, the company behind USDT, claims to have implemented various security measures, including multi-signature technology, cold storage of funds, and regular audits.

Has USDT ever been frozen before?

There have been no reports of USDT being frozen in the past. As a decentralized cryptocurrency, it is highly unlikely that USDT will be frozen by any authority.

Are there any risks associated with using USDT?

Like any cryptocurrency, there are risks associated with using USDT. These risks include price volatility, potential hacking or security breaches, and regulatory risks. It is important to thoroughly research and understand these risks before using USDT or any other cryptocurrency.