The Advantages and Disadvantages of Exchanging USDT for Cash

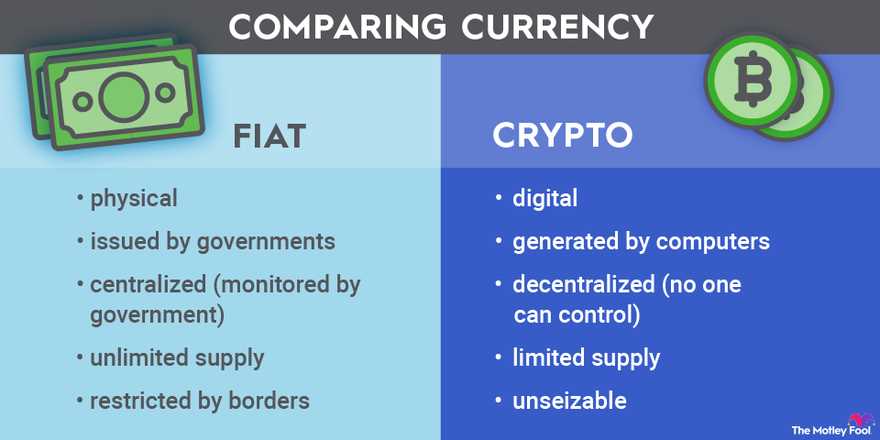

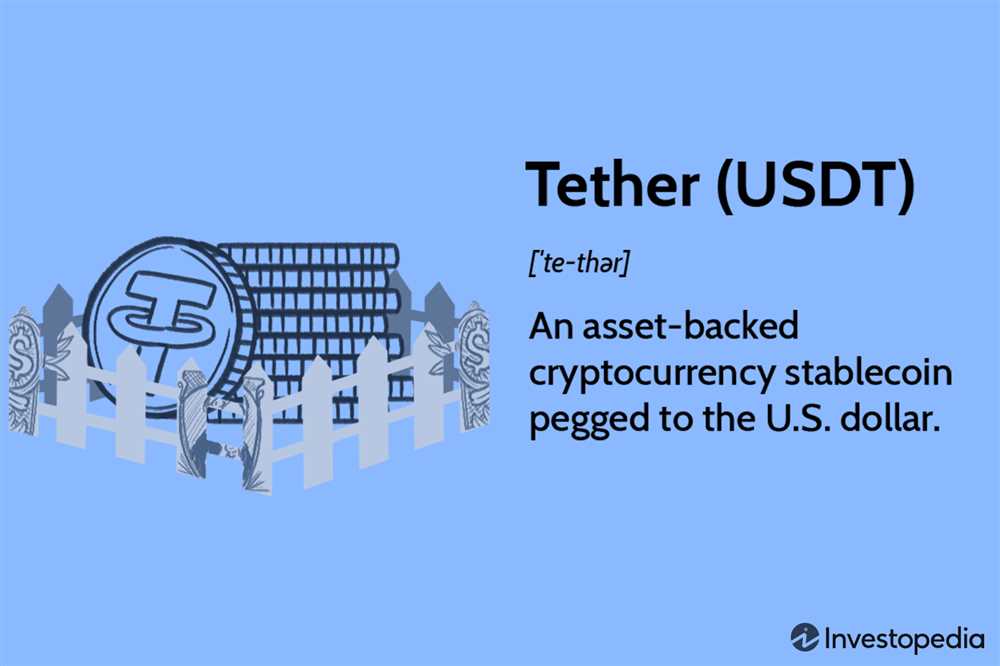

Are you considering converting your USDT (Tether) to cash? While this decision can offer several benefits, it’s essential to be aware of both the advantages and disadvantages involved.

Pros:

1. Liquidity: Converting USDT to cash provides immediate access to funds, making it easier to meet financial obligations or make purchases.

2. Flexibility: Cash offers greater flexibility compared to digital currencies, as it can be used in various ways, both online and offline.

3. Stability: While cryptocurrencies can be volatile, cash is generally more stable, providing a sense of security during uncertain times.

Cons:

1. Transaction Costs: Converting USDT to cash may involve transaction fees or exchange rates, potentially reducing the overall value of your funds.

2. Privacy Concerns: Converting to cash often requires providing personal information, which raises privacy concerns for some individuals.

3. Limited Acceptance: Cash may not be universally accepted, especially in an increasingly digital world where digital payments are more common.

Understanding the pros and cons of converting USDT to cash is crucial in making an informed decision. Consider your specific needs and circumstances before choosing the best option for you.

Benefits of Converting USDT to Cash

Converting USDT (Tether) to cash can offer a range of advantages that make it a popular choice for cryptocurrency users.

1. Liquidity: Converting USDT to cash allows you to access immediate liquidity, which can be crucial in certain situations. Cash is widely accepted and can be used for various purposes, such as paying bills or making purchases.

2. Stability: Cash provides a stable value that is not subject to the volatility often associated with cryptocurrencies. Converting USDT to cash can help mitigate the risks of sudden price fluctuations, providing peace of mind.

3. Flexibility: Cash offers flexibility in terms of how it can be used. Whether you need to make a large purchase, cover unexpected expenses, or simply prefer using physical currency, converting USDT to cash allows for greater flexibility in managing your finances.

4. Accessibility: Cash is universally accessible and widely accepted. Unlike some cryptocurrencies, which may have limited acceptance, cash can be used almost anywhere. This accessibility makes it convenient for everyday transactions and eliminates the need for additional conversion steps.

5. Security: While cryptocurrencies offer certain security benefits, converting USDT to cash removes the risks associated with online transactions. Cash transactions are less susceptible to cyberattacks and hacking attempts, making it a safer option for those concerned about digital security.

6. Ease of Use: Converting USDT to cash is generally a straightforward process, which can be easily done through various platforms, exchanges, or ATMs. This ease of use makes cash a convenient option for those who are not familiar with or do not want to deal with the complexities of cryptocurrency.

7. Privacy: Converting USDT to cash allows for greater privacy compared to using cryptocurrencies. Cash transactions typically do not require providing personal information, offering an additional layer of anonymity for those who value their privacy.

Overall, converting USDT to cash can provide you with greater liquidity, stability, flexibility, accessibility, security, ease of use, and privacy compared to solely relying on cryptocurrencies. It is important to consider these benefits when deciding how to manage your digital assets and financial transactions.

Increased Convenience

Converting USDT to cash offers increased convenience for individuals who prefer to have physical currency in hand. While USDT is a popular digital currency that offers stability and ease of use for online transactions, some people still prefer the tangibility and familiarity of cash.

By converting USDT to cash, individuals can have easy access to their funds for everyday expenses, such as groceries, dining out, or shopping at local businesses that may not accept digital currencies. This eliminates the need for relying solely on digital payment methods or constantly transferring funds between different payment platforms.

Having cash on hand can also be advantageous in situations where online payment options may not be available or reliable, such as during power outages or in areas with limited internet connectivity. It provides a backup option for making essential purchases without being completely reliant on technology.

Furthermore, converting USDT to cash can be beneficial for individuals traveling to foreign countries where digital payment methods may not be widely accepted or where transaction fees for using foreign cards can be high. Having cash allows for greater flexibility and ease of purchasing goods and services while abroad.

Overall, converting USDT to cash provides increased convenience by offering tangible currency for everyday expenses, providing a backup option during technology limitations, and enabling greater flexibility while traveling.

Greater Security

Converting USDT to cash offers greater security for individuals and businesses alike. When holding large amounts of USDT, there is always a risk of theft or loss. By converting USDT to cash, you can eliminate this risk and ensure the safety of your funds.

Furthermore, cash is a universally accepted form of payment and can be easily stored in physical form. This eliminates the need for digital wallets or online platforms, which can be vulnerable to hacking or other cyber threats. By converting USDT to cash, you can have peace of mind knowing that your funds are physically secure and protected from any potential cyber attacks.

In addition, converting USDT to cash provides an extra layer of privacy. With digital currencies, transactions can be traced and tracked, potentially compromising your personal or business information. By converting USDT to cash, you can maintain your privacy and keep your financial transactions confidential.

Increased Control

Another advantage of converting USDT to cash is the increased control you have over your funds. When holding USDT, you are subject to the rules and regulations of the digital currency market, which can be unpredictable and volatile. By converting USDT to cash, you can avoid the risks and uncertainties associated with the digital currency market.

Furthermore, cash allows for easier budgeting and financial planning. With USDT, the value can fluctuate, making it difficult to accurately assess the worth of your funds. By converting USDT to cash, you can have a clearer picture of your financial situation and better plan for the future.

| Pros of Converting USDT to Cash | Cons of Converting USDT to Cash |

|---|---|

| Greater security | Possible loss of investment opportunities |

| Increased control | Potential loss of value due to inflation |

| Easier budgeting and financial planning | Lack of digital convenience |

| Extra layer of privacy | May not be accepted everywhere |

Drawbacks of Converting USDT to Cash

1. Higher Fees: One of the major drawbacks of converting USDT to cash is the higher fees associated with the transaction. When you convert USDT to cash, you may need to pay a certain percentage of the total amount as a fee. This can significantly reduce the value of the cash you receive in return.

2. Liquidity Constraints: Another drawback of converting USDT to cash is the liquidity constraints. While USDT is a widely accepted cryptocurrency, converting it to cash may not be as easy. You may need to find a suitable exchange or platform that supports the conversion, which can be time-consuming and may have certain limitations.

3. Potential Losses: Converting USDT to cash can also expose you to potential losses. The value of USDT and cash can fluctuate, and if the exchange rate is unfavorable at the time of conversion, you may end up receiving less cash than expected. This can be a risk for those who are looking to convert USDT to cash for immediate use or to lock in profits.

4. Security Risks: When converting USDT to cash, there are security risks involved. You need to ensure that you choose a reliable and secure exchange or platform to avoid any potential hacks or scams. It is important to do thorough research and choose a reputable platform to minimize the risks associated with the conversion process.

5. Tax Implications: Converting USDT to cash may also have tax implications. Depending on your jurisdiction, you may need to report the conversion as a taxable event and pay taxes on the gains. It is important to consult with a tax professional to understand the tax implications and ensure compliance with the applicable regulations.

While converting USDT to cash may seem like a convenient option, it is important to consider these drawbacks before making a decision. Make sure to weigh the pros and cons and evaluate your specific needs and circumstances before proceeding with the conversion.

Potential Loss of Value

When converting USDT to cash, it’s important to consider the potential loss of value that may occur in the process. Here are some factors to consider:

Fluctuating Exchange Rates

One potential risk when converting USDT to cash is the fluctuating exchange rates. The value of USDT is pegged to the US dollar, but exchange rates can still fluctuate due to various factors such as economic conditions, geopolitical events, and market sentiment. As a result, when converting USDT to cash, you may receive a different amount than you initially expected.

Transaction Fees

When converting USDT to cash, there are often transaction fees involved. These fees can vary depending on the platform or service you use for conversion. It’s important to factor in these fees when calculating the potential loss of value. Additionally, some platforms may have hidden fees or spread charges, so it’s important to carefully review the terms and conditions before making any conversions.

Overall, converting USDT to cash can result in a potential loss of value due to fluctuating exchange rates and transaction fees. It’s important to carefully consider these factors and plan accordingly to minimize any potential losses.

Limited Usability

While converting USDT to cash can have its advantages, it is important to consider the limited usability of cash in today’s digital world. With the increasing popularity of digital payments and online shopping, cash is becoming less relevant and convenient for everyday transactions. Therefore, converting USDT to cash may limit your options for using the funds in a practical way.

1. Inability to Make Online Purchases

One of the main drawbacks of cash is its inability to be used for online purchases. Many platforms and websites only accept digital payment methods such as credit cards, debit cards, or online payment services like PayPal. By converting your USDT to cash, you eliminate the possibility of using those funds for online shopping, which can be a significant disadvantage in today’s digital age.

2. Limited Acceptance

Cash has limited acceptance compared to digital payment methods. While most physical stores accept cash, there are still instances where cash may not be accepted, especially in certain establishments or specific industries. For example, some restaurants now only accept digital payment methods to enhance efficiency and reduce the risk of theft. By converting USDT to cash, you may encounter situations where cash is not accepted, limiting your ability to use those funds.

In conclusion, while converting USDT to cash might seem like a viable option, it is essential to recognize the limited usability of cash in today’s digital world. Online purchases and limited acceptance can restrict your ability to use cash effectively, making it less practical and convenient compared to digital payment methods.

Q&A:

What are the pros of converting USDT to cash?

Converting USDT to cash provides the convenience of having physical currency that can be used for everyday transactions. It eliminates the need for relying solely on digital currency for purchases and expenses.

Are there any disadvantages to converting USDT to cash?

Yes, there are a few disadvantages to converting USDT to cash. Firstly, the process of converting USDT to cash may incur fees, which can reduce the overall value of the conversion. Additionally, once converted to cash, it becomes less flexible to use for online transactions or investments that require digital currency.