Cold Wallets vs Hot Wallets The Battle between Security and Potential Crypto Loss

When it comes to cryptocurrencies, security is of utmost importance. With hackers becoming more sophisticated and innovative, it’s essential to protect your digital assets from potential threats. Two popular options for storing cryptocurrencies are cold wallets and hot wallets.

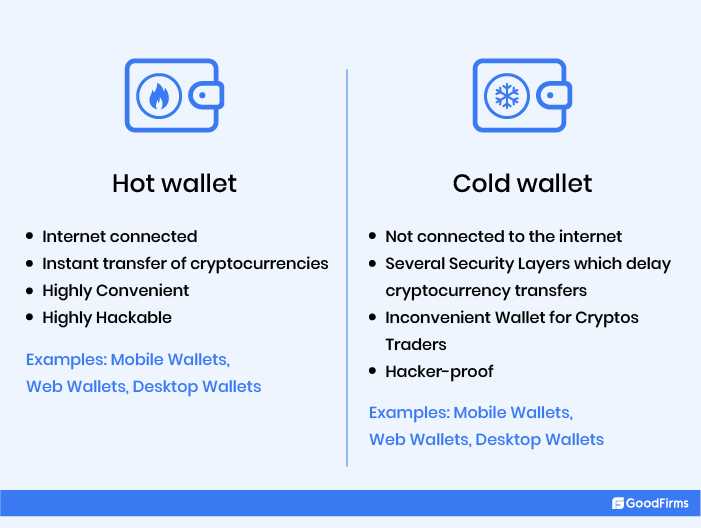

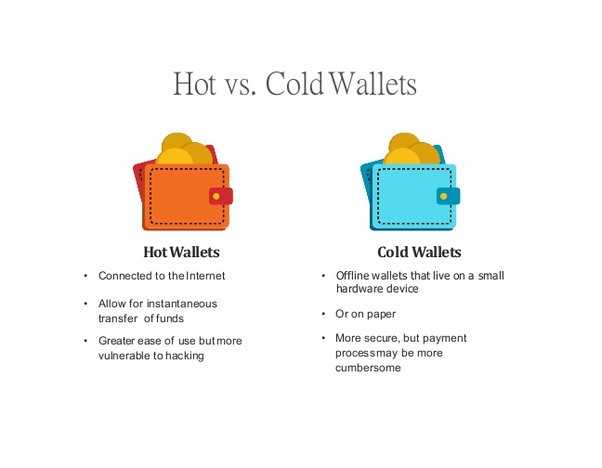

A cold wallet, also known as a hardware wallet, is a physical device that stores your private keys offline. This means that it’s not connected to the internet, making it highly secure against online attacks. Cold wallets provide an extra layer of protection, as even if your computer is compromised, your funds remain safe.

On the other hand, a hot wallet is a software wallet that is connected to the internet. It’s convenient for daily use, as it allows you to access your funds quickly and easily. However, hot wallets are more vulnerable to hacking attempts, as they are online and exposed to potential threats. It’s crucial to take extra measures, such as using strong passwords and enabling two-factor authentication, to minimize the risk.

Choosing between a cold wallet and a hot wallet depends on your individual needs and preferences. If you’re a long-term investor and prioritize security, a cold wallet is the way to go. It provides peace of mind knowing that your assets are stored offline, away from potential hackers. However, if you frequently transact with cryptocurrencies and require easy access, a hot wallet might be more suitable.

In conclusion, the ultimate showdown between cold wallets and hot wallets boils down to balancing security and crypto risk. Evaluate your priorities and assess the level of convenience you require. Remember, no solution is completely bulletproof, so it’s essential to stay vigilant and keep up with the latest security practices in the crypto world.

Cold Wallets vs. Hot Wallets: Which Offers Better Security for Protecting Your Crypto Assets

When it comes to safeguarding your valuable cryptocurrency assets, choosing the right wallet is of utmost importance. The two main options available to you are cold wallets and hot wallets, each offering a unique set of security features and risks. Let’s take a closer look at the pros and cons of each to determine which option offers better security for protecting your crypto assets.

Cold Wallets:

A cold wallet, also known as a hardware wallet, is a physical device specifically designed to securely store your private keys offline. These wallets offer a high level of security by keeping your keys off the internet and away from potential hackers. Cold wallets are typically small, portable devices that you can connect to your computer when you need to make a transaction.

One of the key advantages of cold wallets is that they are not vulnerable to online threats such as hacking, phishing, and malware. Since your private keys never leave the device, even if your computer is compromised, your crypto assets remain safe. Additionally, cold wallets often use additional security features like PIN codes and backup phrases to ensure that even if the device is lost or stolen, no one else can access your funds.

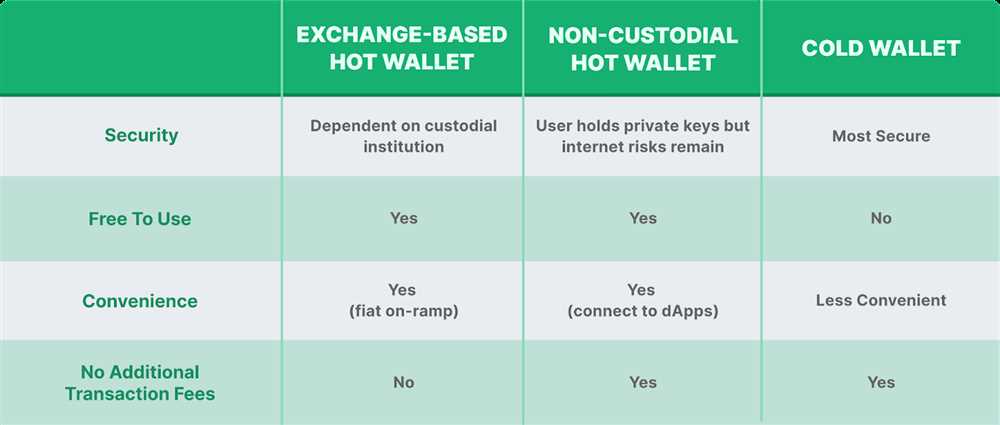

However, cold wallets do have a few drawbacks. Firstly, they can be quite expensive compared to hot wallets. Additionally, the process of connecting your cold wallet to your computer and entering your PIN for each transaction can be cumbersome and time-consuming. If you frequently need to access your crypto assets for trading or other purposes, this may not be the most convenient option for you.

Hot Wallets:

A hot wallet, on the other hand, is a digital wallet that is connected to the internet. It can take the form of a software wallet installed on your computer or a mobile wallet on your smartphone. Hot wallets are typically more user-friendly and offer faster access to your crypto assets compared to cold wallets.

Hot wallets offer convenience and accessibility, allowing you to easily send, receive, and trade cryptocurrencies. However, they come with higher security risks. Since hot wallets are connected to the internet, they are more susceptible to hacking, malware, and phishing attacks. If your computer or smartphone is compromised, your private keys and crypto assets can be easily stolen.

It’s worth noting that some hot wallets have implemented security measures such as two-factor authentication and encryption to mitigate these risks. However, the fact remains that hot wallets are inherently more vulnerable compared to their cold wallet counterparts.

So, which option offers better security for protecting your crypto assets? The answer ultimately depends on your individual needs and preferences. If you prioritize maximum security and are willing to sacrifice some convenience and accessibility, a cold wallet may be the better choice for you. On the other hand, if you value convenience and frequently need to access your crypto assets, a hot wallet with robust security measures may be more suitable.

Regardless of your choice, it is crucial to follow best security practices such as regularly updating your wallet software, enabling multi-factor authentication, and keeping your backup phrases in a secure location. By taking these precautions, you can enhance the security of your crypto assets, regardless of the type of wallet you choose.

The Advantages of Cold Wallets: Maximum Security and Peace of Mind

When it comes to storing your cryptocurrencies, security is paramount. Cold wallets offer maximum security and peace of mind, making them a popular choice among cryptocurrency enthusiasts.

Offline Storage

The biggest advantage of cold wallets is that they store your private keys offline. This means that they are not connected to the internet and are therefore immune to hacking attempts or malware attacks. By keeping your private keys offline, you eliminate the risk of unauthorized access to your funds.

Protection Against Online Threats

Since cold wallets are not connected to the internet, they provide an extra layer of protection against online threats. This includes phishing attempts, malware, and hacking attacks that are common in the cryptocurrency space. Even if your computer or smartphone gets infected with malware, your funds will remain secure in your cold wallet.

No Third-Party Risk

Using a cold wallet means that you are in complete control of your private keys. There is no need to rely on third-party platforms or exchanges to hold your funds. This reduces the risk of potential hacks or breaches on these platforms, which have occurred in the past and resulted in the loss of significant amounts of cryptocurrency.

Physical Security

Cold wallets are physical devices, such as hardware wallets or paper wallets, that you can hold in your hand. This means that you have full control over the physical security of your wallet. You can store it in a safe place, such as a vault or a safe deposit box, protecting it from theft, fire, or other physical disasters.

Overall, cold wallets provide the highest level of security for storing your cryptocurrencies. By keeping your private keys offline and protecting them from online threats, you can have peace of mind knowing that your funds are safe and secure.

The Benefits of Hot Wallets: Convenient Access and Easy Transactions

When it comes to managing your cryptocurrency assets, hot wallets can offer a range of benefits that make them an attractive option for many users.

One of the main advantages of hot wallets is the convenient access they provide. Unlike cold wallets, which are typically physical devices that need to be connected to a computer or a mobile device, hot wallets can be accessed from any internet-connected device. This means that you can easily check your balance and make transactions on the go, without the need for any additional hardware.

In addition to convenience, hot wallets also offer easy transactions. When using a hot wallet, you can easily send and receive cryptocurrency with just a few clicks or taps. This makes it a breeze to pay for goods and services using your digital assets, as well as transfer funds between different wallets or exchanges.

Hot wallets also often provide seamless integration with popular cryptocurrency exchanges, allowing you to easily trade your assets without the need for any additional steps or transfers. This can save you time and effort, as you can quickly take advantage of market opportunities or adjust your portfolio as needed.

Furthermore, hot wallets typically come with user-friendly interfaces that are designed to be intuitive and easy to navigate. This can be especially beneficial for newcomers to the world of cryptocurrency, as it reduces the learning curve and makes it easier to get started with managing and using your digital assets.

However, it is important to note that with the convenience and easy access of hot wallets comes a greater level of risk compared to cold wallets. Hot wallets are connected to the internet, making them potentially susceptible to hacking and other security threats. It is crucial to take appropriate security measures, such as using strong passwords and two-factor authentication, to protect your funds.

In conclusion, hot wallets offer convenient access and easy transactions, making them a popular choice for many cryptocurrency users. However, it is essential to balance the benefits with the potential risks and ensure that you prioritize the security of your digital assets.

Understanding the Risks: Potential Vulnerabilities of Hot Wallets

Hot wallets, while convenient for frequent transactions and quick access to cryptocurrency, come with their fair share of potential vulnerabilities and risks. It is crucial to be aware of these risks in order to make informed decisions about the security of your digital assets.

- Online Attacks: One of the most prominent risks associated with hot wallets is the threat of online attacks. Hot wallets are connected to the internet, making them susceptible to hacking attempts and unauthorized access. Hackers can exploit vulnerabilities in the wallet software or leverage social engineering techniques to gain access to the private keys or passwords associated with the wallet.

- Phishing Attacks: Another common risk is phishing attacks, where scammers trick users into revealing their wallet information through fraudulent websites or emails. These phishing attempts can mimic legitimate crypto platforms or wallet providers, making it challenging for users to discern the authenticity of the website or email.

- Malware and Keyloggers: Malicious software and keyloggers present a significant threat to hot wallet security. If a user’s device is infected with malware or a keylogger, it can secretly record keystrokes, monitor activities, and steal sensitive information such as wallet passwords or private keys.

- Physical Theft: While hot wallets are primarily digital, physical devices such as smartphones or laptops used to access them can be stolen. If an unauthorized person gains physical access to a device with an active hot wallet, they may be able to gain control of the wallet and transfer funds without the owner’s consent.

- Exchange Vulnerabilities: Hot wallets provided by cryptocurrency exchanges are particularly vulnerable to attacks. As exchanges centrally store users’ private keys, a successful attack on the exchange could result in the loss of users’ funds.

To mitigate these risks, hot wallet users should take precautions such as implementing two-factor authentication, regularly updating software and operating systems, being cautious of suspicious emails or websites, and only storing small amounts of cryptocurrency in hot wallets for immediate use.

While hot wallets offer convenience and accessibility, it is essential to balance these benefits with the potential vulnerabilities and risks they present. Ultimately, the decision between hot and cold wallets depends on an individual’s risk tolerance and storage preferences.

Striking a Balance: Combining the Best of Both Worlds

In the debate between cold wallets and hot wallets, it’s easy to see the merits of each. Cold wallets offer the highest level of security, keeping your cryptocurrency offline and out of reach from hackers. On the other hand, hot wallets provide convenience and quick access to your funds, allowing you to easily transact with your cryptocurrency on the go.

But what if there was a way to have the best of both worlds? What if you could combine the security of a cold wallet with the convenience of a hot wallet? It turns out, there is a solution – using a hybrid approach.

The Hybrid Approach

The hybrid approach involves keeping the majority of your cryptocurrency in a cold wallet for long-term storage and security. This means storing your private keys offline, such as on a hardware wallet or paper wallet, and only accessing them when you need to store or transfer funds.

However, to take advantage of the convenience that hot wallets offer, you can keep a smaller portion of your cryptocurrency in a hot wallet. This allows you to easily transact with your funds on a daily basis without exposing your entire portfolio to online threats.

By combining the best of both worlds, you can have the peace of mind knowing that the majority of your cryptocurrency is secured offline, while still enjoying the flexibility and accessibility of a hot wallet.

How to Implement the Hybrid Approach

To implement the hybrid approach, you’ll need to follow a few simple steps:

- Choose a reputable cold wallet provider and set up your cold wallet. This can be a hardware wallet or a paper wallet.

- Transfer the majority of your cryptocurrency holdings to your cold wallet. Make sure to follow best practices for securely storing your private keys.

- Choose a reputable hot wallet provider and set up your hot wallet. This can be a mobile wallet or an online wallet.

- Transfer a smaller portion of your cryptocurrency holdings to your hot wallet. This can be the amount you plan to use for daily transactions.

- Ensure that you have strong security measures in place for your hot wallet, such as two-factor authentication and regular software updates.

- When you need to make a transaction, transfer the required funds from your cold wallet to your hot wallet. After completing the transaction, transfer any remaining funds back to your cold wallet for safekeeping.

By following these steps and maintaining a careful balance between your cold and hot wallets, you can enjoy the security of offline storage while still having the flexibility to transact with your cryptocurrency whenever you need to.

| Cold Wallet | Hot Wallet |

|---|---|

| Highest level of security | Convenience and quick access |

| Offline storage of private keys | Online access to funds |

| Less vulnerable to hacking | Potential risk of online threats |

So why choose between security and convenience when you can have both? By striking a balance with a hybrid approach, you can enjoy the benefits of both cold wallets and hot wallets, without compromising the safety of your cryptocurrency.

Q&A:

What is the difference between a cold wallet and a hot wallet?

A cold wallet is an offline storage device that is not connected to the internet, while a hot wallet is connected to the internet and allows for quick and easy access to funds.

Which type of wallet is more secure?

Cold wallets are generally considered to be more secure since they are not connected to the internet and therefore less prone to hacking or cyber attacks.

What are the advantages of using a hot wallet?

A hot wallet allows for quick and easy access to funds, making it convenient for frequent transactions and trading. It is also usually free to use and doesn’t require any additional hardware.

How can I protect my cryptocurrencies if I use a hot wallet?

To protect your cryptocurrencies when using a hot wallet, you can take several steps such as enabling two-factor authentication, using strong and unique passwords, keeping your software and antivirus up to date, and being cautious of phishing attempts or suspicious links.